NPO reporting is a responsibility that falls on all structures of this kind. Despite the fact that such organizations are not created for the purpose of making a profit, the state closely monitors their activities. That's why they have to report. In this material we will understand what kind of reporting, where and when non-profit organizations should submit.

There are several reporting forms for non-profit organizations that are submitted to the Ministry of Justice. Their forms are approved by Order of the Ministry of Justice of the Russian Federation dated March 29, 2010 No. 72.

Accounting statements of a non-profit organization

NPOs submit accounting reports according to the general rules once a year, within the standard time frame - within 90 calendar days after the end of the reporting year. There are exceptions for non-profit organizations - consumer cooperatives. They can use simplified accounting forms from Appendix 5 to Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

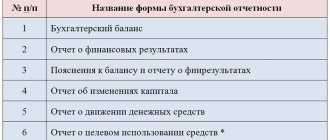

You can quickly determine the composition of financial statements for a non-profit organization using the table. For information on how to fill out accounting forms, see What documents to submit as part of financial statements.

The general rules are as follows. All NPOs hand over:

- Balance sheet;

- Report on the intended use of funds.

This is stated in paragraph 2 of Article 14 of the Law of December 6, 2011 No. 402-FZ.

Plus, some non-profits submit a financial performance report. This should be done when:

- The NGO received significant income from business activities;

- It is impossible to assess the financial position of an NPO without an indicator of the income received.

In all other cases, the NPO reflects data from business activities in the report on intended use in the line “Profit from income-generating activities.” But if this is not enough to reflect the financial position of the nonprofit, submit an income statement. This is stated in the information of the Ministry of Finance of Russia No. PZ-10/2012.

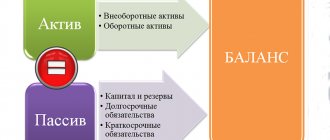

Balance sheet

Non-profit organizations fill out the balance sheet in a special way (see general instructions for filling out the Balance Sheet). Some sections need to be renamed. For example, Section III should be called not “Capital and Reserves”, but “Targeted Financing”. After all, a non-profit organization does not have the goal of making a profit. Instead of capital and reserves, NGOs reflect the balance of earmarked revenues. The balance sheet lines that NPOs must replace in Section III are named in the table below.

| Code of the balance line whose name of the non-profit organization needs to be replaced | Line names for commercial organizations | NPO line names |

| Section III of the Balance Sheet “Capital and Reserves” | Section III of the Balance Sheet “Targeted Financing” | |

| 1310 | Authorized capital | Unit trust |

| 1320 | Own shares purchased from shareholders | Target capital |

| 1350 | Additional capital (without revaluation) | Targeted funds |

| 1360 | Reserve capital | Fund of real estate and especially valuable movable property |

| 1370 | Retained earnings (uncovered loss) | Reserve and other target funds |

This procedure is prescribed in Note 6 to the Balance Sheet and in Note to Appendix 4 of Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010.

Cash flow statement

The cash flow statement of NPOs is not included in the financial statements. This is directly stated in paragraph 85 of the regulation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n.

Other reports

There are special features for funds. They are required to annually publish reports on the use of their property (clause 2 of article 7 of the Law of January 12, 1996 No. 7-FZ).

Reporting principles

All types of reports are prepared on the basis of information obtained from existing organizational (for the report on the constituent composition) and accounting documents.

They must clearly and clearly reflect the essence of the processes that took place and completed operations without unnecessary detail. The list of information required by the Ministry of Justice is also published on the official website, and its independent expansion is not very welcome.

All reports must be prepared on official forms (or in online form on the official website), submitted to the appropriate departments and within the prescribed period.

Tax reporting

All non-profit organizations are required to submit information about the average number of employees to the tax office. This needs to be done even if there are no employees. In addition, all non-profit organizations are required to submit certificates in form 2-NDFL for each employee and calculations in form 6-NDFL.

For more information on this topic, see:

- What rights and responsibilities do taxpayers have;

- How to correctly fill out the certificate form 2-NDFL;

- How to draw up and submit a calculation using Form 6-NDFL.

