Chapter 26.2 of the Tax Code of the Russian Federation is devoted to the simplified taxation system. This special regime allows you to reduce the level of tax burden on a business entity. The transition to the simplified tax system is carried out on a voluntary basis by individual merchants and enterprises. “Simplified” people do not need to pay income taxes, property taxes and VAT (with certain exceptions). are exempt from paying personal income tax on business income. The right to apply this special tax regime is retained until:

- the taxpayer will declare in writing his desire to switch to a common system or another regime from the beginning of the year;

- or the conditions for using the simplified tax system will no longer be met (exceeding the limits on the number of personnel, the level of business profitability or the total residual value of fixed assets).

Advantages of the simplified tax system

Switching to a simplified system can be a good solution for young businesses or those suffering from a lack of money. This tax system has a bunch of benefits that will allow you to save a good amount on taxes.

- The enterprise is not obliged to remit VAT, income tax or property tax (with rare exceptions under paragraph 2 of Article 346.11 of the Tax Code of the Russian Federation).

- The taxpayer is free to choose an object (“Income 6%” or “Income minus expenses 15%”), due to which he can choose a more convenient option for himself.

- In some regions, tax rates for both objects have been lowered by regional authorities, which makes the simplified tax system even more profitable.

- Intangible assets and fixed assets are included in expenses if they were purchased within the period of application of the simplified tax system.

- Accounting becomes noticeably simpler: there is no need to certify the book of income and expenses with the tax office, and it is enough to submit reports once a year.

In addition, a conditional 6 or even 15% simplified tax system will significantly reduce the company’s tax expenses. Especially when you compare them with the 20% rate for an LLC on the general system. However, for individual entrepreneurs, the simplified tax system is also more profitable - you don’t have to deal with VAT and other unpleasant concepts.

Who can use simplified work?

The simplified taxation system is more profitable compared to others. But not all entrepreneurs can work on it. Certain criteria must be met. They relate to economic situation, business size and scope of activity.

Criteria for a company that is going to switch to the simplified tax system:

- There should not be more than 100 employees

- The payer is not engaged in certain types of activities (banking, insurance, mining of non-common minerals, pawnshops, and so on).

- Annual income does not cross the threshold of 150 million rubles.

- The company has no branches.

- Income for 9 months of the current year does not exceed 112.5 million rubles if the transition is carried out with OSNO.

- The residual value of the enterprise's fixed assets is less than 150 million rubles.

If a company violates at least one criterion or is engaged in one of the activities “prohibited” for the simplified tax system, then it cannot count on the use of this system.

Before submitting the notification, recalculate your indicators again. And if you are just registering a company, then think about it - will you be able to fit into the established limits?

Transition notification: features

The most important document, without which an entrepreneur will not be able to apply the simplified tax system in his activities, is an application to change the tax regime. to go for the empty form, put into effect on November 2, 211 by Order of the Federal Tax Service of the Russian Federation 2 N ММВ-7-3/ [email protected] . You can fill it out before visiting the tax office.

There is no particular difficulty in writing a notice. To make sure of this, let’s look at a sample of filling out the application step by step:

- We enter in the TIN line the numerical designation assigned at the time of registration of the individual entrepreneur

- In the checkpoint column we put dashes - such a number is assigned only to organizations. IP does not have it

- We enter in the allocated space the code of the tax department that serves the region where the businessman operates. It can be clarified on the official portal of the Federal Tax Service

- In the box signed as “taxpayer identification” we put the number 3. It indicates a transition to simplified taxation from a different taxation regime

- In the lines below we enter the name of the businessman

- Number 1 is entered in the column “switches to a simplified taxation system” if the application is filled out by an existing entrepreneur. In this case, the year of the regime change is indicated in the cells below. If the individual entrepreneur is just registered, the number 2 is entered

- Specify the tax object code. “Income” is encrypted under the number 1, “Income minus expenses” corresponds to number 2. Below, indicate the year of transition

- Indicate the profit for 9 months

- Specify the balance limit

- In the column “Name of individual entrepreneur taxpayer” we put dashes - it is intended exclusively for organizations

- Next, indicate the phone number, date of completion and signature

It is worth remembering that you can submit a notification only if you meet the requirements for individual entrepreneurs working on the simplified tax system. The tax office will not check the data at the time the notification is submitted. However, if violations are subsequently discovered, the entrepreneur is punished.

