Accounting options under a simplified taxation system

Keeping accounting under the simplified tax system for companies became mandatory after the adoption of the new law on accounting under No. 402-FZ of December 6, 2011.

The same law established the possibility of using simplified methods of accounting for small businesses (SMB), which, for the most part, include firms operating under the simplified tax system. Firms operating on a simplified basis, but not small enterprises, as well as “simplified” companies that have the risk of switching to OSNO, carry out accounting under the simplified tax system in full according to the rules of accounting legislation. This accounting option is also preferable for companies that work steadily on the simplified tax system, but use accounting data to obtain detailed information about the state of affairs in the organization and economic analysis of activities.

Options for conducting simplified accounting for small businesses are contained in 2 documents:

- Order of the Ministry of Finance of Russia dated December 21, 1998 No. 64n, indicating the possibility of organizing accounting (clause 21):

- without using property registers of a small enterprise (simple form);

- using registers of such accounting (register forms are given as appendices to the order);

- complete, carried out through double entry using the accounting registers of SMP assets;

- abbreviated, in which accounting is carried out through double entry without using the accounting registers of SMP assets;

- simple, carried out without the use of double entry.

The accounting methods proposed by the IPB RF are characterized by certain features of the management methodology and are preferable for each of them for their own circle of small businesses:

- Full simplified accounting is carried out according to generally established accounting rules, but allowing for some simplifications (non-application of a number of accounting standards, reduction of the chart of accounts, simplified accounting registers, the possibility of correcting errors of previous years by the current year). It is preferable for SMEs conducting diversified activities that require recording of all its aspects, but allowing for the sufficiency of aggregated indicators for its assessment.

- Abbreviated simplified accounting is limited to keeping records in a ledger for recording facts of economic activity, which is a single table in which all events are reflected in double entry. This method is possible for small SMEs conducting monotonous activities with a small number of transactions that require the use of a very limited number of accounting accounts.

- Simple simplified accounting is also kept in the ledger of all facts of economic activity in the form of a table, but without the method of double entry. This method is only available for micro-enterprises.

For companies that have the right to simplified accounting, current legislation allows for the possibility of conducting it on a cash basis (clause 12 of PBU 9/99 and clause 18 of PBU 10/99).

Which commercial organizations have the right to use simplified accounting methods, including simplified financial statements? The answer to this question is in the ConsultantPlus system. Get a free trial and proceed to the 2021 Accounting Guide.

Read about the differences between the accrual method and the cash method here.

However, there are no recommendations for its organization. Most likely, this is due to the fact that cash accounting does not meet the main task of accounting: to provide complete and reliable information about all the facts of the company’s economic activities. When applying the cash method in accounting, not only the real picture of the economic life of the organization is distorted, but also its financial statements. Therefore, it is still better to conduct accounting using the accrual method, and the cash method can only be recommended as a method of maintaining tax accounting. In particular, it is this method under the simplified tax system that paid income and expenses taken into account when calculating tax are reflected in the book of income and expenses, which, when simplified, is a mandatory tax register (Article 346.24 of the Tax Code of the Russian Federation).

Read about the accrual method in accounting in the material “What is the essence and features of the accrual method in accounting .

Taking into account the fact that accounting is carried out in accordance with the procedure established by the current law on accounting and PBU, and tax accounting according to the rules of the Tax Code of the Russian Federation, accounting and tax accounting data will almost always differ. You can try to bring them as close as possible by choosing similar accounting methods. But at the same time, financial statements will always be compiled according to accounting data, and tax calculations will be done according to tax accounting data.

For information on the requirements for financial reporting, read the article “What requirements should accounting reporting satisfy?” .

Not keeping accounting records according to established rules is risky. The current legislation provides for liability for this (clause 3 of article 120 of the Tax Code of the Russian Federation and article 15.11 of the Code of Administrative Offenses of the Russian Federation). Such violations, in particular, include the lack of accounting registers, the absence of primary records and systematic errors in filling out accounting registers.

