Well done, the Federal Tax Service! You have to come up with this so cleverly - in just a few

Accounting options under a simplified taxation system Accounting under the simplified tax system has become mandatory for companies

The concept of targeted financing Targeted financing is the allocation of funds for the implementation of strictly defined goals with

Changes have once again been made to the procedure for calculating property tax for organizations. Federal law

Business entities are required to report to government regulatory authorities. Currently the list of these

What tax agents should do During the year, tax agents (organizations and individual entrepreneurs with

In the current economic situation, a bank guarantee is one of the most popular

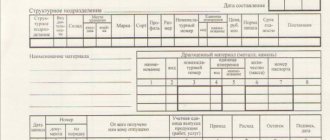

Accounting entries Receipt of materials into the organization is carried out under supply contracts, through the production of materials by

NPO reporting is a responsibility that falls on all structures of this kind. Despite,

In addition to recording the movement of inventory items, it is equally important to record the documents that accompany the movement