How to switch to simplified tax system

To change the taxation system to a simplified one, you need to prepare a notification in a special form and submit it to the Federal Tax Service. Before that, you will have to think about the object of taxation. Choose carefully - you can only change it after a year.

How to inform the tax authorities about the transition to simplified taxation

To notify the INFS that you wish to work under a simplified taxation system, you must write a notification. A special form No. 26.2-1 has been developed for it . You must fill out the form and send it to the inspectorate. There are some features of filling out this one-pager:

- If you submit the form along with documents for registration, then leave the “TIN” and “KPP” fields empty.

- Only direct individual entrepreneurs or LLC managers can sign the notice. If you want someone else to sign (for example, the founder) - issue a power of attorney for this person.

You will have to bring the notification to the inspection department where the company was originally registered. You need to make two copies and submit one to the Federal Tax Service, and ask for the second to be certified and kept for yourself. Don't lose this copy! Without it, you will not be able to prove, if necessary, that you really are now working according to the simplified tax system.

Download a blank form and an example of filling out an application in form 26.2-1 for the transition to the simplified tax system

| “ Notification on form 26.2-1 about the transition to the simplified tax system - empty form ” Downloading will begin immediately after the click |

| " Notification on form 26.2-1 about the transition to the simplified tax system - an example of filling out for an LLC " Downloading will begin immediately after the click |

| " Notification on form 26.2-1 about the transition to the simplified tax system - an example of filling out for individual entrepreneurs " Downloading will begin immediately after the click |

Which tax object to choose?

Before switching to the simplified tax system, you need to decide on the object of taxation. That is, with that part of the money with which you will have to pay a tax contribution. There are two objects of taxation:

- “ Income ” - 6% of all income, regardless of expenses - 15% of the profit remaining after deducting various expenses.

Which one should you choose? The answer to the question depends on the economic activity of the enterprise itself. Let’s say a certain editorial office of “Mart” earns 1 million rubles a year. At the same time, she spends 750 thousand rubles on the editorial needs. A similar editorial office, April, receives the same million dollars a year. But she needs less money for work, and she spends only 100 thousand on expenses.

If they use the “Revenue” object, they will pay 60 thousand rubles, since the companies have the same revenue:

1,000,000 / 100 * 6 = 60,000 rubles.

But as a result, the companies’ profits will be different:

- “Mart” will receive only 190,000 rubles in profit, since 750,000 rubles were expenses, and another 60,000 were taxes.

- “April” will earn 840,000 rubles at the end of the year , taking into account 100,000 rubles spent on the needs of the editorial office and 60,000 taxes.

That is, it is logical that for the “April” editorial office the “Revenue” object is much more profitable than for the “March” editorial office. If they use “Income minus expenses”, then the picture will be completely different:

- “March”: (1,000,000 – 750,000) / 100 * 15 = 37,500 rubles.

- “April”: (1,000,000 – 100,000) / 100 * 15 = 135,000 rubles.

And in this situation, the editorial office of “Mart” already wins, which pays three times less taxes than “April”. The profit of the second one, of course, will still be higher, but these are already production costs.

Yes, these are very unlikely situations in real life. But using the example of two non-existent editions, you can roughly understand when which object of taxation is more profitable.

To correctly calculate what is more profitable specifically in your situation, it is better to use the help of an accountant. Approximate recommendation: if expenses are more than 60% of earnings, then you should think about choosing the “Income” object and pay 6% of the balance. If it is less, then “Income minus expenses.”

How long to wait for an answer

There is no need to wait until the tax office deigns to respond to the application. She does not have to respond to it in documentary form - for reporting, a stamp placed on a copy of the application is sufficient. If a company meets the criteria that allow it to use the simplified tax system, the consent of the Federal Tax Service is not required.

