General information

Account 67 is used to collect and process data on loans and borrowings whose repayment period exceeds one year. Among them:

- amounts of loans and borrowings by their types;

- percentage part;

- repayment transactions;

- fines for late payments.

Information on account 67 is recorded according to:

- loans and credits;

- credit institutions;

- institutions that issued the loan;

- specific funds issued at interest;

- credit institutions that purchased securities, and other credit obligations on bills.

From a structure point of view, account 67 is similar to account 66. Their main and only difference is the duration of the credit period. Account 66 is intended to record information about short-term credit relationships, the payment period of which is less than one year.

Account 67 reflects the financial balance of the enterprise, expressed in its debt obligations and income for the current period. This allows the designated account to be considered passive - its balances for a specific period are included in the organization’s sources of profit for this period.

If the loan repayment period is reduced to a year or less, the debt can be transferred to short-term status.

Account 66: characteristics

Whether an account belongs to a balance sheet category can be determined by the objects whose value is accumulated on it. Active accounts accumulate amounts of the enterprise's assets, that is, they reflect what belongs to the organization. Passive accounts are needed to account for liabilities, that is, the sources of formation of the company's assets. A separate category is active-passive accounts - they have the characteristics of the two previous varieties, depending on what balance remains on them, the account acquires the features of an active or passive one.

Subaccounts and analytics

Additional subaccounts can be opened for account 67:

- 67.1 - long-term loans;

- 67.2 - long-term loans;

- 67.3 - interest on payments of loans and credits;

- 67.4 - fines and penalties for the payment of loans and borrowings;

- 67.5 - overdue loans and borrowings;

- 67.6 - loans for the issue of securities;

- 67.7 - loans and credits for employees.

Analytics is carried out separately within each subaccount. In addition, separate sub-accounts can be created for loans in foreign currency (by each type of currency). The number and composition of subaccounts are determined by the accounting policy of the enterprise.

Transferring a long-term loan to a short-term entry

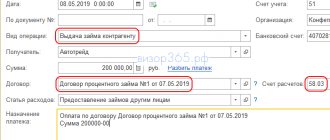

Source: Glavbukh magazine Many companies are forced to take out a loan or credit to develop their business. In this case, the company accountant is faced with the question of how to reflect the debt in the accounting accounts.

Let's start with the fact that special accounts are provided for accounting for loans and credits: account 66 “Settlements for short-term loans and borrowings” and 67 “Settlements for long-term loans and borrowings”. And you need to choose which of the two accounts to use. The decision depends on the duration of the loan.

Thus, account 66 is intended for loans and borrowings received by an organization for a period of no more than 12 months. For example, for three months, six months or exactly a year. Such loans are called short-term. Interest on short-term loans that you must pay to your lender is also recorded in account 66. Only separately from the principal amount of the debt. Answer: Transfer of short-term debt to long-term debt 1. The place of such loans (interest-free) as part of other creditors (in the Balance Sheet for sure).

Since a normal loan involves incurring expenses in the form of interest, and such agreements are nothing more than ordinary financing of one’s own. If the amount is significant, then the explanatory note describes the composition of the other creditors.2.

In the PBU “Accounting statements of an organization,” liabilities must be divided into long-term and short-term, therefore, in the Balance Sheet, this loan must be reflected in the line “Other long-term liabilities”3. There seems to be no responsibility for incorrect reflection of assets and liabilities in the accounts, there is no one to present)))).

Analytical accounting of short-term and long-term loans and borrowings is carried out by type of loans and borrowings, credit organizations and other lenders who provided them. Clause 8 of PBU 15/01 contains information on the organization of analytical accounting of debt, namely, it provides recommendations for the following construction of sub-accounts on synthetic accounts 66 and 67: 1st level sub-account (66.x, 67.x) - by type of borrowed loans and loans - budgetary, commercial, bank, in the form of issued bills or bonds, etc.; 2nd level subaccount (66.x.x, 67.x.x) - each type of loans and credits is presented in the context of counterparties (lenders) - budgets of various levels, specific legal entities, etc.; 3rd level subaccount (66.x.x.x, 67.x.x.x) - for each lender, obligations are divided into individual loans and credits (agreements, transactions, etc.). Further, long-term loan accounting can be carried out in two ways:

- On the account 67 before maturity.

- On the account 67 until there are 365 days left until maturity. After this, the loan amount is transferred to the account. 66 by posting D67 K66, that is, long-term debt is transferred to short-term debt.

The chosen accounting method must be reflected in the order on the accounting policy, which can be read about in the article “Accounting Policy of the Organization.” Postings to accounts 66 and 67 The table below discusses the accounting of credit operations: obtaining long-term and short-term loans and their reflection.

Debit and credit

Accounting entries compiled from the debit entries of account 67 indicate a decrease in the amount of debt on loans with a long repayment period. This happens after:

- debt repayment;

- fulfillment of obligations by both parties to the loan agreement;

- transition of debt from the status of long-term to the status of debt with a short payment period;

- crediting an outstanding loan or loan to other profits;

- crediting to other profits an increase in the cost of goods or services associated with an increase in the rate of a loan or loan with a long period of payment in foreign currency.

