From January 1, 2021, the minimum wage remained at 7,500 rubles. However, despite this, from January 1 there have been changes in the calculation of some “children’s” benefits. How to calculate “children’s” benefits from January 1, 2017? What is the amount of benefits from January 1, 2021? Has the amount of child care benefit changed? How much will the Social Insurance Fund reimburse for “children’s” benefits from January 1? You will find answers to these and other questions related to children's benefits, as well as a table with new sizes in this article.

Types of "children's" benefits

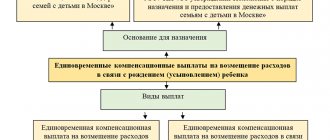

“Children’s” benefits usually include payments related to the birth of children. The list of “children’s” benefits is given in Federal Law No. 81-FZ dated May 19, 1995 “On state benefits for citizens with children.” Let’s consider how the amounts of the most frequently paid “children’s” benefits will change from January 1, 2021, namely:

- benefits for registration in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly child care allowance up to 1.5 years;

- maternity benefits.

These benefits are paid by the employer. However, we note that in certain regions of the Russian Federation a pilot experiment is being conducted to pay benefits directly from the Social Insurance Fund budget. FSS units in the experimental regions themselves calculate and pay “children’s” benefits to employees. See “Participants in the FSS pilot project.”

If an organization or individual entrepreneur has employees to whom he is obliged to pay child benefits, then the employer should know the amount of child benefits from January 1, 2021.

Indexation from February 1, 2021

From February 1, 2021, child benefits were indexed by a factor of 1.054. Therefore, do not get confused: in January there will be one benefit amount, and from February 1 there will be another. After reading this article, we recommend that you familiarize yourself with the materials “Children’s benefits from February 1, 2021: new amounts and features of payments”, “Children’s benefits are indexed from February 1, 2021”.

Regional assistance

Many regions, in addition to federal assistance to parents, provide their own social benefits. This is done by social protection authorities. They also make the payments; there is no point in contacting the employer. It is better to look for information about specific conditions on the official websites of the region.

For example:

- Moscow pays a one-time allowance for the birth of children to young families under 30 years of age. The amount for the 1st child is 88,395 ₽, the 2nd is 123,753 ₽, the 3rd and subsequent children is 176,790 ₽. An ordinary family will receive 5,808 rubles for the first-born, 15,312 rubles for the second and subsequent children.

- St. Petersburg pays a one-time benefit for the first child in the amount of 32,339 ₽, for the 2nd - 43,122 ₽ and for the 3rd - 53,900 ₽. But you can only spend this money on buying baby food and items for children.

Indexation of benefits from January 1, 2017

There will be no indexation of “children’s” benefits from January 1, 2021, since legislators have not provided for such an indexation coefficient. However, payments for children will be indexed from February 1, 2017, taking into account the consumer price index for 2021. In this regard, from January 1 to February 1, 2021, “children’s” benefits should be paid in the same amounts as in 2021. Let us summarize the amounts of “children’s” benefits in the table from January 2021. These dimensions have not changed in any way.

| Type of benefit | Benefit amount in January 2021 |

| Benefit for registration in early pregnancy | RUB 581.73 |

| One-time benefit for the birth of a child | RUB 15,512.65 |

| Minimum monthly allowance for child care up to 1.5 years | Care for the first child - 3,000 rubles; Care for the second child RUB 5,817.24. |

However, some changes in the amount of benefits from January 1, 2017 will still occur. We'll talk about them further.

Who is entitled to a one-time payment?

READ ON THE TOPIC:

Maternity capital will be indexed only in 2021.

The wife of a conscript

has the right to a one-time payment . It is worth noting that this payment is due for an officially registered marriage, and one of the main documents that will need to be provided to receive the benefit will be a marriage registration certificate.

The right to receive a monthly payment for the child of a conscript soldier has the child’s mother or a guardian or other person caring for the child if the mother has died, been deprived of parental rights, or for other objective or subjective reasons cannot care for the child. If several relatives are caring for the child of a conscript, then one of them is selected to receive benefits.

Monthly allowance for child care up to 1.5 years

So, we said above about the minimum monthly allowance for child care up to 1.5 years (see table). The minimum size has not changed in any way since January 1, 2021. This benefit is not limited to the maximum amount. However, the amount of average daily earnings from which child care benefits are calculated is limited.

