Home — Articles

At the beginning of this year, the Russian Ministry of Finance approved the new PBU 23/2011 “Cash Flow Report”. The purpose of this provision is to correctly reflect in the relevant accounting report information about the sources of income and directions of use of funds by the organization. Such information is useful in assessing a company's ability to generate cash and cash equivalents, as well as the company's need to utilize those flows. In anticipation of the annual reporting, we will consider the specified PBU in more detail.

Determination of cash and cash equivalents

In the previous form of ODDS it was indicated that it was possible to provide information on the movement of not only cash, but also their equivalents. However, there was no definition of the term cash equivalents in Russian standards. And many companies have used the definition given in IAS 7.

And so, in paragraph 6 of PBU 23, they finally gave a definition of cash equivalents, information on the movement of which, together with cash, is presented in the ODDS. Cash equivalents are short-term, highly liquid financial investments that can be easily converted into a known amount of cash and are subject to an insignificant risk of changes in value.

What does short-term mean?

IAS 7 proposes to consider a three-month repayment period or another similarly short period as the time criterion for cash equivalents. In fact, we find indirect confirmation that Russian companies can focus on this period in subparagraph h) of paragraph 9 of PBU 23, which provides examples of current cash flows. Among other things, this subclause states that these may include cash flows on financial investments acquired for the purpose of resale in the short term (usually within three months).

The company must independently establish and consolidate in its accounting policies exactly which financial investments it will include in cash equivalents, based on determining their short-term nature, liquidity and exposure to an insignificant risk of changes in value.

Investments in shares of other organizations do not qualify as cash equivalents unless they are purchased with the intention of resale in the near future (for example, shares of large companies purchased for the purpose of speculating on their price). Typically, cash equivalents are intended more to pay off short-term obligations (for example, highly liquid bills that will be used to pay a supplier) rather than for investment.

Examples of cash equivalents include highly liquid bills or bonds, demand deposits and short-term bank deposits that are opened to manage an organization's cash flows in order to earn interest income.

ODDS does not show the transfer of cash or cash equivalents from one form to another. After all, this will lead to double the flow. The transfer of money into cash equivalents (their acquisition) and the receipt of money from the redemption of these equivalents are not cash flows.

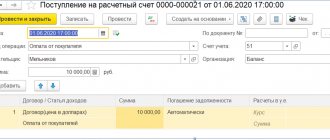

Example 1

| The company placed the money on a short-term deposit. Then it was closed, the money was returned to the current account with interest. Only accrued interest is reflected in the ODDS. The movement of money from the current account (account 51) to the deposit (account 55) and back is not shown in the ODDS. |

General provisions

The accounting regulations “Cash Flow Statement” (PBU 23/2011) were approved by Order of the Ministry of Finance dated 02.02.2011 N 11n. This provision establishes the rules for drawing up cash flow statements by commercial organizations (with the exception of credit institutions). The form of the cash flow statement was approved by Order of the Ministry of Finance dated July 2, 2010 N 66n. The specified form is included in the annual financial statements (clause 49 of the Accounting Regulations “Accounting statements of an organization” (PBU 4/99), approved by Order of the Ministry of Finance dated July 6, 1999 N 43n). Please note that the cash flow statement (hereinafter referred to as the Report) may not be submitted to small businesses and non-profit organizations. This rule is stated in clause 85 of the Regulations on accounting and financial reporting in the Russian Federation, approved. By Order of the Ministry of Finance dated July 29, 1998 N 34n (hereinafter referred to as Order N 34n). The Report reflects the organization's cash flows, as well as the balances of cash and cash equivalents at the beginning and end of the reporting period (clause 6 of PBU 23/2001). Simply put, it is necessary to show information about the sources of income and directions of use of funds by the organization. Cash flows of an organization are payments to the organization and receipts of cash and cash equivalents to the organization (clause 6 of PBU 23/2011). Cash equivalents are highly liquid financial investments that can be easily converted into a known amount of cash and are subject to an insignificant risk of changes in value (clause 5 of PBU 23/2011).