The transfer of funds provided at interest for a long period (as well as the amount of interest) is expressed as a loan.

How to reflect in accounting and reporting the transfer of long-term debt to short-term debt

The transfer of long-term debt to short-term debt is not reflected in synthetic accounting accounts.

Record the debt transfer as follows:

- In accounting - internal records for analytical accounts of long-term and short-term debt, if such analytics are carried out.

- In the balance sheet - by presenting it as short-term rather than long-term debt (clause 19 of PBU 4/99 “Accounting statements of an organization”, Letter of the Ministry of Finance of Russia dated January 28, 2010 N 07-02-18/01).

- In the explanations to the balance sheet and the income statement, if the organization uses the form of explanations given in the Example of explanations - by indicating in the column “Changes for the period, transfer from debt to short-term debt” tables 5.1 and 3. Indicators available at the end years of long-term debt should be reduced as a result, and short-term debt indicators should be increased.

For example, the amount of debt on a long-term cash loan with a maturity date of March 25, 2021 is reflected:

- In the balance sheet for 2021 - in line 1510 “Borrowed funds” section. V “Short-term liabilities”.

- In the explanations for 2021, if the organization uses the form of explanations given in the Example of preparation of explanations, in table 5.3 in the column “Changes for the period, transfer from debt to short-term debt”: In line 5551 “Long-term accounts payable - total” and line for disclosing data on long-term loans - in parentheses as a reducing value.

- In line 5560 “Short-term accounts payable - total” and the line for disclosing data on short-term loans - as an increasing amount.

Is it possible to transfer short-term debt to long-term debt?

The transfer of short-term debt to long-term debt is not provided for by regulations. However, such a transfer is possible if the parties have agreed to increase the debt repayment period (for example, in the case of restructuring of debt on loans and credits), as a result of which, as of the reporting date, the debt repayment period will exceed 12 months (or the duration of the operating cycle, if it is more than 12 months ).

Reflect the transfer of short-term debt into long-term debt as follows:

- in accounting, make internal entries for analytical accounts of long-term and short-term debt, if such analytics are carried out. If analytics are not carried out, then there is no need to make entries in accounting, but there is one exception. Show the transfer of debt on loans and borrowings using the debit of account 66 “Settlements for short-term loans and borrowings” and the credit of account 67 “Settlements for long-term loans and borrowings”. This is due to the fact that the choice of account for accounting for borrowed funds is determined by the terms of the agreement. And since the terms of the contract have changed, the account for recording the debt must change;

- in the balance sheet, present the debt as long-term and not short-term (clause 19 of PBU 4/99, Letter of the Ministry of Finance of Russia dated January 28, 2010 N 07-02-18/01);

- in the explanations to the balance sheet and the income statement, it is necessary to increase the indicators of long-term debt existing at the end of the year by the amount of transferred debt, and reduce the indicators of short-term debt. To do this, if the organization uses the form of explanations given in the Example of Explaining Explanations, it is necessary to add the column “Changes during the period, transfer from short-term to long-term debt” to tables 5.1 and 3.

>Short-term loan became long-term posting

Typical accounting entries for account 67

The main accounting entries for account 67 include:

- crediting long-term credits and loans - Dt 50, 52, 55 - Kt 67 ;

- fulfillment of the terms of the loan agreement for long-term loans and borrowings after depositing funds - Dt 67 - Kt 50, 52, 55 ;

- change of data on the loan after its renewal - Dt 66 ‒ Kt 67 ;

- transfer of credits or loans to a bank account - Dt 67 - Kt 51, 52, 55 ;

- payment to the supplier from funds issued at interest for a long period - Dt 60 ‒ Kt 67 .

How to record the transfer of long-term loans to short-term ones

Source: Glavbukh magazine

Many companies are forced to take out a loan or credit to develop their business. In this case, the company accountant is faced with the question of how to reflect the debt in the accounting accounts. Let's start with the fact that special accounts are provided for accounting for loans and credits: account 66 “Settlements for short-term loans and borrowings” and 67 “Settlements for long-term loans and borrowings”. And you need to choose which of the two accounts to use. The decision depends on the duration of the loan.

Thus, account 66 is intended for loans and borrowings received by an organization for a period of no more than 12 months. For example, for three months, six months or exactly a year. Such loans are called short-term. Interest on short-term loans that you must pay to your lender is also recorded in account 66. Only separately from the principal amount of the debt. Therefore, it is necessary to provide two subaccounts to account 66: “Principal amount of obligation” and “Accrued interest”.

But if the loan is provided to you for a period of more than 12 months, say, for three or five years, you need to use account 67. In this case, interest accounting, as in the case of account 66, must be kept separately. Therefore, open corresponding subaccounts for account 67.

As time passes, the term of use of any loan is reduced. And as a result, long-term loans turn into short-term ones. However, this may not be reflected in accounting. That is, there is no need to transfer the debt from account 67 to account 66. Moreover, it is even wrong to do so. The instructions for the Chart of Accounts do not provide for such posting. At the same time, it is advisable to open a special sub-account for account 67 - “Settlements for long-term credits (loans), the repayment period of which after the reporting date is no more than 12 months.” And transfer loans within account 67. Why is this necessary? To correctly prepare reports.

