Almost all reporting to the tax office for each employee is provided by the employer. However, in some situations it is necessary to fill out the declaration yourself. Most often we are talking about Form 3 of personal income tax, which is relevant not only for individual entrepreneurs and notaries, but also for ordinary citizens who are either required to pay tax on additional income or apply for a tax deduction. Entering information into this document has a number of features, since they are presented in encoded form. Let us consider in more detail the question of what to indicate in the field in which the code for the name of the object is displayed in 3 personal income tax, and in what cases it is necessary to fill it out.

Who makes the calculations and why in appendices No. 6 and No. 7 of form 3-NDFL

Appendices No. 6 and No. 7 in 3-NDFL are filled out by individual taxpayers who:

- are tax residents of the Russian Federation;

- carried out an operation (operations) with real estate, which gives them the right to a tax deduction in the reporting year in accordance with Art. 220 Tax Code of the Russian Federation.

However, at the same time:

- Appendix 7 calculates the deduction associated with the purchase of property specified in subparagraph. 3 and 4 clauses 1 art. 220 Tax Code of the Russian Federation;

- Annex 6 reflects the formation of a deduction associated with the sale of property named in subparagraph. 2 p. 2 art. 220 Tax Code of the Russian Federation.

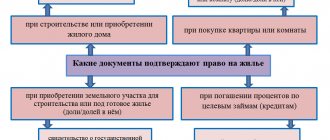

In this material we will look at the procedure for forming Appendix 7, which is filled out in the following cases:

- if the personal income tax payer purchased residential real estate (apartment, house, etc.);

- if the personal income tax payer purchased land under a residential building or suitable for building such a house on it;

- if the payer built the house himself;

- if for the purposes of the above purchase or construction the payer took out a loan at interest and paid the interest.

For all these reasons, the personal income tax payer can reduce the amount of tax withheld from him and request a refund from the budget of the personal income tax amounts previously transferred for him.

To receive a tax deduction (and refund), the payer needs:

- submit to your tax office documents confirming his expenses on the grounds set out in subparagraph. 3 and 4 clauses 1 art. 220 Tax Code of the Russian Federation;

For a list of documents submitted to obtain a property deduction, see the material “Documents for a tax deduction when purchasing an apartment in 2019-2020.”

- write an application for deduction (refund) of personal income tax amounts for the period;

- draw up and submit a 3-NDFL declaration indicating your income (for example, by place of work in the reporting year) and calculating the amount of deduction due to him in Appendix 7 of the 3-NDFL declaration.

ConsultantPlus experts explained how to fill out a declaration when selling and buying a home in the same reporting period. Get trial access to the system and start studying the issue for free.

NOTE! The declaration for 2021 must be submitted in a new form as amended by the order of the Federal Tax Service dated 10/07/2019 No. ММВ-7-11 / [email protected] declaration 3-NDFL and Appendix 7 you can here.

Where did the conditional property number come from?

Before the entry into force of Federal Law No. 221-FZ of July 24, 2007 “On the State Real Estate Cadastre,” real estate registration was carried out by the BTI and land chambers, which assigned conditional registration numbers. From March 1, 2008, records were also kept using conditional numbers assigned by the body carrying out state registration of rights to real estate and transactions with it until 2012. Thus, until 2012, the prerequisites for creating a full-fledged real estate register were formed.

During 2012, the BTI electronically transferred to Rosreestr all the documents that were in their archives. By the end of 2012, all real estate objects that had a conditional number were automatically assigned a cadastral number.

Since the digitization and transfer to Rosreestr of a huge number of documents was carried out in a short time, we recommend that you check for free whether your property has been assigned a cadastral number if your title documents only have a conditional one.

Name code: table

You need to record the object name code. That is, indicate what kind of property was acquired. The meaning of the code depends on what kind of real estate was purchased by the individual:

| Type of property | Object name code in 3-NDFL |

| House | 1 |

| Apartment | 2 |

| Room | 3 |

| Share in a residential building/apartment/room/land plot | 4 |

| Land plot provided for individual housing construction | 5 |

| The land plot on which the purchased residential building is located | 6 |

| Residential building with land | 7 |

How to correctly fill out 3-NDFL for filing a tax deduction

The rules for the formation of 3-personal income tax are established in accordance with the procedure approved by the order of the Federal Tax Service dated October 3, 2018 No. ММВ-7-11/ [email protected] taking into account the changes made by order No. ММВ-7-11/ [email protected] (hereinafter referred to as the Procedure ).

