When accounting for the condition of fixed assets, various methods of calculating depreciation are used, which have a common feature - for all of them it is necessary to use a special intermediate indicator - the depreciation coefficient.

What this indicator reflects, what its calculation depends on, how exactly it is produced, and also what its dynamics can indicate to an experienced eye, we will talk about in this article.

Definition

A conditional indicator that determines the assessment of the state of the enterprise's fixed assets and carries an analytical value is called the depreciation coefficient of fixed assets, otherwise - the depreciation coefficient .

Any fixed asset is subject to wear and tear over time, whether it is in use or simply kept idle. At the same time, its residual value decreases. The process of reducing value and transferring it to manufactured products - depreciation - occurs at different rates, which depend not only on the depreciation group to which a specific fixed asset is assigned, but also on the reporting period. For more information about this, see the material depreciation and amortization of fixed assets.

Concept of wear and depreciation

A significant share of the company's costs are associated with expenses for capital sources (equipment, premises). Their specificity is that they are not consumed in one production cycle, like raw materials, but serve for years. But at the same time they are subject to wear and tear. Depreciation is the process of an object losing its collations, the result of which is a decrease in its value and depreciation. This may apply to such fixed assets of the enterprise as equipment, buildings, transport, etc. In the economic sense, a distinction is made between physical and moral wear and tear. Physical wear and tear is associated with the wear and tear of property when it loses its properties as a result of aging during the use of this property. It is calculated as the ratio of the operating time of an asset to its standard service life. Obsolescence occurs as a result of partial loss of fixed assets of their value as a result of the emergence of new, more ideal special technologies or under the influence of other factors. Depreciation is the process of partially transferring the cost of fixed assets as they wear out to the cost of manufactured products. It is carried out using depreciation rates. There is a so-called circulation of fixed assets. It includes three stages: wear, depreciation and redemption. Depreciation and amortization are carried out in the process of using fixed assets in production, redemption - during their creation and improvement.

Conventional wear coefficient

The value of this indicator is used for analytical accounting, and does not reflect the actual state of a particular fund. An asset that is not actually completely worn out may have a zero residual value. The reason for the conditionality is the dependence of the wear coefficient on the chosen method for determining depreciation charges. Thus, it shows not how much fixed assets are worn out, but to what extent they are depreciated.

IMPORTANT! If you need to evaluate the depreciation rate more objectively than simply taking into account depreciation, it must be compared with the corresponding data for the industry or correlated with similar data for this group of fixed assets from partners or competitors.

The depreciation rate of fixed assets can be calculated in relation to:

- physical depreciation of fixed assets;

- obsolescence of tools, equipment, etc.;

- the ratio of the residual value of funds and their market price.

Rubric “Question and answer”

Question No. 1. Favorit JSC is engaged in the retail trade of food products, for which it uses street refrigerators and trading trays. In the retail sector, the standard value for wear and tear of street retail equipment is accepted at 45%. Can Favorit fix the value of this indicator at 50% in its accounting policy?

“Favorite” has the right to accept a wear rate of 50% or lower as the norm. However, given the specifics of the industry, the indicator will not reflect the real picture of the state of fixed assets of this group. It is advisable for “Favorite” to take into account the figure of 45% and lower as the wear rate for street trading equipment.

Question No. 2. According to the calculation results, the wear rate of computer equipment at Globus LLC is 68%. The wear rate on the Globus is set at 50% and below. Is Globus obliged in this case to urgently replace the computer equipment used at the enterprise?

The legislation does not contain direct requirements regarding the replacement of fixed assets if the depreciation rate does not meet standard indicators. However, an analysis of the wear indicator at Globus suggests that the equipment is outdated and requires urgent replacement. If Globus does not have the opportunity to replace all computer equipment with newer ones, then it is advisable to conduct an additional analysis of the equipment in the context of subgroups (computer equipment, multifunctional devices, etc.) and identify which equipment requires priority replacement and which - No.

Formula for calculating the depreciation rate of fixed assets

The depreciation rate of fixed assets is actually the ratio of the summed depreciation deductions to the original cost of a given fixed asset. It is calculated as a percentage, for which the calculated value must be multiplied by 100%.

The formula for calculating the depreciation rate is as follows:

Kizn. = ∑damper. / STperv. x 100%

- Kizn. – wear coefficient (depreciation coefficient);

- ∑shock – the amount of depreciation charges for the calculated period;

- STfirst – the initial cost of the fixed asset.

Data for determining the amount of depreciation, as well as the cost of the fixed asset, the depreciation rate of which needs to be determined, are taken from the organization’s financial statements.

ATTENTION! If modernization or improvement of a fixed asset was carried out, as a result of which its value was increased, then the final indicator, that is, the indicator increased as a result of the measures taken, will be used in calculating the depreciation rate.