Simple Form of Accounting

The fundamental difference between the simple form of accounting and the two previous ones is that in this case, accounting accounts and double entry are not used (clause 6.1 of PBU 1/2008). The simple system is permitted for micro-enterprises with up to 15 people and annual revenue of up to 120 million rubles, as well as for non-profit organizations, with the exception of foreign agents (clause 6.1 of PBU 1/2008).

But not only the scale of the business is important here. In any case, accounting should provide complete information about the company (Clause 1, Article 13 of Law 402-FZ). Simple accounting will satisfy this requirement if the following conditions are met:

- The nature of the company's activities allows it to determine its financial results using the cash method. Under this method, revenue is recognized when cash is received and expenses are recognized when payment is made.

- The company does not have depreciable assets.

- All receivables and payables are repaid in the period of their occurrence.

- There are no significant balances of other property and liabilities that could affect the assessment of the company's financial position.

An example of maintaining a Book with simple accounting is given below.

Accounting book for ______________

rub. cop.

| Contents of the fact of economic life | Current account transactions admission + write-off - | Normal activities | USN income tax | |

| Revenue | Expenses | |||

| 3 | 4 | 5 | 6 | 9 |

| Cash balance at the beginning of the reporting year | 0 | |||

| Contributions received from founders | 2 000 000 | |||

| Paid supplier invoices for goods received (300 units)* | -6 000 000 | 6 000 000 | ||

| Payment was received from buyer “A” for the goods delivered (100 units)* | 4 400 000 | 4 400 000 | ||

| Payment was received from buyer “B” for the goods delivered (180 units)* | 7 600 000 | 7 600 000 | ||

| Paid rental services | -400 000 | 400 000 | ||

| Wages transferred to employees | -1 600 000 | 1 600 000 | ||

| Transferred to the personal income tax budget, withheld from employees’ wages | -240 000 | 240 000 | ||

| Mandatory insurance contributions transferred to the budget | -555 680 | 555 680 | ||

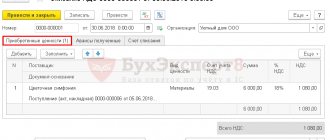

Accounting policies and chart of accounts for the simplified tax system

The accounting policy under the simplified tax system is the same serious and detailed document as is drawn up by any organization working on the OSNO.

The chosen method of accounting and the features of its maintenance are necessarily fixed in the order on accounting policies.

Along with the organizational and technical aspects of accounting, the text of the order should reflect the choice:

- forms of accounting registers;

- accounting accounts used for accounting (working chart of accounts);

- forms of primary accounting documents;

For recommendations on the preparation of primary documents, see the material “Primary document: requirements for the form and the consequences of its violation” .

- accounting forms;

- methods of storing primary materials;

- document flow rules;

- use or non-use of PBU;

- boundaries between fixed assets and low-value property;

- creating reserves or abandoning them;

- the possibility or impossibility of accounting for losses from previous years.

The forms of simplified accounting registers must be provided as appendices to the order. For the full simplified accounting option, they will generally be similar to the balance sheets used in OSNO, but can combine information on related accounting accounts and require the formation of a consolidated checkerboard sheet in addition to them. The forms of simplified accounting registers recommended by the Ministry of Finance of Russia can be seen in the appendices to the protocol of the IPB of the Russian Federation dated April 25, 2013 No. 4/13 and the order of the Ministry of Finance of Russia dated December 21, 1998 No. 64n.

The consolidation of data on accounting accounts is based on a reduced chart of accounts, in which it is possible to reduce the number of accounts used by enlarging them. You can, for example, combine inventory accounting accounts (07, 10, 14, 15, 16) on account 10, cost accounting accounts (20, 23, 25, 26, 28, 29) on account 20, non-cash accounts (51 , 52, 55, 57) on account 51, accounts for settlements with counterparties (73, 75, 76, 79) on account 76. The decision on how the accounts will be combined must be reflected in the accounting policy. The working chart of accounts is a mandatory appendix to the text of the order.

In connection with the right granted to SMP to generate financial statements in a shortened version (only in two forms) and in aggregated indicators (with fewer lines in the forms), it is necessary to consolidate this right in the accounting policy.