For your information. On July 18, 2011, the Ministry of Finance of Russia posted on its website (www.minfin.ru) a draft order “On amendments to the forms of financial statements of organizations.” This project took into account the innovations introduced by PBU 23/2011. The result was that the form of the cash flow statement was presented in a new edition. It introduced such concepts as “Cash Flows” and “Cash Equivalents”. The adjustments also affected the balance sheet. At the same time, in Sect. II “Current assets” indicators “Financial investments” and “Cash” were renamed respectively to “Financial investments (except for cash equivalents)” and “Cash and cash equivalents”.

If we talk about international financial reporting standards (hereinafter referred to as IFRS), then we are talking about IAS 7 “Cash Flow Statement” (hereinafter referred to as IAS 7). Let us note that if the legislation of the Russian Federation does not establish any methods of accounting, then when forming an accounting policy you have the right to turn to IFRS (clause 7 of the Accounting Regulations “Accounting Policy of the Organization” (PBU 1/2008), approved by Order Ministry of Finance dated October 6, 2008 N 106n). This fact is of particular importance when preparing the Report, because PBU 23/2011 does not cover all issues related to the reflection of cash flows and cash equivalents.

Cash flow classification

Drawing up the ODDS consists of distributing all receipts (inflows) of funds and their expenses (outflows) by type of activity.

As before, in ODDS cash flows are presented in the context of current, investment and financial activities (clause 7 of PBU 23). The definitions of activities themselves have become more detailed and closer to IAS 7.

It is important that the new provision provides many examples of classifying most types of income and expenses into specific types of activities.

Current cash flows

Cash flows from current activities are formed mainly in the course of the main activities that generate the organization's revenue. Thus, they are usually the result of operations that affect the formation of net profit (clause 9 of PBU 23).

Cash generated by current operations is the most important indicator of whether a given category of activity generates enough cash to repay loans, maintain operations at existing levels of productivity, pay dividends, and make new investments without seeking outside financing. Analysis of current flows from previous periods is used to forecast future current flows in conjunction with other information.

Examples, in particular, are (clause 9 of PBU 23):

- receipts from sales to customers (they are reflected in line 4111 of the ODDS form, approved by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n);

- income from the rental of property, royalties, fees, commissions and other income (line 4112);

- payments to suppliers of materials, goods, works and services (line 4121);

- remuneration of employees, including payments in their favor to third parties (line 4122);

- income tax payments, unless they are related to financial or investment activities;

- payment of interest on debt obligations (line 4123), with the exception of interest that is included in the cost of investment assets according to the rules of PBU 15/2008;

- receipt of interest on receivables from buyers (customers);

- cash flows on financial investments purchased for the purpose of resale in the short term (usually within three months).

Cash flows from investing activities

Cash flows from investment activities are associated with the movement of non-current assets and provide cash receipts in the future (clauses 7, 10 of PBU 23).

Examples of such flows include:

- payments to suppliers (contractors) and employees of the organization in connection with the acquisition, creation, modernization, reconstruction and preparation for use of non-current assets, including R&D costs or their sale (line 4221);

- payment of interest on debt obligations included in the cost of an investment asset according to the rules of PBU 15/2008;

- payments in connection with the acquisition (sale) of shares (participatory interests) in other organizations, debt securities (rights to claim funds from other persons), not related to cash equivalents (line 4222);

- provision of loans to other persons and their repayment;

- dividends and similar income from equity participation in other organizations (line 4212);

- receipts of interest on debt financial investments, with the exception of those acquired for the purpose of resale in the short term (line 4212).

Financial activities

Financial activity changes the size and structure of the organization's equity capital and its loans and borrowings. Such flows help creditors and shareholders (participants) predict future cash flows and borrowing needs.

Examples of financial cash flows are (clause 11 of PBU 23):

- cash contributions from owners (participants), proceeds from the issue of shares, increases in participation interests (line 4313);

- payments to shareholders (participants) in connection with the repurchase of shares (participatory interests) of the organization from them or their withdrawal from the membership;

- payment of dividends and other payments for the distribution of profits in favor of owners (participants). They are reflected on line 4322;

- proceeds from the issue of bonds, bills and other debt securities and payments in connection with their repayment;

- receipt (repayment) of loans and borrowings from other persons (lines 4311 and 4321).

