According to the civil legislation of Russia, an obligation is a relationship between one person (debtor) and another person (creditor), in which the debtor undertakes to perform certain actions in favor of the creditor. The general concept of obligation is enshrined in Art. 307 of the Civil Code of the Russian Federation. The Civil Code of the Russian Federation names the grounds for the emergence of legal relations - under an agreement, transaction, as a result of causing harm, etc. In our article we will talk about the grounds for termination of an obligation and dwell in more detail on the legal nature of the so-called “compensation”.

What entries should be made to reflect the write-off of accounts receivable under an indemnity agreement?

In this case, this is an assignment of the right to claim receivables, which you transfer to the founder. And in the future, offset the dividend debt against payment under the assignment agreement.

The right of claim that the assignor transfers to the assignee is part of his property rights and is taken into account as assets.

Therefore, in the assignor’s accounting, reflect the assignment of the right of claim as its sale (disposal) to “Other income and expenses.” Proceeds from the sale of the right of claim are recognized as other income (clause and PBU 9/99). It is accepted for accounting in the amount established by the agreement on the assignment of the right of claim (clause

and PBU 9/99). Reflect the proceeds from the transfer of rights in accounting under the credit of account 91 in correspondence with “Settlements with other debtors and creditors”, to which the organization has the right to open a separate sub-account “Settlements under the agreement for the assignment of the right of claim”.

The assignment of the right of claim under the agreement for participation in shared construction should be reflected on the date of registration of the assignment agreement. At the same time, on the date of signing the assignment agreement, make the following entry in accounting: Debit 76 subaccount “Settlements under the agreement of assignment of the right of claim” Credit 91-1 – the right of claim under the assignment agreement has been realized. The value of the right of claim, at which it is recorded on the assignor’s balance sheet, is reflected as part of other expenses in the debit of account 91 (clause

and PBU 10/99). In this case, on the date of signing the assignment agreement, make the following entry in accounting: Debit 91-2 Credit 62 – the value of the realized right of claim under the assignment agreement is written off from the balance sheet.

Assignment of rights

Accounting

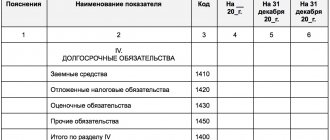

The principal amount of the liability for the loan received is reflected in accounting as accounts payable in accordance with the terms of the loan agreement in the amount specified in the agreement. Interest on a loan is reflected in accounting separately from the principal amount of the loan obligation (clauses 2, 4 of the Accounting Regulations “Accounting for expenses on loans and credits” (PBU 15/2008), approved by Order of the Ministry of Finance of Russia dated October 6, 2008 N 107n). Repayment of the principal amount of the loan obligation is reflected as a reduction (repayment) of accounts payable (clause 5 of PBU 15/2008).

On the date of transfer of goods under the compensation agreement, the organization reflects the repayment of the loan obligation (both the principal amount of the loan obligation and accrued interest) and at the same time recognizes the proceeds from the sale of goods as income from ordinary activities in an amount equal to the amount of the repaid loan obligation (without accounting for VAT presented upon transfer of goods to the buyer (lender)) (clauses 3, 5, 6.3, 12 of the Accounting Regulations “Organizational Income” PBU 9/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 32n).

At the same time, the cost of transferred goods is included in expenses for ordinary activities and forms the cost of sales (clauses 5, 16, 18, 9 of the Accounting Regulations “Organization Expenses” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n ).

Accounting records for the transactions under consideration are made in accordance with the Instructions for the application of the Chart of Accounts for accounting the financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, and are shown in the following table of entries.

Accounting for termination of compensation obligations

Accounting, taxation, reporting, IFRS, analysis of accounting information, 1C: Accounting

10/23/2007 subscribe to our channel

Current legislation provides for a number of options for terminating obligations between participants in economic relations*.

In the article by D.G. Lapteva, chief accountant of BIOTROF LLC, examines accounting and tax accounting for the termination of compensation obligations, and also analyzes the benefits and losses of both parties in various cases. Note: * Options and their reflection in accounting were discussed in the article by V.V.

Patrova, M.L. Pyatova From a legal point of view, the termination of an obligation means the repayment of the subjective rights and obligations of its participants that constitute the content of the obligatory legal relationship. Upon termination, the obligation ceases to exist, and its participants are no longer bound by the obligations that were previously based on this obligation.

In particular, the creditor no longer has the right to make any claims against the debtor, relying on this obligation, the parties are not obliged to bear responsibility for it; they cannot assign their rights and obligations in the prescribed manner to third parties, etc. Obligations are terminated by the occurrence of certain events stipulated by civil law. Obligations are terminated

What entries should be made to reflect the fixed assets received under the compensation agreement?

Answered by Natalia Sorokina, expert in accounting and tax accounting In accounting, reflect these transactions with the following entries: Debit 60 (76) Credit 62 (76) – receivables are repaid by concluding a compensation agreement; Debit 91-2 Credit 60 (76) – expenses for legal services are taken into account; Debit 41 Credit 60 (76) – reflects the cost of a truck crane received under a compensation agreement; Debit 44 Credit 60 (76,10,70,69...) – expenses for repairing a truck crane are reflected; Debit 90 Credit 44 – the cost of repair costs is written off; Debit 62 Credit 90-1 – revenue from the sale of the crane is reflected; Debit 90-2 Credit 41 – the cost of the crane is written off.

