Employer reporting

Olga Yakushina

Tax expert-journalist

Current as of May 29, 2019

Line 130 in reporting form 6-NDFL is called “Amount of income actually received.” The main question that arises for everyone who prepares these reports: what data should be included in this line - the amounts accrued to the individual or actually paid? Let's figure out what tax authorities want to see in form 6-NDFL.

What information does lines 130 and 140 of the 6-NDFL declaration contain?

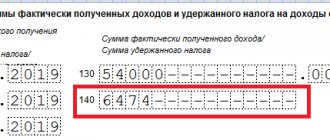

In lines 130 and 140 of section 2 of form 6-NDFL, information about the total income of the company’s employees is recorded. In this case, the amount excluding withheld taxes is placed in line 130, and the entire tax deducted from this income is entered in line 140.

In the reporting process, it is necessary to remember that the amount of employee income for the month entered in line 130 will correspond to the amount of actually accrued income only if it is completely tax-free. This point is explained in more detail in the Letter of the Federal Tax Service of Russia dated December 15, 2016 No. BS-4–11/ [email protected]

Reflection of vacation compensation upon dismissal of an employee

According to the Labor Code of the Russian Federation, dismissed citizens have the right to count on monetary compensation for those vacations that they did not take advantage of. Such payments are subject to personal income tax in accordance with the general procedure.

Features of recording data in form 6-NDFL:

- line 100 “Date of actual receipt of income” indicates the date of payment of compensation for vacation;

- line 110 reflects the date of tax withholding, in this case it coincides with the date of payment of compensation.

The days of tax withholding and payment of compensation for unused vacation will coincide

The working day following the day of payment of income will be considered the date of transfer of personal income tax for compensation upon dismissal.

Management can pay a former employee even before his dismissal, that is, make a payment in advance that compensates him for unused vacation. In this case, income tax is withheld until the employee is dismissed. The calculation itself is made on the day of his dismissal, i.e. the employee has the right to take advantage of the remaining days of rest before dismissal, and then leave the place of work. Then the day of dismissal will coincide with the day of vacation. In this case, compensation for unused vacation is not paid and is not reflected in the 6-NDFL declaration.

Video: vacation pay in 6-NDFL

Rules for filling out lines 130 and 140

It should be kept in mind that line 130 is part of the information blocks of the second section of form 6-NDFL. In order to fully understand the rules for calculating personal income tax and the procedure for reflecting information in lines 130 and 140, you should refer to the order of the Federal Tax Service of the Russian Federation No. ММВ-7–11 / [email protected]

How to fill line 130

The order mentioned above provides a detailed procedure for entering data into the lines, and also clarifies that line 130 includes all income received by the employee (before deducting personal income tax from it). This income is paid on the day recorded in line 100.

The tax agent must enter in line 130 the generalized amount of income received without deducting withholding tax

Line 130, intended to reflect the income of individuals, is fraught with a number of difficulties for accountants when entering data into it. The fact is that each line 130 present in 6-NDFL was created using machine-readable code, and to reflect the total income of employees there are only 17 cells into which indicators in rubles and kopecks must be entered. Therefore, large companies may have a situation in which the available cells to reflect total income are not enough.

Line 130, like any line present in 6-NDFL, is encoded and designed to reflect special information

Data for line 140

Line 140 of the second section indicates the amount of tax withheld from any payment that exists in the report. This line is also included in the information blocks of the second section of the 6-NDFL form, numbered from 100 to 140. To avoid confusion, the information should be placed there in the correct sequence:

- first, line 100 indicates the day individuals received income payments from the enterprise (taking into account the norms of Article 223 of the Tax Code of the Russian Federation);

- then line 130 shows the actual amount of payment received on the day indicated on line 100 (in full, including personal income tax);

- then in line 110 the day is entered when personal income tax must be withheld from the payment, information on which is entered in line 100 and line 130 (in accordance with the requirements of Article 226 of the Tax Code of the Russian Federation);

- after this, in line 140 you must indicate the amount of tax withheld from the payment for which the block is filled out;

- Finally, line 120 of the report reflects the day no later than which the personal income tax shown on line 140 must be transferred to the budget.

It turns out that the data in line 140 is interconnected with the data in other lines.

Reflection of different types of income

In the process of work, situations often arise when an employee receives different types of income at the same time - this could be:

- payment of part of the salary;

- payment of sick leave.

Then the tax withheld from them is transferred on different dates. In such cases, information about events is entered in lines 100–140 separately.

It is known that document 6-NDFL is drawn up on an accrual basis, however, some information in the report should take into account data for previous quarters. It must be borne in mind that this rule applies only to section 1 of the report. Section 2 contains the amounts of payments to employees that took place exclusively in the previous three months of work.

Line 140 in form 6-NDFL is drawn up as amounts of income and payments that took place only in the previous quarter

What information to provide if tax was not withheld from the payment?

According to the comments of the Federal Tax Service, set out in Letter No. BS-4–11/ [email protected] , the absence of a direct fact of tax withholding should be taken into account. If it was not there, 0 is recorded for these payments in the second section on line 140.

