Termination of an employment contract by agreement of the parties is the preferred method of ending an employment relationship. Despite the fact that this is the most painless option for terminating an employment contract, there are certain rules, which we will discuss in detail.

In Russia, legislation provides the parties to an employment contract with the opportunity to separate by mutual consent. This method of terminating the relationship between an employee and an employer differs from dismissal at the employee’s own request. Article 78 of the Labor Code provides for such grounds for termination of a contract as dismissal by agreement of the parties. This option for ending cooperation is optimal if the relationship does not work out and is beneficial for each party.

In this article we will consider in more detail the procedure for registering dismissal by agreement of the parties. This procedure is not clearly regulated by law. But in this case, the employee also has all the rights provided for by the Labor Code of the Russian Federation, including compensation and payments upon dismissal by agreement of the parties, established by law. By the way, no one forbids agreeing that dismissal without work will follow, because this is a completely logical decision if, for example, the relationship is strained.

What is dismissal by agreement of the parties?

To avoid the burden of litigation, which is a necessary measure in case of wrongful deprivation of work, company management is using dismissal by agreement of the parties in 2021.

This procedure helps normalize the work process. Employees of organizations see that dismissed persons are dealt with fairly, in accordance with the Labor Code, management makes payments upon dismissal by agreement of the parties in 2021.

With proper documentation, the likelihood of a dismissed employee filing lawsuits sharply decreases, since he must sign all papers. A citizen who stops working benefits from the procedure for concluding an agreement, since it is possible to negotiate compensation payments individually. The settlement amounts may be large amounts determined by the parties.

What if an employee doesn't agree with the size?

The first solution is amicable. Those. the employee comes to the employer and explains with reason why he does not agree with the amount of payments. The director makes a decision: either recalculates or refuses the dismissal.

After the refusal, the offended person can go to the labor inspectorate with a statement, and this is fraught with inspections and fines for the enterprise. If during the inspection it is indeed revealed that the dismissed person was not paid extra, then the latter will be provided not only with the missing amount, but also with additional compensation.

The conclusion from this is: follow the calculations and calculate everything carefully, otherwise disaster will not be avoided..

Legal regulation

Dismissal by agreement of the parties with payment of compensation in 2019 is regulated by Article 78 of the Labor Code of the Russian Federation, which indicates that an employment contract can be terminated by agreement of the parties at any time before expiration at the initiative of the management or employee of the company. This also applies to contracts concluded for an indefinite period. The amount of compensation payments for certain categories of citizens is limited by Article 349.3 of the Labor Code.

The lower limit of compensation upon dismissal by agreement of the parties with payment of compensation in 2021 is established by Part 1 of Article 127 of the Labor Code of the Russian Federation, which states that a citizen must receive additional payment for unused periods of vacation provided annually, according to the number of days. The company is obliged to issue settlement documents to the dismissed person out of turn, on the day when the citizen receives the documents. This procedure is provided for in Articles 84 Part 1 and 140 of the Labor Code of the Russian Federation.

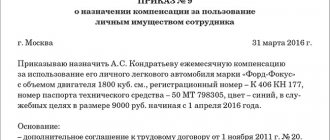

Order to dismiss an employee

Based on the agreement, a dismissal order is issued (you can use the unified form No. T-8, approved by Resolution of the State Statistics Committee dated 01/05/04 No. 1). In this case, in the line (column) “Grounds for termination (termination) of the employment contract (dismissal)” you must indicate: “Agreement of the parties, paragraph 1 of part one of article of the Labor Code of the Russian Federation.” And in the line (column) “Base (document, number, date)” you should write: “Agreement dated_ No. on termination of the employment contract dated_ No_”, or “Additional agreement dated_ No_ to the employment contract dated_ No_”, depending on how the agreement was concluded.

The employee must be familiarized with the dismissal order against his signature.

Compose and print an order for free using form No. T‑8

What could be the reasons

The reasons why employees and employers agree to this rather exotic form of dismissal can be different. As a rule, for an employee such reasons will be:

- The desire to receive severance pay or other payments that may be provided for in the employment contract.

- In order not to be fired “under the article” - that is, for violation of discipline, the Labor Code of the Russian Federation or regulatory acts of the enterprise.

