Latest changes in the Tax Code of the Russian Federation for mineral extraction tax

Changes to the text of Ch. 26 of the Tax Code of the Russian Federation, dedicated to mineral extraction tax, are not introduced too often. So, from 2021, these are changes aimed at stimulating the production of rare metals (law dated 02.08.2019 No. 284-FZ), according to which:

- the list of types of relevant minerals has been clarified;

- The mineral extraction tax rate for the extraction of rare metal ores was reduced from 8% to 4.8%, and a reduction factor (Krm) was introduced to the rate, characterizing the features of the extraction of rare metals.

In 2021, there were innovations introduced by laws:

- dated July 29, 2017 No. 254-FZ, which adjusted the boundaries of the periods of application of one of the coefficients involved in the calculation of the indicator characterizing the features of oil production (clause 1 of Article 342.5 of the Tax Code of the Russian Federation) - the start date of the period of application of the value has shifted from 2020 to 2021 a coefficient subsequent to that which will be used in 2019–2020;

- dated September 30, 2017 No. 286-FZ, which supplemented the chapter with the text of Art. 343.3, describing the new tax deduction, and adding 1 more paragraph (clause 6), referring to this new deduction, to the text of Art. 343, devoted to the procedure for calculating tax (see below for more details);

- dated November 27, 2017 No. 335-FZ, which lifted restrictions on establishing deadlines for applying the mineral extraction tax rate when extracting hydrocarbons from a new offshore hydrocarbon deposit, the tax base for which is determined as their cost.

The new tax deduction described in Art. 343.3 of the Tax Code of the Russian Federation, in the period 2018–2020, taxpayers registered in the Republic of Crimea until 2021 who produce natural gas from fields (not new) located in the Black Sea can use it.

ConsultantPlus experts spoke in detail about the benefits in force in 2021. Get free demo access to K+ and go to the Ready Solution to find out all the possibilities for legally reducing your tax burden.

The deduction amount will be the cost of acquiring and bringing to a state of serviceability fixed assets included in the investment program for the development of the gas transmission system of Crimea and Sevastopol. The amount of deduction can reach 90% of the amount of accrued tax. The use of this deduction frees the payer from using in tax calculations the coefficient characterizing the belonging of the field to the regional gas supply system.

Read about other benefits that exist for mineral extraction tax in the material “Benefits for mineral extraction tax”.

Payers

Organizations and individual entrepreneurs carrying out mining operations on the basis of a license for the right to use subsoil

The Tax Code determines that these persons are subject to registration with the tax authorities on a separate basis - as a taxpayer of mineral extraction tax.

30 calendar days

Registration is carried out within 30 calendar days from the date of state registration of the license to use the subsoil plot - at the location of the site, on the territory of the corresponding constituent entity of the Russian Federation. If the subsoil plot is not located on the territory of the Russian Federation, registration is carried out at the location of the organization (or individual) - the user.

Object of taxation

- minerals extracted from the depths of the Russian Federation;

- minerals extracted from waste (losses) of mining production, if such extraction is subject to separate licensing;

- minerals mined outside the territory of the Russian Federation.

- common minerals and groundwater not listed on the state balance sheet of mineral reserves, extracted by an individual entrepreneur and used directly by him for personal consumption;

- mined mineralogical, paleontological and other collection materials;

- minerals extracted from the subsoil during the formation, use, reconstruction and repair of specially protected geological objects that have scientific, cultural, aesthetic, sanitary or other public significance;

- minerals extracted from their own dumps or waste (losses), if they were taxed during extraction in the generally established manner.

More details (Article 336 of the Tax Code of the Russian Federation)

Mineral extraction tax rates in 2020-2021

All rates for calculating the mineral extraction tax, which is a federal-level tax, in 2020-2021 are reflected in the Tax Code of the Russian Federation (Article 342). They are divided into 2 types:

- expressed as a percentage;

- set in rubles.

Many of them provide for the use of coefficients that take into account:

- fluctuations in consumer prices;

- extraction method;

- characteristics of the territory of the developed field;

- fluctuations in world prices;

- mining difficulty level;

- degree of depletion of the deposit.

Some of the applied coefficients are relevant only to a certain type of fossil, others are valid for several types, and a number of coefficients for some of the fossils are applied in combination. The latter type of minerals includes oil and gas, which makes calculating taxes on them quite complex.