Cash flows that cannot be clearly classified are classified as current.

Sometimes it may be necessary to split one operation into several activities. For example, if, when repaying a loan, the sum of the debt and interest is paid in a single amount, then the amounts should be divided for the purpose of being reflected in the ODDS. Debt repayment should be shown as a financial flow, and interest should be attributed to current activities (clause 13 of PBU 23).

Reflection of individual business transactions

Previously, experts pointed out that the ODDS should exclude internal movements of money between certain accounts, for example, between a ruble and a foreign currency account, between a cash register and a current account. And they recommended showing transactions for the sale/purchase of currency only in part of the resulting difference, since these transactions are associated with the transformation of one type of money into another. Now in paragraph 6 of PBU 23 it is directly stated that cash flows are not: foreign exchange transactions (except for losses or benefits from the transaction) and other similar payments to the organization and receipts to the organization that change the composition of cash or cash equivalents, but do not change them total amount.

Companies that prepare consolidated statements when preparing a general income statement should pay attention to paragraph 20 of PBU 23. It states that significant cash flows between the parent, subsidiaries and dependent organizations are reflected separately from similar cash flows between the organization and other persons. It is not possible to dwell in detail on the preparation of consolidated statements within the framework of this article.

Who should provide ODDS

ODDS in 2021 is provided by all persons who maintain accounting records in their organization. However, there is an exception to this rule; a report is not required for:

- small businesses (i.e. small firms that meet the criteria of Article 4 of the Federal Law “On the Development of Small and Medium-Sized Businesses in the Russian Federation” dated July 24, 2007 N 209-FZ (as amended on November 27, 2017) and operate according to a simplified system taxation);

- Skolkovo residents.

The persons listed above can provide a report if they wish if they are confident that it can provide the most complete description of the state of the organization. If the organization decides that the preparation of such a report is not required and it will not provide any important information, this is reflected in the explanatory note to the annual financial statements. For example, in an explanatory note you can indicate that all the company’s revenues are associated exclusively with the sale of goods, and expenses include only payroll, taxes and payments to suppliers.

Transit and bulk operations

As a general rule, each significant type of receipts in the capital income tax is reflected separately from cash payments, i.e., in detail (clause 15 of PBU 23).

Exceptions are provided for transit operations and mass flows, which can be reflected on a scaled-down basis, using the net method. Flows of a transit nature are those that:

- reflects the activities of the client to a greater extent than the organization itself;

- or when receipts from some persons determine corresponding payments to other persons.

Classic examples of transit payments are commission and agency, when a commission agent or agent receives funds and quickly transfers them to the owner of goods, the provider of works or services, minus his remuneration. They also include payments from counterparties to reimburse utilities or receive compensation in connection with cargo transportation.

The fact that this rule was specified in the PBU is very important. When compiling ODDS, many Russian companies showed all turnover on current accounts, taking into account funds transferred within a short time, for example, to the principal. Users of reporting, incl. Banks had a misleading impression of such flows, and they could present commission agents with some advantages in servicing.

The long-awaited clarification is provided in paragraph 16 of PBU 23 on VAT and other indirect taxes that come from buyers and customers or are paid to suppliers and contractors. Such taxes can be considered transit, since they are almost immediately sent to the budget or reimbursed from it. It follows from this that cash flows received from/transferred by these persons can be “cleared” of VAT. After all, they have virtually no effect on the net flow generated by the company for the year. Of course, the word “may” means that this choice will be recorded in the organization’s accounting policies.

Mass flows are characterized by high turnover, large amounts and a short repayment period (clause 17 of PBU 23). Examples of such income and payments include:

- mutually determined payments and receipts for settlements using bank cards;

- purchase and resale of financial investments;

- short-term (usually up to three months) refinancing.

Currency operations

Flow indicators in ODDS are reflected in rubles. The amount of cash flows in foreign currency is recalculated into rubles at the rate of the Central Bank of the Russian Federation on the date of payment or receipt (clause 18 of PBU 23).

