Latest changes in the Tax Code of the Russian Federation for mineral extraction tax Changes to the text of Ch. 26 Tax Code of the Russian Federation,

Chapter 26.2 of the Tax Code of the Russian Federation is devoted to the simplified taxation system. This special regime allows you to reduce the level of tax

The UTII declaration for the 3rd quarter of 2021 is filled out by all impostors. 3rd quarter ends

From January 1, 2021, the minimum wage remained at 7,500 rubles. However, despite

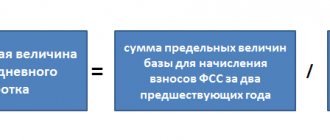

How the 4-FSS form has changed. The current 4-FSS calculation form has been approved by order of the FSS of the Russian Federation.

Just a few years ago it was believed that it was unprofitable to produce in Russia. They say it is impossible to compete with

Criteria Let’s say right away that the criteria for switching to the simplified tax system in 2021 are stipulated in different

According to the civil legislation of Russia, an obligation represents such a relationship between one person (debtor) and

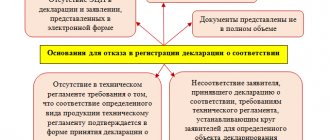

The Capital Amnesty Law (140-FZ) requires the declarant (the person wishing to use the law) to fill out a special

Tax notices The procedure and deadlines for paying taxes differ depending on what status