As for the rest, the composition of tax reporting in NPOs depends on the tax regime.

Results

Thus, the reporting submitted by NPOs is somewhat different from the reporting that commercial enterprises must submit. Non-profit organizations can submit financial statements in a simplified form, and also detail balance sheet items in accordance with individual characteristics. Separately, NPOs must submit special reports to the Russian Ministry of Justice.

Non-profit organizations (hereinafter referred to as NPOs), like all organizations, must submit accounting, tax, statistical reporting, as well as reporting on insurance premiums. There is also special reporting for NPOs - to the territorial branch of the Russian Ministry of Justice.

Tax reporting: OSNO

Non-profit organizations submit tax reports under the general regime, which is mandatory for all organizations.

Income tax

All NGOs are required to file an income tax return. This obligation does not depend on whether there is taxable income or not. This conclusion follows from Article 246 and paragraph 1 of Article 289 of the Tax Code of the Russian Federation.

For NPOs that do not have a profit, there are special features. They submit a declaration only once a year in a simplified format:

- Title page (sheet 01);

- Calculation of corporate income tax (sheet 02);

- Report on the intended use of property (including funds), works, services received as part of charitable activities, targeted income, targeted financing (sheet 07);

- Appendix No. 1 to the tax return.

This follows from Article 285 and paragraph 2 of Article 289 of the Tax Code of the Russian Federation, paragraph 1.2 of the Procedure approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

If a non-profit organization makes a profit, the declaration must be submitted quarterly. At the same time, NPOs do not pay advance payments if sales revenues for the previous four quarters did not exceed an average of 10 million rubles. for each quarter (clause 3 of Article 286 of the Tax Code of the Russian Federation).

VAT

Non-profit organizations under the general regime are required to submit a VAT return quarterly in accordance with the general procedure. If there is no object subject to VAT, submit only the title page and section 1 (clause 3 of the Procedure approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558).

An NPO can submit a single (simplified) tax return, which was approved by Order of the Ministry of Finance of Russia dated July 10, 2007 No. 62n, only if it does not simultaneously have:

- object of VAT taxation;

- transactions on current accounts.

Property tax

Non-profit organizations under the general regime submit property tax returns quarterly, in accordance with the general procedure. The exception is organizations that do not have fixed assets. The procedure for filling out a property tax return is set out in the article.

Since NPOs do not charge depreciation, on lines 020–140 of section 2 of the declaration, indicate the difference between the balance of account 01 “Fixed Assets” and the amount of depreciation on off-balance sheet account 010 (clause 1 of Article 375 of the Tax Code of the Russian Federation).

As for other tax returns, the obligation to submit them depends on whether the NPO has an object subject to the corresponding tax.

Deadlines for submitting reporting forms

For non-profit organizations, when preparing reporting documents, methods of submitting them to regulatory authorities through a personal visit, mail or TKS are relevant. The latter option is available for those institutions that have issued a qualified digital signature.

Reporting forms must be submitted to the Ministry of Justice by representatives of NPOs by April 15. The generated set of financial statements is accepted from the business entity in compliance with deadlines - before the end of the three-month interval counted from the end of the reporting year.

These standards are also relevant for a simplified set of accounting reporting documentation, for the provision of written explanations and transcripts to individual articles of reporting forms.

The VAT return form is prepared on a quarterly basis. It must be submitted by the 25th day of the month following the reporting period. For property tax obligations, a declaration is submitted to the Federal Tax Service once a year. It will be completed within 3 months after the end of the period under review. A separate form is submitted for advance payments made on a quarterly basis.

Income tax reporting must be done monthly or quarterly. 28 calendar days are allotted for preparation. For tax obligations on land plots, the declaration is submitted by February 1 after the end of the annual reporting interval. Similar time frames are set for transport tax. Tax authorities collect information on the SSC before January 20 of each year for the previous period. The declaration under the simplified tax system is submitted once a year until the end of March. The obligation to submit it is established for enterprises even in situations where they actually had no income.

