In 2021, the new 34th chapter of the Tax Code came into force, which regulates the procedure for calculating and paying insurance coverage in Russia. Policyholders submit unified reporting on insurance premiums using the new Federal Tax Service form. An exception is the 4-FSS report on accidents and occupational diseases; it should be sent to Social Insurance.

The RSV-1 form in the form approved by the Resolution of the Pension Fund of the Russian Federation of January 16, 2014 No. 2p is no longer used. But there were no major changes in the procedure for reflecting information in the new reporting form. The changes affected the fact that information on insurance premiums, which previously belonged to different funds and was provided by different reports (RSV-1 and 4-FSS), is now grouped into the ERSV 2021. Only insurance premiums “for injuries” are excluded.

What are they for?

Code numbers approved by the Federal Tax Service help inspection specialists quickly and accurately process data from unified calculations of contributions. Basically, they characterize parameters that provide complete information about an economic entity and, if necessary, allow you to classify the submitted report.

Of course, many accountants are accustomed to the codes in the RSV-1 calculation. In 2021, due to a change in the report format, their composition was updated, but the general approach is the same. They are located on the following parts of the single calculation:

- title;

- information about an individual without individual entrepreneur status;

- Section I;

- Section II;

- Section III.

Please note that some codes are entered by a tax official. But basically the responsibility rests with the enterprise. Therefore, it is important to understand which codes should be used when calculating insurance premiums in 2019 and how to indicate them correctly.

First of all, we will consider the features of filling out codes on the title page - billing period, reporting option, etc.

When completing a single calculation of contributions, follow the procedure for filling it out, which is established by Order of the Ministry of Finance No. ММВ-7-11/551 dated October 10, 2016.

Values for the RSV title page

Most of the codes are given in the relevant appendices to the Procedure for filling out the form, approved. Order No. ММВ-7-11/ [email protected] (hereinafter referred to as the Order). The title page of the report contains the most encrypted fields. The payer's TIN and KPP are indicated on each sheet of the form, the sheets are numbered in order.

Let's look at the codes that the policyholder fills out.

Correction number

The field shows the number of adjustment reports filed by the policyholder.

In the primary report, “0—” is entered in the cells for the adjustment number (clause 3.5 of the Procedure). When filling out the second and subsequent options for the same period, clarifying the first calculation, a number is given in order: “1—”, “2—”, etc.

Period codes for DAM 2020

A mandatory indicator in the DAM is the billing period. Code depends:

- from the time period for which the report was compiled;

- from the person providing the form.

For convenience, we will display the possible values (approved in the Appendix to the Procedure) in the table below.

Table 1. Value of the billing period

| The period for which the calculation is completed | When deregistering an individual entrepreneur, the head of a peasant farm | Upon liquidation (reorganization) of a company | For all other policyholders |

| For 1 quarter | 83 | 51 | 21 |

| For half a year | 84 | 52 | 31 |

| In 9 months | 85 | 53 | 33 |

| In a year | 86 | 90 | 34 |

An error in the period code in the RSV may lead to the blocking of the payer's accounts. This situation may arise if the tax authorities, due to an incorrectly specified code, consider that the company did not send invoices for the reporting period.

Year code in RSV

The report must indicate the year for which information is being submitted. Since the form begins to operate with the report for the 1st quarter of 2021, the first value reflected in the special field is “2020”. In updated reports, the year is indicated, the data for which is corrected.

Tax authority code

Each Federal Tax Service Inspectorate is assigned its own number. You can find it using ]]>service on the Federal Tax Service website]]> - at the payer’s registration address, or by personally contacting the tax office at your place of residence.

Coding according to the place of presentation of the Calculation

This indicator was introduced in order to immediately recognize the type of policyholder filing the DAM. Possible encoding values (approved in the Appendix to the Procedure) are reflected in Table 2.

Table 2. Place of presentation codes

| Calculation provided | Code |

| At the place of residence of an individual (not an individual entrepreneur), other private practitioner | 112 |

| At the place of residence of the individual entrepreneur | 120 |

| At the lawyer’s place of residence | 121 |

| At the notary's place of residence | 122 |

| At the place of residence of the member (head) of the peasant farm | 124 |

| At the location of the Russian organization | 214 |

| At the place of registration of the legal successor of the Russian organization | 217 |

| At the location of a separate division of the Russian organization | 222 |

| At the location of the legal entity - (head) of the peasant farm | 240 |

| At the location of a separate division of a foreign organization in the Russian Federation | 335 |

| At the place of registration of the international organization in the Russian Federation | 350 |

The selected option makes it clear who is submitting the report - a company, individual entrepreneur, peasant farm or other person.