The legislation provides that the amount of average daily earnings for calculating benefits cannot exceed the sum of the maximum values of the base for calculating insurance premiums for the two years preceding the year of parental leave, divided by 730 (Part 3.3 of Article 14 of the Federal Law of December 29. 2006 No. 255-FZ). Therefore, in order to determine the maximum amount of average daily earnings, the following formula is used:

Therefore, if maternity leave begins in 2017, when calculating, it is necessary to take the values of the maximum values of the base for calculating contributions to the Social Insurance Fund for 2015 and 2021. Let us recall that in 2015 the maximum value of the base was 670,000 rubles. (Resolution of the Government of the Russian Federation dated December 4, 2014 No. 1316), and in 2021 – 718,000 rubles. (Resolution of the Government of the Russian Federation dated November 26, 2015 No. 1265).

Taking into account the new values of the marginal base, in 2021 the maximum value of average daily earnings for calculating benefits is 1901.37 rubles (670,000 rubles + 718,000 rubles) / 730. Note that the exact value is 1901.3698630136 rubles, however in further calculations we will use 1901.37 rubles.

Next, let’s calculate the maximum average earnings for a whole month. For these purposes, it is necessary to multiply the average daily earnings by the average monthly number of calendar days equal to 30.4 (Part 5.1 of Article 14 of Law No. 255-FZ). Total in 2021, the maximum average monthly earnings for calculating benefits will be 57,801.64 rubles. (RUB 1,901.37 × 30.4).

The amount of the monthly childcare benefit for a child up to 1.5 years old is generally equal to 40% of the average monthly earnings (Part 1, Article 15 of Law No. 81-FZ). Therefore, in 2021, the maximum amount of monthly benefit per child will be 23,120.66 rubles. (RUB 57,801.64 × 40%). For comparison, we note that in 2021 the maximum amount of benefits that was reimbursed from the Social Insurance Fund was 21,554.82 rubles. per month. That is, the amount of benefits reimbursed from the Social Insurance Fund increased by 1,565.84 rubles. (RUB 23,120.66 – RUB 21,554.82). Also see “Starting from 2021, a new certificate of calculation will need to be submitted to the Social Insurance Fund.”

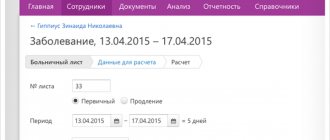

Below we give an example of calculating child care benefits if they were assigned in January 2021.

Example. From January 16, 2021, employee of Zoology LLC Odinokov A.S. goes on maternity leave. The billing period is 2015 and 2021. In 2021, the woman was on sick leave for 25 calendar days, and on maternity leave for 124 days.

Salary for 2015 - 350,000 rubles, for 2021 - 240,000 rubles. The number of days in the billing period is 582 days. (365 + 366 – 25 – 124). Average daily earnings - 1013.745704 rubles. ((RUB 350,000 + RUB 240,000) / 582 days).

Therefore, the monthly child care allowance is 12,327.15 rubles. (RUB 1013.745704 × 40% × 30.4 days).

Other benefits and benefits

The state subsidy complements other benefits and is not the only assistance. For example, reduced tax deductions from the wages of officially working parents will allow the family to save from 2,000 to 18,000 rubles. There are often monthly payments available in the regions aimed at low-income families. For example, in St. Petersburg, 3,768 rubles are transferred to a low-income family’s social children’s card for the maintenance of a second child up to one and a half years old, and from the age of 1.5 to 7 years, a little less - 848 rubles, but this is also noticeable for a family with two children. The Social Code of St. Petersburg stipulates that a family is considered low-income if each member has less than one and a half times the minimum subsistence level. From the local budget, 3,768 rubles are transferred monthly to the Children's bank card, and it can only be used in specialized stores. Such assistance measures are also available in other regions of Russia, and you can find out more about them at the regional MFC by asking the operator how much they currently give for a second child in your specific region. In total, benefits and payments provide tangible support to young parents when a new baby appears in the family. Let us be grateful to the state for its help and do not be lazy in processing the payments due to you.

When child care benefits up to 1.5 years old need to be recalculated

Some accountants may have a question about whether, from January 1, 2021, it is necessary to recalculate already assigned child care benefits up to 1.5 years. The answer is no. There is no need to revise anything. The fact is that, as a general rule, child care benefits for children up to 1.5 years old are counted once - on the start date of parental leave. Therefore, if the benefit is assigned in 2021, then the benefit for those months of vacation that fall in 2017 should not be reviewed. That is, in 2021, you need to pay monthly the amount of benefits that was calculated in 2016.