Rationale From the recommendation of Sergei Razgulin, Actual State Advisor of the Russian Federation, 3rd class. How to formalize and reflect in accounting the acquisition of fixed assets for a fee. Reflect the acquisition of property for resale by posting: Debit 41 Credit 60 (76) – property acquired for resale is capitalized. From the recommendation "" From the recommendation of Elena Popova, State Advisor of the Tax Service of the Russian Federation, rank I. How to reflect the sale of goods in bulk in accounting. If revenue is recognized on the date of shipment, reflect the sale of goods in accounting as follows. On the date of shipment: Debit 62 Credit 90-1 – revenue from the sale of goods is reflected; Debit 90-2 Credit 41 – the cost of the goods is written off.

If the organization that sells goods is a VAT payer, at the same time as recognizing revenue, accrue this tax: Debit 90-3 Credit 68 subaccount “VAT Calculations” – VAT is charged on the sale of goods.

Due to its independence, compensation will help save taxes

It would seem that compensation as a way to terminate an obligation (Article 409 of the Civil Code of the Russian Federation) cannot have any taxation features. After all, it is akin to mutual offset. But that's not true.

Their main difference is that during offset there are two independent transactions. Whereas with compensation there is only one main transaction, the transfer of compensation is a dependent operation to which market pricing principles cannot be applied. This feature allows you to legally use the compensation for optimization related to price variations. There are also nuances regarding VAT.

The compensation will explain the transfer of fixed assets at non-market prices

When selling expensive property, tax officials almost always check the marketability of the price in accordance with Article 40 of the Tax Code of the Russian Federation. Especially if the value of the property has not been confirmed by an independent appraiser. But officials of the Russian Ministry of Finance suggested how to secure the sale of assets at non-market prices, including at a loss (letter dated January 18, 2010 No. 03-03-06/2/1). This can be done using compensation.

When transferring an asset as compensation, the involvement of an independent appraiser is not necessary - the value of the property is determined exclusively by the parties to the transaction (Article 409 of the Civil Code of the Russian Federation). Consequently, the object transferred as compensation may be cheaper or more expensive than the original obligation.

For example, a potential buyer issues a loan to the owner of the property equal to the amount of the planned transaction for the purchase and sale of property. The borrower, being unable to repay the money on time, transfers the object as compensation. It is quite logical that this asset will be valued below its market value, since it is transferred under force majeure circumstances. Market prices are unlikely to apply to them.

The opposite situation is also possible - artificially creating a loss for one of the parties to the property. To do this, a company that needs a loss receives property as compensation at a valuation higher than the market value. Her consent to such a settlement may be justified by the lack of market prices for the object or the desire to receive at least something from the debtor. After which this highly valued property is sold to a third party at the market price, that is, at a loss.

In the mentioned letter, the Russian Ministry of Finance does not see anything criminal in taking such a loss into account for tax purposes. At the same time, even if a fixed asset was received as compensation, such a loss can be recognized at a time (clause 2 of Article 268 of the Tax Code of the Russian Federation). Not for the remaining useful life.

The excess of the value of the compensation over the debt does not form income for the recipient

If the residual value of fixed assets transferred as compensation exceeds the amount of the liability being repaid, then there is a risk of claims from tax authorities. The recipient of the object may be subject to additional income tax and property tax.

Thus, in a case considered by the Federal Arbitration Court of the North Caucasus District, tax officials stated that the excess of the residual value of the property received under compensation over the repaid debt should be taken into account as part of non-operating income as property received free of charge. At the same time, in accounting, the fixed asset must be reflected at its residual value according to the debtor. Based on this, property taxes should be calculated.

However, the judges decided that the mere fact that the book value of the transferred object does not correspond to the amount of the debt does not indicate its gratuitous nature (resolution dated September 24, 2009 No. A32-14927/2008-51/113). The provisions of the Tax Code of the Russian Federation provide for the formation of the value of property received by the creditor as compensation, based on the costs of its acquisition (clause 1 of Article 257 of the Tax Code of the Russian Federation). That is, in the amount of the repaid obligation.

Also, fixed assets are accepted for accounting according to the amount of the company’s actual costs for acquisition, construction and production (clauses 7, 8 and 11 of PBU 6/01 “Accounting for fixed assets”). Consequently, the property tax claims are unfounded. By ruling of the Supreme Arbitration Court of the Russian Federation dated January 29, 2010 No. VAS-17594/08, the decision of the federal court was upheld.

Thus, friendly companies, by paying off the compensation obligation, can form the desired value of the fixed asset.

The compensation will allow you to defer the payment of VAT on the advance

In practice, companies often use compensation in order to defer the transfer of VAT, avoiding paying this tax on the advance amount. This method is effective, but quite risky. To do this, as in the previous example, instead of a supply agreement with the condition of prepayment, the parties enter into an interest-free loan agreement.