Economic activity type code

The company declares the selected types of activities at the time of registration, selecting values from the OKVED2 classifier. You can check the assigned codes using an extract from the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs. If desired, the company has the right to change them. On the title page of the RSV, the OKVED2 code is indicated by the main area of activity.

Codes for reorganization/liquidation

For companies that have submitted documents for reorganization or deregistration, a special line is allocated. The numerical value in it reflects the form of reorganization or shows what has closed - a separate division or the company itself. In the RSV, the liquidation/reorganization code can take the values given in Table 3 (from Appendix 2 to the Procedure).

Table 3. Coding of the reorganization form during liquidation, deprivation of authority, closure

| Name | Code |

| Conversion | 1 |

| Merger | 2 |

| Separation | 3 |

| Selection | 4 |

| Accession | 5 |

| Division with simultaneous accession | 6 |

| Selection with simultaneous appendage | 7 |

| Deprivation of powers (closing) of a separate division | 9 |

| Liquidation | 0 |

The field “Deprivation of authority (closing) of a separate division” is used when submitting an updated calculation for a division that previously made accruals for individuals and submitted calculations, but by the time the adjustment was submitted, was already deprived of such authority/closed.

What codes to use for reporting and billing periods?

A single calculation must be submitted after the 1st quarter, 6, 9 and 12 months. The deadline is no later than the 30th day of the month following such reporting period. The combination of numbers informing tax authorities about the reporting period is defined in Appendix No. 3 of the procedure for filling out a single calculation:

As you can see, the billing period is a year. It corresponds to code 34.

EXAMPLE

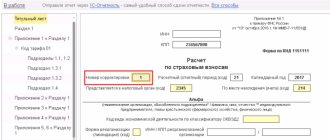

submits reports on contributions for the first quarter of 2021. When drawing up the first sheet in the field for reporting and billing periods, she notes the number 21:

An example of determining the period for calculating the average salary

Consider a situation in which it is necessary to calculate the average salary for the past 12-month period:

The employee went on a business trip on February 14, 2021. For this period, the company paid him an average salary. To calculate the value, it is necessary to consider the period from 1.01. until 31.12. last year, 2015. The employee was not at the workplace all the time:

- from April 12 to April 23, 2015 – on a business trip;

- from July 5 to July 25, 2015 – was on unpaid leave;

- from November 20 to November 28, 2015 – was incapacitated for work on sick leave.

Based on these data, the accountant determined the billing period:

- from January 1 to April 11;

- from April 24 to July 4;

- from July 26 to November 19;

- from November 29 to December 31.

According to the working time schedule, weekends will be excluded from the total number of days.

Code of the tax authority to which the report was submitted

Depending on the territorial location, tax inspectorates are assigned an individual number. You can find it out on the official website of the Federal Tax Service of Russia, from accounting reference books, or take the first four digits of the TIN.

The table shows values for some regions:

| Region of Russia | IFTS/MIFNS code |

| Moscow | 77— |

| Moscow region | 50— |

| Saint Petersburg | 78— |

| Tyumen region | 72— |

| Novosibirsk region | 54— |

| Amur region | 28— |

Where: “–” is the serial number of the tax authority in the region.

Location code

The field for this code is located on the title page to the right of the Federal Tax Service code. It is indicated depending on the territorial location of the enterprise and its legal status. The values can be as follows:

EXAMPLE

Let's assume that Guru LLC is located in Russia - in Tomsk. Then in the field in question they put the number 214, and the Federal Tax Service code is 7017:

Activity code

On the title page, after the name of the organization, you must indicate the code of economic activity - according to OKVED2. It contains information about the name of the company’s field of activity and a description of the grouping of its specific activities. You can view its value:

- in the all-Russian classifier;

- certificate of registration of an economic entity.

EXAMPLE

The scope of activity of Guru LLC is the production of armored and reinforced safes, as well as fire-resistant doors. According to the 2nd edition of the Classifier, the type of activity in question is assigned code 25.99.21. It is indicated in the corresponding field of the title page:

What codes to indicate for methods of submitting calculations for insurance premiums?