Remember: your task is not to obtain the consent of the tax inspectorate, but to notify it of the transition to the simplified tax system.

The INFS will not respond even if your company does not qualify for the simplified tax system according to some parameters. But then he will exact the full amount from her. If you are not sure that you are working under the simplified tax system, you can submit a request for confirmation of which tax system you use.

How to refuse the simplified tax system if the application has already been submitted

If you do not want to work under the simplified tax system, but have already sent an application to the tax office, you can refuse to use this system. It is enough to submit a notification to the Federal Tax Service once again before the expiration of the deadline, in which you indicate the new tax system for your organization. The same application must be accompanied by a letter indicating that the previous notification must be cancelled.

The inspection will not be able to refuse you. Since in fact you have not yet worked under the previously chosen taxation system, the rule of one shift per calendar year does not apply here. But if you do not have time to submit a new notification before January 9, you will have to work for a year under the simplified tax system, and it will be possible to change the system only from 2020.

How to draw up a document

The document on the transition to the simplified tax system should be provided in paper or electronic form in person, through a proxy or by registered mail. Please note that income for nine months is indicated without value added tax. If any lines of the notification are left blank, then a dash should be added. The form fits on one page and does not require special skills to fill out.

If the application is submitted through a representative, it is necessary to show a document that confirms the person’s authority. The date of receipt of the notification is the day the application was submitted or the data on the postal stamp.

Until what time do you need to apply for transfer?

The transition to a simplified taxation system is a serious matter. Each individual situation of entrepreneurs and companies has its own deadlines and features. Remember that you can only change the tax system once a year, so approach the decision wisely. When submitting an application, take into account weekends and shortened working days of the Federal Tax Service. Don’t wait until the last minute: if you’re even a day late, you’ll have to work for another year using OSNO.

An important nuance: legally you can submit an application until December 31, 2021, which is a holiday. Consequently, the deadlines are postponed to the first working day after the holidays. That is, you can submit all applications until January 9, 2021.

By the way, if you worked under the simplified tax system in 2021, then you do not need to notify the tax authorities about this again. No one will change the tax system for you if you meet all the criteria for applying the simplified tax system.

For new entrepreneurs

If you have just decided to register a business and decided that you want to pay taxes according to the simplified tax system, then you don’t have to bother and submit an application on the same day on which you came to register an individual entrepreneur or LLC.

You can also switch to the simplified tax system without unnecessary problems, if 30 days have not yet passed since the registration of the business. You just need to bring an application and submit it to the Federal Tax Service, and then you will pay taxes according to the simplified system, and not according to the originally chosen system.

For those switching from OSNO

If you are switching to the simplified tax system from the general taxation system, you must submit a corresponding notification before December 31, 2021. In this case, the new scheme will apply from January 1, 2019.

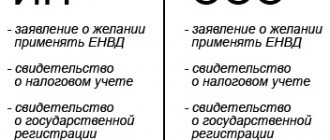

For those transferring from UTII

At the businessman’s own request, you can change the taxation system in the same way as in the case of OSNO - once a year, and the changes will only take effect from January 1 of the next year. But if the enterprise’s imputation activities are closed, then the business owner can switch to the simplified tax system at any time of the year, and not just from January 1, 2021. You must submit an application within 30 days from the date of deregistration as a UTII payer.

It is interesting that this relaxation applies only to companies on UTII that have been deregistered due to imputation. And if something has changed for companies using other systems, they do not have the right to change them to the simplified tax system according to this principle.

Do I need approval from the Federal Tax Service?

Tax authorities do not issue any documents confirming the transition to a simplified taxation system. However, the company owner may request background information that reflects this information. Therefore, if the transition to the simplified tax system from 2019 was completed according to all the rules, you can start working according to this system from the billing period.

You also need to be careful in cases where a notification about the use of the simplified tax system has been submitted, but in fact the calculation of the tax has not changed for one reason or another. Despite the fact that the courts quite often take the side of entrepreneurs, it is recommended to correlate the documentary part and the actual state of affairs.