- Psychological pressure from the management of the organization (although usually in these cases the employee is required to resign of his own free will).

In turn, the employer benefits from dismissal by agreement of the parties:

- If you need to get rid of a disloyal employee, even if you pay him some money if he insists on it.

- If you don’t want to follow the normal downsizing procedure.

- If you need to dismiss an employee with benefits who cannot be dismissed in the usual manner.

The latter, it must be said, is completely illegal, and if the employee then goes to court or the prosecutor’s office, he may well be reinstated at work and paid for forced absence.

As a rule, the initiator of dismissal by agreement of the parties is the employer. For an employee who does not want to continue working at the enterprise, it is much easier to resign of his own free will and persuade management to fire him before the expiration of the two-week period of service. However, the law does not prohibit an employee from approaching the employer with such an initiative.

What factors should be taken into account when making calculations?

If an employment or collective agreement or agreement provides for payments related to the amount of average earnings, you need to keep in mind what is specifically taken into account when calculating this amount. For calculations you need to know :

The employee's salary.- The amount of regular bonuses provided for in the employment contract or local regulations of the enterprise.

- Salary increments for length of service or experience, part-time work, management of a site or team, etc.

- Additional payments for special working conditions (night work, difficult conditions, etc.).

- The amount of time actually worked, excluding sick time, days of rest or vacation, other absence from work for any reason, downtime, etc.

In general, this issue is regulated by Regulation No. 922, approved in 2007 by the Government of the Russian Federation. The provision also indicates that when calculating average earnings, any kind of social payments, material assistance and other amounts not received for work and not provided for in Art. 129 Labor Code of the Russian Federation.

For average earnings, the billing period is also important. This term refers to the period of time for which calculations are made.

Over time, an employee’s salary may change, he may improve his qualifications, learn a new profession, earn additional bonuses - and therefore the average salary is calculated based on the most current data , that is, for the last period before the employment contract was terminated.

Necessary conditions for dismissal by agreement

The most important condition under which dismissal is made by agreement of the parties is its complete voluntary nature. By law, neither party has the right to force the other to enter into such an agreement.

This is also important to know:

Bypass sheet upon dismissal: is it needed upon dismissal, sample filling

When dismissing at one's own request, the employer has the right only to demand to work for a two-week period, but cannot prohibit the employee from quitting. If dismissed due to staff reduction or for committing an offense on the contrary, the employee cannot prevent the management of the enterprise from terminating the employment contract.

But if we are talking about the dismissal taking place under Art. 78 of the Labor Code of the Russian Federation, both the employee and the employer have the right to vote, and without their mutual consent, dismissal cannot take place.

Otherwise, the law does not regulate in any way the conditions under which such dismissal occurs. The parties can agree on severance pay, but it is not mandatory.

Also, the employee and the employer can agree that some time may pass between the consent to dismissal and the dismissal order itself, but they can terminate the employment contract immediately.

Dismissal of pensioners and pre-retirees

Working pensioners and pre-retirees also have the right to resign by agreement of the parties to the employment contract. But there are nuances here too.

ATTENTION. Article 144.1 of the Criminal Code of the Russian Federation establishes criminal liability for the dismissal of pre-retirement employees. It occurs if the reason (motive) for dismissal is the employee’s age. This means that the dismissal agreement should not contain provisions from which it can be concluded that it was concluded in connection with the employee acquiring pre-retirement status. In particular, there is no need to indicate the fact that the employee has reached the appropriate age, or whether he has benefits provided to pre-retirement workers.

As in other cases, the conclusion of the agreement must be voluntary. Otherwise, the pre-retirement person will be reinstated at work, the company will be fined (Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation), and its manager may be brought to criminal liability (Article 144.1 of the Criminal Code of the Russian Federation).

Termination of an employment contract by agreement of the parties

The process of leaving work by mutual agreement of management and employee includes several successive stages. They are not stipulated by law, but in order to avoid conflict situations resolved in court, documentation must be drawn up in writing, with copies of official paper forms being issued to interested parties. Termination of labor activity occurs according to the following algorithm:

- An initiative expressed orally by management or subordinates to stop work.

