How the 4-FSS form has changed

The current 4-FSS calculation form was approved by Order No. 381 of the FSS of the Russian Federation dated September 26, 2016; it must be applied starting with reporting for the 1st quarter of 2021. The main difference from the previously valid form is the absence of sections on contributions for disability and maternity, which is why the new form 4-FSS 2017 has significantly decreased in volume.

Otherwise, today’s 4-FSS calculation looks almost the same as Section II of the old form, dedicated to “traumatic” contributions, and does not contain any special innovations.

The new form of Form 4-FSS for the 1st quarter of 2021 consists of a title page and five tables, of which only tables 1, 2 and 5 are required to be submitted. The title and these sections must be submitted even if the policyholder had no accruals at all during the reporting period on "injury". The remaining tables are filled in when appropriate indicators are available.

Responsibility for being late

An insured who has not submitted a 4-FSS report on time for the 4th quarter of 2021 will be fined under paragraph 1 of Article 26.30 of the Law of July 24, 1998 No. 125-FZ. The fine is 5 percent of the amount of contributions due to the budget for the last three months of the reporting (calculation) period (October, November and December 2021). This fine will have to be paid for each full or partial month of delay. The maximum fine is 30 percent of the amount of contributions according to the calculation, and the minimum is 1000 rubles.

In addition, administrative liability is provided for late submission of 4-FSS calculations for 2017. At the request of the FSS of Russia, the court may fine officials of the organization (for example, the manager) in the amount of 300 to 500 rubles. (Part 2 of Article 15.33 of the Code of Administrative Offenses of the Russian Federation).

In addition, the policyholder may be fined for refusing to provide documents that confirm the correctness of the calculation of premiums, and for missing the deadline. The fine amount is 200 rubles. for each document not submitted. The fine for the same violation for officials is 300–500 rubles. (Article 26.31 of the Law of July 24, 1998 No. 125-FZ, paragraph 3 of Article 15.33 of the Code of Administrative Offenses of the Russian Federation).

Let's give an example of calculating fines for late reporting for the 4th quarter of 2021.

Deadlines for submitting the new form 4-FSS from 2021

The deadlines for submitting a new calculation for “injuries” remained the same, and depend on the number of employees of the insured (clause 1, article 24 of the law dated July 24, 1998 No. 125-FZ):

- if there are more than 25 employees, then the calculation is submitted electronically, and the deadline for submitting form 4-FSS 2021 is no later than the 25th day of the month, after the reporting quarter;

- if there are fewer employees, then the calculation can be submitted on paper, but in a shorter period of time - on the 20th of the month following the reporting period.

The calculation must be submitted quarterly on an accrual basis. For the 1st quarter of 2021, the electronic form is due on 04/25/2017, and the paper form is due on 04/20/2017.

If the electronic form is not followed when it is necessary, the policyholder faces a fine of 200 rubles. For late submission of Form 4-FSS from 01/01/17, a fine is imposed on only one basis - contributions for “injuries”. For each overdue month, the FSS will collect from 5% to 30% of the amount of contributions excluding benefits paid, but not less than 1000 rubles.

Let us remind you that by April 15, policyholders must confirm their main type of activity by submitting to the Social Insurance Fund a certificate indicating those types of businesses for which income was received in 2021. If this is not done, the Fund will assign the highest class of pro-insurance from all types of activities of the policyholder, which will increase the rate of contributions for “injuries” (Resolution of the Government of the Russian Federation dated June 17, 2016 No. 551).

Methods for passing 4-FSS

How can you present 4-FSS - only online or are there other methods available? Who delivers and in what way depends on the number of staff. This norm is directly provided for in paragraph 1 of Art. 24 of Law No. 125-FZ. Policyholders are required to submit reports:

- Electronically - if the average headcount for the current reporting period is more than 25 people.

- “On paper” – if the average headcount is less than 25 people.

The paper version of the report can be submitted in person, that is, by coming to your territorial Social Insurance office; send by mail - for the legality of this method, you will need to have an inventory of the attachment; the letter must be valuable. In any case, it is not prohibited to send the form via TKS; this is very convenient because it allows you to identify errors in tax calculations, that is, injuries.