This is a very important provision, which radically changes the rules established for the reflection of flows in foreign currency, which were previously established in paragraph 16 of the Instructions on the procedure for drawing up and presenting financial statements. According to the old rules, the entire cash flow was presented to reporting users at the exchange rate of the Central Bank of the Russian Federation as of the date of preparation of the financial statements. And in order to comply with this rule, the accountant had to generate several preliminary forms of general tax accounting for each type of foreign currency used by the organization. After this, the data for each calculation line was recalculated at the rate of the Central Bank of the Russian Federation as of December 31, and then summed up with the ODDS data on the movement of funds in Russian rubles. As a result, the reporting user was presented with a snapshot of the movement of all funds from the position of the foreign currency exchange rate as of December 31 of the corresponding reporting year. That is, for all lines of the report, along with ruble funds, movements of foreign currency funds were shown translated into rubles at the exchange rate of the Central Bank of the Russian Federation set as of December 31.

In connection with these complex recalculations, certain differences arose, which many accountants tried to attribute to the last line of the report, “The magnitude of the impact of changes in the exchange rate of foreign currency against the ruble.” And only an experienced auditor knew that this indicator represents the difference between the ruble equivalent of foreign currency funds available to the organization at the beginning of the year (at the rate at the end of the reporting year), and the equivalent of the same amount at the rate at the beginning of the reporting year, reflected in the balance sheet line 260.

Example 2

| As of January 1, 2011, the organization’s cash desk had a cash balance of 1,000 rubles. The balance in the bank account was 100,000 rubles, and in the foreign currency account - 1,000 USD. The official US dollar exchange rate set by the Central Bank of the Russian Federation as of December 31, 2010 (the end of the previous reporting period) was conditionally equal to 29.3804 rubles/USD. The total cash balance at the beginning of 2011 on line 260 of the balance sheet is shown as RUB 130,080. (RUB 1,000 + RUB 100,000 + USD 1,000 x RUB 29.3804/USD). For the purpose of filling out line 4450 of the ODDS “Cash balance at the beginning of the reporting period”, foreign currency funds must be recalculated at the Central Bank exchange rate as of the reporting date, i.e. as of 12/31/2011. Let's say it will be equal to 34 rubles/USD. The line value will be equal to 135,000 rubles. = 1,000 rub. + 100,000 rub. + 1,000 USD x 34 rubles/USD. That is, the data on the cash balance at the beginning of the year in the balance sheet on line 260 will differ from the data on the same balances in the ODDS. |

What is now said about the rules for “reversal” of foreign exchange transactions in PBU 23?

First position. We have already noted that the entire currency flow in the report is not recalculated at the rate of the Central Bank of the Russian Federation on the reporting date, but is reflected at the rate of the Central Bank of the Russian Federation on the date of payment or receipt (clause 18 of PBU 23). That is, the accountant was spared from drawing up preliminary ODDS in each foreign currency and reversing the flow at the rate of each currency as of December 31.

Second position. It was separately prescribed that the balances of cash and cash equivalents in foreign currency at the beginning and end of the reporting period are reflected in the ODDS according to the rules established by PBU 3/2006, that is, at the official exchange rate of the Central Bank of the Russian Federation as of the reporting date (clause 19 of PBU 23/2010) . That is, fund balances at the beginning of the year should no longer be recalculated at the rate at the reporting date (December 31). Therefore, in both the balance sheet and the cash flow statement, the amount of cash at the beginning and end of the year should now be the same.

Exchange differences do not affect the amount of cash flows, but they change the values of balance sheet indicators at the reporting date. Therefore, exchange rate differences are not reflected in any of the sections of the ODDS, but are shown separately as the impact of changes in the foreign currency exchange rate against the ruble (line 4490). This is necessary to ensure that the opening and closing balances of cash and cash equivalents are maintained.

The difference arising in connection with the recalculation of the organization's cash flows and cash balances and cash equivalents in foreign currencies at rates on different dates is reflected in the cash flow statement separately from the organization's current, investing and financial cash flows as the impact of changes in the foreign currency exchange rate against the ruble (line 4490). In essence, these differences are exchange rate differences resulting from the recalculation of cash balances during the reporting period.