Calculation example

Derevo-Stil JSC has 12 woodworking machines on its balance sheet. Their initial cost, reflected on the balance sheet in January 2021, is RUB 900,000. for each machine, that is, only 12 x 900,000 = 10,800,000 rubles. At the end of March, 3 machines were modernized, higher quality components were supplied, as a result of which the cost of each of the modernized machines increased by 25,000 rubles. Thus, the cost of 3 out of 12 machines was (900,000 + 25,000) x 3 = 2,775,000 rubles, and the remaining 9 machines are reflected on the balance sheet at a cost of 9 x 900,000 = 8,100,000 rubles.

The amount of depreciation charges for this group of equipment of Derevo-Stil JSC as of 04/01/2017 was equal to 4,005,620 rubles. Let's calculate the wear rate of equipment, just as an accountant would do.

To apply the formula, we need to know two indicators:

- the initial cost of the asset (in our case, we need to take into account the modernization), for which we sum up the book value of conventional and improved machines: 2,775,000 + 8,100,000 = 10,875,000;

- the indicator of accrued depreciation charges (according to accounting documents) - for JSC Derevo-Stil as of 04/01/2017 it is equal to 4,005,620 rubles.

We calculate the wear rate using the above formula: 4,005,620 / 10,875,000 x 100% = 37%.

Thus, the depreciation rate of these machines owned by Derevo-Stil JSC as of April 1, 2021 is 37%.

How to determine the amount of depreciation of a fixed asset

Fixed assets are objects involved in the manufacture of finished products or in the process of enterprise management. The period of their useful use is longer than twelve months. Wear and tear is a fragmentary transfer of their value to the cost of products produced by the organization. In other words, this process is called depreciation. After studying this article, you will gain knowledge on how to calculate the amount of depreciation of fixed assets.

Types of wear

At the present stage, there are two types of wear:

- Functional wear and tear, the essence of which is that the main equipment has become obsolete, the reason for which is the achievements of science and technology. Therefore, the functionally worn-out main tool is the typewriter, because its operation is no longer relevant due to the invention of computer equipment;

- Physical wear and tear occurs when the main asset has worn out in material terms during use. An example of this is a woodworking machine, when its components are worn out and rusty.

Features of the depreciation calculation process

So that by the time the fixed asset wears out completely, the organization can buy or create a new one in its place, a special depreciation fund is created. Which is replenished every month with depreciation charges.

There are a number of principles when calculating depreciation that must be observed:

- It doesn’t matter whether the company made a profit or a loss, it still needs to accrue depreciation;

- Depreciation deductions must be made every month, and the first deduction must be made a month after the object is accepted for accounting;

- The company must stop making depreciation deductions one month after the final wear and tear or disposal of the fixed asset.

Methods for calculating depreciation

There are various methods for calculating depreciation of fixed assets. The organization itself must choose the appropriate method for each of the existing objects. Below is a detailed description of each of them.

- Linear - in order to calculate accumulated wear by this method, the following parameters should be highlighted:

- The primary cost of a fixed asset item (consists of the amount of expenses for the purchase of a fixed asset or the total cost of its creation);

- The useful life of a fixed asset (determined based on the classification list approved by the Decree of the Government of the Russian Federation);

- Depreciation rate (calculated by dividing one by the useful life and multiplying by one hundred percent).

Therefore, in order to calculate the amount of depreciation per month using the above method, it is necessary to perform a mathematical operation: multiply the initial cost of the asset by the depreciation rate and divide by twelve months.

- The next technique is reducing balance. In order to apply this technique, certain parameters are also required:

- Residual value (equal to the primary cost of the object minus accumulated depreciation);

- Useful life;

- Depreciation rate;

- Accelerating coefficient (assigned by the company; according to the rules, it cannot be equal to a number greater than three).

To calculate the amount of depreciation charges per year using the above method, you should do the following: multiply the residual value by the accelerating factor and the depreciation rate and then divide the result by one hundred. To calculate the monthly depreciation amount, divide the result by twelve.

- There is also a technique called “by the sum of the numbers of years of useful work.” To determine the amount of depreciation, this method uses certain data:

- Primary cost;

- Useful life;

- The sum of the numbers of years of useful work (calculated by summing the numbers of years of work). Let's give an example: if the period of operation of a fixed asset is three years, then the sum of the numbers of years of useful work is taken to be equal to six (one plus two plus three equals six).

To calculate depreciation charges using the above method, the following action is performed: dividing the number of years until final wear and tear by the sum of the numbers of years of useful work and multiplying the result by the primary cost of the asset.

- The last technique is proportional to the volume of manufactured products. The following parameters are used to calculate depreciation:

- Primary cost of the object;

- Actual volume of manufactured products in the current period;

- The total planned number of products produced.

Depreciation should be calculated using this method as follows: the primary cost of an item of fixed assets should be multiplied by the ratio of the volume of products produced in the period to their total planned volume.

Enterprises are allowed to decide on the appropriate method on their own. To avoid mistakes, it is necessary to correctly apply the useful life. To do this, you should carefully study the classification list.

Source: https://buh-spravka.ru/buhgalterskij-uchet/amortizaciya-iznos-os/kak-rasschitat-iznos-osnovnyh-sredstv.html

Interpretation

Certain norms for the depreciation coefficient are not prescribed in any legislative documents. As noted above, the meaning of this indicator is purely analytical. However, the standard value must be determined for each specific organization and recorded in internal documentation defining accounting policies. This means that the limit value of wear must be determined, at which the degree of “used” is considered high enough to begin to take any measures: make a decision on repairs or an immediate future replacement.