Regarding filing 3-NDFL for the purpose of obtaining a tax deduction under Art. 220 of the Tax Code of the Russian Federation, the following main points can be highlighted:

1. The declaration must contain a cover page containing the information required by the Procedure.

2. Section 1 is formed, which indicates the total amount that the payer intends to return from the budget, and the BCC and OKTMO for which the overpayment occurred in the reporting year.

3. Section 2 is filled in, which displays the calculation of the resulting overpayment. As a rule, this occurs due to the fact that during the year tax agents withheld personal income tax from the payments of the person applying for deduction and sent it to the budget. Information about such total payments and deductions is disclosed in Appendix 1 of the form.

IMPORTANT! For the calculation in Appendix 1, it is also recommended to stock up on documents confirming income and deductions (for example, 2-NDFL certificates from employers). This requirement is not established by law, but inspectors have the right to demand it. See details here .

3. Transcript sheets are filled out:

- Appendix 1 - income from a source in the Russian Federation (as many sheets A are filled out as there were sources in the reporting year);

- Appendix 7 - calculation of the property deduction for the acquisition (construction) of a residential real estate property (also filled out for each property separately, that is, there will be as many sections of Appendix 7 as there were purchased or built objects);

- Appendix 6 - calculation of the deduction due upon the sale of real estate (information for each object is filled out in the same way as Appendix 7).

How to fill out 3-NDFL if housing was purchased using maternity capital? The answer to this question is in ConsultantPlus. If you don't already have access to the system, get a free trial online.

How to enter the type of property in line 020

After the applicant for the deduction has noted the name of the property in the 3-NDFL form, the tax inspector must make it clear what type of property is registered for this property. The indication of the type is required in paragraph 1.2 near the designation 020. The numbering of these types is four-digit. We propose to understand the meaning of each of the signs:

- One. This code is written in situations in which the taxpayer has registered a private type of property for housing and is the sole owner of the property.

- Two. This code must be used if the property is jointly owned by two or more individuals, one of whom is an applicant for a reduction in the tax base. Moreover, the housing is not only jointly owned, but shares are also distributed.

- Three. Three is indicated if more than one individual invested in the purchase of real estate. That is, when the owner of a given object is more than one person.

- Four. Russian legislation allows for property transactions related to the registration of housing or land in the name of individuals who are currently under eighteen years of age. Thus, if the property is owned by a child, then the number four is written on the 3-NDFL form.

In addition to the name code and type of ownership of the property, you must write the coordinates of its location on sheet D1. You will also need to enter data regarding the date of receipt of documents on the basis of which the taxpayer became the legal owner of housing or land. And only after this can you proceed to settlement transactions related to the calculation of property tax discounts.

After the sheet is completely completed, be sure to check whether it contains the page number, surname, initials and identification code of the applicant for the deduction, as well as his personal signature and today’s date.

Almost all reporting to the tax office for each employee is provided by the employer. However, in some situations it is necessary to fill out the declaration yourself. Most often we are talking about Form 3 of personal income tax, which is relevant not only for individual entrepreneurs and notaries, but also for ordinary citizens who are either required to pay tax on additional income or apply for a tax deduction.

Filling out Appendix 7, if the deduction is issued for the first time: section 2

Section 2 calculates the deduction amount. Actually, this is the section for which the entire declaration is filled out. And it is this that causes the greatest difficulty for those who are not used to filling out tax forms.

Some tax authorities working with payers on personal income tax returns verbally recommend that those who submit 3-personal income tax, filled out manually on paper, make entries in section 2 of Appendix 7 with a simple pencil so that they can correct something and circle it with a pen in the presence of an inspector.

The first thing anyone applying for a deduction should know is that the deduction is provided not from the personal income tax amount (as many mistakenly believe), but from the tax base. To make it clearer, let's look at an example.

Example

Petrov purchased an apartment for 3,000,000 rubles. The maximum deduction for this purchase, due to him under Art. 220 of the Tax Code of the Russian Federation - 2,000,000 rubles. In total, during the period specified in the declaration, Petrov earned 800,000 rubles, personal income tax on them amounted to 104,000 rubles. These 800,000 rubles are Petrov’s tax base. And it is precisely this that should be reduced by the amount of the deduction. In this case, the tax base can be reduced in full: 800,000 – 800,000 = 0. That is, Petrov will receive a tax refund in the amount of 104,000 rubles (800,000 × 13%). And Petrov can transfer the deduction balance of 1,200,000 (2,000,000 – 800,000) rubles to the following years.