However, keep in mind that there may be a situation where you may need to change the amount of the benefit determined in 2021. This can happen if a person interrupts parental leave for up to 1.5 years, and in 2021 takes the same leave again. And then the amount of child care benefits will need to be calculated based on the new values. The fact is that child care benefits are also calculated from average earnings calculated for the two calendar years preceding the year the parental leave began (Part 1, Article 14 of Law No. 255-FZ). Therefore, if a new vacation is taken out in 2017, the new payroll period should be taken into account: 2015 and 2021 (unless the employee exercises the right to transfer the payroll period). As a result, the benefit amount may differ from what was previously paid. Let's give an example.

Maternal capital

Maternity capital has been another measure of support for families with children for 13 years. If previously only the family in which the second, third, etc. child was born could receive it, now it is available for the first child. You can receive maternity capital only once, and use the money no earlier than after 3 years (with the exception of some cases).

Payment amounts in 2021:

- as of June 2021, the amount of maternity capital is 466,617 rubles for the first child born in 2021 and later;

- for the second, born in 2021 and later, the amount increases to 616,617 rubles;

- if the second or subsequent child was born before 2021, the family will receive 466,617 rubles;

- if the third or subsequent child was born in 2021, and previously there was no right to maternity capital, the family will receive 616,617 rubles.

If the family has already used part of the money in previous years, then the rest will be indexed. The same will happen with a certificate that has already been received, but the money has not yet been spent on anything.

Capital registration

The document that confirms the registration of maternity capital is a certificate. To receive it you need to apply:

- in person at the branch or remotely on the Pension Fund website;

- in the MFC;

- through State Services.

Attach to the application:

- birth certificates of children with a mark on Russian citizenship;

- passport and SNILS of the mother or other legal recipient of funds;

- documents giving the right to receive capital to someone other than the mother.

Managing money

Maternity capital can be spent strictly for certain purposes:

- Improving living conditions: buying an apartment (primary and secondary markets) or a room, building a house, including on a garden plot. Housing can be purchased with a mortgage, in which case the money will be allowed to be used without waiting for a three-year period.

- Education. It is possible to teach with state money not only the person receiving assistance, but also, for example, an older child. Payments are allowed for the services of any educational institution, including kindergartens. The cost of the latter’s services can be reimbursed with capital without waiting for a three-year period. Other educational institutions - strictly after 3 years.

- Mom's pension. All or part of the maternity capital can be allocated to the funded part. Before retirement, the decision is allowed to change and use the money differently.

- Costs of maintaining a disabled child. There is a clear list of goods and services on which you can spend maternity capital funds. But you don’t have to wait 3 years.

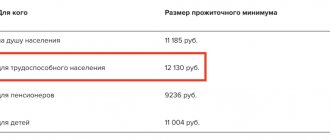

- Monthly payment for the second child until his third birthday. The method is available only to families with incomes not exceeding two times the regional subsistence level.

Maternity benefit from January 1, 2021

Maternity benefits paid by employers are not indexed annually. However, the maximum benefit will increase from 1 January 2021 as the accountant will need to take into account the new maximum average daily earnings when calculating benefits.

Let us remind you that maternity benefits are paid in a lump sum and in total for the entire period of maternity leave, which is (Part 1, Article 10 of Law No. 255-FZ):

- 140 days (in general);

- 194 days (with multiple pregnancies);

- 156 days (for complicated births).

Maximum benefit amount

To calculate the maximum amount of maternity benefit from January 2017, you need to take into account the maximum average daily earnings. It is calculated using the same formula as when calculating child care benefits for children up to 1.5 years old (Part 3.3 of Article 14 of Law No. 255-FZ). That is, in 2021 it will also be 1901.37 rubles (670,000 rubles + 718,000 rubles) / 730.

Thus, in 2021, the maximum amounts of maternity benefits reimbursed from the Social Insurance Fund will change and amount to:

- RUB 266,191.8 (RUB 1,901.37 × 140 days) - in the general case;

- 368,865.78 rubles (1901.37 rubles × 194 days) - for multiple pregnancies;

- 296,613.72 rubles (1901.37 rubles × 156 days) - for complicated births.