How is car depreciation calculated?

As a result of a traffic accident, a car inevitably loses its appearance and market value. On the one hand, the car owner does not need to take special measures to assess the extent of damage. For repairs they will charge him as much as necessary. In this case, replacement of parts, as a rule, occurs with new analogues or used ones with the consent of the owner.

The need to carry out calculations to assess the degree of wear and tear arises when a person applies for an insurance premium to his insurer. According to the current agreement, the person will be compensated for the cost of restoration work and the price of spare parts, taking into account wear and tear. If in the first case a citizen can count on the application of current prices, then in the second case a large number of disputes almost always arise.

Car wear and tear

Since 2010, a document has been in force in the Russian Federation, the provisions of which are addressed by experts from independent agencies, representatives of insurance companies and vehicle owners themselves. Calculation of material damage in accordance with the Government Decree involves determining the fair value of spare parts, taking into account their depreciation.

Each side of the conflict may interpret this document differently, but the fact remains: citizens use it to compare their losses. The calculation formulas are quite complex, but in any case they help clarify the situation. A special group includes spare parts for a car, which have a direct impact on safe driving.

For example, for wear and tear of a vehicle body, parameters such as age and the manufacturer’s warranty against through corrosion are used. To calculate the depreciation of a machine tire, the following initial data are taken: the height of the pattern of the new product and the actual height, the parameter of the minimum permissible height. An additional factor that corrects the degree of wear is the age factor. So, if the tire has been in use for more than three but less than 5 years, a 15% deflator is used. For older items more than five years old, the amount is adjusted by 25%.

Studying trends in establishing wear indicators, it is noted that underestimation of coefficients occurs for the best-selling car brands in Russia. According to calculated data, the average depreciation of a domestic car is 5-6% per year. It turns out that after 20 years there is no particular point in taking out insurance, since the insurance company will only pay for repairs, but not for parts.

This issue was resolved by the legislator only in 2014. According to the regulations of the Central Bank of the Russian Federation, the maximum degree of wear and tear for a car cannot exceed 50%.

Still, calculating wear and tear is best left to experts. Experts take into account three stages in which a part becomes obsolete. The first is the running-in of adjacent parts as a result of friction. The second stage is considered the normal period of operation. The third period is considered the time of critical (complete) wear and tear, at which the car or its individual component becomes unsafe.

Additional indicator - suitability coefficient

To clarify the degree of wear and tear, along with the depreciation coefficient, the serviceability coefficient of fixed assets is calculated. It does not show the degree of depreciation, but part of the residual value of the asset in relation to the original (according to accounting documents). To calculate it, you need to divide the residual value (that is, the amount minus accrued depreciation) by the original cost of the asset (if improvements were made, then taking into account the increased cost). For a percentage value, multiply the result by 100%.

Kgodn. = STost. / STperv. * 100%

The lower the depreciation rate, the better the condition of the funds. With the serviceability coefficient, the situation is the opposite - the lower it is, the shorter the effective service life of the fixed asset will be.

The determination of the normative validity of the suitability coefficient is completely similar to the wear coefficient, the only difference is in the sign: for the wear coefficient the norm is set “not higher than” a certain percentage, and for suitability – “not lower”.

How to calculate the percentage of depreciation of fixed assets

The assets of a business entity have the property of wear and tear. To determine its degree, the depreciation coefficient of fixed assets of a business entity is used. The parameter is calculated based on information from accounting reports based on a given date. How to calculate the percentage of depreciation of fixed assets, what the resulting figure means, and how to apply this information in practice in analyzing the operation of the enterprise operating system.

general information

The amount of depreciation of company assets, which include buildings, equipment, machinery, tools and other items used in production activities, is identified by their depreciation rate.

All objects used in the enterprise are accounted for on the balance sheet. As they become obsolete, their value is lost, after which a write-off procedure is initiated. It is implemented by transferring the cost of the object to the products produced or services provided. When determining the amount of deductions to the depreciation fund, one of the methods regulated by regulations is used. At the same time, the residual value decreases with each reporting period; accrued depreciation is accumulated in a designated account.

The coefficient, which identifies the level of depreciation of the enterprise’s assets, makes it possible to determine how urgently it is necessary to carry out measures aimed at repair work or the complete replacement of individual objects.

With its help, you can determine the level of risks of stopping the production process, which is important for worn-out equipment. It is also necessary to determine the need for equipment modernization. Any management decision is made only after settlement transactions have been carried out, the results of which have been assessed and analyzed.

How to reduce wear

When talking about the physical wear and tear of individual components, mechanisms and car parts, we mean friction. This is the main reason why products wear out, which inevitably leads to the need to replace it.

The most common way to combat the phenomenon of friction is the use of additives, special compounds, oils and other substances. Often such materials are called metal conditioners. In some cases, changing the oil gives the expected effect - the car owner spends less on purchasing spare parts. Experienced drivers usually try to purchase time-tested products that do not contain solid particles or compounds.