There are different options for submitting a single calculation of contributions to the Tax Service. Can personally bring the document, send it by mail or telecommunications networks. After receipt, the inspection itself puts down a code depending on the method chosen by the enterprise. This must be done by an employee of the Federal Tax Service. Possible values are presented in the table:

Code of type of reorganization or liquidation

When there is a process of termination of the activity of an economic entity, the creation of one/several companies or other changes related to legal succession, the corresponding code is indicated in a single calculation of insurance premiums. Its possible values are specified in Appendix No. 2 of the procedure for filling out the calculation:

If there are no actions related to reorganization or liquidation, a dash is placed in the appropriate field.

New control ratios for zero tariff

The Federal Tax Service published new control ratios for calculations at zero tariffs in a letter dated June 10, 2020 N BS-4-11/9607. They complement the previous list of controls for the DAM form (letter of the Federal Tax Service dated 02/07/2020 No. BS-4-11/ [email protected] ).

In total, three new control ratios have been added, but the essence of all is the same. Let's look at the first example: “In the presence of sub 1.1 adj. 1 rub. 1 SV according to field value 001 adj. 1 rub. 1 SV = 21 mandatory compliance with the conditions for the application of reduced insurance premium rates established by Article 3 of Federal Law No. 172-FZ dated 06/08/2020.” Similar rules apply to subsection 1.2 of Appendix 1 and Appendix 2.

This means that you can fill out the DAM at zero tariffs with code “21” only if you meet the conditions for exemption from Federal Law No. 172-FZ dated 06/08/2020. The Federal Tax Service will check this.

What codes to indicate in information about an individual without individual entrepreneur status

On the second page of the reporting in question, it is necessary to indicate the code of the country of citizenship. A list of all values is presented in the All-Russian Classifier of Countries of the World (Resolution of the State Standard of the Russian Federation No. 529-st).

Here are examples of some positions:

| The name of the country | Digital code |

| Russia | 643 |

| Belarus | 112 |

| Kazakhstan | 398 |

| Kyrgyzstan | 417 |

| Estonia | 233 |

In the section about the address of residence, indicate the code of the region of Russia in which the person is registered. When writing, follow Appendix No. 7 for the procedure for filling out a single calculation.

How to prepare this report

Before examining the reporting rules, it is worth highlighting the edited parts. Below are the main changes that every employee in the accounting department should be aware of:

- The unit of measurement has become thousands of rubles; you cannot fill out reports in millions.

- OKVED has been replaced by OKVED2.

- A new line has been added in which the inspector specifies whether a particular organization requires an audit or not, as well as full information about the auditor.

The accountant can remove or add items himself, despite the fact that the full form of the balance sheet recommends highlighting it in the appropriate sections of the balance sheet. The more amendments and comments an employee provides when preparing a report, the higher the reliability of the prepared reporting. There is a simplified form in which small entrepreneurs work, in which some articles are interconnected. This greatly facilitates the work of the compiler and the reviewer. When drawing up a balance, you must follow a number of rules:

- the source of information for drawing up the balance sheet is accounting data;

- accounting data must be generated according to the rules of the current accounting regulations and in accordance with the accounting policies adopted by the enterprise;

- credentials must meet the requirements of completeness and reliability;

- an enterprise that has branches draws up a single balance sheet for the organization;

- the data reflected in the balance sheet must be;

- the allocation of items in sections of the balance sheet is carried out according to the principle of materiality;

- the reporting period for the balance sheet is a calendar year;

- assets and liabilities reflected in the balance sheet should be divided into short-term and long-term;

- offset between items of assets and liabilities is not made if it is not provided for by the PBU;

- property is valued at its “net” value (less regulatory items);

- The accounting data of the annual report must be confirmed by the inventory.

Important! Make comparisons with data from previous periods and check the status of indicators at the time of drawing up the report.

Form

Insurance tariff: table of codes for calculating premiums

When submitting an invoice, be sure to indicate the tariff code. It characterizes the payer category, as well as a number of related characteristics.