However, in practice, a situation often arises when it is necessary to reflect partially non-taxable income - such as financial assistance exceeding 4,000 rubles, or, for example, daily allowances exceeding established standards.

In this case, in line 020 you need to enter data on the total amount of accrued income. Further:

- the non-taxable part of income is entered in line 030;

- line 130 records the entire amount received by the employee (including calculated tax);

- line 140 reflects the amount of personal income tax withheld from the taxable portion of income.

Who is entitled to deduction

You can receive a deduction from your employer before the end of the tax period (clause 8 of Article 220 of the Tax Code):

- for construction, purchase of housing (or a share in it) and land for individual housing construction;

- on interest paid on loans, loans for the purchase of new housing or land.

Tax agents-employers do not provide property deductions for other types.

What is needed for deduction

To receive a property deduction, an employee must:

- obtain from the Federal Tax Service a notice confirming the right to a deduction, which indicates its amount;

- write an application to the employer, attaching to it the document received from the tax office.

Beginning in the month of application, the employer will provide a deduction on accrued income until the end of the year, or until the deduction is fully spent. If the employee who submitted the application has the right to standard deductions (for children, for example), then first you need to take into account the standard deductions, and only then the property deductions.

Features of checking the correctness of filling

The easiest way to check the correctness of filling out the report is to use a special methodology of the Federal Tax Service of Russia, which in Letter dated March 10, 2016 No. BS-4–11/ [email protected] clarified the updated control ratios.

The ratios no longer require an equality between the tax amount from section 2 and the tax amount from section 1. Now it turns out that the sum of all lines 140 of section 2 does not have to match line 70 of section 1.

Although until recently it was believed that the total amount of lines 140, reflecting the amount of tax withheld, should be equal to the amount of line 070 from the previous section. And if the indicators did not match, this was considered a violation.

Video: about the features of filling out form 6-NDFL

https://youtube.com/watch?v=Veox_B0rgbE

Preparing and submitting 6-NDFL calculations is a complex and responsible matter. In the event of even the slightest inaccuracy, there may be a very real interest in the process of calculating and withholding personal income tax in a company on the part of supervisory authorities. To avoid such troubles, you need to follow all the rules for filling out the report.

- Author: ozakone

Rate this article:

- 5

- 4

- 3

- 2

- 1

(0 votes, average: 0 out of 5)

Share with your friends!

Sample filling when paying wages for the months preceding dismissal

If, before the day of termination of the employment contract, the employee has not yet received wages for the period preceding the month of completion of work, then it is paid on the last day of work. For wages, paragraph 2 of Article 223 of the Tax Code of the Russian Federation establishes that the actual date of receipt of income is the last day of the month for which it is accrued.

Accordingly, the tax agent fills out two blocks in section 2.

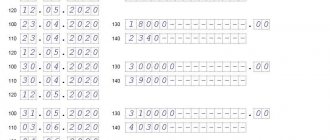

Let’s supplement the example with the condition that on May 12, 2020 the employee was paid not only a salary for May, but also for April in the amount of 20,000 rubles.

In this case, the organization will fill out two blocks in section 2:

- the first block reflects the salary for April;

- in the second - the final payment.

6-NDFL when dismissing an employee in the middle of the month with payment of wages for the previous month

Several employees left in the first quarter

In March, several employees quit, whose income the company reflected in the calculation of 6-personal income tax for the first quarter.

The company fills out section 1 of the calculation with a cumulative total (clause 3.1 of the Procedure, approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11 / [email protected] ). Including line 060, which counts the number of “physicists” who received income in the reporting period. Therefore, even if employees quit last quarter and no longer received income, they need to be counted in line 060 of the half-year calculation.

For example

In the calculations for the first quarter, the company reflected the income of 15 “physicists”. In line 020 I wrote down 600,000 rubles, in lines 040 and 070 the calculated and withheld personal income tax from this amount is 78,000 rubles. (RUB 600,000 × 13%). At the end of the first quarter, 5 employees left and were no longer receiving income from the company. For April, May and June, the company paid income to the 10 remaining employees - 450,000 rubles, calculated and withheld personal income tax - 58,500 rubles. (RUB 450,000 × 13%).

The company reflected income and personal income tax on an accrual basis. In line 020 - 1,050,000 rubles. (600,000 + 450,000), in lines 040 and 070 - 136,500 rubles. (78,000 + 58,500). In line 060, the company counted all the “physicists” to whom it accrued and paid income during the six months. In the first quarter, 15 employees received income, in the second, 10 employees out of the same 15 people. The second time, the company did not take into account the “physicists”, but included those laid off in the calculation. The company filled out Section 1 of the calculation as in sample 91.

Sample 91. How to reflect dismissed employees in the calculation:

Top

We reflect the payment of dividends

Another difficult point that we will talk about is how to reflect the payment of dividends in 6-NDFL. They must be reflected separately in section 1. The rate for residents is set at 13%, therefore dividends paid to them are reflected in the same block with accruals to employees. But they are highlighted in line 025 of section 1.