Minimum benefit amount

When calculating maternity benefits, the average daily earnings cannot be less than the value determined by the following formula (Part 1.1, Article 14 of Law No. 255-FZ):

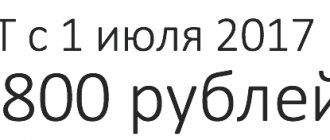

From January 1, 2021, the federal minimum wage has not changed and remains at 7,500 rubles. See “Minimum wage from January 1, 2021.” Therefore, if maternity leave begins in 2021, the minimum average daily earnings for calculating maternity benefits will be 246.58 rubles (7500 rubles × 24 / 730). This value is used for further calculation if it turns out to be greater than the actual average daily earnings of the employee. The minimum amounts of maternity benefits in January 2021 are as follows:

- 34,521.20 rubles (246.58 rubles × 140 days) - in the general case;

- 47,835.62 rubles (246.58 rubles x 194 days) - for multiple pregnancies;

- RUB 38,465.75 (RUB 246.58 x 156 days) - for complicated childbirth.

Children of conscripts

A subsidy of ten and a half thousand when the child reaches the age of 3 helps military wives avoid financial difficulties. From the first of February, after the next indexation, the amount increased to 11,096.77 rubles. In some cases, it may be assigned to another relative of the baby who is caring for him. In the event of the loss of a breadwinner, children of military personnel and employees of services equivalent to the military can receive compensation for the loss of a breadwinner from the local department of social protection; payments for the second child in 2021 will amount to 2,279.47 rubles. The benefit will be issued upon reaching working age, or until the age of 23 in the case of studying at a higher educational institution.

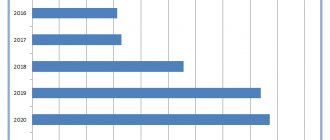

Benefit amounts from January 1, 2021: table

In the table we present the new benefit amounts from January 1, 2021 and compare the changed values with 2021. New values in the table are highlighted.

| Benefit | 2016 | from January 1, 2021 |

| Benefit for registration in early pregnancy | RUB 581.73 | 581.73 rub. |

| One-time benefit for the birth of a child | RUB 15,512.65 | RUB 15,512.65 |

| Minimum monthly allowance for child care up to 1.5 years | • care for the first child - 3,000 rubles; • care for the second child RUB 5,817.24. | • care for the first child - 3,000 rubles; • care for the second child RUB 5,817.24. |

| Maximum monthly allowance for child care up to 1.5 years | RUB 21,554.82 | RUB 23,120.66 |

| Minimum amount of maternity benefit | • RUB 34,521.20 - in general; • 47,835.62 rub. - during multiple pregnancy; • 38,465.75 rub. - during complicated childbirth. | • RUB 34,521.20 - in the general case; • 47,835.62 rub. - during multiple pregnancy; • 38,465.75 rub. - during complicated childbirth. |

| Maximum amount of maternity benefit | • RUB 248,164. - in general; • 343,884.4 rub. - during multiple pregnancy; • 276,525.6 rub. - during complicated childbirth. | • RUB 266,191.8 - in the general case; • RUB 368,865.78. - during multiple pregnancy; • RUB 296,613.72. - during complicated childbirth. |

Read also

07.07.2016

Payments to the pregnant wife of a conscript

In connection with the introduction of amendments to the legislation on conscription, deferments were canceled for conscripts whose wives were in a position for more than 26 weeks or had children under 3 years of age. The state assumed compensation due to the temporary absence of the breadwinner. The pregnant wife of a serviceman is assigned a one-time subsidy, for 2021 its amount is 25,892.45 rubles. In the area of residence of the spouse in which the regional coefficient is applied, this amount will be equal to its multiple. To receive this cash benefit, the wife of a conscript soldier must be in the third trimester of pregnancy for at least 180 days, confirmed by a certificate from that medical organization. In which he is registered.

Tax benefits for a second child

Article 218 of the Tax Code of the Russian Federation provides for tax deductions for children, providing compensation in the amount of 13% of income tax. Moreover, the deduction is based on every minor or full-time student at a university up to 24 years of age. In 2021, deductions for the first and second child are 1,400 rubles each during the tax period. To apply for a tax deduction, you must submit to the tax authority a tax return in form 3-NDFL, a birth certificate for each child and a certificate from the university if the son or daughter is between 18 and 24 years old.

How to get help for children under 16 years of age

The state provides social benefits to low-income families. Such child benefits are accrued if the income for each family member does not reach the subsistence level. For such children, local authorities provide benefits.

To receive it, you must submit an application to the local USZN authority. There you will have to provide income certificates for the last year to justify the need to receive funds.

Important: A single parent receives this benefit in double calculation. If the second parent evades child support, an additional 50% of the amount is charged.