- Writing a statement indicating the date of termination of activities, oral discussion of conditions and compensation payments.

- Written consent, with registration and signing by the parties to the transaction.

- Issuance of an order in the established form, under which the employee must sign.

- Settlement with the issuance of agreed funds.

- Entry in the work book.

- Handing money and documents to the dismissed person.

Application for dismissal by agreement of the parties

The HR department of an enterprise requires a clearly and competently drawn up application for dismissal. The employee can type on a computer or write a statement in his own hand indicating the necessary data:

- In the upper left corner - the full name of the company, surname, initials of the general director, surname, initials, position of the employee.

- In the middle, in large font, is the word “Statement.”

- The main text contains the essence of the petition, indicating the end date of the work, the reasons for the severance of the employment relationship, and the legislative norms justifying the initiative. For dismissal by agreement of the parties with payment of compensation in 2021, the standard is Art. 77, clause 1 of the Labor Code of the Russian Federation.

- Date, applicant's signature and transcript.

Discussion of the conditions and amount of compensation payments between the parties

Agreement to terminate cooperation is beneficial to the worker if he receives large amounts of money. The employee is entitled to wages for the time actually worked, additional payments for unused leave, compensation for termination of the transaction, if such is stipulated in the employment contract.

There are nuances that a citizen signing a document with payment of compensation should know. If compensation is not specified in the company’s local regulations, then management is not obligated to make payments.

Registration and signing of the agreement

The document is drawn up in any form. The agreement must indicate the following information:

- Company name, last name with initials of the manager, full name of the employee.

- Details of the employment contract that needs to be terminated, an indication of legal standards.

- The date of termination of contractual obligations (depending on whether the employee leaves with or without work), the amount of compensation payments by the employer to the employee.

- Obligations of the employee to return material assets, documents, and other property used in the process of work.

- The obligation of the parties not to have mutual claims after signing the document.

- Signatures and details of the parties to the agreement.

Order and familiarization of the employee against signature

After signing the form, the HR department issues an order for the enterprise, which indicates the full name of the dismissed employee, details of the contract, agreements, and the wording of termination of the contract.

The paper has a number that is entered in the work book. The order form is signed by the head of the company; in addition, the signature of the resigning employee is required, indicating the fact that he has read and agreed with the text of the document.

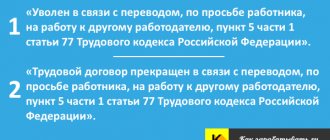

Entries in the work book and personal card

After registering the order, the head of the personnel department (HC) enters the following information into the work book of the resigning worker:

- Serial number of the record, date.

- Information about dismissal - number, date of the document, articles of the Labor Code of the Russian Federation justifying the action.

The personal card must have similar information about the reasons for dismissal, details of the order, agreement. Records are made for verification of record keeping by supervisory authorities. The work book with a record of dismissal is provided to the employee immediately after payment of the payroll. The following documents are issued:

- employment history;

- copy of the order;

- copy of the agreement.

Calculation note in form T-61

For the management of the enterprise, the act of the unified form T-61 serves as evidence of payments made to the dismissed party. The details are filled in by the OK employee; the calculation of the amount of salaries due for compensation payments is made by the organization’s accounting department.

Free legal consultation

We will answer your question in 5 minutes!

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Ask a Question

Columns 3 and 4 of the document indicate the average salary of a worker and the number of hours worked. The rules for calculating compensation are the same as for calculating regular vacation pay.

Issuance of documents and monetary compensation on the employee’s last day of work

According to the legislation, a dismissed citizen can apply for calculated additional payments from the moment of signing the order, without waiting for the day the salary is issued. Along with financial resources, documents are issued indicating the peaceful settlement of monetary and legal disagreements regarding the premature termination of the contract at the initiative of one of the parties.

Compensation for unused vacation

This type of compensation payment is due to all employees with whom the employment contract is terminated. It does not matter on what basis the dismissal is issued.

On the last day of work, the number of unused days of annual basic and additional leave is counted. Next, average earnings are calculated based on the employee’s income for the last annual period.

The resulting average daily earnings are multiplied by the number of vacation days not taken off.