Particular attention should be paid to the need for maintenance. The principle of reducing wear on the driving mechanisms of a car is quite simple: if you replace used parts in a timely manner, this will prevent the failure of more serious units.

In first place among the leading components is the body. It not only provides protection for internal mechanisms, the driver and passengers from precipitation, but also serves as the basis for fastening and assembling the entire vehicle. Body wear can be reduced by constantly monitoring the surface of the paintwork. If defects are detected, corrective measures should be taken immediately (priming and painting).

To determine irreparable wear and tear, use the value by which the price of an object is reduced due to a cause-and-effect relationship with its technical characteristics. When studying the quality of funds, both an excess and a lack of useful properties may be discovered. The determination of depreciation in this case is based on the calculation of capitalized losses.

Top

Write your question in the form below

How to calculate the percentage of depreciation of fixed assets, formula

To determine how worn out the fixed asset is, calculations are made. The basic calculation values are:

- the price of the asset at which it was acquired, interpreted as its original cost;

- the time period, calculated in years, during which the use of the object is planned, which is identified by the useful life and is often regulated by regulations that take into account the time of operation without deterioration of characteristics;

- the cost of an asset transferred to cost through depreciation.

To determine the percentage of depreciation of assets, you should find the quotient of depreciation and initial cost. The resulting value should be adjusted to 100.

Example

The equipment was purchased for a million rubles. Its service life, during which no deterioration in performance is expected, is 10 years. The management regulated the linear method of calculating depreciation with a monthly frequency.

If the equipment has been in use for 5.5 years from the date of purchase, then depreciation will be 1000000X55/100=550000 rubles, and the percentage of wear and tear (55000/1000000)X100%=55%.

When calculating the degree of wear and tear of equipment, information is taken from the accounting records of the business entity. Accounting is required to provide data on the original cost of the object and what percentage of depreciation was accrued as of the date the parameter was determined. When carrying out calculations, not only physical wear and tear is taken into account, but also moral wear and tear. The residual value is also compared to the market value.

If the enterprise has revalued assets, then in the calculations it is necessary to take into account the replacement value and the full value when revaluing or depreciating the value.

The minimum value of the wear factor cannot be less than 50 percent. If the indicator is higher than this value, then we can judge that the wear and tear of fixed assets at the enterprise is high, which indicates the need to take measures to replace assets. During the analysis, one should take into account the specifics of the business entity’s activities, the values of the coefficients in the industry average and the possibility of an accelerated method of writing off assets.

What is wear and tear

Wear and tear is the decrease in the value of an object during its operation or simply over time. Each asset is purchased for a specific amount, called the initial cost (IC) expressed in Russia in rubles, and is fixed at the time of commissioning or putting on the balance sheet. They also measure the amount of absolute wear.

The initial cost includes estimated commissioning and delivery costs.

Annual changes in value are subtracted from the NA, and the difference represents the real value of the object.

Determination of service life

The time during which an object retains its properties of suitability for further use is called its service life. This parameter is the most important for determining the degree of wear and is justified by the technical characteristics specified in the asset passport or other regulatory documentation.

In case of exhaustion of the service life, renewal of fixed assets is required.

What is replacement cost

The seemingly simple task of determining wear and tear is complicated by inflationary processes. The calculated price during its formal calculation may differ significantly from the market price, which necessitates revaluation and bringing it in accordance with the current situation. The result of a rather complex process, carried out taking into account many factors, is the replacement cost, which in simplified form is the real price of a similar object minus depreciation.

Types of wear

An object may lose its value for two reasons:

- Physical deterioration;

- Obsolescence.

The reasons for the first are obvious and fully correspond to the name. According to all the laws of physics, parts of technical equipment during operation are exposed to frictional forces, deformations and other factors leading to exhaustion of motor life. These destructive but inevitable processes of the reliability curve are described, which by the end of its service life falls below the permissible standard.

As for obsolescence, it is associated with the emergence of more modern means of production, which makes the operation of equipment on the balance sheet ineffective or even pointless. There are many examples.

At one time, thousands of perfectly serviceable and new (in lubricated and original packaging) mechanical adding machines became completely unnecessary after the advent of electronic calculators.

Intangible assets, for example, computer programs, deserve special mention. If their cost does not exceed one hundred thousand rubles, they can be written off “at a low price” when they become obsolete, while more expensive ones are subject to depreciation, with an acceptable minimum two-year service life.

Today, environmental and social types of wear associated with legislative changes in safety requirements and working conditions are also added to this list.

Depreciation rate of fixed assets - calculation formula

Related publications

When determining the degree of depreciation of an enterprise's assets, the depreciation coefficient of fixed assets (FA) is used. The indicator is calculated for a given date according to financial statements. Let's look at how to calculate the depreciation rate of fixed assets. We will also learn how to apply the information received in practice to analyze the performance of the company's assets.

