Current regulatory framework

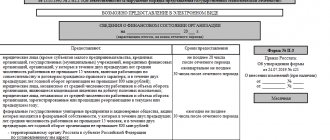

By Order of Rosstat No. 404 of July 15, 2021 (hereinafter referred to as the Order), updated reporting forms for business entities in Form 1-T were approved for the implementation of federal statistical surveillance. Statistics provide three independent reports with a similar designation:

- 1-T on the number and wages of employees (Appendix No. 1 to the Order);

- 1-T (working conditions) on working conditions and compensation for preferential categories of workers (Appendix No. 2 to the Order);

- 1-T (GMS) – on the number and wages of government employees (Appendix No. 5 to the Order).

According to clause 1 of the above Order No. 404, the new edition of the forms comes into effect from the final report for 2021. You will find a list of reporting forms sent to Rosstat in our article.

How to draw up a unified form T-1

An order in form T-1 is issued to employees who are employed under an employment contract. Actually, the concluded employment contract is the basis for issuing the order. For those who work under civil contracts, an employment order does not need to be drawn up.

The order is drawn up by the person whose responsibilities include hiring and registering employees.

The document must indicate:

- name of the structural unit;

- the position (specialty) for which the employee is hired;

- test period, if established;

- conditions of employment and the nature of the upcoming work (part-time, by way of transfer from another organization, to replace a temporarily absent employee, to perform certain work, etc.).

If an employee is hired for an indefinite period, in the “Date” detail, the “to” line (column) is not filled in.

After the order is signed by management, the employee must be familiarized with it against his signature.

For a line-by-line comment on filling out an employment order in Form N T-1, see the Ready-made solution from ConsultantPlus. Get trial access to K+ for free.

The order serves as the basis for opening a personal card for the employee (form T-2) and a personal account in the accounting department (form T-54 or T-54a). Also, based on the order, an entry is made in the employee’s work book.

Read about the personal card in the material.

You can find a sample of filling out an order in form T-1 on our website.

What changed

In a literal sense, the new form of 1-T statistics, the form of which you can download below, has not changed fundamentally. A significant part of the updates are of a technical nature, but at the same time, a number of additional information items have appeared in the new form.

Let us define the amendments more specifically.

Form 1-T “Information on the number and wages of employees” (Appendix No. 1 to the Order):

- Line No. 14 “Unlisted employees” was excluded from the previously valid form;

- The procedure for indicating information on the accrued wage fund has been changed. Previously, this data was reflected in two columns - for payroll employees and external part-time workers. Now the information is indicated in more detail, in four columns:

- total amount of accrued wages for the enterprise (column 2),

- the amount of wages accrued to employees on the payroll /excluding external part-time workers/ (column 3),

- the amount of salary accrued to external part-time workers - filled in if there are any at the enterprise (column 4),

- the amount of wages accrued to persons not on the payroll and those who performed work under GPC contracts (column 5).

- The submission deadline for this statistical report has been changed. Previously, it was submitted to Statistics no later than January 20; now the deadline for its submission is January 30 after the reporting period.

Form 1-T of occupational statistics (working conditions) (Appendix No. 2 to the Order):

- The positioning of the list of respondents who must submit this report to the statistical authorities has changed. Previously, it was indicated in paragraph 1 of the explanations on the formation of a statistical report, now it is included in the header of the report form;

- The deadline for submitting the report has been changed. The previous requirement was “January 21 after the reporting period.” Now the more specific wording “January 21” has been applied.

Unified form T-1 (form)

The form of the unified form T-1 and instructions for filling it out were approved by Decree of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1. If you continue to use documentation approved by the State Statistics Committee in your work, you can download the unified form T-1 on our website.

Let us remind you that from January 1, 2013, for most employers, unified HR forms are not mandatory for use.

Read more about this in the article “Primary document: requirements for the form and the consequences of its violation .

Who takes 1-T statistics

The obligation to submit a 1-T report to Rosstat is assigned to all legal entities that did not submit form P-4 to statistics in the reporting year. The exception is small businesses - they are exempt from submitting this type of statistical reporting. Let us remind you that these include business entities that:

- the average headcount for the previous reporting period did not exceed 100 people (and for microenterprises this figure was reduced to 15 people);

- annual income amounted to no more than 800 million rubles. (for microenterprises – 120 million rubles).

Unified form T-1a

This form is called an order (instruction) on hiring employees. It is issued when you need to hire not just one employee, but several at once. Otherwise, it performs the same function and contains the same information as the unified form T-1.

Sources: Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 N 1

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Features of report generation

Filling out the 1-T statistical report form does not cause any particular difficulties. However, let us note the main points of the formation of the 1-T form (number and salary of employees):

- The average number of personnel in column 1 is indicated without taking into account external part-time workers and persons working under civil servants' agreements. It is determined by summing the average number for each month of the reporting year and dividing the resulting value by 12.