Fill out form 4-FSS for the 1st quarter of 2021

When filling out the new Form 4-FSS, you must follow the instructions that are approved by Order No. 381 of the FSS of the Russian Federation (Appendix No. 2). The paper version of the calculation can be filled out using a black or blue pen in block letters, or you can fill it out on a computer, for which you first need to download the new form 4-FSS 2021.

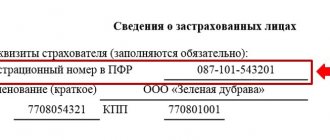

At the top of each page, the policyholder must put down his registration number and subordination code, which are indicated in the notice issued upon registration with the Social Insurance Fund. At the bottom of the page is the signature of the policyholder and the date of signing.

Indicate the adjustment number on the title page: when submitting form 4-FSS for 1 sq. 2021 for the first time, enter “000”, if an updated calculation is submitted - “001”, the next time the same report is updated - “002”, etc. The updated report is submitted in accordance with the form in force in the corrected period. The reporting period code for the 1st quarter is “03”, year “2017”.

All completed pages of the new Form 4-FSS 2017 are numbered, and their number and the number of application pages (if any) are indicated on the title page.

Monetary indicators are indicated in calculations without rounding - in rubles and kopecks. If any indicator is zero, the corresponding column is crossed out.

Table 1 reflects the calculation of the base for calculating contributions for “injuries”. Indicators are entered incrementally from the beginning of the year, and broken down by month of the last quarter of the reporting period.

Table 1.1 is filled out only by those who, under a contract, sent their employees to temporary work with other employers (clause 2.1 of Article 22 of Law No. 125-FZ of July 24, 1998).

Table 2 of the Form 4-FSS report in 2021 is filled out based on the policyholder’s accounting data on the status of settlements for contributions and expenses.

Table 3 is filled in if there are expenses for “injuries”: sick leave payments for accidents and injuries, payment for leave for treatment in a sanatorium, financing of preventive measures.

Table 4 is located on the same page of Form 4-FSS for 2017 as Table 3. Based on the relevant acts on occupational diseases and accidents at work, it indicates the number of people injured.

Table 5 is intended for information on the results of a special assessment of working conditions and medical examinations of workers. This reflects the number of jobs subject to assessment, the number of workers in hazardous industries and, accordingly, the number of jobs assessed and the number of workers who underwent medical examinations at the beginning of the year.

Form 4-FSS 2021: available here.

The procedure for drawing up the 4-FSS report in 2021

Accurate and detailed regulations for filling out f. Policyholders can find 4-FSS in Appendix 2 to Order No. 381. For the convenience of users, the following are the basic rules for drawing up the document, including innovations in the report. What has changed in the latest edition:

- On the title page of the document, a cell for budgetary institutions has been added. Coding 1 is intended for financing from the federal budget, 2 – regional budget, 3 – municipal, 4 – mixed.

- In Table 2, new rows have appeared: 1.1 – for the debt of a reorganized insurer or an OP removed from state accounting; 14.1 – for the debt of Social Insurance to the policyholder or his OP who has been deregistered.

The generally accepted filling requirements are as follows. The report is generated “by hand” or using computer equipment. Moreover, in 4-FSS there should be no erasures, erasures, corrections using corrective means and inaccuracies. If checking report 4 showed errors, you must correct the incorrect entry by crossing out and entering the correct data. Certification is carried out by the responsible employee, and a date and stamp are additionally affixed.

For each corresponding line, only one entry is entered; if there is no information to reflect, dashes are added. To prevent funds from refusing to accept documents, remember that information should be filled out only in block letters using blue (black) ink. The report is printed and all pages are certified by the signature of the policyholder’s director; if there is a seal, an imprint is also placed. The pages are numbered in chronological order; those sheets that are not mandatory do not need to be submitted as additional ones.

If reporting is sent via TKS, you should first check report 4. This will help identify and correct inaccuracies and errors. A common error code is 503, which means the file name is invalid. Coding 598 indicates the entry of an incorrect TIN of the policyholder, and 508 signals failure to pass format and logical control. The reason may be incomplete uploading of the document to 1C or the use of an outdated version of the calculation generation.

Next, we’ll talk about the format and deadlines for submitting reports to Social Security.

Change of supervisory authority when paying insurance premiums

Previously, all employers’ contributions for compulsory medical insurance and compulsory health insurance were handled by the Pension Fund, and the Social Insurance Fund controlled, accordingly, mandatory revenues in the social sphere.