The amount must be paid to the resigning person along with his salary on the last day of work, which is established by agreement.

Calculation of compensation upon dismissal under a fixed-term employment contract.

Dismissal by agreement:

Maternity maids

For women on maternity or child care leave, there are a number of benefits. In particular, they cannot be fired due to staff reduction; if a fixed-term employment contract expires, they have the right to demand its extension, etc.

This is also important to know:

How dismissal occurs on a day off: a detailed description

That is why, in order to get rid of such employees, employers often dismiss them by agreement of the parties. If such an agreement is concluded, no benefits apply, and the maternity leave may be dismissed.

However, we repeat once again: such dismissal is permissible only if the woman agrees to this option. If the employer exerts pressure, it will be absolutely illegal, and then the labor inspectorate, the prosecutor’s office and the court will side with the employee.

However, it should be remembered: if a woman nevertheless agreed to such a dismissal, then she will not receive any benefits or other payments unless their payment is directly indicated in the agreement. That is why, in practice, cases of dismissal by agreement of the parties to this category of workers are very rare.

Pensioner

Working pensioners enjoy all the rights provided for other categories of workers. Moreover, Art. 3 of the Labor Code of the Russian Federation directly prohibits restrictions on labor rights and freedoms based on age.

That is why the same rules apply to them when dismissing them by agreement of the parties as when dismissing any other employees on this basis.

Part-timer

The only difference in such dismissal for a part-time worker will be only a slightly different wording of the entry in the work book.

If the job from which he quit was not the main one, then in the work book, where, at the employee’s request, entries about part-time work can be made, it will be written: “Dismissed from part-time work...”.

The rest of the entry (including references to clause 1 of Article 77 of the Labor Code of the Russian Federation) will be absolutely the same as for other employees.

Large family and single mother

Since dismissal by agreement of the parties is completely attributed to the will of the parties by the Labor Code of the Russian Federation, when dismissing a mother with many children and a single mother who has agreed to terminate the employment contract, the general rules will apply.

They will not have any additional benefits not specified in the agreement. The only thing you should pay attention to is that consent to dismissal must be absolutely voluntary.

During pregnancy

According to the law, an employer cannot fire a pregnant woman, except in cases of liquidation of the enterprise or termination of the individual entrepreneur’s activities.

Dismissal by agreement of the parties is carried out on a general basis; the employee does not receive any benefits. She can only count on the amount specified in the contract. Payment of maternity benefits required by law is not made.

This is also important to know:

Dismissal of an employee of pre-retirement age

Judicial practice shows the possibility of challenging a contract. To do this, the woman must prove that she did not know about the pregnancy at the time of signing it. Consequently, she did not calculate the consequences of voluntarily refusing to work.

The protection of motherhood and childhood is the prerogative of the state, prescribed in Article 38 of the Constitution of the Russian Federation; as a result, the court often sides with the mother, annulling the agreement.

To avoid such situations, the employer is recommended to reach an agreement with the employee out of court by paying compensation. In turn, she acts at her own risk and if the outcome is unfavorable, she pays legal costs.

When staffing is reduced

Employees subject to staff reduction are entitled to severance pay not lower than the average monthly salary, payment for unused vacation and salary at the time of dismissal. If in the next two months he was unable to get a job and turned to the employment service, the employer pays compensation for this period.

An employee is given 2 months notice of dismissal. He must sign, confirming familiarity with the document, and at the same time, the company must notify the trade union and employment services.

Naturally, this procedure makes dismissal by mutual consent the preferred procedure only for the employer. The employee’s only motive is decent compensation, covering the amounts due to him by law.

During probationary period

According to current legislation, the probationary period for an employee should not exceed 3 months.

The basis for dismissal by the company is the unsatisfactory qualities of the employee, absenteeism, or violations of discipline.

The employee can find a more suitable location. Dismissal by agreement of the parties gives him the opportunity not to work even the required 3 days, counting on all payments due.

The employer also quickly gets rid of the employee, protecting himself from potential claims and starting to look for another specialist.

During the period of sick leave

Article 81 of the Labor Code of the Russian Federation denies the employer the right to dismiss a sick employee on his own initiative.