In total, the legislation provides for 29 such codes. All of them are presented in the table below (Appendix No. 5):

| 1 | Payers of insurance premiums for OSN and applying the basic tariff of insurance premiums |

| 2 | Payers using the simplified tax system and applying the basic tariff |

| 3 | Payers on UTII and applying the basic tariff |

| 4 | Payers are business entities and business partnerships whose activities involve the practical application (implementation) of the results of intellectual activity (programs for electronic computers, databases, inventions, utility models, industrial designs, selection achievements, topologies of integrated circuits, production secrets (know-how) how), the exclusive rights to which belong to the founders (participants) (including jointly with other persons) of such business entities, participants of such economic partnerships - budgetary scientific institutions and autonomous scientific institutions or educational organizations of higher education that are budgetary institutions, autonomous institutions |

| 5 | Payers of insurance premiums who have entered into agreements with the management bodies of special economic zones on the implementation of technology-innovation activities and make payments to individuals working in a technology-innovation special economic zone or industrial-production special economic zone, as well as payers of insurance premiums who have entered into agreements on the implementation tourism and recreational activities and making payments to individuals working in tourist and recreational special economic zones, united by a decision of the Government of the Russian Federation into a cluster |

| 6 | Payers carrying out activities in the field of IT (with the exception of organizations that have entered into agreements with the management bodies of special economic zones on the implementation of technology-innovation activities and making payments to individuals working in a technology-innovation special economic zone or industrial production zone) |

| 7 | Payers of insurance premiums who make payments and other remuneration to crew members of ships registered in the Russian International Register of Ships for the performance of labor duties of a ship crew member |

| 8 | Payers of insurance premiums applying the simplified taxation system, and the main type of economic activity, which is specified in subparagraph 5 of paragraph 1 of Article 427 of the Code |

| 9 | Payers of insurance premiums who pay a single tax on imputed income for certain types of activities and have a license for pharmaceutical activities - in relation to payments and remunerations made to individuals who, in accordance with the Federal Law, have the right to engage in pharmaceutical activities or are allowed to carry them out |

| 10 | Payers of insurance premiums are non-profit organizations (with the exception of state (municipal) institutions), registered in the manner established by the legislation of the Russian Federation, applying a simplified taxation system and carrying out activities in accordance with the constituent documents in the field of social services for the population, scientific research and development, education, healthcare, culture and art (activities of theatres, libraries, museums and archives) and mass sports (except professional) |

| 11 | Payers of insurance premiums are charitable organizations registered in accordance with the procedure established by the legislation of the Russian Federation and applying the simplified tax system |

| 12 | Payers of insurance premiums are individual entrepreneurs who apply the patent taxation system in relation to payments and rewards accrued in favor of individuals engaged in the type of economic activity specified in the patent, with the exception of individual entrepreneurs carrying out the types of business activities specified in subparagraphs 19, 45 - 47 paragraph 2 of article 346.43 of the Tax Code of the Russian Federation |

| 13 | Payers of insurance premiums who have received the status of participants in the Skolkovo project |

| 14 | Payers of insurance premiums who have received the status of participant in the free economic zone in Crimea |

| 15 | Payers of insurance premiums who have received the status of resident of the territory of rapid socio-economic development |

| 16 | Payers of insurance premiums who have received resident status of the free port of Vladivostok |

| 21 | Payers of insurance premiums paying insurance premiums at additional rates established by paragraph 1 of Article 428 of the Code |

| 22 | Payers of insurance premiums paying insurance premiums at additional rates established by paragraph 2 of Article 428 of the Code |

| 23 | Payers of insurance premiums paying insurance premiums at additional rates established by paragraph 3 of Article 428 of the Code when establishing the class of working conditions - dangerous, subclass of working conditions - 4 |

| 24 | Payers of insurance premiums who pay insurance premiums at additional rates established by paragraph 3 of Article 428 of the Code when establishing the class of working conditions - harmful, subclass of working conditions - 3.4 |

| 25 | Payers of insurance premiums paying insurance premiums at additional rates established by paragraph 3 of Article 428 of the Code when establishing the class of working conditions - harmful, subclass of working conditions - 3.3 |

| 26 | Payers of insurance premiums paying insurance premiums at additional rates established by paragraph 3 of Article 428 of the Code when establishing the class of working conditions - harmful, subclass of working conditions - 3.2 |

| 27 | Payers of insurance premiums paying insurance premiums at additional rates established by paragraph 3 of Article 428 of the Code when establishing the class of working conditions - harmful, subclass of working conditions - 3.1 |

| 28 | Payers of insurance premiums paying insurance premiums for additional social security specified in paragraph 1 of Article 429 of the Code |

| 29 | Payers of insurance premiums paying insurance premiums for additional social security specified in paragraph 2 of Article 429 of the Code |

Please note that when filling out Appendix 1 of Section I, the combination of numbers 21 to 29 is not used in line 001 if several tariffs were in effect during the period. That is, the appropriate number of Appendix 1 (or its subsections) should be completed. Each of them must contain the required tariff.