When filling out Appendix 7 for the first time, Section 2 indicates:

- page 2.5 - tax base (Petrov from the example will put 800,000 there);

- page 2.6 - confirmed amounts of expenses by which the tax base for the period is reduced (Petrov confirmed with documents all 2,000,000 due to him, which means he will put the value that he actually uses - 800,000);

- line 2.8 - the balance of the deduction carried over to the following periods (years) (Petrov will put 1,200,000 in line 2.8, intended for the deduction that is given specifically for the purchase (construction) of the real estate itself).

Appendix 7 of the 3-NDFL declaration - sample filling if the deduction is issued again

When carrying forward the balance that can be deducted to subsequent years, in these subsequent years:

- the procedure for applying for a deduction (remainder) will remain the same - again to the tax office with an application, documents and a new 3-NDFL declaration;

- There will be nuances in filling out section 2 of appendix 7 of the declaration.

Let's look at an example of how to fill out sheet 7 of the 3-NDFL declaration in case of transferring the balance of the required deduction to another period.

Example

Toporkov P.B. purchased an apartment in 2021 for 4,000,000 rubles. At the same time, Toporkov took out a loan for part of the amount, which he repaid in 2021 and 2021. In 2019, for the first time I submitted an application for a deduction for the year 2018 under clause. 3 p. 1 art. 220 of the Tax Code of the Russian Federation (purchase of real estate) and received it in the amount of 514,200 rubles. He also declared and confirmed the interest for 2021 paid to the bank on the loan that he spent on buying an apartment - 120,000 rubles. For 2021, Toporkov is again applying for a deduction. The amount of income from which tax was withheld by Toporkov’s employer is 702,540 rubles. In addition, Toporkov includes in the declaration and draws up documents for the second part of the interest that he paid on the loan - 240,000 rubles.

How all this will be reflected in Appendix 7, we will consider further:

- subsection 2.1 - amount of tax deduction for 2021 - 514,200 rubles;

- subsection 2.2. — the amount of interest deduction for 2021 is 120,000 rubles;

- subsection 2.6 - the amount of documented expenses for the reporting year 2021 - 702,540 rubles;

- subsection 2.7 - amount of interest expenses for 2021 - 240,000 rubles;

- subsection 2.8 - the balance of the property deduction carried forward to subsequent years RUB 783,260. (2,000,000 - 514,200 - 702,540);

- subsection 2.9 - the balance of the interest deduction is 0, because the amount of interest paid corresponds to the approved limit of RUB 390,000. (3,000,000 * 13%).

Thus, next year Toporkov will have the right to again apply for deduction and return of personal income tax in the amount of 783,260 rubles under sub. 3 p. 1 art. 220 of the Tax Code of the Russian Federation (purchase of an apartment).

Declaration on the Federal Tax Service website

1. The general procedure for filling out a declaration on the website of the Federal Tax Service of Russia is described here.

2. By analogy with filling out the Declaration 2021 in the PPO, at the “Deductions” step on the “Property” tab, you must put the “Provide property tax deduction” marker.

3. Click “Add object” and fill in the fields, if necessary, selecting data from the drop-down lists:

- method of acquisition - purchase and sale agreement;

- object name - apartment;

- type of property - property;

- the taxpayer's attribute is the owner;

- object number code - conditional;

- object number;

- location;

- date of registration of ownership;

- cost of the object;

- interest on loans.

4. Go to the “Totals” tab and check the amount to be refunded. It, as in the PPO Declaration 2021, amounted to 68,952 rubles.

5. Check the declaration form by clicking “Download” and opening the *.pdf file. The calculation of the deduction on sheet D1 is similar to the calculation in the PPO Declaration 2021.

6. Further filing of the declaration through the Federal Tax Service website is described here.

As we can see, there are no discrepancies between the programs regarding the property deduction. Use the option that is most convenient for you.

How to find out the conditional number of an apartment or land plot

The conditional number of a property is easy to find, since in the 2000s this number was assigned to all objects and placed in the documents “Certificate of Ownership” or as they are usually called “Zelyonki”. Below is an example of a Conditional Number on a document:

What is the purpose?

Why do you need a conditional apartment code? It is not given to land plots, only to houses, apartments, rooms . Such a digital code is an identification indicator of this particular object, and not another.

By the signs contained, you can find out where the property is located. This code is needed to link all objects to the area and put them on maps.