However, its effect does not apply to the mutual consent of the parties. As a result, the employee’s incapacity to work is not grounds for termination of the dismissal agreement. It is carried out exactly within the specified period and cannot be challenged by certificates and sick leave certificates.

In the absence of a sick employee, a corresponding entry is made in the dismissal order, and a notification is sent to him with a request to appear for a work book or to express consent to receive it by mail.

If the disability occurred during the validity of the employment contract, benefits are also paid for the period following the dismissal, namely 30 days from the moment the employee is familiar with the dismissal order. When sick leave is received by an enterprise, it is paid on the next day of payment of wages. Payments are made on a general basis, even if there is an agreement of mutual consent to dismissal.

A similar principle applies to injuries or illnesses that occur within 30 days after dismissal, if the employee did not manage to get a job elsewhere. Only illnesses resulting from a proven suicide attempt, deliberate self-harm, or commission of a crime are not covered.

Vacation followed by dismissal

The company may give the employee leave with further dismissal. It is provided for the full term, even if the year is not fully worked. Financial compensation applies only to the allotted days.

The employer may reject the employee's request, limiting himself to benefits for unused vacation. In this case, the conditions set out in the contract are fulfilled in full.

Dismissal of pregnant women

The Labor Code does not contain restrictions on the circle of persons who can be dismissed “by agreement”. This means that a similar method of terminating an employment contract is also permissible in relation to a pregnant woman, regardless of the stage of pregnancy. Including, the conclusion of an agreement is possible even after the employee goes on maternity leave.

But there is one caveat. If a woman found out about her pregnancy shortly after signing the agreement and, therefore, changed her mind about quitting, it is better to reinstate the employment contract. Otherwise, this can be done by the court based on the claim of a pregnant woman (rulings of the Supreme Court of the Russian Federation dated 06.20.16 No. 18-KG16-45 and dated 09.05.14 No. 37-KG14-4). Therefore, before concluding an agreement to dismiss a pregnant employee, you need to make sure that she has previously submitted documents about her pregnancy. This could be a certificate of registration in the early stages of pregnancy, or an application for leave or time off due to pregnancy, etc. If there are no such papers, and the employer is not ready for the subsequent reinstatement of an employee who has changed her mind about leaving, then it is better not to formalize the dismissal “by agreement” with her.

ATTENTION. There is no need to indicate in the agreement that the employee is pregnant. This may be regarded as dismissal for this reason. And such an action is a crime, liability for which is provided for in Article 145 of the Criminal Code of the Russian Federation (clause 16 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated December 25, 2018 No. 46). Similar criminal liability will arise if the court finds that a pregnant woman was forced to sign such an agreement. Evidence may include facts of physical impact or psychological pressure; creation of unfavorable working conditions; illegal application of disciplinary sanctions; threats of using methods of influence that could lead to adverse consequences not only for the employee, but also for his relatives (appeal rulings of the Supreme Court of the Republic of Dagestan dated 08.16.16 No. 33-2669/2016, Astrakhan Regional Court dated 05.30.12 in case No. 33-1592 /2012).

How is the amount of compensation determined upon dismissal by agreement of the parties?

The amount of compensation is calculated by the accounting department. The procedure is not unified, i.e. The head of the enterprise himself decides for what period the compensation will be provided and how its amount will be determined. If the employment contract states that as a result of dismissal the employee will be paid a fixed amount of money, then so be it. An exception is situations when the agreement contains information about the provision of compensation. Accountants determine the amount of payments as follows:

- by average earnings for a certain period of time;

- in the amount of the official salary (double, triple, etc.);

- in the form of a fixed amount specified in the employment contract.

Fixed amount

A number of organizations prescribe a certain amount of compensation in a collective or individual employment contract. The director can change its size if information about this is included in the concluded agreement. The legislation does not provide for any restrictions regarding the fixed amount of compensation. Often it is equal to the tariff rate for one working month.

In the amount of official salary

The tariff rate is specified in the employment contract. If a citizen was promoted several times during his work or the salary was increased, this is reflected in this document. Compensation will be equal to the salary in the last specialty. Ordinary employees are often given triple pay, but directors and top managers are paid compensation equal to six times their salary.

