Good afternoon, dear readers! Today we continue a series of articles on how to fill out KUDIR for those who use a simplified tax regime or a patent as a special tax regime. We have already written about filling out the KUDIR on the simplified tax system for income, as well as about filling out the KUD for individual entrepreneurs on a patent. Today we will talk about KUDIR for those who calculate the simplified tax system tax on a different base, reducing income for expenses. It’s more difficult to fill out such a KUDIR, but you can still figure it out. If you do not have many transactions per year, then you can fill it out yourself.

The most convenient way to fill out KUDIR automatically, keep records and submit reports is in a special service.

Content

- Step 1: How to fill out the cover page

- Step 2: What to put in Section I Income and Expenses

- Step 3: How to do the calculations in Section II

- Step 4: What to do with Title III

I think there is no need to remind you that KUDIR is maintained by all individual entrepreneurs and companies that use the simplified form. There are no fundamental differences in filling out the book with the first and second ones - everything is done almost the same way. We have already spoken about the basic requirements for filling it out, so we will not repeat ourselves. Let's get straight to the point.

KUDIR has a unified form, you need to fill it out. You can find the form and instructions for filling it out in Order of the Ministry of Finance of the Russian Federation No. 135n dated October 22, 2012, taking into account the changes made by Order of the Ministry of Finance No. 227n dated December 7, 2016. According to the updated KUDIR form, it is filled out starting in 2021; previous periods must be filled out on the old form. There are no changes for 2021; we fill out the data using the existing form.

The report can also be found HERE.

So, if you have already downloaded and printed the form and it is already in front of you, let’s go through its sections, of which there are only four. Well, plus the title page. The form contains:

- Title page – here we indicate information about the taxpayer;

- Section I Income and expenses – for quarterly reflection of income / expenses;

- Section II Calculation of expenses for fixed assets and intangible assets, which are taken into account when calculating the tax base - filled out if the fixed assets and intangible assets themselves are available;

- Section III Calculation of the amount of loss taken into account when calculating the simplified tax system - we fill it out again as necessary, i.e. if there was a loss in previous years;

- Section IV Expenses that reduce the tax on the simplified tax system in accordance with the Tax Code of the Russian Federation - here the amounts of insurance premiums are shown by those who calculate the simplified tax system on Income.

- Section V Trade Fee Data. For now, this Section is relevant only for Moscow entrepreneurs who use the simplified tax system “Income” and pay a trade tax.

Setting up the formation of a ledger for accounting income and expenses in 1C 8.3

Before creating KUDIR, you should check the organization's accounting policy settings. They can affect the correct formation of the book.

Let's go to the "Main" menu, then follow the "Organizations" link to the list of organizations. Let’s go to the organization we need, and then to “Accounting Policies”. In 1C, 90% of cases like “KUDiR is not filled in” or “does not fall into KUDiR” are resolved by setting up accounting policies.

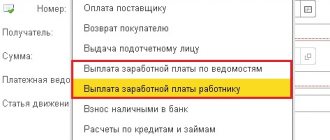

Click on the “Recognition of expenses” button (this button appears when the object of taxation is “income - expenses”).

In addition to the general settings in the Accounting Policy, there are also settings for printing the book itself.

Let's return to KUDIR and click the "Show settings" button.

A window with settings will open:

The most interesting and necessary thing here is the “Output transcripts” checkbox. By checking this box, you can see which document generated this or that income or expense.

Other settings affect the appearance of the book. Different tax authorities require it differently.

Checking the register Other calculations in the SV part

Accumulation register Other

calculations

- an auxiliary register that tracks write-offs of funds in an organization not directly related to the payment of inventories, works or services, for example:

- calculations with accountable persons;

- payment through a payment agent (payment cards in retail);

- salary;

- payment of taxes and contributions.

Responsible for offsetting payments when creating expenses accepted or not accepted under the simplified tax system.

In the presence of:

- Balance Kt 69 – entry in the register with the type of movement – Expense ;

- Balance Dt 69 – entry in the register with the type of movement + Receipt.

Answer Profbukh8

Elena Bobkova (Master group Profbuh8.ru)

Svetlana, if you had a simplified tax system with the object “Income”, then you would reduce the tax by the amount of contributions paid. Clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation

You have “Income minus expenses”. In this case, the tax is not reduced, and contributions are accepted as expenses, i.e. reduce the tax base. clause 7 clause 1 article 346.16 of the Tax Code of the Russian Federation.