Example from ConsultantPlus: calculation of mineral extraction tax on minerals mined for sale: In March, the organization extracted 12,000 tons of construction sand and sold 8,000 tons for 8,000,000 rubles. (excluding VAT). The cost of delivering sand to the buyer is 1,000,000 rubles. (excluding VAT)…. If you do not have access to the K+ system, get a trial online access and proceed to the calculation example for free.

Odds may have a specific meaning or be calculated. However, the specific value may vary depending on the year the indicator was applied. The latter, for example, refers to the coefficient characterizing the export profitability of a unit of standard fuel and involved in gas calculations (Article 342.4 of the Tax Code of the Russian Federation).

In certain situations, taxpayers are entitled to rate reductions:

- by 30% if they carry out search and exploration of deposits at their own expense;

- by 40%, when mining minerals (but not hydrocarbons or common ones) in a special zone of the Magadan region.

To learn about the specifics of determining the object of taxation, read the article “What is the object of taxation under the mineral extraction tax?”

Types of extracted minerals

For tax purposes, extracted mineral resources are recognized as products of the mining industry and quarrying, contained in mineral raw materials (rock, liquid and other mixtures) actually extracted from the subsoil (waste, losses), the first in quality corresponding to the national standard, regional standard, international standard, and in case of their absence - to the organization’s standard.

The types of extracted minerals are:

- oil shale;

- coal (anthracite, etc.);

- peat;

- hydrocarbon raw materials (including oil, gas, gas condensate, methane);

- marketable ores of ferrous, non-ferrous and rare metals;

- multicomponent complex ores;

- useful components of multicomponent complex ore, extracted during further processing;

- mining chemical non-metallic raw materials (apatite-nepheline and phosphorite ores, potassium, magnesium and rock salts, boron ores, sodium sulfate, sulfur, barites, asbestos, iodine, bromine, fluorspar, earth paints (mineral pigments), carbonate rocks and others );

- mining non-metallic raw materials (abrasive rocks, vein quartz, quartzites, carbonate rocks for metallurgy, quartz-feldspathic and siliceous raw materials, glass sands, natural graphite, talc (steatite), magnesite, talc-magnesite, pyrophyllite, mica-oscovite, mica-phlogopite , vermiculite, refractory clays for the production of drilling fluids and sorbents, others);

- bituminous rocks;

- raw materials of rare metals (scattered elements) - in particular, indium, cadmium, tellurium, thallium, gallium;

- non-metallic raw materials used mainly in the construction industry (gypsum, anhydrite, natural chalk, dolomite, limestone flux, limestone, limestone, natural building sand, pebbles, gravel, sand-gravel mixtures, building stone, facing stones, marls, clays, other);

- qualified product of piezo-optical raw materials, especially pure quartz raw materials and semi-precious stone raw materials (topaz, jade, jadeite, rhodonite, lapis lazuli, amethyst, turquoise, agates, jasper and others);

- natural diamonds, other precious stones from primary, alluvial and man-made deposits, including rough, sorted and classified stones (natural diamonds, emerald, ruby, sapphire, alexandrite, amber);

- concentrates and other intermediate products containing precious metals (gold, silver, platinum, palladium, iridium, rhodium, ruthenium, osmium) obtained during the extraction of precious metals:

- natural salt and pure sodium chloride;

- underground waters containing minerals (industrial waters) and (or) natural healing resources (mineral waters), as well as thermal waters;

- raw materials of radioactive metals (in particular, uranium and thorium).

More on the topic Customs clearance of cars from Kyrgyzstan and Kazakhstan when imported into Russia in 2021

Read more (clause 2 of Article 337 of the Tax Code of the Russian Federation)

The tax amount is calculated based on the results of each tax period (month) for each mineral extracted.

On the 25th day of the month following the expired tax period The amount of tax payable at the end of the tax period is paid no later than the 25th day of the month following the expired tax period.

The tax is payable to the budget at the location of each subsoil plot provided to the taxpayer for use.

The amount of tax calculated for minerals mined outside the territory of the Russian Federation is subject to payment to the budget at the location of the organization or the place of residence of the individual entrepreneur.