Based on average earnings for a certain time

With this method, it is important to correctly determine the amount of compensation. The accounting department calculates the amount of payment based on the established monthly salary and the number of days worked in the month. For example, a manager has a salary of 25,000 rubles. He will be fired on February 20, 2021. According to the production calendar, this month has 20 working days. For the period from February 1 to February 20, there are only 14 of them. The accountant will calculate the average earnings using the following formula: 25,000/20*14=17,500 rubles.

How to correctly calculate this value

The average earnings themselves are calculated according to the rules described in Art. 139 of the Labor Code of the Russian Federation and in Regulation No. 922. According to these standards, the calculation is tied to the billing period of the 12 previous calendar months. They also indicate that the employer has the right to establish his own forms of calculation at the enterprise, but only on the condition that the result turns out to be more profitable for the employee than the standard one.

This is also important to know:

Forced dismissal: how an employee should behave, what threatens the employer

If we are talking about compensation upon dismissal by agreement of the parties, usually we should talk about calculating average earnings per month. It is calculated using the following formula:

SMZ = SMD x Dwhere:

- SMZ – average monthly salary;

- SMD – average daily earnings;

- D – number of working days in a month.

Calculation example. Let’s say that employee Ivanov received a total salary of 264 thousand rubles for the year. At the end of the year, according to the employment contract, he received a bonus that amounted to 40 thousand rubles. In total, according to working time records, he was present (minus sick leave, business trips and days off) for 210 days. In this case, the average daily payment will be:

264,000 + 40,000 / 210 = 1,447 rubles

Next, you need to multiply it by the number of days. Here you can use the average number of either calendar days (this technique is used when calculating compensation for vacations, and then the coefficient 29.3 is used) or workers (in this case, data from the production calendar for the corresponding year is used).

For those who have worked for less than a year

In the event that the resigning employee worked for less than the calculation period, that is, a year, it is necessary to be guided by other formulas. This is especially important when it comes to calculating the compensation due to him for vacation. The following formula is to be used:

SDZ = ZP / (29.3 x PM + NPM) where:

- SDZ – average daily earnings;

- Salary – all remuneration for labor (including regular bonuses);

- PM – months worked in full;

- NPM – months not fully worked.

Calculation example: employee Petrov has worked in the organization for less than a year. During this time, he was credited with 218 thousand rubles. They worked for 11 months in full. Thus, during this time the following days should be taken into account:

11 x 29.3 = 322.3 days

In the last month, Petrov worked 25 calendar days. As a result, his average daily earnings will be:

218,000 rub. : (322.3 days + 25 days) = 628.24 rubles.

Free legal consultation

We will answer your question in 5 minutes!

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

Ask a Question

Is severance pay mandatory?

In addition to the payments required by law, which are made on a general basis, the employer is not obliged to pay additional money to the worker if he does not agree with his claims, and otherwise is not stipulated by the employment contract. The company's management can accommodate the worker halfway by paying amounts in excess of the subsidies established by law if they see this as a benefit for themselves. The amount of compensation is discussed verbally.

Limitation on the amount of compensation for executive employees

According to Article 349. Clause 3 of the Labor Code of the Russian Federation, persons holding senior positions in private and public companies cannot apply upon resignation, by agreement, to receive amounts exceeding three times their earnings.

The article provides a caveat: compensation does not include wages due, earnings maintained during temporary incapacity for work, payments when going on business trips and studies, or additional payments for vacations.

Payment terms

Even in the case when the employment relationship is terminated due to the signing of an agreement on mutual consent of the two parties and sealed with the signatures of the subordinate and the employer, the latter must not forget that all funds due to the employee must be paid within the time specified by law deadlines.

Article 140 of the Labor Code provides for the payment of all money due to an employee on the last day of his work with a given employer. Accordingly, the same rule applies to the calculation of payments upon dismissal by agreement of the parties, which means that on the last day of the employee’s work activity specified in such an agreement, the employer must pay all the money he last earned.

If the employee was not on vacation, he is entitled to a cash payment for the vacation that he did not use.