Read about SMP reporting in the article “Simplified small business reporting .

Particular attention should be paid to the issues of storing primary accounting documents, which may be needed even by simplified companies that maintain accounting at the simplified tax system of 6% (income), in the event of a change in the taxation system.

Accounting under the simplified tax system should be organized in such a way that, if it is necessary to return to OSNO or switch from the simplified tax system “income” to the simplified tax system “income minus expenses,” it is possible to restore analytics using accounting data in accordance with the requirements of the relevant tax system with a minimum amount of labor costs.

For information about what else an order on accounting policies should contain, read the material “Form of an order for approval of accounting policies .

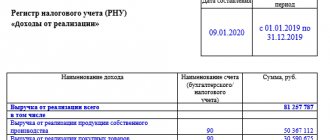

Limiting criterion - income instead of revenue

If the “numerical” parameters and conditions of clause 1.1 of Art. 4 of Law No. 209-FZ, an applicant for SME status needs to check one more indicator - business income for the previous calendar year. If it exceeds the value established by the Government of the Russian Federation, it will not be possible to obtain NSR status.

ATTENTION! On 08/01/2016, Russian Government Decree No. 265 dated 04/04/2016 came into force, establishing the maximum values for business income that allows one to obtain the status of SSE:

- micro-firms - 120 million rubles;

- small companies - 800 million rubles;

- medium enterprises - 2 billion rubles.

The previously effective decree of the Russian Government (dated July 13, 2015 No. 702) operated with the same digital thresholds, however, instead of income, revenue from the sale of goods (work, services) excluding VAT was taken as the indicator being compared.

Learn the nuances of accounting for revenue and VAT with materials from our website:

- “IFRS No. 18 Revenue - application features (nuances)”;

- “Basic rules when an organization without VAT works with an organization with VAT”.

Revenue and income are not identical concepts. Income from business activities is a broader aggregate indicator that includes not only revenue, but also other income received by the merchant (for example, penalties collected from counterparties, bank interest received for placing a deposit, etc.).

The articles posted on our website will tell you about the nuances of determining entrepreneurial income:

- “If the creditor does not require payment of penalties provided for in the contract, should they be included in income?”;

- “What income is non-operating?».

Accounting policy when simplified for the object “income minus expenses”

When drawing up an accounting policy according to the simplified tax system “income minus expenses”, the order must reflect all the features of accounting for its financial and economic activities. Particular attention should be paid to expense accounting issues, which are usually carefully checked by the tax authorities:

- determining the cost of the OS;

- the procedure for writing off the cost of fixed assets and intangible assets;

- determining the cost of inventory items;

- the procedure for writing off the cost of inventory items;

- the procedure for recording and writing off TZR;

- procedure for accounting and writing off VAT;

About the procedure for accounting for VAT under the simplified tax system, read the article “What is the procedure for writing off VAT on expenses (postings)?” .

- the procedure for accounting for sales expenses;

- the procedure for accounting for standardized expenses;

- the procedure for accounting for future expenses;

- the procedure for accounting for losses of previous years;

- the procedure for accounting for the minimum tax paid upon a loss.

You can download a sample accounting policy for simplifiers using “income minus expenses” in the ConsultantPlus system. Sign up for a free trial access to K+ and receive a document from K+ experts.

More information about the preparation of accounting policies can be found in the articles:

- “Accounting policy under the simplified tax system “income minus expenses” (2021)”;

- “A ready-made accounting policy is a sample for an organization.”

Results

Keeping accounting records under the simplified tax system is mandatory only for legal entities. If the legal entity applying the simplified tax system is a small business entity, it has the opportunity to use a simplified method of accounting and generate reporting in a simplified form. The selected accounting methods, the applied chart of accounts, forms of documents, reporting, the procedure for storing documents and many other aspects of the organization and maintenance of accounting are developed by the organization independently and approved in the accounting policy.

Sources:

- Federal Law of December 6, 2011 N 402-FZ “On Accounting”

- Order of the Ministry of Finance of the Russian Federation dated December 21, 1998 N 64n

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.