I tried to make your situation in my database.

I still had to make a manual entry in KUDIR regarding the payment of contributions to the fund, so that the contributions would be reflected in the expense column accepted under the simplified tax system.

Elena Bobkova (Master group Profbuh8.ru)

Yes, sorry, the account for accounting for individual entrepreneur contributions to the Pension Fund was written incorrectly: 69.06.5 (in the 1C 8.3 program)

Svetlana

Thanks a lot. You helped me a lot.

Please rate this question:

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

Example of filling out KUDIR on the simplified tax system Income 6%

Individual entrepreneur I.M. Kuznetsov bought raw materials for the production of buns for 230,000 rubles on January 11, 2016 and sold 100 buns at a price of 20 rubles per piece. The buyer returned one bun to the entrepreneur due to broken packaging. In addition, IP Kuznetsov received an advance from the buyer in the amount of 10,000 rubles. Kuznetsov has one pastry chef whose salary is 30,000 rubles. For January 2021, Kuznetsov paid insurance premiums for the employee - 9,000 rubles.

Here is what a sample of filling out KUDIR for individual entrepreneurs on the simplified tax system of 6% looks like in this example.

Answer Profbukh8

Irina Shavrova (Master group Profbuh8.ru)

Svetlana, how did you pay the fee anyway? Via Sberbank card?

I looked at the information on the Pension Fund website:

“From January 1, 2011, in the absence of a bank, insurance premium payers - individuals can pay insurance premiums free of charge through the cash desk of the local administration or through the federal postal service.”

Then your option seems to work... But that’s not how you paid, right?

Theoretically, such correspondence is possible, but somehow I’m not sure about it.

I think that 51 accounts still need to be used, albeit in a “cunning” way. ————————————————————————-

I looked at the information on the 1C 8.3 forums, here, for example, is this option:

1. Create a Cash Deposit Order with the transaction type “Cash Deposit to Bank”. In this case, in the “Bank account” field, select a specially created new account, with an arbitrary number and name it something distinctive

2. Create a bank write-off with the transaction type “Tax transfer”. Select the debit account - to which you deposited from the cash register.

Such a reflection in 1C 8.3 will normally end up even in the RSV.

PS: let me forward this question to Elena Bobkova, she will try to answer the question over the weekend. This is for sure, okay?)

Svetlana

Hello.

I didn't pay with a card. I paid at the Sberbank branch in cash at the window using their receipt, form No. PD-4sb (tax). No commission.

Let's redirect to Elena Bobkova. Maybe she can tell us the most correct option.

Thank you very much for your time. I'll wait for an answer.

Answer Profbukh8

Irina Shavrova (Master group Profbuh8.ru)

Elena has your question marked, she will also give her authoritative opinion.

Elena Bobkova (Master group Profbuh8.ru)

Svetlana, good evening!

You have the right to pay taxes (contributions) in cash.

In the 1C 8.3 program, use cash documents:

1. Cash receipt. Type of operation “Personal funds of an entrepreneur”:

- Dt 50.01

- Kt 84.01

2. Cash withdrawal. Type of transaction “Tax payment”:

- Dt 69.02.7 (69.03.1)

- Kt 50.01.

Here the 1C 8.3 program will generate an Expense Record in KUDiR.

You have no obligation to pay quarterly contributions, only payment. They are calculated annually, that's right. But then they will be included in KUDiR as accepted expenses only after accrual, i.e. at the end of the year. And this is methodologically correct.

If you want contributions to be reflected in expenses quarterly, then accrue them manually using Operation.

Svetlana

Thank you very much!!! I will try!!!

What confuses me a little is that you said that the expenses will go to KUDiR. And if I have a simplified tax system for income minus expenses, they are not accepted as expenses? Or am I misunderstanding something?

Example of filling out KUDIR under the simplified tax system Income minus expenses

Let's look at an example of how to fill out KUDIR for individual entrepreneurs on the simplified tax system of 15%. Data on income and expenses of individual entrepreneur I.M. Kuznetsova Let's take from the previous example. Plus, Kuznetsov paid in advance the rent for the bakery premises in January - 100,000 rubles for February-March 2021. The rent advance in KUDIR is included not on the date of transfer of money, but on the date of fulfillment of the counter-obligation, that is, the signing of an act on the provision of rental services on the last day of March 2021.

