Business entities are required to report to government regulatory authorities. Currently, the list of these bodies includes the Pension Fund of Russia, the Federal Tax Service and the Federal State Statistics Service. The need to provide statistical reporting in a prescribed manner is stated in the Federal Law “On Official Statistical Accounting and the System of State Statistics in the Russian Federation.” Legislative acts indicate that the reporting organization provides reporting in a fixed form in paper or digital form - your choice.

Rosstat conducts continuous and sample surveys. Continuous ones imply the constant submission of documents on time for a certain group of subjects. A sample study is conducted on a focus group, the composition of which is determined by Rosstat, so in theory any organization can be included in the group, but in practice this probability is low.

Checking the 1C database for errors with a 50% discount

We will provide a written report on errors. We analyze more than 30 parameters

- Incorrect indication of VAT in documents;

- Errors in mutual settlements (“red” and expanded balances according to settlement documents or agreements on accounts 60, 62, 76.);

- Lack of invoices, checking duplicates;

- Incorrect accounting of inventory items (re-grading, incorrect sequence of receipts and expenses);

- Duplication of elements (items, currencies, counterparties, contracts and accounts, etc.);

- Control of filling out details in documents (counterparties, contracts);

- Control (presence, absence) of movements in documents and others;

- Checking the correctness of contracts in transactions.

More details Order

The essence of statistical reporting

Statistical reporting is a centralized, legally regulated form of control by government agencies over the activities of business entities. It is implemented through the periodic receipt of statistical information, issued in the form of various forms of reports for a certain period of time. The reliability of information in statistical reporting is confirmed by the signatures of responsible officials. In order for reporting to be generated correctly in the 1C program, you need to check the presence of a registered 1C ITS subscription; you can request this information from a specialist from the First Bit company.

Statistical reporting is divided depending on the frequency of its presentation into urgent, monthly, quarterly, semi-annual and annual. To fill them out, the information contained in the company’s documents is used, i.e. they are documentary evidence of the reliability of the data reflected in the reports.

In the practice of Russian statistical activities, reporting is divided into two large groups:

- general reporting containing the same information for a certain sector of the economy and for business entities as a whole;

- specialized reporting containing specific indicators and information on individual sectors of the economy.

The obligation of business entities to submit statistical reports is regulated by Federal Law dated November 29, 2007 No. 282-FZ. The conditions for the presentation of primary statistical and administrative statistical data are enshrined in Decree of the Government of the Russian Federation dated August 18, 2008 No. 620.

According to these regulations, submitting statistical reports is a mandatory procedure. It must be carried out using specific statistical forms, transmitted in paper or electronic form.

Conducting statistical observation can be either continuous or selective. In the first option, respondents report at a certain frequency in accordance with the deadlines established by law. In the second option, observation is carried out in a selective form according to specific parameters, and therefore an economic entity does not always fall into a specific sample.

Who should submit statistical reports?

The following entities must submit statistical reporting:

- legal entity, including SMP subjects;

- IP;

- government agencies;

- branches and representative offices of foreign enterprises operating in Russia;

- notaries and lawyers.

According to Federal Law No. 209-FZ of July 24, 2007, small and medium-sized enterprises (which include many entrepreneurs) are allowed to submit statistical reports in a simpler manner. To classify an entity as a small and medium-sized business, several criteria have been established (based on the average number of employees, revenue, share of participation in the authorized capital), and a direct list of them is contained on the Federal Tax Service website.

Platform advantages

Using the electronic service, business representatives receive a number of advantages:

- all information on current and submitted reports is collected in one place;

- access to data on codes and forms without registration;

- no need to visit a Rosstat branch to submit statistical data;

- technical support promptly resolves user problems.

Using the electronic service websbor.gks.ru in 2021, more than 9.7 million reports were sent to the Federal State Statistics Service. The platform is used by more than 859 thousand respondents, which indicates the convenience and practicality of the solution. There is no longer any need to visit stuffy offices and deal with paperwork, since all actions are completed online.

Statistical reporting forms

Reporting forms to be filled out by companies when conducting statistical monitoring are approved and regulated by Rosstat. They include indicators and information on the economic entity necessary for further analysis by statistical authorities.

There are quite a few forms of statistical observation, but which ones need to be submitted for research depend on the activities of the business entity, its organizational and legal form, whether it belongs to a small business, etc. The most common forms of reporting are information:

- about the activities of the enterprise (1-enterprise);

- about the financial condition of the organization (P-3);

- about the number, salary and movement of company employees (P-4);

- on underemployment and movement of employees (P-4 (NZ));

- on the number and salary of employees (1-T) - for companies that do not submit monthly form P-4;

- on additional professional education of company employees (1-personnel);

- on the main performance indicators of a small enterprise (SM).

Information on which forms a business entity needs to submit can be found on the Rosstat website. You can also get advice from specialists at the territorial department of statistics.

By mail

Yes, it’s not only grandmothers who stand in line at the post office to receive their pension. During reporting periods, many accountants rush to send cherished letters.

Usually this is not a whim of the accountant, but the reluctance of the director or entrepreneur to connect to electronic reporting. But individual entrepreneurs and organizations do have the right to send by post.