EXAMPLE

applies the basic taxation regime and deducts contributions at the basic rate. This means that in line 001 of Appendix 1 of Section I, she notes code 01:

An example of calculating average daily earnings for an incomplete period

Consider the situation: an employee will be granted paid leave from June 15, 2021. The monthly billing period for payments is from 06/1/15 to 05/31/16, this time was not fully worked: from February 18 to 25, the employee was sick. In addition to sick leave payments, the employee is due a salary totaling 240 thousand rubles.

Let's make the calculation:

- Number of days for fully worked months: 11 × 29.3 = 322, for February: 29.3: 29 × 21 = 21.

- In total, the following will be used to calculate vacation pay: 322 + 21 = 343 days.

- Average daily earnings will be: 240,000: 343 = 699.7 rubles.

What codes to use for document types?

The single calculation also includes a code that informs about the type of document identifying the insured. The designation used also depends on the presence of Russian citizenship and the status of the employee. Full information is presented below (Appendix No. 6 to the order of the Federal Tax Service No. ММВ-7-11/551):

These codes indicate:

- in information about an individual without individual entrepreneur status;

- in personal data about the insured (page 140 of Section 3).

EXAMPLE

In the personalized accounting information, the company reflected information about employee N.V. Maneev on the basis of a temporary identity card issued to a citizen of the Russian Federation. In such a situation, in line 140 you must specify code “14”:

Insured person category codes

The category codes of the insured person also help to simplify the processing of the information contained in the calculation. They are assigned to groups of people when they meet certain conditions. These could be employees who work in particularly difficult conditions, are engaged in intellectual activities, etc.

The meaning of the code usually depends on the nationality and tariffs at which contributions are calculated. A complete list of these codes can be seen in Appendix No. 8 to the procedure for filling out a single calculation.

EXAMPLE

When using the basic tariff, the organization making payments for a foreigner temporarily residing in the Russian Federation indicates the code “VZHNR”. For holders of Russian passports, its value will be “NR”.

For more information about this, see “Insured Person Category Codes for 2021: Table with Explanation.”

DAM with zero contributions

Companies that do not pay contributions for the 2nd quarter fill out the form along with all other payers. Do not confuse the DAM with a zero contribution rate and with zero reporting on insurance premiums:

- in the first case, there are accruals to employees or other individuals, but the amounts are exempt from taxation due to the application of a preferential rate of 0%;

- in the second, there are no accruals for individuals at all (the organization does not conduct business, does not pay remuneration for labor, including under civil servants’ agreements).

This is important, since the composition of the sections presented in the Calculation differs in each case. Below we will consider the option of filling out a report for companies using a preferential rate of 0% in the 2nd quarter.

Budget classification code

The corresponding 20-digit number is placed on some pages of Sections I and II. It allows you to correctly distribute cash receipts from contributions depending on their purposes:

- pension insurance (compulsory and at an additional rate);

- medical insurance (CHI);

- social security;

- additional social security;

- illness and motherhood.

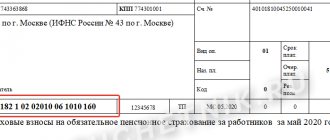

EXAMPLE

prepares calculations for insurance premiums for the first 6 months of 2019. Which BCCs need to be reflected in the first section for compulsory pension and health insurance are shown below:

When filling out a single calculation, use the new BCCs in force in 2021. Since the Federal Tax Service is now in charge of controlling insurance premiums, some changes have occurred.

Who reports with zero contributions

The preferential rate of 0% is valid for only 3 months - from April to June 2020. It was introduced by Federal Law No. 172-FZ dated 06/08/2020. The same document indicates for whom contributions have been canceled:

- Individual entrepreneurs and organizations related to small and medium-sized businesses (included in the SME register based on reporting results for 2021), whose activities are classified as affected industries;

- SONCO (socially oriented non-profit organizations);

- religious organizations (centralized and included in their structure).

The list of industries (according to OKVED code) classified as those most affected by the pandemic is given in Government Decree No. 434 of 04/03/2020 (as amended on 06/26/2020). If a company or individual entrepreneur meets the criteria, then they have the right to submit reports for the first half of 2021 with zero contributions for April-June.