In this example, a sample of filling out KUDIR for an individual entrepreneur on the simplified tax system of 15% will look like this.

In the sample documents on our website you can download KUDIR according to the simplified tax system. If you have questions about how to fill out the KUDIR according to the simplified tax system, we recommend that you seek a free consultation from 1C:BO specialists.

Find out how to fill out KUDIR on the simplified tax system

Filling out KUDIR under the simplified tax system Income

Since the taxpayer uses the simplified tax system for income only to take into account his own income, then in section I of KUDIR he will reflect only receipts to the current account or to the cash desk. At the same time, not any money received is taken into account as income for determining the tax base. According to Art. 346.15 of the Tax Code of the Russian Federation, the simplifier takes into account as income his revenue and non-operating income - rental of property and other income from Art. 250 Tax Code of the Russian Federation. The list of income that cannot be taken into account on the simplified tax system is given in articles 224, 251, 284 of the Tax Code of the Russian Federation.

This list is long, most of the income is very specific. Let us point out the most typical for the daily activities of most businessmen: money received from the Social Insurance Fund to reimburse the costs of child benefits and sick leave for employees, the return of advances or any overpaid amounts, the amount of loans received, or the return of a loan issued by the organization itself cannot be considered income.

Individual entrepreneurs have even more nuances when accounting for taxes on income received under the simplified system. The entrepreneur does not take into account in the KUDIR according to the simplified tax system his income as wages for hire, replenishment of the cash register of his own enterprise. The sale of property not used in business activities (for example, a car or apartment) is also not included in income when calculating the tax base.

How to conduct KUDIR with the simplified tax system of 6%? Income receipts are reflected by registering the PKO, payment order or bank statement. If revenue is deposited according to BSO, then one receipt order can be made for several forms, but provided that the forms were issued within one business day. If you need to reflect the return of money to the buyer in KUDIR, then this amount must be entered in the “income” column with a minus sign.

Another nuance of filling out KUDIR according to the simplified tax system for income is filling out section IV. Since the taxpayer can reduce the amount of tax on insurance premiums using the simplified tax system for income, the amount of these contributions should be reflected in section IV of the KUDIR. The book contains information about the payment document, the period for payment of contributions, the category of contributions and their amount. Entrepreneurs in this section indicate not only contributions for employees, but also their own pension and health insurance. Based on the results of each quarter, as well as half a year, 9 months and a calendar year, results are summed up.

Let's sum it up

Each taxpayer using the simplified tax system must maintain a KUDiR, based on the data of which it calculates the tax and advance payments payable.

The composition of the KUDiR sections varies depending on the selected taxation object.

For individual entrepreneurs and organizations, the book form is the same.

It is not required to submit the KUDiR to the tax office, but tax authorities have the right to request it and the taxpayer may be fined for its absence.

Read also

20.11.2019

General rules for maintaining KUDiR

The general rules that must be followed when registering KUDiR include the need to:

- keep a separate book for each tax period, including one for which there is no data to fill out;

- enter only information relevant to tax calculations;

- maintain the chronology of records;

- provide links to the details of specific primary documents that served as the basis for each of the entries;

- prepare a paper copy of the book, regardless of which of the possible methods it was maintained (electronically or on paper);

- sew the book, number its pages, certify it with the signature of the head of the legal entity or individual entrepreneur and a seal, if used.

In what form should KUDiR be conducted?

KUDiR must be filled out according to the approved form.

The form and procedure for filling out the KUDiR for the simplified tax system were approved by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n (hereinafter referred to as Order No. 135n).

Next, using a direct link, you can download the KUDiR for free, current for 2019-2020:

The KUDiR form is the same for organizations and individual entrepreneurs, as well as for both objects of taxation. The only differences are in the number of sections to be filled out.

KUDiR begins to be maintained from the beginning of the calendar year or from the moment the simplified taxation system begins to be applied and ends at the end of the calendar year. Starting next year, you need to start a new book.

The procedure for maintaining the book allows for both electronic and paper versions of formation. At the end of the tax period, the electronic version must be converted to paper format (clause 1.4 of Appendix No. 2 of Order No. 135n). KUDiR is printed out, the pages are numbered and laced. On the last page indicate the number of laced pages and certify with a signature and seal (if any).

There is no need to annually submit KUDiR to the tax office . KUDiR must be presented to inspectors when requested during inspection activities.