When exactly it is necessary to charge VAT in this situation: during the period of shipment, during the period of concluding a compensation agreement or during the period of concluding a loan agreement is a controversial issue. Based on the norms of the Civil Code, loan obligations are terminated at the moment of the actual transfer of property as compensation, and not the conclusion of an agreement on this (clause 1 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 21, 2005 No. 102). This means that VAT must be calculated during this period.

The Federal Tax Service of Russia believes otherwise, stating that when repaying a debt, a compensation loan is recognized as an advance during the period of conclusion of the specified agreement (letter dated November 28, 2008 No. ШС-6-3/868 @, agreed with the Ministry of Finance of Russia - letter dated October 21, 2008 No. 03-07 -15/155). It’s just not clear what kind of agreement it is from the text of the letter. Either the VAT obligation arises at the time of concluding a compensation agreement, or a loan agreement.

Most experts are inclined to the first interpretation - during the period of concluding a compensation agreement. Sergei Tarakanov, 3rd class adviser to the State Civil Service of the Russian Federation, agrees with this. This position is beneficial and allows you to actually defer the payment of VAT in this way. The parties simply sign the agreement on the same day they transfer the property. Whereas the supplier can use the money from the moment the loan is received.

The second interpretation – about the need to charge VAT during the period of concluding a loan agreement – is the most illogical and most unprofitable. If the loan was issued several years ago, the borrower will have to submit VAT clarifications and pay penalties for the period of delay.

Transfer of property under compensation may not be subject to VAT

As arbitration practice shows, local inspectors sometimes fundamentally disagree with the opinion of the Federal Tax Service of Russia regarding the reclassification of a loan into an advance.

Thus, in a case considered by the Ninth Arbitration Court of Appeal, the inspectors argued that the loan not only is not an advance payment under the sales contract, but in general the entire transaction is not subject to VAT.

The arguments of the inspectors when checking the company, which declared a deduction for the object received as compensation, were as follows. In accordance with civil law, the provision of compensation does not affect the content of the obligation that it terminates. Therefore, if the primary obligation (for example, a cash loan) was not subject to VAT, then the transfer of property under compensation is not subject to this tax. In this particular case, the court avoided answering, pointing out that if the supplier of the object paid the tax to the budget, then the recipient can accept it as a deduction (resolution dated 12/08/09 No. A40-18178/08-141-56).

More often, courts come to more definite conclusions. Some believe that the controversial transaction is subject to VAT (rulings of the federal arbitration courts of the Moscow district dated 02.26.10 No. KA-A40/1076-10-P, Central districts dated 01.07.09 No. A68-8203/08-505/18). After all, subparagraph 1 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation directly states that the object of VAT taxation is the transfer of goods, work or services under an agreement on the provision of compensation.

But, for example, the Federal Arbitration Court of the Moscow District, in similar circumstances, indicated that the transfer of real estate as compensation under a loan agreement does not attract VAT (resolution dated March 27, 2006 No. KA-A40/1987-06). The same court later expressed similar doubts (resolution dated January 30, 2009 No. KA-A40/13334-08).

Since there are courts in favor of not paying VAT (and, accordingly, not accepting deductions for such an item), then their arguments can also be used. If the seller of property transfers the goods as compensation and does not charge VAT, then he must restore this tax from the under-depreciated cost of the object (subclause 2, clause 3, article 170 of the Tax Code of the Russian Federation). Consequently, it is beneficial for the seller not to impose VAT on this operation, if only the repaid debt in the amount is greater than the residual value of the property. As for the buyer, it is more profitable for him not to impose VAT on the transfer of an object only if he uses a special regime. And cannot claim VAT refund from the budget. In any other case, it is more profitable to accept VAT as a deduction.

Special opinion of inspectors increases tax risk

It would seem that the dispute regarding VAT can only be whether this transaction is taxable or not. The right of the recipient of the object to deduction depends on this. But inspectors may have a special opinion on this issue: tax should be charged on sales, but it cannot be taken as a deduction.

Thus, in one of the internal documents of the Federal Tax Service of Russia, the situation under consideration, when VAT was charged and accepted for deduction, was considered by the tax authorities to be an illegal tax refund scheme. They say that the provision of compensation does not affect the content of the obligation that it terminates (in this case, a loan); the company that received the property under compensation cannot have any deductions. But the organization that transferred the property has VAT to pay, since the transfer of ownership has taken place.

Here the taxpayer can arm himself with arguments both in favor of the absence of an object subject to VAT, and in favor of its presence. Depending on the purpose of using the compensation: not to pay VAT or to defer its payment.

How compensation can be used in practice

In practice, the tax features of compensation can be used not only in transactions with independent counterparties, but also within a group of companies. An example of such use would be the following relationship structure (see diagram).

Standard situation: a manufacturer sells its products to both VAT payers and non-payers of VAT. The obvious solution in this situation is to make sure that goods are sold to VAT evaders, and to payers - on a common system. Moreover, it is beneficial to transfer as much profit as possible to the “simplified” person.

If a manufacturer creates a trading house on the “simplified” market and sells products to it at reduced prices, the tax authorities’ claims are guaranteed. A waiver can reduce the risk in this situation.