Working conditions class code

The indicator under consideration affects the amount of insurance premiums. Additional rates are provided for employees who work in difficult or hazardous conditions. When making a single calculation, in the “Working conditions class code” box of Subsection 1.3.2, enter the number 1 if the hazard subclass is 4. And codes 2, 3, 4 and 5 correspond to subclasses 3.4, 3.3, 3.2 and 3.1.

EXAMPLE

compiles a calculation of insurance premiums for the first half of 2021. When entering data about K.V. Kuznetsov, who works as an electric welder, must enter the number 4 in the “Class of working conditions” field in Subsection 1.3.2.

Sample of filling out the DAM for the 4th quarter of 2021

Let's look at a sample of filling out the DAM for the 4th quarter of 2021. The title page, which is mandatory for all submitters of the calculation, contains data on the name of the organization (or individual entrepreneur), code of the billing period, code of the tax authority to which the calculation is submitted. In the reporting for 2021, in the “billing period code” field we indicate “34”. In the field “Average headcount (persons)” we indicate the average headcount, which is determined in the manner established by Rosstat Order No. 711 dated November 27, 2019. All insurers are required to include in the calculation:

- section 1;

- subsections 1.1 and 1.2 of Appendix 1 to Section 1, Appendix 2 to Section 1;

- section 3.

Peasant farms fill out section 2 of the form. The remaining calculation sheets are filled out by policyholders who have the appropriate indicators.

All calculations are carried out in applications, and the final indicators are entered in section 1.

Section 3 provides personalized information about employees who received income that is subject to insurance contributions.

Other codes in the calculation of insurance premiums and their designation

Above we looked at the most important codes that appear in the unified calculation of contributions. But when filling out the sheets of this document, you can come across a number of additional digital combinations. Let's take a closer look at them.

OKTMO

In Sections I and II you need to indicate OKTMO. It characterizes the territorial affiliation of the municipality where contributions are paid. You can view its value:

- in the order of Rosstandart No. 159-st;

- on the official website of the Federal Tax Service of Russia.

EXAMPLE

For the Sokolniki municipal district of Moscow OKTMO 45315000. And for the Yukhnovsky district of the Kaluga region - 29650000.

Legal basis additional tariff

When deductions are made for additional tariffs, the basis must be indicated:

- when employees work in difficult conditions, contributions of 6% are assessed. In this case, enter the number “2” in the corresponding field;

- if the activity is associated with harmful working conditions, the additional payment is 9%. Indicate the number "1".

Basis for filling according to additional tariff

In Subsection 1.3.2, the enterprise will need to mark the attribute on the basis of which the additional tariff was established:

- if the decision was made based on the results of a special assessment, put “1”;

- based on the results of certification of workplaces - 2;

- when combining these bases – 3.

Sign of payments for illness and maternity

At the beginning of Appendix 2 of Section I, it is necessary to indicate the payment indicator:

Put “1” if you indicate contributions to be paid to the budget. And “2” if you show the amount of excess of expenses for payment of insurance coverage over calculated contributions for illnesses and maternity.

It is also placed at the end of this Appendix:

Identification of the insured person in the system

In Section III, at the end of the information about the insured, you must put a code in the “Identification of the insured person” field. Its value depends on whether the person is insured in the pension, medical and social insurance systems. If the answer is positive, put “1”, and if the answer is negative, put “2”.

Read also

28.10.2019

Accrual of vacation pay for periods not fully worked

When determining the period of work for which an employee is granted paid rest, the following time is not taken into account:

- receiving average earnings;

- illness, maternity leave;

- unpaid leave;

- additional days off to care for a disabled child;

- downtime due to the fault of the enterprise;

- other cases provided for by law.

When subtracting the listed periods, it turns out that the employee did not work the entire period calculated for vacation, but only part of it. This results in an incomplete rest time that needs to be determined.

To find how many calendar days of the pay period the employee is due for vacation, you need to perform several mathematical operations:

1. Calculate the number of days worked in a part-time working month: Td. = 29.3 : Td.m. × Tot.d., where:

- Td.m. – number of calendar days of the month;

- That.d. – number of days actually worked.

2. Determine the amount of average daily earnings using the formula: SD. = Z: (29.3 × Tm. + Td.), where:

- Z – total amount of earnings accrued for the period;

- Tm. – number of fully worked months;

- etc. – the number of days worked in a part-time working month (see clause 1).

If there are several incomplete months in one period, the calculation should be made separately for each of them, and then the results should be summed up.