07/01/2019 0 277 4 min. Paying taxes is an obligation that applies to every employed person.

Often in enterprises, some employees work part-time. That is, they perform some kind of work in

1C experts tell you how to calculate your monthly care allowance in 2021

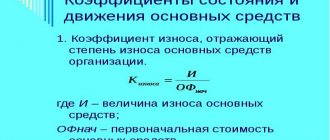

When accounting for the condition of fixed assets, various depreciation methods are used, which have a common

How did the BCC change in 2018-2019 and were there any changes to the BCC according to

Termination of an employment contract by agreement of the parties is the preferred method of ending an employment relationship.

Characteristics of account 62 62 accounting account is an analytical account that summarizes information on

Over time, fixed assets physically wear out and become obsolete. If such an object cannot be restored

Insurance premium and types of insurance Insurance premium is a payment for insurance (Article 954

Almost all reporting to the tax office for each employee is provided by the employer. However, in some