From January 1, 2021, almost all administrative functions from extra-budgetary funds were transferred to tax authorities. Now the Federal Tax Service of Russia will collect the necessary insurance contributions from employers and check them for the completeness and correctness of all calculations. In addition, the new supervisory authority is designed to monitor the timeliness of payments and the provision of appropriate financial reporting on them. And in case of violations of the delivery procedure or deadlines, the tax service has the right to apply penalties to negligent employers.

The full list of acquired powers is enshrined in the letter of the Federal Tax Service under the number BS-4/11/1539, which contains a detailed draft of the “reform”. It is dated February 2, 2021, when the innovation was still under consideration by the Government of the Russian Federation.

One of the extra-budgetary funds affected by the changes is the Social Insurance Fund. However, it does not completely transfer its functionality to the tax authorities, but only that part that includes deductions for temporary disability and maternity. Contributions for so-called “injuries” at work remain under the control of social insurance.

Next, we will look at how organizations and individual entrepreneurs reported to the Social Insurance Fund before and what has changed for them in 2021.

Changes and adjustments

The Social Insurance Fund made changes to the 4-FSS report form by order No. 275 dated 06/07/2017, and the document must be submitted in the new form, starting with reporting for 9 months. As a result, the report for the third quarter of the FSS will only be accepted in a new form.

The deadline for submitting the report remains the same, without changes. The calculation must be submitted quarterly no later than the 20th day if it is provided on paper, and on the 25th day - in electronic form, in the month following the reporting month.

Let's look at the main changes that need to be taken into account when generating a report:

- in Table 2, rows have been added to reflect the successor organization’s data on the transformed organization or separate division;

- on the title page only budgetary enterprises make the corresponding entry;

- in accordance with the new requirements, the 4-FSS report must be submitted electronically by accountants of organizations in which the average number of employees for the previous year is more than 25 people;

- other organizations choose the form of reporting at their discretion - paper or electronic;

- By order of the Social Insurance Fund dated March 9, 2017 No. 83, an electronic form was approved for calculating contributions for occupational injuries;

- enterprises that make payments to employed disabled people, as a result of which they use a reduced rate when calculating insurance payments, or companies that pay for additional days off to care for disabled children, are required to present supporting documentation (an extract from a medical and social examination institution, a certificate from the child’s parents - disabled person, VTEK);

- in addition, the provision of documents confirming the correctness of the calculation for disabled people and children with disabilities is mandatory, regardless of whether the reporting is provided in paper or electronic form.

How to fill out a reporting form if the company is temporarily not operating and does not pay salaries to employees?

Author: Tatyana Sufiyanova (tax and duties consultant)

Reporting time has arrived and all accountants are preparing reports for 9 months. It often happens that one or another form of reporting changes in the middle. In particular, this happened with form 4-FSS. If for the first half of 2021 we submitted data using the old form, then for 9 months of 2021 we should report using the new form.

Let us recall that by order of the Social Insurance Fund of the Russian Federation dated 06/07/2017 No. 275 “On introducing amendments to appendices No. 1 and 2 to the order of the Social Insurance Fund of the Russian Federation dated September 26, 2021 No. 381 “On approval of the form of calculation for accrued and paid insurance premiums for compulsory social insurance against accidents at work and occupational diseases, as well as the costs of paying insurance coverage and the procedure for filling it out,” some amendments were made to the reporting form 4-FSS.

The new form must be applied starting with reporting for the nine months of 2021.

I would like to immediately draw your attention to the following: if a company or entrepreneur wants to submit an adjustment for previous periods, for example, an error was discovered in the first quarter of 2021, then the adjustment should be submitted in the form in which the primary reporting form was submitted.

What changes have been made and what to pay attention to?

1) A new field “Budget organizations” has appeared on the title page of the form on the right. Such employers indicate there the policyholder in accordance with the source of financing;

2) New lines have appeared “1.1” “Debt owed by the reorganized policyholder and (or) a separate division of a legal entity deregistered” and “14.1” “Debt owed by the territorial body of the Fund to the insured and (or) a separate division of a legal entity deregistered” in the table No. 2.

How to fill out form 4-FSS correctly?