But they do not include this code in the State Property Committee register; only when registering with the State Property Committee will all available information about the property be entered, including the old code.

Decoding

Groups of characters are separated by a hyphen and a vertical slash. The “old” numbering is a long combination of digital characters.

What do the numbers mean? The first two characters are the number of the subject of the Russian Federation , the second are the registration district . Here is an example of the “old” designation: 32-32-03/004/2004-216. After the second hyphen, the combination 01/002/2005 hides the number of the book of registration and accounting of incoming securities , where:

- 03 – code of the Federal Reserve Service department performing the registration of rights;

- 004 – number of the accounting book in order;

- 2004 – the year in which the real estate was registered;

- 216 – the serial order of entries in the registration ledger.

This numbering is quite understandable and logical, but is not subject to electronic recording, which is available throughout the country.

What is the difference between cadastral and conditional numbers?

Data on numbers assigned to real estate is stored by the state body Rosreestr. The main differences between the numbering are:

- Conditional numbers are no longer assigned and are for informational purposes only. Using UNON you can find out the cadastre code, as well as identify information about the history and location of the object on the cadastral map.

- KNON is assigned by the cadastre and is used in registration of real estate transactions. Objects without KNON are most likely not registered with Rosreestr. This complicates legal manipulations; it is necessary to assign a number in the cadastral chamber.

- The recording format and transcript are different. The principles of formation of the KNON and UNON ciphers also differ. Digital sets come in different lengths.

KNON helps to systematize real estate on the territory of the Russian Federation; they are assigned to any objects, including land plots. UNON is found only near buildings and apartments.

Structure of a conditional number

Ciphers consist of numbers and hyphens between them. Each group of numbers has a specific meaning:

- The first 2 digits before the hyphen indicate the code of the subject of the Russian Federation. Among the subjects are districts, regions, regions, territories, etc. The codes are generally accepted and were assigned according to the same principles in all documents. Region means the place of registration of the object, not the actual location.

- The following numbers after the hyphen are the registration authority code. Indicates the specific department of the authority that carried out the registration.

- No. of the archive book in which there is a record of registration of real estate, year and serial calculation of the record.

In essence, UNON is the serial number of registration of a specific object in the region.

Cadastral number structure

The cipher consists of four groups of numbers separated by colons. Sequentially the values of numeric groups:

- District;

- Area;

- Quarter;

- No. of land plot.

KNON contains basic information about the actual location of the property. There is no ordinal calculation.

All numbers are assigned by Rosreestr, the only authorized body in the Russian Federation. By law, all real estate in the country is subject to accounting and registration.

How to find out the conditional number of an object

All buildings, structures, apartments have documents, passports, certificates. If the object was built before 2002, UNON will be indicated in the documents. If the certificate is lost or the building is relatively new, there is no point in looking for a code.

UNON will help in finding the cadastral number, but in itself is no longer important. It is classified as reference information and has no legal significance when concluding transactions. It is more important for owners and interested parties to know KNON for real estate transactions.

Results

Appendix 7 in 3-NDFL is formed in cases where the personal income tax payer has the right to a tax deduction as a result of transactions to improve housing conditions. The rules for filling out the sheet are established by the Federal Tax Service order No. MMV-7-11/ [email protected] 3, 2018, as amended by the Federal Tax Service order No. MMV-7-11/ [email protected] There are nuances to filling out Appendix 7 in cases , when a tax deduction declaration is submitted for the first time or is submitted again, for the balance of the confirmed deduction for previous periods (years).

Learn more about the nuances of forming 3-NDFL from the article “Sample of filling out a 3-NDFL tax return.”

Read more about the specifics of registering a deduction when purchasing real estate in the article “Procedure for compensation (return) of personal income tax when purchasing an apartment.”

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated October 7, 2019 N ММВ-7-11/ [email protected]

- Order of the Federal Tax Service of Russia dated October 3, 2018 N ММВ-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Title page

The following details have been removed from the title page:

- “Address of residence (place of stay) of the taxpayer” (postal code, region code, district, city, locality, street, house number, building, apartment);

- “Residence address outside the Russian Federation.”

Also, the title page has been supplemented with new information “Details of the document confirming the authority of the taxpayer’s representative.”

In addition, the reference book “Document Type Codes” used when filling out information about a taxpayer’s identity document has been clarified. In the declaration for 2021, the type of document “Military ID of a reserve officer” was assigned a separate code “27”, although previously the code “24” was used for such a document.