To do this, a Simplified trading house with a “income minus expenses” base registers a trademark and transfers it under a license agreement to a friendly manufacturer of goods for use. License fees (royalties) are accrued periodically, but are not paid to the trading house. This allows the licensee to take them into account as expenses (accrual method), and the licensor not to recognize them as income (cash method).

After some time, the parties enter into a compensation agreement, according to which the trading house, in order to repay the obligation to pay royalties, receives goods produced by the licensee at cost or even at a loss. This allows all profits from the sale of these goods to the end consumer to be transferred to the “simplified”. At the same time, the risks under Article 40 of the Tax Code of the Russian Federation are significantly reduced. Risks regarding the deduction of VAT do not arise here, since the “simplified” person does not have the right to it.

A method of separating commodity flows using compensation

The court indicated that an individual must assign the debt to himself, but as an individual entrepreneur

In a case considered by the Federal Arbitration Court of the Far Eastern District, tax authorities refused to deduct VAT to an entrepreneur who received real estate as compensation for a loan. They argued this by saying that at the time of concluding the loan agreement, the lender was not yet registered as an entrepreneur. The compensation agreement was concluded to fulfill the loan agreement, so they cannot be considered separately. And since the subject of legal relations under a loan is an individual, then upon termination of obligations under it, the subject of legal relations is also an individual. Therefore, the deduction of input VAT is illegal.

And the court supported similar arguments (resolution dated October 22, 2003 No. F03-A51/03-2/2087). In addition, the courts explained to the taxpayer how he needed to act in such a situation in order to be able to offset VAT. It turns out that the individual had to assign the right to claim the loan to himself, but as an individual entrepreneur. In this case, the loan obligation would be repaid to the entrepreneur who is a VAT payer.

Compensation

Reflection in accounting of the fact of termination of an obligation by providing compensation.

paid in cash before the commencement of the contract. No. Debit Credit Contents of the transaction Accounting entries for the debtor organization 1 91-2 51 Compensation was transferred as compensation for damage caused as a result of non-fulfillment of the original contract. The transfer of compensation is reflected as part of other expenses of the debtor organization. Accounting entries from the creditor organization 1 51 91-1 Compensation was received as compensation for damage caused as a result of non-fulfillment of the original contract.

Receipt of compensation is reflected in other income of the creditor organization. Reflection in accounting of the fact of termination of the obligation by providing compensation.

We recommend reading: Professional standard for the teacher profession March 2021

paid in non-cash (property) before the start of execution of the contract.

Goods (products, materials) were transferred as compensation. No. Debit Credit Contents of the transaction Accounting entries for the debtor organization 1 91-2 10, 41, 43 Goods (products, materials) were transferred as compensation to compensate for damage caused as a result of non-fulfillment of the original contract. The book value of the transferred goods (products, materials) is reflected in other expenses of the debtor organization 2 91-2 68 subaccount “VAT Calculations” VAT payable on the transfer of goods (products, materials) under the agreement is accrued

Judicial practice on compensation

The experience of judicial proceedings on JI is constantly summarized, which then results in clarifications and determinations by the Supreme Arbitration Court of the Russian Federation. The most frequently asked questions are of interest.

How is compensation different from innovation?

Such methods of changing obligations as compensation and innovations are quite close in meaning (Article 414 of the Civil Code of the Russian Federation). However, these procedures have significant differences:

- The essence of the transaction. The CO provides for the complete termination of the obligation through the transfer of compensation and the subsequent termination of relations between the parties. The novation agreement (NA) establishes the replacement of one obligation with another, new obligation. In other words, the relationship between the parties does not end, but only changes its form, providing for other legal consequences.

- Termination period of the obligation. It occurs at the moment of transfer of compensation and only by agreement of the parties can occur immediately after signing the document. In the case of SN, the previous contractual obligation always terminates after the conclusion of the agreement, because replaced by innovation.

- Consequences of non-fulfillment of the agreement. According to the CO, if the debtor fails to fulfill his obligations to transfer compensation, the creditor has the right to demand fulfillment of the obligation under the original agreement. In case of SN, this right is lost. The creditor can only demand from the debtor the fulfillment of a new obligation.

When concluding an agreement, the parties must clearly understand the differences between these procedures, because they give rise to different legal consequences.

Can compensation be provided by a third party?

Article 409 of the Civil Code of the Russian Federation does not limit the participation of third parties in joint ventures. There are no indications that compensation must be presented by the debtor. Consequently, a third party on a voluntary basis has every right to transfer his right to property.

The law does not establish a mandatory form of CO. Taking this into account, the issue of the participation of a third party is resolved by concluding a tripartite agreement. Such a document is signed by the creditor, the debtor and the actual owner of the compensation.

The agreement itself, according to its legal consequences, is divided into 2 agreements:

- between the creditor and the debtor on the termination of obligations after the provision of compensation;

- between the creditor and the owner of the property for the transfer of ownership rights.

This agreement does not in any way fix the relationship between the debtor and the owner of the compensation. They may be determined by other agreements, family ties, and other obligations not reflected in the CO. The agreement describes the subject of the compensation, the terms and procedure for its provision, the terms and procedure for terminating the debtor’s obligations. The cost of compensation is established.

