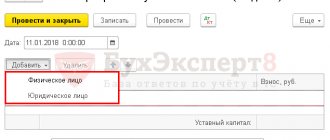

Authorized capital is part of the company’s funds contributed during its creation in the amount established by law.

In 2021, when individual entrepreneurs register, they choose the taxation system that is most suitable for them. Because

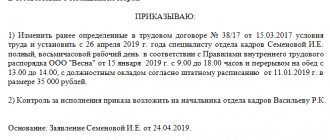

A transfer from part-time to full-time is a change in the working conditions of an employee, in which

Basic concepts A corrective invoice confirms the change for VAT deduction, which was formed due to changes made

General concepts Successful business conduct is impossible without a detailed analysis of the financial and economic indicators of the economic activity of an economic entity.

Previously, business entities sometimes faced refusal to accept VAT or tax returns

How to fill out dividends in 3-NDFL Since this is income, it is reflected on sheets A and

Notification of the opening of a separate division in the Federal Tax Service On the creation, any changes in previously provided

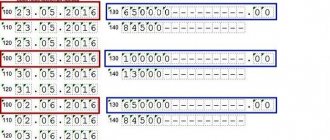

Employer reporting Olga Yakushina Tax expert-journalist Current as of May 29, 2019 Line 130 in

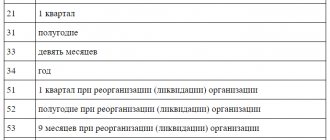

In 2021, the new 34th chapter of the Tax Code came into force, which regulates the procedure