Additionally, PBU 23 establishes that in the event of a minor change in the exchange rate, conversion into rubles associated with a large number of similar transactions in such foreign currency can be carried out at the average rate calculated for a month or a shorter period (clause 16 of PBU 23). Obviously, the accounting policy needs to establish what change in the exchange rate will be considered insignificant, for what period and how the average exchange rate will be calculated.

Another important provision is the possibility of reflecting the acquisition and sale of foreign currency on the “net valuation” principle (clause 18 of PBU 23).

Recalculation may not be carried out if, within a few days after receiving a payment in foreign currency, the organization changes the amount received to rubles. Then the cash flow is reflected in the capital income tax in the amount of rubles actually received without intermediate conversion of foreign currency into rubles.

You can also do this if you have to pay in foreign currency and the exchange is made the day before. In the ODDS, you can reflect the amount of rubles actually paid without intermediate conversion of currency into rubles.

This is also an important provision, since the “unfolding” of operations in this case changed the essence of the operations. In fact, in most cases, the organization only incurred expenses for the purchase of foreign currency or income from its sale. And for those organizations that work with foreign suppliers or buyers, the ODDS was inflated due to the expansion of operations and the reversal of the currency on different dates. We recommend that you consider the innovations and write down the appropriate provisions on the rules for drawing up capital income tax in your accounting policies.

Additional Information Disclosure

Unlike the balance sheet and profit and loss account, the new ODDS form does not have an “Explanations” column, which refers to the relevant explanations. At the same time, if an organization provides additional explanations to any ODDS indicator in reporting, then the corresponding article of the report will have to contain a link to these explanations (clause 19 of PBU 23). ODDS items should be interconnected with equivalent items in the balance sheet (clause 22 of PBU 23).

Paragraph 23 of the Accounting Regulations requires disclosure in the notes to the financial statements of the accounting policies related to the preparation of the financial statements. We are talking about setting out the principles that guide the company when separating financial investments and cash equivalents, converting the value of cash flows in foreign currency into rubles, and making a decision on a compressed presentation of cash flows of a transit or mass nature. Other explanations necessary to understand the information presented in the DSDS may also be provided.

The organization must disclose information about the possibility of additionally raising funds in the future, including (clause 24 of PBU 23):

- the amount of unused loan funds indicating the existing restrictions on their use;

- the amount of funds that can be received by the organization on overdraft terms;

- guarantees received by the organization from third parties that were not used as of the reporting date to take out a loan, indicating the amount of funds that the organization can attract;

- the amount of loans (credits) not received as of the reporting date under concluded loan agreements (credit agreements), indicating the reasons for such shortfall.

If the indicators are significant, the organization must disclose information (clause 25 of PBU 23):

- about amounts unavailable for use (for example, letters of credit opened in favor of other organizations) indicating the reasons for the restrictions;

- about cash flows associated with maintaining the organization’s activities at the level of existing production volumes, separately from cash flows associated with expanding the scale of activities;

- on current, investment and financial cash flows for each reportable segment, determined in accordance with PBU 12/2010;

- about funds in letters of credit opened in favor of the organization, along with information about the fact that the organization fulfilled its obligations under the agreement using the letter of credit as of the reporting date. If the obligations under an agreement using a letter of credit are fulfilled by an organization, but the funds of the letter of credit are not credited to its current or other account, then the reasons for non-crediting and the amount of non-credited funds are disclosed.

From the editor. In economic programs, PBU 232011 will be implemented by the reporting campaign for 2011.

What is PBU

PBU is the main regulatory document for accounting of a commercial enterprise. The provisions apply regardless of taxation system and business size. The PBU specifies the rules and requirements that a company’s accounting must comply with. Accounting regulations were approved by the Ministry of Finance of the Russian Federation.

The PBU reference book is needed to understand what each provision regulates and when it needs to be applied. It is not a fact that you apply all the provisions. You won’t need some of them, it all depends on the nature and size of the activity.

For reference: in the article we talk only about the PBUs that regulate accounting for commercial organizations and individual entrepreneurs. Accounting for non-profit and credit institutions is conducted differently and on the basis of other standards.