To ensure confirmation that you actually sent a declaration and not a stack of paper, you need to fill out an inventory (2 copies). Like that:

The envelope must also bear the inscription “Declared value 1 ruble (one ruble).” You will receive an inventory with a postal stamp and a shipping receipt. This is evidence of the submission of the report, you must keep it.

Pros:

- Personal control and confirmation in hand;

- A valuable letter can be tracked through the Russian Post website.

Minuses:

- It will take a long time for your report to arrive by mail, and it will take even longer for it to be processed by the inspectorate;

- Risks of errors remain;

- Once again, you are left to find and fill out current forms yourself.

Suitable for: all organizations and individual entrepreneurs, provided that they have the right to send reports on paper.

Risks: all the same as when submitting the report in person. Even more, because the inspector may notice some shortcomings and immediately point them out, but when sending by mail, you will only find out about them during a camera inspection or even from a request.

There is a risk that you will not track the fate of the letter, and the post office will safely lose it, for example, at some distribution point. While you are figuring it out, the Federal Tax Service will already sound the alarm - there is no report, it will start sending demands and scaring you by blocking accounts. Some people find out that the report has not arrived just from a non-functioning account.

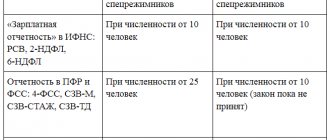

If you suddenly exceed the limits on the number of employees, for example, for 6-personal income tax this is 10 people, inclusive, then you are required to submit a report electronically. It's great if you know about it, but what if you don't? Or they simply forgot and sent the documents on paper. We return to the beginning - the report will be considered not submitted. Failure to submit a report = fine. Minimum - 1000 rubles.

Formation of statistical reporting in 1C

It is easier to generate statistical reporting in the 1C: Salary and Personnel Management 8 program, since in this case the information will be presented in accordance with accounting, tax and personnel records. The specialist will need less time to generate and submit documents, and the information in them will be reliable and accurate.

The standard 1C configuration contains an extensive list of various forms of statistical reporting. However, if some form is missing due to its specificity, you can supplement the program by making appropriate adjustments, or use a universal statistics report. It is designed to prepare statistical reporting forms based on XML templates published by Rosstat.

Based on the universal statistical report, you can fill out the necessary reporting form, download it electronically and send it to the territorial statistical bodies. In addition, it does not need to be downloaded, but after its formation, it can be immediately sent through secure channels to government agencies.

To generate a universal report, you need to open the “Statistics” tab and go to the “Other Forms” section. After selecting the form that is available in the list, you need to click on the “Create” button, and then the form for filling out the report will open. If the form is not in the list, then you need to go to “Templates” and download the required report, having first downloaded it from the Rosstat website.

The advantages of generating statistical reporting in 1C are the following:

- presentation of accurate and complete information on the business entity;

- automatic filling of information and mandatory reporting details;

- rapid collection and analysis of information;

- reducing labor costs and employee time;

- simplicity and ease of filling out reports;

- generation of a document in electronic form required for sending via TKS.

Via the Federal Tax Service website

Indeed, you can submit reports, although not all, through the tax service website.

What is needed for this:

- Internet access and Internet Explorer browser;

- Qualified electronic signature;

- Configured workplace (you need to install certificates, configure the use of a key, etc.);

- Registration in the reporting service (performed by the taxpayer independently).

The reporting must be filled out or uploaded in a special free program “Legal Taxpayer” . Then create an electronic file and pack it. You will get an encrypted file of the transport container, which must be uploaded to the website, signed and transferred to the Federal Tax Service.

Pros:

- In Taxpayer you can check the completion of the report;

- Shipping is free;

- You don’t need to go anywhere, you don’t have to communicate with inspectors or postal workers.

Minuses:

- Not all reports can be submitted through the website. For example, you cannot send a VAT return this way;

- The Federal Tax Service website is not the most reliable service. Either preventive maintenance, or errors, or overloads;

- Taxpayer Legal Entity is not the best software for generating reports, it resembles Excel at minimum wage, it needs to be updated manually;

- Accordingly, through the Federal Tax Service website you can only send reports to the tax office; you will have to report to the Pension Fund or the Social Insurance Fund in another way;

- You are tied to a specific computer; in order to send reports from another, you will also need to configure it to the requirements of the system.

Suitable for: all organizations and individual entrepreneurs, provided that there are no restrictions in the Tax Code (as with VAT).

Risks: this method, of course, is more reliable than mail, but, as you can see, it has limitations and is quite troublesome. One of the risks is manual updating; you will have to monitor the relevance of reporting in the Taxpayer yourself.

Responsibility for failure to provide statistical reporting

If an economic entity, obligated by law to submit one or another type of statistical reporting, does not comply with the requirement, it is fined in accordance with Art. 13.19 Code of Administrative Offenses of the Russian Federation:

- 10 - 20 thousand rubles. for officials;

- 20 - 70 thousand rubles. for legal entities.

In case of repeated violation of this legal norm, administrative liability becomes stricter:

- 30 - 50 thousand rubles. for officials;

- 100 - 150 thousand rubles. for legal entities.