Consequences of delay for the employer

When drawing up the Labor Code of the Russian Federation, the interests of the employee before the administration of the enterprise were taken into account. It is possible to bring the employer to punishment only if guilt in committing an offense is established. For late payment of the settlement, the employer may be held liable, including financial liability, for each day of delay in payments.

Attention! For non-compliance with laws, a fine may be imposed on the enterprise itself, or, in rare cases, in case of gross violations of the dismissal procedure, the activity of the enterprise may be suspended for up to 90 days.

Dismissal by agreement of the parties is the best way to terminate an employment contract, both for the employee and the employer. The procedure can be carried out during vacation, illness and in other situations. Payments to a former employee are enshrined in law and do not lead to legal proceedings.

Calculation for an employee

Senior salesperson Sevanova Anastasia Pavlovna is resigning by agreement of the parties as of 06/07/2019. An additional agreement was signed to pay the employee severance pay in the amount of average monthly earnings for two months after dismissal.

An amount equal to one average monthly salary is paid upon dismissal, the other part is paid in the period from 07/07/2019 to 08/06/2019 on the day the salary is paid. The parties agreed that for the calculation the period from 06/01/2018 to 05/31/2019 is taken. During this period, the seller worked 210 days. Days of vacation and sick leave, as well as the amount of payments for them, are skipped. The employee’s total earnings for the year amounted to 359,000 rubles.

Average salary = 359000/210 = 1709.52 rubles.

The benefit is paid for the period from 06/07/2019 to 08/06/2019. The billing period includes 20 working days for the first month and 21 days for the second.

VP=1709.52*20=34190.40 rubles.

On the day of dismissal, severance pay is paid in the amount of 34,190.40 rubles. The remaining portion, which will be received next month, is also calculated using the formula and amounts to 34,899.92 rubles.

Personal income tax and insurance premiums according to the Tax Code of the Russian Federation are not deducted from this amount.

On our portal you will find other information about dismissal by agreement of the parties. Read about the application for dismissal, about drawing up a work book, as well as about compensation.

Personal income tax on payments upon dismissal as agreed by the parties in 2019

Tax Code in paragraph 3 of Art. 217 provides for an exemption from income tax on compensation issued upon retirement to a citizen if it does not exceed three times his salary. If payments are higher than the specified level, then the excess amount is subject to personal income tax.

This is also important to know:

How to correctly write a letter of resignation at your own request

For residents of the Far North, the upper non-taxable subsidy ceiling is set at six times the monthly wage.

Calculations in case of salary increase

The calculation of the average salary in the event of a salary increase carried out by the employer or as a result of the adoption of framework legislation will be carried out taking into account exactly when the salary increase took place.

- If the salary was increased during the pay period, then the average monthly salary will be calculated taking into account the increasing coefficient, calculated according to the scheme: the official salary in the month of the increase is divided by the official salary before the increase. The difference will be the coefficient, the calculation of which is included in the calculator system.

- If the salary was increased after the end of the billing period, but before the occurrence of an event giving the right to maintain the average monthly salary, then the average earnings for the billing period will be increased.

- If the salary was increased after the occurrence of an event giving the right to maintain the average salary, then the average salary will be increased from the day the salary was increased until the day the right to maintain the average salary ends.

The very fact of a salary increase will entail an increase not only in official salaries, but also in other types of remuneration directly resulting from the size of the salary.

Peculiarities of calculating insurance premiums to the Pension Fund of Russia and the Social Insurance Fund of Russia from the amount of compensation

All compensation paid by the employer to the employee under employment contracts and collective agreements are subject to contributions to the Pension Fund, Social Insurance Fund and Compulsory Medical Insurance Fund. This is established by federal law dated July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund.”

In accordance with paragraph 2 of Article 9 of the said act, compensation for unused vacation, payments in the form of severance pay in part exceeding three times (for those who worked in the Far North - six times) the amount of monthly earnings must be subject to insurance contributions to the specified funds. No deductions are made from other payments related to the dismissal of an employee.

No salary

If the employee does not have any payments during the calculation period (12 months) or for a time period exceeding this period, the accounting department must take the employee’s monthly salaries for the previous period as a basis. Thus, if from June 1, 2017 to June 1. In 2021, the employee did not receive a salary or did not work at all, then the time period from June 1, 2016 to June 1, 2016 will be taken as the calculation period. 2021.