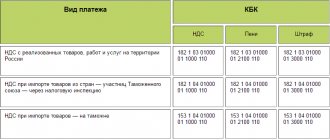

Budget revenue classification codes

Coefficients for calculating oil tax

When calculating the mineral extraction tax on oil in 2020-2021, the following special (related only to this fossil) indicators are used:

- taking into account fluctuations in world prices and determined monthly by the Government of the Russian Federation or by independent calculation (clause 3 of Article 342 of the Tax Code of the Russian Federation);

- characterizing the degree of complexity of production and taking on a certain value depending on the specific characteristics of the deposit and the year of development (clauses 1, 2 of Article 342.2 of the Tax Code of the Russian Federation);

- reflecting the degree of depletion of the field; depending on the value of the previous coefficient, it can take either a specific value or become a calculated one (clauses 3, 6 of Article 342.2 of the Tax Code of the Russian Federation);

- characterizing the characteristics of oil production and calculated using a formula that includes several coefficients, both calculated and taking a certain digital value depending on the year of application (Article 342.5 of the Tax Code of the Russian Federation).

The deduction provided for by the Tax Code of the Russian Federation, applied to the calculated tax amount, is also special for such a fossil as oil. It is used in production carried out in the Republic of Tatarstan and Bashkortostan, and is provided for oil that is desalted, dehydrated and stabilized. The amount of the deduction depends on the volume of the initial reserves of the field and is determined by a formula that takes a specific form depending on the year in which it is applied (Article 343.2 of the Tax Code of the Russian Federation).

An example of oil tax calculation can be found here.

Deadlines for payments and reports on mineral extraction tax

The deadlines established for paying taxes and submitting reports on them are tied to the end of the tax period. Such a period is a month (Article 341 of the Tax Code of the Russian Federation). That is, you must pay tax and submit a tax return every month in the month following the reporting month.

The deadlines for this are defined in the Tax Code of the Russian Federation and correspond to:

- for payments - on the 25th (Article 344);

- for the report - the last day of the month (clause 2 of Article 345).

The established dates are subject to the general rule of transferring days that fall on weekends to the next weekday (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Subject to the above, the expiration dates applicable for tax for the remainder of 2021 and in 2021 will be as follows:

| Payment and reporting period | Deadline for payment of mineral extraction tax in 2020-2021 | Deadline for submitting the mineral extraction tax declaration in 2020-2021 |

| September 2020 | 26.10.2020 | 02.11.2020 |

| October 2020 | 25.11.2020 | 30.11.2020 |

| November 2020 | 25.12.2020 | 31.12.2020 |

| December 2020 | 25.01.2021 | 01.02.2021 |

| January 2021 | 25.02.2021 | 01.03.2021 |

| February 2021 | 25.03.2021 | 31.03.2021 |

| March 2021 | 26.04.2021 | 30.04.2021 |

| April 2021 | 25.05.2021 | 01.06.2021 |

| May 2021 | 25.06.2021 | 30.06.2021 |

| June 2021 | 26.07.2021 | 02.08.2021 |

| July 2021 | 25.08.2021 | 31.08.2021 |

| August 2021 | 27.09.2021 | 30.09.2021 |

| September 2021 | 25.10.2021 | 01.11.2021 |

| October 2021 | 25.11.2021 | 30.11.2021 |

| November 2021 | 27.12.2021 | 31.12.2021 |

The deadlines for making payments and submitting the report for December 2021 will be in January 2022 and will correspond to 01/25/2022 and 01/31/2022.

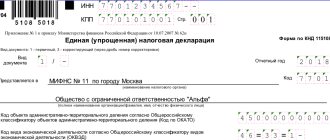

The mineral extraction tax declaration is formed on the form approved by order of the Federal Tax Service of Russia dated December 20, 2018 No. ММВ-7-3 / [email protected] in its current version.

Penalties for failure to submit reports or pay taxes on time

Failure to submit a return on time is a tax offense for which Art. 119 of the Tax Code of the Russian Federation. The amount of the penalty depends on the duration of the delay. It is set as a percentage of the amount of tax that needs to be paid or paid additionally according to the declaration:

- if an organization submitted a mineral extraction tax declaration within 180 days after the deadline, the fine is 5 percent of the tax amount on the declaration. Please note that a fine will have to be paid for each full or partial month of delay. But the total amount of the fine for the entire period of delay cannot exceed 30 percent of the tax amount according to the declaration and be less than 100 rubles.

- if the delay is more than 180 days, then the fine is 30 percent of the tax amount according to the declaration plus 10 percent for each full or partial month of delay starting from the 181st day.