- The wage fund accrued for the reporting period is indicated in column 2 as the total amount for the company, and in columns 3, 4, 5 with a breakdown by group of employees. Includes both monetary and other types of remuneration for work, additional payments, allowances, compensation, bonuses (including one-time payments), systematic payments for food and accommodation.

- Column 6 indicates social payments not related to benefits from extra-budgetary funds (for treatment, recreation, travel, etc.).

- In column “A” on lines 03-10, the information indicated in line “01” is deciphered by type of activity (in the same order). The type of activity is prescribed according to OKVED codes.

Number of copies of TTN

The consignment note consists of two sections:

- The first, commodity, refers to everything associated with a product;

- The transport section contains information related to the cargo carrier.

The waybill is always issued in 4 copies. The consignee fills out all 4 copies of the consignment note , and leaves the first copy of the consignment note It serves as the basis for deregistration of transported inventory items (TMV). In this case, the consignment note plays the role of a primary document in the formation of the expenditure side of the balance sheet.

The remaining three copies of the TTN are handed over to the forwarding driver. The main requirement is that these copies must be signed by those present (the driver and a representative of the shipper’s company) and certified by the seal of the shipper’s organization.

the second copy of the consignment note to the recipient of the cargo. This copy serves as the basis for registering received goods.

The third and fourth copies of the TTN are certified by the consignee with the signatures and seal of the organization and handed over to the driver. The driver submits these copies to the accounting department of the motor transport enterprise. One copy of the TTN serves as the basis for issuing an invoice to the client (the customer of the cargo transportation) and is sent to him along with the invoice for payment for services. The last, fourth copy of the TTN form is attached to the waybill and serves as the basis for calculating wages to the driver who delivered the cargo.

An important detail: since the TTN serves as the basis for the payment of wages, it must be issued separately for each flight, regardless of the homogeneity of the goods transported. The driver loaded up and received a TTN. I unloaded and submitted the TTN to the accounting department. 1 flight – 1 TTN.

Form 1-T statistics: filling out and submitting a report

The 1-T statistical report can be generated by the responsible person manually or using a computer.

Submitting a report to the statistical authorities of the region where the business entity is registered can be done in the following ways:

- upon a personal visit by the inspector;

- using electronic communication systems (in this case, the document must be certified with a verified electronic signature);

- by sending a valuable letter by Russian Post with an inventory and notification.

To avoid errors when creating a document, use the sample for filling out Form 1-T (statistics). 2021 can be found below.

Filling out the TTN section “Unloading”

- Column 11 “Contractor” - indicates the direct performer of the unloading work (the consignee himself, an involved third-party organization).

- Column 12 “Additional operations” - lists all actions in addition to unloading associated with the receipt of goods (weighing, recalculation).

- Column 13 “Device and mechanisms” - indicates the mechanisms and equipment with the help of which unloading was carried out.

- Column 14 “Unloading method” is a list of unloading methods. It can be done partly manually, partly mechanized.

- Columns 16,17 “Time of arrival”, “Time of departure”. Determined in the same way as during loading. As soon as the driver has presented the waybill and three copies of the TTN to the consignee, the time of arrival of the transport is entered in them. The departure time is determined by the completion of unloading work and the transfer of the remaining copies of invoices to the driver. The line “Transport services” contains a list of services provided by the forwarding driver when transporting cargo.

- Column 18 “Additional operations”. This column includes a list of additional operations necessary to carry out the unloading process.

- Column 19 “Signature of the responsible person.” This column contains the signature of the person accepting the goods. With his signature, the representative of the consignee confirms that the consignment note has been filled out correctly and that the goods actually received correspond to the quantity and weight of the goods specified in the consignment note.

- The lines containing data on the acceptance and transfer of goods must contain information about the seal numbers if the goods were sealed. The total weight of the goods and the number of pieces are also indicated. In addition, if the product is heterogeneous (several items of different types were delivered), the weight is indicated for each item with an error of up to 1 kg (in numbers and in words).

The “Accepted” line is filled in by the consignee’s representative indicating the surname and initials, as well as position. The data is certified by the signature and stamp of the organization. The “Passed” line is filled in with the same data of the forwarding driver.

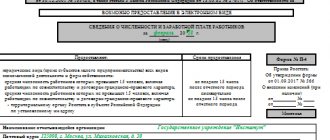

First section

This part of the report should indicate the number of workers who are employed in hazardous or hazardous industries. All employees should be taken into account, with the exception of women on maternity leave or parental leave.

We indicate the total number of employed workers in line 01 without taking into account production factors.

In line 02, indicate the number of employees employed in hazardous industries, in accordance with the special assessment of workplaces. If one employee is exposed to several harmful factors, then count it only once.

In lines 03–13, decipher line number 02 according to the highlighted categories (factors). If one workplace is exposed to several harmful factors, consider such sites in each category.

In line 12, indicate workers exposed to increased physical stress when performing work duties, and in line 13 - mental stress.

IMPORTANT!