The rate for non-residents is set at 15%. If the founder is a non-resident, then Section 1 must also be completed for dividends.

The procedure for withholding income tax for dividends has no special features: it must be withheld on the day of payment, and transferred no later than the next business day.

Using the conditions of the first example, let’s supplement it: on May 25, dividends were paid to the resident founder in the amount of 100,000 rubles.

Why was personal income tax-6 invented?

The taxpayer is obliged to submit to the Federal Tax Service a calculation of the personal income tax accrued and transferred to the budget f.-6. Such an obligation arose for him on January 1, 2021, as an addition to the personal income tax-2 form already in force at that time, which must be submitted no later than the end of the first quarter of each year. In contrast to this form, personal income tax-6 must be submitted quarterly. This ensures enhanced control by the tax authorities over the correctness of calculations and timely payment of income tax by taxpayers.

FAQ

When an employee is dismissed, he is paid compensation for unused vacation and salary. Do you need to reflect information from these payments separately in 6-NDFL?

If wages and vacation compensation are paid one-time and together, then in order to report, it is no longer advisable to break down these amounts. The employer is required by law to make full payment to the resigning person. And if the salary and compensation settlement parts are paid together, then the transfer to the tax account is also carried out in one day.

How to formulate in 6-NDFL the payment of disability benefits for a citizen (due to illness) on April 4 for January?

Since the benefit was paid in full in the 2nd quarter, it is not recommended to indicate the amount reimbursed for sick leave in calculations for the 1st quarter. This information must be reflected in annual reporting in lines 020, 040.

A legal entity rents work space from one of its employees under a contract. Rent is credited to the balance monthly, and it is reimbursed once per quarter until the 20th day of the month following the quarter. How to display this situation in the 6-NDFL report?

Regardless of the frequency of accruals for rent repayments, the employee receives income once per quarter. And cash deductions coming to his account must be recorded according to their actual disbursement. That is, for example, for the period from April to June it is necessary to display payments for six months in the report. In subsequent periods, by analogy:

- pp. 100 – 20.06;

- pp. 110 – 20.06;

- pp. 120 – 21.06 (working day following payment - in it the withdrawn funds will go to the budget for personal income tax);

- line 130 – amount of quarterly rent payment;

- page 140 – quarterly tax deduction.

How to correctly fill out Section 2 of 6-NDFL?

Section 1 of the report records summary information in accordance with the established reporting period. Section 2 indicates the transactions of the last quarter of the reporting year. It defines:

- page 100 - the date of receipt of money by the taxpayer (for example, for an advance payment - this is the 20th day of the accounting month);

- page 110 – day of collection of the state personal income tax duty;

- page 120 – the date of transfer of tax funds to the state (following their nominal receipt by the employee);

- p. 130 – the totality of “dirty” profits (total tax shares);

- page 140 – the amount of the tax contribution.

What is the most correct way to process an employee’s 6-personal income tax allowance upon leaving the organization if it is 7,000 rubles more than three times the average salary?

Any amount exceeding the threshold must be recorded in both sections. Moreover, only the difference between the permissible maximum and the funds issued is indicated - 7,000 rubles. What is necessary for them is entered on pages 070, 140 (910 rubles are transferred to the state). Dates for transactions are entered as standard on pages 100, 110, 120.

Filling out information for the Federal Tax Service on dismissed personnel in 6-NDFL is simplified as much as possible. The forms contain only the necessary fields, leaving enough space for entering the necessary data. And the ability to optimize reporting preparation through 1C programs allows accountants to significantly reduce the amount of routine work.

To whom and when to fill out and where to submit

6-NDFL must be submitted to persons who are designated as tax agents in accordance with the Tax Code of the Russian Federation:

- legal – factories, firms, factories, etc.;

- IP;

- non-departmental notaries, lawyers;

- other persons conducting private business activities.

The report contains data aggregated to all income for a specified period. They also include remuneration to employees in total with dividends and incentives, the provision of which must be fixed in a civil contract of employment or receipt of one-time services.

Income from the sale of personal (non-current) property is not subject to taxation.

The report for 6-NDFL is compiled and submitted to the tax authorities before the deadline of the month after the reporting quarter, 2-NDFL - before the beginning of April of the year succeeding the accounting one. An individual reports at the place of residence, a legal entity – in the region of registration.

The Tax Code of the Russian Federation provides for a number of exceptions, such as the transfer of documentation via mail or online report, if another option is not available to the taxpayer.

Particular attention must also be paid to the transmission of the report to the regulatory authority. Methods for filing 6-NDFL for 2021:

- Filling out the form in writing/on a PC. Afterwards it is handed over by the person (authorized representative) in person or by registered mail by Russian Post.

- Formation of data in a PC and sending through your personal account using an electronic signature. Most payers use this method because of convenience, but for legal entities with more than 25 employees, it is mandatory and the only one.