General information on fixed assets

In the process of conducting business, all business entities use fixed assets (fixed assets). The number of fixed assets and their cost depends on the specifics of the enterprise, production volume, field of activity, etc. Read also the article: → “Depreciation of fixed assets: types, calculation features, use in management.” Fixed assets include not only equipment that is directly involved in the production process, but also:

- buildings, premises housing production workshops, offices, retail outlets, etc., that is, real estate used for the production and sale of goods, work and services;

- transport and other movable property that is used for production purposes;

- furniture, computer equipment and other property necessary to support the production process.

Fixed assets recorded on the balance sheet of an enterprise are subject to depreciation. As a result of monthly deductions, part of the cost of the equipment is written off as depreciation, so the balance sheet reflects the residual (real) value of the property based on the period of its use.

What is the depreciation rate of fixed assets

The depreciation rate of fixed assets shows the extent to which objects - equipment, buildings, tools, structures, etc. - are depreciated. All fixed assets used by the enterprise in the accounting process are written off by assigning the original purchase price to the cost of manufactured products (services). When determining the amount of depreciation charges, one of the methods available under the legislation of the Russian Federation is used. In this case, the amount of the residual value of the depreciable object decreases, and on the account. 02 accumulates the amount of accrued depreciation.

Coef. depreciation of fixed assets helps determine the urgency of repair or complete replacement of the operating system, the presence of risks of stopping production processes due to high wear and tear of equipment, the level of reflection of the operating system in the balance sheet of the enterprise, the need to modernize assets, etc. Management decisions are made using CIOS after calculating the indicator.

Comparison of depreciation and wear

Based on a comparison of the concepts of depreciation and depreciation, the following differences can be distinguished: - by time of occurrence - depreciation is accrued as a result of depreciation of fixed assets, i.e. is its consequence; - depreciation is the monetary equivalent of depreciation of fixed assets, while depreciation does not have a monetary expression; - depreciation does not necessarily depend on the level of depreciation - the cost of an object can be fully depreciated, while it has not yet been subjected to complete physical wear and tear and is subject to future use; The opposite situation also occurs - when equipment breaks down before its cost is completely written off; - companies can independently determine depreciation rates; - in accounting, the term depreciation is not used, only depreciation; depreciation is a representation from the field of financial review; - the term depreciation is enshrined in law, while there is no legal definition of depreciation; - depreciation is a decrease in the value of fixed assets and an indicator of equipment obsolescence, and depreciation is a transfer to the cost of manufactured products, which allows the restoration of the fixed asset fund .

The fixed asset must be payable and bring economic benefits. If the operation of a fixed asset does not generate revenue, then there is no point in the organization spending its financial sources on its contents. Depreciation shows whether the fixed asset is suitable for subsequent use, and the amount of depreciation indicates the degree of its payback and financial return.

Fixed assets or funds are means of labor that are used by an organization for more than 12 months or one production cycle and are not prepared for subsequent resale.

How to calculate the depreciation rate of fixed assets

The calculation of the coefficient in % is carried out according to the physical wear and tear of the operating system, obsolescence of assets, as well as the ratio of the residual price data and the current market price in order to establish the correspondence of the cost. For calculations, you will need information from the organization’s accounting records, first of all, data on the accrued amount of depreciation and the initial cost of the objects.

If an enterprise revaluates assets in accordance with the norms of PBU 6/01, when determining the CIOS, one should take into account the amounts of the replacement cost and the total value obtained during the revaluation (depreciation) of objects. Since there are several ways to calculate depreciation for a company’s fixed assets, the results of the formulas for calculating the coefficient will vary depending on the depreciation calculation method, that is, indicator A.

Wear indicator

Wear and tear is the loss of fixed assets of their physical, moral and economic properties. Depreciation also depends on depreciation groups and codes of the All-Russian Classifier of Fixed Assets (OKOF). Depreciation deductions are a cost expression of the degree of depreciation of labor instruments. They are accrued monthly during the calendar year depending on the useful life of fixed assets and are included in the cost of finished products, work performed or services rendered. This is the process of recoupment of the enterprise’s financial sources invested in fixed assets. The depreciation indicator is calculated by dividing the collected amount of depreciation (amortization) by the original or replacement (based on revaluation) cost of fixed assets. The resulting value can be multiplied by 100%, then depreciation will be expressed as a percentage of the total number of fixed assets, conventionally taken as 100%. This indicator shows what part of fixed assets is worn out, and is calculated at the beginning and end of the calendar year.

Depreciation rate of fixed assets - calculation formula

In general, the depreciation rate of fixed assets is calculated as the ratio of the depreciation amount to the original price of the asset:

KIOS = A / PS x 100%, where:

A is the amount of depreciation charges accumulated as of the date of calculation (balance on account 02);

PS – the value of the initial purchase price of fixed assets (balance on account 01).

In addition to the CIOS, there is the wear and tear coefficient of fixed assets (KGOS). This indicator characterizes the technical condition of the object and is calculated as the ratio of the residual price to the original price.

KGOS = OS / PS.

Note! The minimum standard value of CIOS is on average 50%. If the indicator exceeds this level, the wear and tear of the enterprise's assets is high and replacement of assets is necessary. When analyzing, you should take into account the specifics of the organization’s activities, industry average values of the coefficient and the use of an accelerated method for writing off objects.