If the employee did not have payments before the start of the pay period, then the accounting department will take as a basis the salary in the month from which the employee became entitled to maintain the average salary.

In the case where payments did not take place and during the period of occurrence of the case giving the right to maintain the average monthly earnings, the calculation will be carried out based on the salary assigned to the employee.

Appealing agreements

After the employment contract has been completed by mutual agreement of the parties, and all controversial issues between the employee and his former boss have been resolved, situations often occur when, after a short time, many of the former employees begin to think that their dismissal was illegal, and this is even despite the fact that they themselves gave their consent to it.

Many of these citizens are dissatisfied precisely with the fact that the payments agreed upon by the parties upon dismissal on mutually beneficial terms for both parties turned out to be not as large as they would like, and in various ways they try to put pressure on the former employer so that he pays more money than has already been received. Based on this, appeals to the court begin.

How to calculate average earnings?

The procedure for its calculation is given in Article 139. Labor Code of the Russian Federation . To find out, you need to take the salary actually accrued to the employee and the time he worked over the last 12 months that preceded his dismissal.

This annual amount should be divided by 12 and 29.3 (the average number of days in a month).

Now an example . Let's assume that baker Ivanov worked for only 8 months, i.e. less than a year Multiply 29.3 by 8. We get: 234.4 days. The total amount paid to Ivanov for the period worked was 258,600 rubles. Now let's divide 258600 by 234.4. Total: 1103 rubles. This is the average salary.

An example from judicial practice

The employee suggested that the employer end their employment relationship because he was not satisfied with the salary, and he had already found another job, especially since interpersonal relations with the boss had not been going well for a long time, to which the employer agreed. The employer drew up an agreement that stated the conditions under which dismissal would take place by agreement of the parties, what payments were due to the employee in this case, the latter agreed to everything and signed this agreement. As a result, it turned out that his employment contract stated a condition that upon dismissal, by agreement of the parties, he should be paid compensation in the amount of 15,000 rubles and no more, but the former boss paid only 11,000, with which the former employee agreed.

At the court hearing, the dismissed employee stated that he was forced to sign this agreement or was threatened with dismissal “under the article”, because the boss had long ago appointed another person to take his place, and persistently proved the fact that the dismissal was illegal. He also asked the court to reinstate him at work and to recover additional money from the employer to compensate him for moral damage.

The court, having examined the case materials and the agreement itself, having heard the testimony of witnesses, came to the conclusion that there were no violations of labor law in the actions of the employer, all payments by agreement of the parties upon dismissal of the said employee were made to him, including the payment of benefits , stipulated by the agreement concluded with the former boss. Therefore, at the court hearing, the said citizen’s claims were completely denied.

The court also pointed out the fact that all payments by agreement of the parties when dismissing employees on mutually beneficial terms are made by the employer on the basis of the law, which provides for the mandatory payment of wages and compensation for vacation and does not take into account in this case the strict payment of benefits.

Benefits and risks for the employer

First of all, we note that there is no conflict with the outgoing employee, who receives an absolutely neutral entry in the work book, as well as additional cash payments. Consequently, the chances of future complaints and litigation are reduced (especially if the “compensation” is paid on time and in full).

If they do appear, then the fact of the stability of the agreement, mentioned as a “minus” for the employee, as a basis for dismissal, turns into a “plus” for the employer. If this document is properly executed, the employee’s chances of being reinstated at work (and therefore receiving payment for forced absence and moral damages) are not great.

However, we cannot say there is a complete absence of risks in the event of termination of the employment relationship by agreement of the parties. Thus, if an employer delays payment of the amounts specified in the agreement, he faces a fine under Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation (for legal entities - up to 50 thousand rubles, for individual entrepreneurs - up to 5 thousand rubles).

Also, the fact that dismissal occurs “by agreement” does not mean that the employer will not be responsible for violations committed when preparing the relevant personnel documents (dismissal order, work book, etc.). In this situation, a fine can be assessed under Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation (for legal entities - up to 50 thousand rubles, for individual entrepreneurs - up to 5 thousand rubles).

Create a staffing table using a ready-made template Try for free