Compensation and bankruptcy of the debtor

Law No. 127-FZ of October 26, 2002 (Article 142.1) regulates the repayment of debt of a bankrupt person (legal or individual) by providing compensation. An important limitation has been established on the subject of CO. As compensation, the bankrupt's property remaining after the sale in the manner prescribed by law may be provided to pay off current payments, as well as payments of the first and second priority; not registered as collateral and not subject to restrictions.

Repayment of debt by providing compensation is carried out with the consent of the creditor and subject to the principle of priority, as well as proportionality. The following procedure must be followed: first, the bankrupt debtor puts the property up for auction, and uses the proceeds to pay off debts (loans) in order of priority, starting with current payments. If the property cannot be sold, then he sends to the creditor or the meeting of creditors (when there are several of them) through the bankruptcy trustee a proposal to provide compensation.

The proposal provides a list of the proposed property with its description, cost and terms of transfer. If they agree, the creditors send an application for repayment of the debt to compensation. The meeting considers applications and distributes compensation among creditors, taking into account their interests. It also establishes the value of the property, and it should not be less than 50% of the price of the property when it was put up for auction. Based on the decision of the meeting of creditors, joint agreements are concluded with each interested creditor separately.

The agreement helps creditors return the funds issued if the debtor has no money. In this way, impossible obligations are terminated. The transaction will be considered completely legal if legal standards are observed. It is carried out strictly on voluntary terms, but must satisfy the interests of the parties as much as possible.

We draw up compensation and take it into account in accounting and tax accounting

The article from the magazine “MAIN BOOK” is current as of August 3, 2012. A.V.

Ovsyannikova, tax expert There are situations when an organization has a debt to a supplier, but there is no money to pay off this debt. But the debtor can offer his property to the creditor as compensation. And if such an offer interests the lender, that’s great.

In our article we will talk about how to correctly process the transfer of compensation, as well as how to reflect this operation in accounting and tax accounting, depending on who you are in this case - a debtor or a creditor.

If the debtor’s current account is “squeezed out” to the penny, the creditor may agree to pay the debt with property. The agreement must indicate the period for providing the compensation, because if the compensation is not transferred to the creditor within this period, then he has the right to demand that the debtor repay the original obligation (hereinafter - Letter No. 102).

The decision to “pay off” the creditor by providing compensation must be formalized by agreement. It is important to understand that the obligation is considered extinguished at the moment the compensation is provided, and not at the moment the agreement on it is signed.

In addition, the agreement must indicate:

- an obligation that is planned to be terminated by compensation;

- property that will be transferred as compensation.

You can also specify in the agreement:

- what is the cost of the compensation?

Drawing up an agreement

The basis of the transaction in question is the compensation agreement. This is an absolutely voluntary decision of the interested parties to terminate the previously concluded agreement. The document is signed by the participants in a previously concluded agreement, according to which there are significant obligations of one of the parties to the other party.

Compensation agreement form

The legislation does not provide for a mandatory form for COs. It is subject to general rules in accordance with Art. 158-165 Civil Code of the Russian Federation. According to Article 160 of the Civil Code of the Russian Federation, documents of this type are drawn up in simple written form. It should be noted that the CO is not linked to the agreement itself, despite the requirements of Article 452 of the Civil Code of the Russian Federation, because the agreement does not change it, but only terminates the obligation. The document is not subject to state registration and notarization, even if the agreement itself has undergone such procedures (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated September 25, 2007 No. 7134/07).

agreements:

Subject of compensation

The following may be recognized as compensation under the CO:

- Amounts of money. This type of compensation is often offered as an option to compensate for the failure to provide a service or damage caused.

- Property. As compensation you can offer: real estate (housing, cottage, land, various buildings), movable property (vehicles), valuables (jewelry, jewelry, antiques, etc.) and papers (stocks, bills), goods and equipment, other items and things of interest to the creditor.

- Rights. Of interest may be the obligations of third parties, shares in the authorized capital, copyright and the right to the result of intellectual activity.

It is necessary that the subject matter of the joint venture be of interest to the second party and have a certain material value, the amount of which is indicated in the agreement.

Essential conditions

The parties to the joint venture themselves determine all the terms of the agreement. At the same time, the following must be provided:

- An obligation that is subject to termination as a result of a transaction.

- Type of compensation, i.e. the subject of the agreement, as well as its agreed value. Its description and main characteristics should be given.

- Time limit and procedure for transferring compensation.

- Duration and procedure for termination of the obligation. The termination date may coincide with the date the document was signed or the date the compensation was transferred. The obligation may be terminated in whole or in part.

Taking into account the clarification of the Supreme Arbitration Court of the Russian Federation (Determination No. 18255/13 of December 19, 2013), an agreement without a deadline for providing compensation may be considered unconcluded. The fact of transfer is confirmed by the Transfer and Acceptance Certificate or the receipt of the recipient.

What other documents will be required?

When concluding a joint venture, in addition to the main document - the agreement establishing the obligation, the following documents will be required:

- identity cards of the persons signing the document;

- a document confirming ownership of the subject of the agreement;

- consent of the spouse to transfer property.