Calculation form 4 - FSS is filled out using computer technology or by hand with a ballpoint (fountain) pen in black or blue in block letters.

When filling out the form, only one indicator is entered in each line and the corresponding columns. If there are no indicators provided for in the Calculation form, a dash is placed in the line and the corresponding column.

The title page, table No. 1, table No. 2, table No. 5 of the Calculation form are mandatory for submission by all policyholders. If the company had no accruals and did not conduct any activity, then the specified “mandatory” tables and title page are presented as zero.

Tables such as No. 1.1, No. 3 and No. 4 are filled out as necessary. If there are no indicators for filling out table No. 1.1, table No. 3, table No. 4 of the Calculation form, the specified tables are not filled out and are not submitted.

After filling out the Calculation form, sequential numbering of the completed pages is entered in the “page” field. At the top of each completed page of the Calculation, the fields “Registration number of the policyholder” and “Subordination code” are filled in in accordance with the notice (notification) of the policyholder issued during registration (registration) with the territorial body of the Fund.

At the end of each page of the Calculation, the signature of the policyholder (successor) or his representative and the date of signing of the Calculation are affixed.

In what form should the 4-FSS Calculation form be submitted?

If a company or entrepreneur has more than 25 employees, then the report should be submitted electronically. In other cases, it can be done on paper. But the deadline for submitting the Calculation will depend on the chosen method of submitting the report.

1) For the electronic form of submission of the Calculation - the deadline is October 25, 2017 for nine months of 2021;

2) For the “paper” form of submission of the Calculation - the deadline is October 20, 2017 for nine months of 2021.

Where is Calculation 4-FSS submitted?

Let us remind you that the report must be submitted to the Social Insurance Fund, and not to the tax office, which, from January 1, 2021, administers other mandatory insurance contributions (except for injuries). If the company does not have separate divisions, then 4-FSS must be sent to the territorial social insurance office at the location of the organization.

What should you pay attention to when filling out the report?

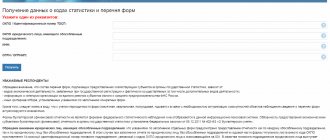

1) Correct filling of the organization’s TIN.

When an organization fills out a TIN, which consists of ten characters, in the area of twelve cells reserved for recording the TIN indicator, zeros (00) should be entered in the first two cells.

2) Correct filling of the OGRN.

When filling out the OGRN of a legal entity, which consists of thirteen characters, in the area of fifteen cells reserved for recording the OGRN indicator, zeros (00) should be entered in the first two cells.

3) The phone number is entered correctly.

In the “Contact phone number” field, indicate the city or mobile phone number of the policyholder/successor or representative of the policyholder with the city code or cellular operator, respectively. The numbers are filled in in each cell without using the dash and parenthesis signs. Look how this is done in the figure:

Report to the Social Insurance Fund before the separation of control functions

Previously, legal entities and individual entrepreneurs provided the FSS with a summary report in Form 4-FSS. This form was a rather lengthy document of 14 pages. It contained information on the calculation and payment of social security contributions (compulsory social insurance) in the following cases:

- temporary disability;

- motherhood;

- industrial accident;

- occupational diseases.

The first two cases were included in the first section of the form, and the last two - in the second. A paper report was submitted every quarter by the 20th day of the month following the end of the reporting period. The electronic version of the same report was allowed to be submitted until the 25th.

If the organization had less than 25 employees, the employer independently decided which option for passing the 4-FSS to choose. If there were more employees, only an electronic type of report transmitted via telecommunication channels was allowed.

With the arrival of the new regulatory body, 4-FSS was significantly simplified, and its previous format became suitable only for the report for 2016 and clarifying or correcting data for the same period.

What has changed in the calculation of 4-FSS for 9 months of 2021

Form 4-FSS for the 3rd quarter of 2021 was put into effect by Order No. 381 of September 26, 2016. For the first time, it was necessary to provide data on injuries using the new form for the 1st quarter of 2021 and the first half of the year. For 9 months it is required to report on an adjusted form (changes are regulated by the Social Insurance Fund in Order No. 275 of 06/07/17). The document was updated primarily due to the transfer of administration of social insurance contributions to the Federal Tax Service of the Russian Federation. Injuries remain under the control of the FSS - such payments must be calculated and paid, as before, in Sostra.