IMPORTANT! Statistical forms that non-profit structures must compile and submit to Rosstat divisions serving their territory are submitted taking into account the deadline of April 1 in the year following the reporting period.

NPOs using the simplified tax system - what kind of reporting to submit is a question that all non-profit organizations using the simplified tax system face in the first year of operation. NPOs, like commercial companies, must submit reports to government authorities on time. Let us consider in more detail in our material the features of submitting NPO reports using a simplified approach.

Tax reporting: simplified tax system

NPOs submit simplified reporting, which is mandatory for all organizations. In addition, simplified NPOs annually submit to the tax office a declaration on the single tax they pay (clause 1 of Article 346.12 of the Tax Code of the Russian Federation). Moreover, the obligation to submit declarations does not depend on whether there were income and expenses in the reporting period or not.

This conclusion follows from the provisions of paragraph 1 of Article 346.19 and paragraph 1 of Article 346.23 of the Tax Code of the Russian Federation.

In addition, simplified NPOs are required to keep a book of income and expenses. This is stated in Article 346.24 of the Tax Code of the Russian Federation and paragraph 1.1 of the Procedure approved by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n.

For more information on this topic, see:

- How to draw up and submit a single tax return under simplification;

- How to keep a simplified book of income and expenses.

Simplified NPOs do not pay income tax, property tax and VAT (Clause 2 of Article 346.11 of the Tax Code of the Russian Federation). Therefore, a non-profit organization is not required to submit returns for the listed taxes. But there are exceptions to this rule:

- NGOs that have property taxed at cadastral value (clause 2 of Article 346.11 of the Tax Code of the Russian Federation) pay tax on this property and submit a declaration on it in the general manner;

- non-profit organizations - tax agents for VAT, which, for example, rent state or municipal property (clause 3 of Article 161 of the Tax Code of the Russian Federation), are required to withhold and transfer VAT and submit a declaration.

Statistical reporting

NPOs are required to prepare statistical reports (clause 1, article 32 of the Law of January 12, 1996 No. 7-FZ). There are special forms for non-profit organizations:

- 11-short, approved by order of Rosstat dated July 3, 2015 No. 296;

- 1-SO NPO, approved by order of Rosstat dated August 27, 2014 No. 535.

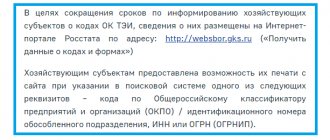

The composition of statistical reporting depends on the type of activity of the NGO. It is better to check the exact list of forms for NPOs with your local statistics department.

For more information on this topic, see:

- Who is required to submit statistical reports to Rosstat;

- What documents are included in statistical reporting;

- How can you submit statistical reports?

NPO reporting to the Russian Ministry of Justice

NPOs submit reports to the territorial office of the Ministry of Justice of Russia according to reporting forms approved by Order of the Ministry of Justice of Russia dated March 29, 2010 No. 72. This order contains four forms that need to be filled out. See the table for the composition of the reporting.

The reporting of non-profit organizations to the Ministry of Justice makes it possible to control that the organization does not have foreign citizens among its members, as well as foreign sources of funding.

This requirement is stated in Part 3.1 of Article 32 of the Law of January 12, 1996 No. 7-FZ.

Methods for providing electronic reporting

As stated above, non-profit organizations have the right to submit reports in both printed and electronic forms. Moreover, if we rely on existing forecasts, in the near future all non-profit organizations will be transferred to a single method of submitting reports - electronic document management with government bodies. Let's take a closer look at how this happens. To submit a report to the Ministry of Justice in electronic form, you must first register on the official website, then log into your personal profile account. This is where you have the opportunity to provide information about the NPO you represent and submit reports using one of the available methods:

- Download an already compiled report in MSExcel format.

- Manually fill out the online report form.

All the necessary forms and forms to fill out on the computer are also available in your personal account. This service was first launched in 2010. So, at the moment, it is fully developed and works stably, saving the time and effort of many accountants.