The list of documents required when transferring real estate or vehicles is significantly increasing. It corresponds to the list required when making purchase and sale transactions. It is important to check whether the legal rights of other persons are being infringed and whether there are restrictions on transactions with property (judgments, pledges, etc.). When transferring the car, you will need a title, compulsory motor liability insurance policy, and a certificate from the traffic police. In the case of real estate, a certificate confirming the absence of debts for housing and communal services will not be superfluous.

When a share in a business (for example, an LLC) is offered as compensation, the consent of the co-founders may be required if it is provided for in the charter. To determine the real value of the compensation, it is best to use the services of an independent expert, and attach his conclusion to the JI.

How to take into account compensation under the simplified tax system

When transferring compensation, draw up a bill of lading or other primary documentation, depending on what kind of property you are transferring.

For example, when transferring a fixed asset, issue an act of acceptance of the transfer. When compensation is transferred to pay off existing accounts payable to a supplier or other counterparty, the accounting records reflect the sale of the transferred property as a regular sale. Then mutual repayment of receivables and payables is made by recording the debit of account 60 “Settlements with suppliers and contractors” (or account 76 “Settlements with various debtors and creditors”) and the credit of account 62 “Settlements with buyers and customers”.

If, for example, you transfer a fixed asset to a creditor, reflect the transactions for the transfer of compensation with the following entries: Debit 62 Credit 91 subaccount “Other income” - income (revenue) from the transfer of a fixed asset as compensation is taken into account; Debit 01 subaccount “Retirement of fixed assets” Credit 01 subaccount “Fixed assets in operation” – the initial cost of the fixed asset is written off; Debit 02 Credit 01 subaccount “Disposal of fixed assets” – accrued depreciation is written off; Debit 91 subaccount “Other expenses” Credit 01 subaccount “Disposal of fixed assets” – the residual value of the fixed asset is written off; Debit 60 (76) Credit 62 – accounts payable were repaid by concluding a compensation agreement. In the accounting records of the receiving party, reflect the receipt of property in the usual manner: Debit 08 (10, 41) Credit 60 - received property was capitalized to pay off accounts payable;

What needs to be checked if the counterparty offers compensation, what accounting entries should be used to reflect the receipt of compensation?

Answered by Liliya Gabsalyamova, expert in accounting and tax accounting In accounting, reflect the receipt of compensation with entries Debit 08 Credit 91-1 (RUB 338,983.05), Debit 19 Credit 91-1 (RUB 61,016.95), Debit 68 Credit 19, Debit 91-2 Credit 62 (400,000 rub.), Debit 91-2 Credit 60 (76) (legal services 40,000 rub.). Justification From the recommendation of Maria Komarova, leading expert of the Sistema Lawyer, Candidate of Legal Sciences Vitaly Dianov, Candidate of Legal Sciences, senior lawyer at Goltsblat BLP Alexander Kryukov, Candidate of Legal Sciences, Deputy Chairman of the Arbitration Court of the Sverdlovsk Region, Master of Private Law What needs to be checked if the counterparty offers compensation Contents of the compensation agreement The compensation agreement must include information about the subject of the agreement, the procedure, amount and timing of the transfer of compensation.

First of all, it is necessary to clearly indicate which obligation the parties intend to terminate by compensation (for example, list the details of the contract) and what exactly will be transferred as compensation.

Compensation can be money or other property: real estate, vehicles, goods, etc.

p. In this case, the agreement must identify the subject of the compensation as much as possible, that is, indicate its name, qualitative and quantitative characteristics.

The law does not provide an exhaustive list of property that may be subject to compensation.

When determining the procedure for transferring compensation, the parties establish what actions the debtor should perform and what documents should be transferred so that the creditor can accept the money paid or the property transferred.

Risks of non-fulfillment and invalidation of the compensation agreement

Before the expiration of the period established by the agreement, the creditor cannot demand compensation. Non-fulfillment is considered to be a situation where the debtor did not present it as agreed - then the creditor has the right to demand fulfillment of the obligation in the form in which it originally existed, and he has the right to collect a penalty.

Question: Are there any risks to a compensation agreement by transferring real estate?

The main danger here concerns the debtor’s possible evasion of state registration of the transfer of ownership of the object. The law protects the creditor: he can apply to the court for state registration of a property on the basis of Art. 551 Civil Code of the Russian Federation.

You should carefully check what exactly and what quality the goods transferred as compensation are. If the goods do not correspond to the description in the agreement, the law gives the party the right not to accept it - Art. 460 Civil Code of the Russian Federation. The same rule applies to cases where the debtor is silent about the encumbrance - the agreement may be declared invalid, and due to failure to fulfill the obligation, interest for the delay will be accrued to the maximum, starting from the day the first delay occurred.

The risk should also include hidden inadequate quality of the transferred goods, non-compliance with the properties reflected in the agreement. The general rules of protection, including judicial protection, of the interests of the party “work” here. For example, on the basis of Art. 475 of the Civil Code of the Russian Federation - return, reduction in the price of goods, elimination of defects, etc. When it is proven that a party deliberately kept silent about the hidden properties of the object that was to be transferred, and the creditor suffered losses in connection with this, the agreement may be declared invalid.