OS wear rate - calculation example

To clearly understand how the depreciation rate of fixed assets changes (the formula is given above), depending on the method of calculating depreciation, we will give a practical example of calculating the indicator.

Let's assume that the LLC has 5 processing machines on its balance sheet. The equipment was purchased in December 2021, the initial cost of each was RUB 250,000, total RUB 1,250,000. The machines were put into operation on 01/01/17. The service life is set at 7 years. Planned production volume for 7 years = 280,000 units. Let's consider how the calculation of CIOS for the first year of operation will change depending on the depreciation calculation method. The calculation was made for all machines:

- Linear method - depreciation for the year = 178,571.43 rubles. (1,250,000 / 7 years). At the same time, KIOS as of December 31, 2017 = 178,571.43 / 1,250,000 x 100% = 14.28% - the degree of wear is within normal limits.

- Reducing balance method – depreciation for the year = RUB 1,250,000. x (100% / 7 years) = 178,625 rubles; KIOS = 178,625 / 1,250,000 x 100% = 14.29%.

- Write-off method according to SPI - depreciation for the year = 1,250,000 rubles. x 7 years / 28 years = 312,500 rubles; KIOS = 312,500 / 1,250,000 x 100% = 25%.

- In proportion to production volume - depreciation for the year = 1,250,000 rubles. x 45,000 units (volume of products actually produced in 2017) / 280,000 units. = RUB 200,892.86; KIOS = 200,892.86 / 1,250,000 x 100% = 16%.

Note! The coefficient of physical depreciation of fixed assets is determined taking into account the real obsolescence of objects, that is, the amount of not only accrued depreciation, but also actual.

Fixed assets statistics

To account for fixed assets in monetary terms, various methods of their evaluation are used. Due to the peculiarities of circulation of fixed assets, the nature of their participation in production and changes in the cost of their reproduction, assessments are distinguished depending on the time to which it is dated and on the state of fixed assets.

Based on the time to which the assessment is dated, two types are distinguished: initial cost, i.e., the cost of an object of fixed assets in the production conditions of the time when it was manufactured; replacement cost, i.e. the cost of reproduction of each fixed asset object in modern conditions.

Depending on the state of fixed assets, two types of their valuation are also distinguished: at full cost, i.e. at the cost of a new object, and at cost minus depreciation (residual), i.e. at the cost of each object not yet transferred to the product .

Consequently, there are four possible options for valuing fixed assets, which are used in accounting and statistics practice.

Full original cost

determined by the actual amount paid for each given object during its construction or acquisition, including costs associated with delivery and installation, as well as additional costs for the expansion and modernization of labor equipment during their operation. According to this assessment, fixed assets are credited to the balance sheet of the enterprise's main activities. It is used when setting fees for funds and forming a depreciation fund. Since the costs of creating and purchasing means of labor were incurred at different times, at different levels of social productivity of labor, objects that are identical in their consumer properties can have different initial costs. The heterogeneity of the initial cost from the point of view of incomparability of prices leads to the fact that this type of assessment is unsuitable for comparisons of the volume of fixed assets.

The original cost minus depreciation (residual) corresponds to the full original cost of each object at the moment minus the amount of depreciation that has accumulated up to that moment. The amount of depreciation needed to determine the residual value is shown in the liabilities side of the balance sheet; the residual value of fixed assets is given in the annual report.

Full replacement cost

determined by the costs required to acquire a given new facility, including delivery and installation costs at the prices and conditions of the period in which the revaluation is made. In this case, the incomparability of prices is eliminated, which makes it possible to create uniform economic conditions at all industrial enterprises when determining the amounts of depreciation and payments for assets, clarifying depreciation rates, studying the volume of fixed assets and its dynamics. The replacement cost coincides with the original cost at the time the objects were put into operation. As we move away from the moment of commissioning of fixed assets, their replacement cost becomes more and more different from the original one.

Replacement cost minus depreciation corresponds to the amount at which each object can be valued in modern conditions of reproduction, taking into account its actual deterioration at the time of revaluation of fixed assets. Replacement cost is determined during inventory and revaluation of fixed assets.

The condition of fixed assets is characterized by wear and tear indicators.

Wear rate

fixed assets are determined by the ratio of the amount of depreciation to their original cost. It can be calculated at the beginning and at the end of the year and shows the share of the cost of fixed assets transferred to the products being created.

Usability factor

is determined by the ratio of the residual value to the original cost of fixed assets or as the difference between one (100%) and the depreciation rate (%). The serviceability coefficient characterizes that part of the cost of fixed assets that has not yet been transferred to products.

A complete picture of the reproduction and movement of fixed assets is provided by the balance sheets of fixed assets. They show the availability of fixed assets at the beginning and end of the current period, their movement during the period under study. Balance sheet data allows one to calculate relative indicators of the movement and condition of fixed assets. Balance sheets of fixed assets can be constructed at initial and residual values.