Fill out the first section with information without taking into account the availability of guarantees and compensation for special working conditions for employees.

Presentation methods

The completed form is sent by the legal entity to the territorial bodies of Rosstat in the following ways:

- in person, when contacting an employee of the territorial office of Rosstat;

- with the help of a trusted person;

- by mail (registered mail);

- electronic.

Rosstat regulations indicate how to submit form No. 1 personnel electronically: sign with an electronic digital signature and send by e-mail to the territorial office (Rosstat order No. 313 of 07/07/2011).

IMPORTANT!

An order to transfer statistical reporting into electronic form is currently being approved by the department. After its approval, respondents will begin submitting information to Rosstat only in electronic form.

Second section

In section No. 2 we write information about guarantees and accrued compensation. Do not take into account information about the calculation of regional and climatic coefficients in the table.

In column 3, indicate your total expenses for the year. Reflect the amounts of payments due to women in column 4. Fill in column 5 with the amounts of expenses incurred at the end of the year. For example, if an employee received additional payment during the reporting period, and resigned at the end of the year, then do not include the amount of accruals for the dismissed employee in column 5.

Who is responsible for filling out the TTN (bill of lading) form?

The owner or seller of goods, when selling and transporting them, is required to issue an invoice form. By agreement, this function can also be performed by the carrier.

| A TTN form is issued for each consignment of goods transported by one vehicle. |

This means that the number of documents must be equal to the number of vehicles involved in the transportation of goods. Also, the bill of lading form is drawn up in 3 copies for each party: sender (seller), carrier, recipient.

Title page

In the address part

The form indicates the full name of the reporting organization in accordance with the constituent documents registered in the prescribed manner, and then in brackets - the abbreviated name (abbreviation). The form containing information on a separate division of a legal entity indicates the name of the separate division and the legal entity to which it belongs.

By line "Mail address"

the name of the subject of the Russian Federation, legal address with postal code are indicated; if the actual address does not coincide with the legal address, then the actual location of the respondent (postal address) is indicated. For separate divisions that do not have a legal address, a postal address with a postal code is indicated.

In the code part

the title page of the form based on the Notification of assignment of the OKPO code (identification number), posted on the Rosstat Internet portal at: https://websbor.gks.ru/online/#!/gs/statistic-codes, the reporting organization puts down:

- code according to the All-Russian Classifier of Enterprises and Organizations (OKPO) - for a legal entity that does not have territorially separate divisions,

- identification number - for a territorially separate division of a legal entity and for the head division of a legal entity.

The head unit of a legal entity is a separate unit where the administration of the enterprise is located or whose location corresponds to the registered legal address.

In case of delegation of authority to provide statistical reporting on behalf of a legal entity to a separate division, a separate division in the code part

The form indicates the OKPO code (for a branch) or identification number (for a separate division that does not have the status of a branch), which is established by the territorial body of Rosstat at the location of the separate division.

Attention! To select the direction for submitting the report (TOGS), follow this procedure:

Attention! If the list of proposed TOGS does not contain the one you need, you can select it by clicking on the “Show all”

. Next, select the appropriate region and TOGS in this region.

Who submits the report

Presented in the table, who passes 1st staff statistics in 2021:

| The report is submitted | The report is not submitted |

|

|

Information about the company’s income (section 5 of form 1-Enterprise)

On page 501 section. 5 indicates the total turnover of the company for the reporting year.

On pp. 502–505 indicators are recorded for the volume of products, services and work performed by the company itself, on p. 505 - revenue from processing customer-supplied raw materials, on p. 506 - revenue from repair work, on pp. 507–511 - revenue from resale, on page 512 - income from the sale of goods and materials previously purchased for the own production of goods.

Pages 513, 514 indicate revenue, respectively, from construction and scientific and technical work performed by third-party legal entities and individuals under subcontracts.

Pages 515, 516 record the cost of manufactured products, which are credited to fixed assets, corresponding respectively to:

- to industrial goods;

- agricultural goods.

Page 517 indicates the cost of construction and installation work carried out by the company for its own needs.

Page 518 records the cost of products that are given to third-party legal entities and individuals free of charge, and paragraph 520 records the cost of agricultural products transferred to internal divisions (not engaged in agriculture).

Page 519 indicates the cost of produced feed and fertilizers that are used for the own production of agricultural products.

Pages 521, 522 record the cost of produced building materials and structures used in construction and installation work, respectively:

- reporting organization;

- by third parties.

In paragraphs 523, 524 indicate data on budget subsidies if they were received by the company.

Page 525 indicates the number of months in the reporting year during which the company carried out commercial activities.

Clause 526 records the amount of customs duties that must be paid by the company for the reporting year.

Probably the most voluminous section of form 1-Enterprise is section. 6. It reflects information about the company’s expenses for the production and sale of products, services and work, as well as related indicators (such as, for example, balances of purchased goods and materials).

It also makes sense to study the structure of the relevant section in more detail.