Thus, first of all, the creditor is at risk - he benefits from the compensation to a lesser extent than the debtor. Lawyers of banks concluding settlement agreements with debtors on compensation under loan agreements have long developed tactics for working with overdue debts, assessing the risks of insolvency, etc. They use various formulas and algorithms that fairly accurately predict the feasibility or inexpediency of a compromise in the form of an agreement.

Registration and accounting of compensation for an organization under the general taxation regime

— Individual participants quite often lend money to the companies they create.

And if the “daughter” is experiencing financial difficulties, then the participants sometimes agree to repay the loan not with money, but with some of its property (for example, goods or fixed assets (FPE) - a car, residential or non-residential premises, etc.). Let's find out how to document this and how to carry out this operation in tax and accounting when applying.

Having received the money, you must also return the money (Clause 1 of Article 807 of the Civil Code of the Russian Federation). If, by agreement with the participant, you return something else to him, then this is already providing compensation (Article 409 of the Civil Code of the Russian Federation).

Any property can be transferred as compensation. In this case, you need to conclude a written agreement with the participant, which must indicate: - a loan obligation terminated by the provision of compensation, that is, the details of the loan agreement and the amount of debt repaid under it (for example, the entire loan amount along with accrued interest, if the agreement is interest-bearing) (Article 409 of the Civil Code of the Russian Federation, paragraph.

1 tbsp. 432 of the Civil Code of the Russian Federation). By the way, if you do not indicate in the agreement that by providing compensation the debt is repaid only in a certain part, then the loan obligation will cease completely (along with the interest accrued on it) (Clause 4 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 21, 2005 N 102).

Moreover, even if the value of the property transferred as compensation is less than the amount of the debt; - property transferred as compensation, its value including VAT (equal to the repaid amount of the debt), the procedure and timing of its transfer (Article 409 of the Civil Code of the Russian Federation, clause.

Recommendations: what to pay attention to

Loan agreements are concluded not only between the debtor and the bank, but also between people. If in such a situation the debtor refuses to pay the amount, but offers his property in exchange, we recommend that before concluding a compensation agreement:

- carefully analyze the value of the transferred property to ensure it corresponds to the amount of debt. You need to understand whether the price of the transferred item covers most of the loan and interest. You can contact the appraisal bureau (available in every city) to confirm or refute the value declared by the debtor. By the way, one should be wary not only if the compensation price is too low, but also if it is excessively high, many times higher than the price of the debt.

- You must always personally inspect the property that is transferred to you as compensation. If this is a car or an apartment, then you should find out whether these objects are under encumbrance, pledged, or whether there are any legal proceedings related to them due to claims from third parties.

- on the website of the regional arbitration court, use the electronic file and full name of the debtor to find out if there is a bankruptcy lawsuit. This way you can avoid the unpleasant surprise that the property promised to you has long been in the bankruptcy estate and you cannot claim it. Here you can also find out about other creditors, their claims and seized property. By virtue of the law, almost all transactions and written alienation agreements concluded during the bankruptcy period are potentially invalid, including the compensation agreement.

- find out if there are any applicants-heirs or spouses for the property that is being offered to you for transfer. For example, if the debtor has not paid the principal for a long time, but today he called and reported the good news about an inheritance in the form of a small dacha, which he can transfer to you as part of the loan agreement, you should definitely find out information about other heirs. It is worth trying to offer the debtor to sell the property and give you the money. Do not forget about the mandatory consent to the alienation of property from the spouse if it was acquired during the marriage.

- if a person acts under a power of attorney, which indicates the right to sign a compensation agreement, one should make sure that such a power of attorney is authentic and that its term has not expired. A guarantee of security can be a personal conversation with the principal, from whom you should clarify all the questions of interest, and also clarify whether the power of attorney has been revoked.

- there is no need to “postpone” the date of granting compensation too far. Over a long period of time, there is a high probability of the occurrence of force majeure circumstances, changes in the financial capabilities of the debtor, etc. It happens that the transfer of exactly the property that was stipulated in the agreement occurs, but on the day of execution it has depreciated so much that it hardly covers part of the price of the original obligation, not counting additional expenses. It is necessary to adhere to reasonable deadlines, with a mandatory assessment of the real possibility of transferring the material object to you. If this does not happen within the agreed period, you should not delay in filing a lawsuit.

Links to legislative acts

- Civil Code of the Russian Federation Article 409. Compensation

- Clause 2 “Compensation” of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 11, 2020 No. 6 “On some issues of application of the provisions of the Civil Code of the Russian Federation on termination of obligations”

Free legal consultation: For any questions

Example: I took out loans from a microfinance organization to renovate an apartment and treat an illness.

I realized late that these were unaffordable loans for me.

They call and threaten with various methods of influence. What should I do? Moscow St. Petersburg By clicking the SEND button, you accept the terms and conditions Send Send

Moscow Government

Ministry of Justice of the Russian Federation

Rospotrebnadzor Latest questions Full comprehensive service From the moment you contact us until the issue is completely resolved, we are ready to accompany our clients, providing them with the necessary services and advice. Free detailed analysis of the situation Our specialists will study your situation in detail, review all available documents, and draw up a clear picture of the problem.