The balance sheet at historical cost is based on the following equation:

where

and - the initial cost of fixed assets, respectively, at the beginning and end of the current period; -received fixed assets at original cost; - retired fixed assets at original cost.

The balance sheet at residual value contains the following equation:

where

and - initial cost minus depreciation (residual value), respectively, at the beginning and end of the current period

-received fixed assets at residual value;

- retired fixed assets at residual value

- depreciation of fixed assets, determined by the amount of depreciation calculations

Depreciation

is the monetary expression of depreciation of fixed assets. Depreciation rates are used to calculate depreciation. They are established by group of fixed assets for the year as a percentage of the original cost. To ensure that depreciation is included evenly in the cost of production, the amount of depreciation is calculated monthly. The monthly depreciation rate is determined by dividing the annual rate by 12.

The annual amount of depreciation is determined by the formula:

where is the average annual initial cost; - depreciation rate.

Depreciation rates are established only for the complete restoration of fixed assets, therefore depreciation is also charged for the complete restoration of fixed assets. The initial, replacement and residual values of fixed assets are calculated at a certain date, for example, at the end of the month, quarter, year.

The volume of fixed assets changes over time due to their movement. The movement of fixed assets refers to their receipt from various sources and disposal for various reasons. Fixed assets can be received through the construction of facilities by contract or economic means, the acquisition of machinery, equipment, vehicles, tools and inventory; gratuitous transfer by other enterprises and individuals or as a government subsidy, as well as transfer of fixed assets by the founders of the enterprise on account of their contribution to the authorized capital at an agreed upon cost.

Fixed assets are retired due to physical and moral wear and tear, as a result of gratuitous transfer to another enterprise, sale, transfer as a contribution to the authorized capital of other enterprises, due to natural disasters, rental, transfer to working capital. The write-off of fixed assets is documented by a liquidation act, a sale act, or an acceptance certificate. The acts indicate: the name of the write-off object, its original cost, the rate and amount of depreciation, the date of commissioning, the date and number of the write-off act, inventory number, reason for write-off, income and expenses for write-off.

The relative characteristics of the movement of fixed assets are the general and private coefficients of retirement and receipt. The overall retirement rate characterizes the intensity of their disposal, regardless of the reasons, and is determined by dividing the initial value of all fixed assets retired during the period ( ) by the initial value of fixed assets at the beginning of the year:

Partial coefficients characterize the intensity of disposal of fixed assets due to transfer to other enterprises or sale (), due to dilapidation and wear and tear (), losses from natural disasters:

Of greatest interest is the retirement rate of fixed assets

due to disrepair and wear and tear, characterizing the intensity of the complete disposal of fixed assets from the production sector.

The sum of the partial retirement rates is equal to the total retirement rate:

To characterize the receipt of fixed assets, general and private coefficients are calculated. The total receipt ratio is calculated as the ratio of the initial value of all fixed assets received during the period to the initial value of fixed assets at the end of the year:

Partial coefficients are the coefficient of receipt of new fixed assets and the coefficient of receipt of other fixed assets, calculated by the formulas:

The coefficient of receipt of new fixed assets is called the renewal coefficient

. It characterizes the intensity of renewal of fixed assets. The partial coefficients of receipt are equal to the total coefficient:

The use of fixed assets is assessed by general indicators of capital productivity and capital intensity.

Capital productivity level

equal to the ratio of production volume to the average cost of fixed assets:

Capital intensity

– the ratio of the average cost of fixed assets to the volume of production

The capital productivity indicator characterizes the level of production per accepted cost unit of fixed assets, and capital intensity characterizes the degree of saturation of production with technical means.

General indicators of an enterprise's provision of fixed production assets are the capital-labor ratio

(Fv) labor:

where is the average annual cost of fixed production assets;

—

average annual number of employees;

To characterize the dynamics of capital productivity, the index method is used. The capital productivity index is calculated using the formula:

where and is the capital productivity indicator in the reporting and base periods, respectively.

Calculated for the group of enterprises included in the association, this index is called the variable composition index and is presented as follows:

where and is the average level of capital productivity for the association as a whole in the reporting and base periods, respectively.

The variable composition index reflects the influence of two factors: changes in capital productivity for individual enterprises that are part of the association, and changes in the share of individual enterprises (organizations) in the volume of fixed assets (structural factor). To assess the influence of the first factor, the constant composition index is calculated:

The impact of structural changes is identified using the structural changes index:

When studying the factors that shape the level and dynamics of capital productivity, multifactor economic and mathematical models can be used. The construction of models is based on the relationship between capital productivity and the factors that form its level and determine its dynamics.

Depreciation and serviceability rates of fixed assets in 2019

Fixed assets tend to wear out, gradually losing their operational properties. Eventually, complete wear and tear occurs, after which the object is written off and is no longer used. To assess the condition of objects, it is necessary to carry out regular calculations of such indicators as the wear rate and the serviceability rate of fixed assets. The first shows the degree of wear and tear of the object, clearly demonstrating how depreciated the OS is. The second provides additional information about the state of the funds. These coefficients can be calculated using special formulas. Calculation formulas are given below, and the calculation of wear and serviceability coefficients is discussed using an example.

