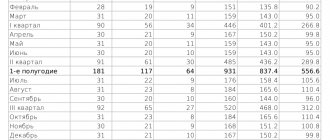

Form P-4 is a form for statistical accounting of enterprises and organizations in which information is entered

Providing closing documents is the direct responsibility of business entities participating in contractual relations. These documents

Everyone must pay taxes. These include not only companies and individual entrepreneurs, but

When it becomes necessary to adjust Situations in which it is necessary to adjust amounts after delivery, in

Tax period is a code that allows you to quickly and accurately determine the time for which

Excise tax is a special tax that is levied on certain types of goods and transactions with these goods.

The Tax Code of the Russian Federation does not contain the concept of “zero reporting”, but most often it means

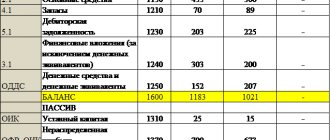

Form 5 of financial statements: general information Form 5 involves filling out the tabular elements of the appendix to

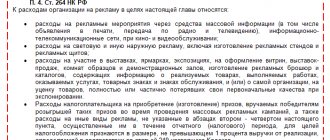

What is the difference between standardized and non-standardized advertising expenses Advertising expenses, which are taken into account for tax purposes, are divided

Home / Labor Law / Payment and Benefits / Wages Back Published: 07.17.2020