The fact is that in the balance sheet (the form was approved by order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n), assets and liabilities are presented with a division into short-term and long-term, depending on the maturity date. Short-term are those whose maturity is no more than 12 months after the reporting date. All other assets and liabilities are long-term.

Thus, long-term loans that have become short-term loans must be shown in the balance sheet as part of short-term liabilities, despite the fact that they are listed in the same account. The same applies to interest accrued on such loans - you will also reflect this on the balance sheet as part of short-term liabilities.

Pay attention to accrued but not yet paid interest on regular long-term loans. You need to look at how long they must be paid to the lender. If this period does not exceed one year, for example, interest is paid monthly according to the agreement, then they should also be reflected as part of short-term liabilities (letter of the Ministry of Finance of Russia dated January 24, 2011 No. 07-02-18/01).

So, the balance on account 67 does not have to be completely included in long-term liabilities. Depending on the circumstances, division is possible.

As for tax accounting, let us remind you that the loan received itself is not reflected in any way under the simplified tax system. In particular, the loan amount you receive does not generate income for you. And there will be no expense when repaying the loan amount (subclause 1, clause 1.1, article 346.15, subclause 10, clause 1, article 251 of the Tax Code of the Russian Federation). But you have the right to reflect interest on the use of borrowed funds as they are transferred to the counterparty as expenses if you apply the simplified tax system with the object of income minus expenses (subclause 9, clause 1, article 346.16 of the Tax Code of the Russian Federation). Moreover, until 2015, interest for tax accounting purposes must be normalized according to the rules set out in Article 269 of the Tax Code of the Russian Federation (clause 2 of Article 346.16 of the Tax Code of the Russian Federation). From January 1, 2015, interest can be taken into account in expenses in full, without any restrictions. Rationing will be provided only for controlled transactions (clause 7, article 3 and clause 2, article 6 of the Federal Law of December 28, 2013 No. 420FZ). And among the “simplified” people there are practically no such things (Article 105.14 of the Tax Code of the Russian Federation).

Example. Integral LLC, which applies the simplified tax system with the object income minus expenses, received three loans on July 1, 2014:

- in the amount of 185,000 rubles. for a period of one year (until July 1, 2015);

- in the amount of 250,000 rubles. for a period of one and a half years (until January 1, 2016);

- in the amount of 300,000 rubles. for a period of two years (until July 1, 2016).

On July 1, 2014, the accountant made the following entries:

DEBIT 51 CREDIT 66 subaccount “Calculations for the principal amount of the loan” - 185,000 rubles. — received a short-term loan;

DEBIT 51 CREDIT 67 subaccount “Calculations for the principal amount of the loan” - 250,000 rubles. — received a long-term loan (for a period of one and a half years);

DEBIT 51 CREDIT 67 subaccount “Calculations for the principal amount of the loan” - 300,000 rubles. — received a long-term loan (for a period of two years).

According to the terms of the agreement, interest for 2014 must be paid in the first quarter of 2015. Total for 2014, according to the schedule, interest was accrued under the agreement:

DEBIT 91 subaccount “Other expenses” CREDIT 66 “Loan interest payments” - 18,500 rubles. — interest accrued on a short-term loan;

DEBIT 91 subaccount “Other expenses” CREDIT 67 “Loan interest payments” - 25,000 rubles. — interest accrued on a long-term loan (for a period of one and a half years);

DEBIT 91 subaccount “Other expenses” CREDIT 67 “Loan interest payments” - 30,000 rubles. — interest accrued on a long-term loan (for a period of two years).

At the end of the year, the accountant checked how much of the long-term debt as of the reporting date (December 31, 2014) had become short-term, given that six months had passed since the loans were received. The total remaining maturity is:

- for a loan in the amount of 250,000 rubles issued for a year and a half (until January 1, 2021) - a year. The loan must be recognized as short-term;

- for a loan in the amount of 300,000 rubles issued for two years (until July 1, 2021) - one and a half years. The loan continues to be long-term.

On December 31, 2014, the accountant made the following entry:

DEBIT 67 subaccount “Calculations for the principal amount of the loan” CREDIT 67 “Calculations for the principal amount of the loan, the repayment period of which after the reporting date is no more than 12 months” - 250,000 rubles. — reflects the change in loan status.

In the balance sheet for 2014, as part of long-term borrowed funds, the accountant reflected only the amount of a long-term loan in the amount of 300,000 rubles. As part of short-term borrowed funds, it showed all other amounts for loans received, including accrued interest. After all, their repayment period does not exceed one year after the reporting date. The total amount is 508,500 rubles. (185,000 rub. + + 250,000 rub. + 18,500 rub. + 25,000 rub. + 30,000 rub.).

In tax accounting, the accountant will include interest as expenses upon payment in the first quarter of 2015. The amount of interest is RUB 73,500. (RUB 18,500 + RUB 25,000 + RUB 30,000).