How to calculate the depreciation rate of fixed assets - calculation formula

Calculation formula:

OS wear coefficient = A / PS * 100%,

- A is depreciation accumulated at the time of calculation. The indicator is taken from the credit of account 02;

- PS is the initial cost of the OS. If revaluation, modernization, reconstruction were carried out, which changed the initial cost indicator, then you need to take the cost taking into account these changes. That is, this is the indicator that is reflected in the debit of account 01.

Based on the formula, it can be seen that the higher the wear rate, the more worn out the equipment; the higher the depreciation charges, the more worn out the fixed asset.

The coefficient can be calculated to determine the wear and tear of the physical and moral condition of objects.

Why is it needed : the indicator allows you to assess the condition of fixed assets, plan further actions to improve and update equipment, and decide on the advisability of replacing fixed assets with new ones. That is, the value of the wear rate makes it possible to rationally analyze the assets of the enterprise in order to develop a further development strategy.

Example of wear factor calculation

The company has 10 cars on its balance sheet, each object is recorded in the debit of account 01 at its original cost, the total value of which is 4,600,000 (460,000 each). An improvement was made to one car; the body was replaced with a more convenient and functional one; this change led to an increase in the initial cost of the car to 630,000 (by 170,000). As a result, the total cost of fixed assets was equal to 4,770,000.

The accumulated depreciation on the credit of account 02 as of the date of calculation of the coefficient is 1,630,000.

Calculation:

It is required to calculate the depreciation rate of cars. To do this, we calculate using the formula:

CI = 1630000/4770000 *100% = 34%

Conclusions:

What conclusion can an accountant make after making such a calculation?

The degree of depreciation of the company's vehicle fleet is 34%, that is, roughly speaking, fixed assets are depreciated by a third. How much such an indicator suits the company is up to it to decide. There are no normative values established by law. No recommendations are given regarding at what wear rate the equipment should be replaced. Each enterprise determines its own standard depending on the type of equipment, fixed assets, and its financial capabilities.

Sometimes it is better not to wait for the OS to completely wear out, when its performance properties are completely lost. Sometimes, it is much more profitable to upgrade equipment to obtain maximum operating efficiency, and write off the old facility as an expense. The feasibility of these actions is assessed during economic calculations.

The company needs to develop acceptable standards for the depreciation rate and consolidate the results in its accounting policies.

In practice, the limit after which measures to renew the fixed assets fleet usually follows is a depreciation rate of 50%. It is believed that if the coefficient is over 50%, the equipment is very worn out and does not provide the proper economic effect from its use.

The value of 34% obtained in the example shows that the cars are not worn out enough to require replacement. In general, the indicator is within the normal range.

Please note that this calculation does not provide an accurate representation of the condition of individual objects. It is possible in some situations to conduct a more detailed analysis of each individual fixed asset to determine the degree of its deterioration. Only a comprehensive analysis will allow you to make a rational decision.

Formula for calculating the OS suitability coefficient

Formula for calculation:

Fit factor = OS / PS * 100%,

- OS - residual value, defined as the difference between the initial and accumulated depreciation charges;

- PS is the initial indicator of the cost at which objects are listed on the balance sheet.

Algorithm for calculating the depreciation coefficient of fixed assets

The depreciation ratio of fixed assets (hereinafter referred to as KAOS) shows how much the fixed assets of an enterprise are worn out and how soon they will have to be repaired or updated. This indicator is calculated using the formula

KAOS = A / PSt × 100,

Where:

A - depreciation (account balance 02);

PSt is the initial cost of fixed assets (account balance 01).

You can also use the data from Form 5 from the notes to the balance sheet to calculate this ratio.

For an algorithm for filling out Form 5, see the article “Filling out the Appendix to the Balance Sheet (Form 5).”

An example of a balance sheet can be found in the material “Procedure for compiling a balance sheet (example).”

In this case, KAOS will be equal to:

KAOS = page 5,200 (data on depreciation) / page 5,200 (data on original cost) × 100.

This indicator is calculated for a specific date, most often at the beginning and end of the year.

KAOS is a conditional indicator and depends on the chosen method of calculating depreciation. Let's look at how it will change in 2015 using an example (for clarity, let's agree that the company has only one OS).

Example

in January 2012 I bought a machine at a price of 578,470 rubles. (including VAT RUB 88,241.18). It was put into operation the same month. The period of use is 8 years. Production capacity - 500,000 units. for the expected service life.

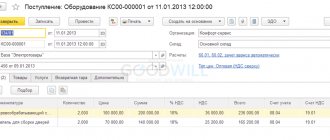

Postings:

Dt 08 Kt 60 — 490,228.82 rub. - OS arrived;

Dt 19 Kt 60 - 88,241.18 rub. — VAT;

Dt 01 Kt 08 — 490,228.82 rub. — OS accepted for accounting.

SALT for account 01 for 2015:

| Beginning balance | Revolutions | Balance | |||

| Dt | CT | Dt | CT | Dt | CT |

| Machine | 490 228,82 | 490 228,82 | |||