Working for results We are interested in the success of your business! Your victories are our victories. We are exclusively results-oriented.

Drawing up documents If necessary, the lawyers of our company will take upon themselves the preparation of all the necessary documents for a positive resolution of the case. Free study of options Only after a detailed analysis of the available documents and immersion in the current situation will we be able to work out solutions and the feasibility of their use.

Submitting documents We take care of everything. Compilation. Collection of the necessary package of documents.

Can compensation be provided by a third party?

Article 409 of the Civil Code does not say that compensation must come from the debtor. Consequently, a third party who did not participate in the conclusion of the original transaction can also terminate the obligation.

Most often, the participation of a third party is required when the subject of compensation is subject to pledge, and a third party acts as the pledgor. To prevent foreclosure, the mortgagor gives the collateral property to the lender. And thereby terminates the debtor’s obligation. The courts have repeatedly recognized such a step as lawful.

The main problem in such a situation will be to determine who the parties to the agreement are. A compensation deal can be concluded between:

- debtor, creditor and pledgor;

- debtor and creditor;

- creditor and pledgor.

In the first case, the agreement does not become multilateral, but includes two transactions:

- A compensation agreement concluded between a creditor and a debtor.

- An agreement between the pledgor and the debtor to transfer the collateral property to the creditor.

Also, the creditor and the pledgor can enter into an agreement on the transfer of property to pay off the debtor’s obligation. But such an agreement will not be considered a compensation agreement, since the composition of the participants changes. And the transaction will not have a modifying nature.

Definitions of the term “compensation”

Here are several options for defining the concept of “compensation” from different dictionaries.

Compensation is a payment, a reward for giving up something. (Explanatory Dictionary of Efremova. T. F. Efremova. 2000).

Compensation - (eng. compensation for termination of contract) - in the civil law of the Russian Federation, a material benefit provided by the debtor in exchange for the fulfillment of an obligation in kind to the creditor (payment of money, transfer of property, etc.). O. is one of the grounds for termination of an obligation. (Encyclopedia of Law. 2015).

Compensation - in civil law, certain material benefits (money, property, etc.) provided by agreement of the parties in exchange for the fulfillment of an obligation. One of the ways to terminate obligations. The amount, terms and procedure for providing O. are established by the parties. (Large legal dictionary. - M.: Infra-M. A. Ya. Sukharev, V. E. Krutskikh, A. Ya. Sukhareva. 2003).

Compensation is a sum of money or property value that one person must give to another person in order to be released from fulfilling his obligations to that person. (Raizberg B.A., Lozovsky L.Sh., Starodubtseva E.B.. Modern economic dictionary. - 2nd ed., revised M.: INFRA-M. 479 p.. 1999).

How is compensation different from innovation?

In addition to compensation, the law provides for another way to terminate obligations - novation. At first glance, these are the same thing, but in fact, these are fundamentally different concepts.

The innovation is described in Article 414 of the Civil Code of the Russian Federation

After concluding a novation agreement, the old obligation ceases to be valid, penalties no longer accrue, interest stops increasing, etc. That is. This is a completely new deal between former participants. And the debtor will be responsible for failure to fulfill only this obligation. For example. The debtor may, in return for paying the debt, bring a certain amount of goods. If a novation agreement is concluded, in case of non-fulfillment, he will be responsible for the undelivered goods.

But compensation is only a surrogate for the original transaction, and the creditor has the right to demand fulfillment only of the main agreement. He cannot file a lawsuit demanding that the terms of the compensation agreement be fulfilled.

Table 1. Differences between compensation and novation

| Sign | Compensation | Novation |

| Definition | The original obligation is terminated by payment of compensation | The first obligation expires, and a completely new obligation appears in its place. |

| Which article of the Civil Code regulates legal relations? | Article 409, chapter 26 | Article 414, chapter 26 |

| Did the participants anticipate the occurrence of such an obligation when signing the first agreement? | No | No |

| Contract name | Compensation agreement | Agreement-novation |

| Consequences | The legal connection between the participants is terminated | The first obligation ends and a new one arises |

| When must the obligation be fulfilled? | Within the specified time frame | Anytime |

| Is consent required from both parties? | Yes | Yes |

What can be provided as compensation? Subject of compensation

The following may be the subject of compensation:

1. Property of the debtor. The debtor can transfer movable and immovable property as compensation, for example, a car, a dacha, an apartment, a plot of land, goods, securities - both documentary (for example, bills) and uncertificated (shares, bonds), other property;

2. Property rights:

- obligatory (the right of claim against a third party),

- corporate (for example, a share in the authorized capital of an LLC),

- exclusive (right to the result of intellectual activity).

3. Works, services or other provision

In paragraph 2 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 11, 2020 N 6, it is clarified that “the rules on compensation do not exclude that work will be performed, services provided or other provision will be made as compensation (clause 1 of Article 407, Article 421 of the Civil Code of the Russian Federation) .