The updated 4-FSS for the 3rd quarter of 2021, which can be filled out below, no longer contains information about insurance premiums for VNIM (temporary disability and maternity). The relevant sections have been excluded as unnecessary. What has changed in the report over the past nine months? Compared to previous documents, the changes are not so significant. The new reporting form contains the following amendments:

- A special field “Budgetary organization” has been added to the list of title page details, where the relevant institutions indicate the funding code - from 1 for subsidies with federal funds to 4 for mixed financing.

- The title page clarifies the algorithm for calculating the average number of employees - the indicator is determined from the beginning of the reporting year.

- In table 2 with data on settlements with the Social Insurance Fund, page 1.1 was added on the amount of debt transferred to the policyholder by way of succession after the procedure of reorganization or deregistration of the SE (separate division) of the company. In connection with the expansion of indicators, the algorithm for calculating the total amount of funds on page 8 has changed.

- In table 2 added p. 14.1, which reflects data on the debts of the Social Insurance Fund to the policyholder, transferred as a result of the completion of the reorganization or closure of the legal entity's subsidiary. The calculation of the total amount on page 18 has changed.

The above changes should be taken into account by policyholders, especially public sector employees and reorganized companies, when filling out the form for the third quarter of 2021. Regulatory additions also affected the Procedure for the formation of 4-FSS for the 3rd quarter of 2021: the document is provided according to the new regulations in accordance with legal requirements. If it is necessary to submit updated calculations for previous periods to Social Insurance, standard forms are used that are relevant for the period of updating the information (clause 1.5 of Article 24 of Law No. 125-FZ of July 24, 1998).

Insurance contributions to the Social Insurance Fund in 2021

Where to submit 4-FSS on paper

Organizations without separate divisions submit 4-FSS reports to the territorial offices of the Social Insurance Fund at their location, i.e., where the company is registered and registered as an insurer.

If there are separations, the form must be submitted:

- at the location of the unit, if it has its own current account and independently pays salaries to employees;

- at the location of the “head”, if the unit does not independently calculate payments, does not have a current account, or is located outside the Russian Federation.

Entrepreneurs, private practitioners and other individual insurers report at their place of residence or registration.

Filling in "1C"

In programs, data for the title page is filled in from the “Organizations” directory automatically when creating a report. In the cells highlighted in yellow, indicators are entered manually or can be changed if necessary. If the cell is left blank and it is not possible to make changes manually, this indicates that the information base has not included the data that must be specified in the Organizations directory. After filling out the directory, you need to return to the report and update it using the “Update” button of the same name.

The sent file is subject to verification for compliance with the requirements for calculation in electronic form. If the answer is positive, the calculation is considered provided. If the answer is negative, the policyholder must repeat the calculation procedure. It is advisable to send the report two or three days before the final submission date in order to correct errors if they occur.

In 1C programs, the implementation of this form is planned for the end of August.

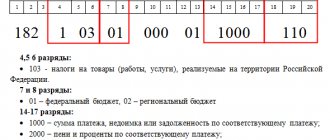

Table one

In Table 1 it is necessary to present the structure and calculation of the tax base for calculating contributions. This section, as a rule, is carefully checked by inspectors of the social insurance fund during on-site and desk audits. You need to be especially careful when filling it out. The basic requirements for filling out Table 1 are given below.

Line 1 reflects all accruals for wages and remuneration for the work of the organization’s employees and other individuals. The amounts are indicated for each month of the reporting quarter and the final result for the year.

So, in the first quarter, column 3 will indicate the amount of columns 4, 5, 6.

In the second quarter, column 3 will indicate the amount of column 3 of the previous quarter (first) plus the amount of columns 4, 5, 6 of the second quarter.

The third and fourth quarters are filled in the same way.

An example is shown in the diagram.

The indicators of line 2 are very important. It indicates amounts not subject to insurance contributions (financial assistance of less than four thousand, benefits from the Social Insurance Fund for certificates of incapacity for work due to illness, pregnancy and childbirth, childcare for children under one and a half and three years old, etc.). d.)

Line 3 is calculated and shows the taxable base.

Line 4 indicates accruals for disabled employees (if the organization employs such).

Line 5 contains the tariff assigned to the Social Insurance Fund for the type of main economic activity.

Example of forming table 1: