Form 5 of financial statements: general information

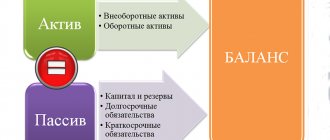

Form 5 involves filling out the tabular elements of the balance sheet appendix for groups of assets that are classified according to the criterion of financial affiliation. The connection between the contents of the balance sheet and Form 5 is direct - the balance sheet acts as the main document, and the appendix to it performs the function of detailed transcripts of generalized indicators.

The peculiarity of filling out the tables in the appendix to the balance sheet by structures using a simplified accounting system is that they reflect the most significant indicators in Form 5. The main factor of significance for such a group of organizations is the possibility or impossibility of assessing the general financial condition. However, they do not have to fill out this form.

The amount of detailed information on the balance sheet in the tabular blocks of the application should correlate with the amount of information contained in the lines of the completed balance sheet. When creating a balance, links to explanatory documents for a specific position are provided. Form 5 does not provide an exhaustive list of indicators. Therefore, for example, when reflecting cash values in the balance sheet, a link to the cash flow statement is created in the explanation column, since Form 5 does not detail this position.

Cash flow statement - form No. 4

The report contains information on the annual movement of financial flows in terms of receipts, expenditures, lending, invested activities and other areas of the company. Disclosure of indicators should be carried out taking into account balances at the beginning and end of the calendar year in the currency of the Russian Federation (rubles). If a non-profit enterprise makes payments in foreign currency, then the report indicators are subject to conversion (recalculation) into rubles at the exchange rate on the date of preparation of the financial statements.

Reporting in Form 4 does not include the following types of cash flow amounts:

- investments of funds related to investing in government securities, bills, shares and other cash equivalents;

- cash receipts from the repayment of cash equivalents excluding interest and payments accrued during the period of use;

- currency exchange transactions without taking into account exchange rate differences (profit or loss);

- transactions for the exchange of cash equivalents without taking into account gains and losses during the exchange;

- transfer of funds of the organization between its current accounts;

- write-off operations to receive cash from the company’s current account;

- other similar cash flows.

A detailed filling algorithm is presented in the regulations according to BU 23/2011 (Order of the Ministry of Finance of the Russian Federation dated 02.02.2011 No. 11n). The text is posted on the official website of the Ministry of Finance.

The report is a collection of tables, the data of which is a detailed explanation of the lines of the organization’s balance sheet. The absence of a form or an error in a document leads to a direct distortion of the financial statements and the impossibility of a real assessment of the results of the financial activities of the NPO.

Form 5 (attachment to the balance sheet): example of completion

The nuances of filling out Form 5 can be seen using an example. The company Globus LLC has the following completed balance sheet lines:

- cost indicators for fixed assets minus depreciation, consisting of production and office equipment, the cost of which changed during the year);

- the amount of reserves (in the presented value of the indicator there are no assets pledged);

- the volume of accounts receivable, which is represented only by short-term loans, the company did not create a reserve for doubtful debts;

- available financial investments;

- monetary resources;

- authorized capital;

- the value of the organization's retained earnings indicator;

- the total amount of outstanding accounts payable formed under agreements with counterparties; there are no long-term liabilities in the total amount.

The appendix to the balance sheet will disclose details on those lines that contain links to the corresponding tabular parts of Form 5:

- 2.1;

- 3.1;

- 4.1;

- 5.1;

- 5.3.

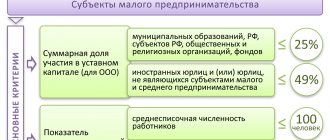

Who is obliged to draw up

Filling out the notes to the balance sheet is mandatory for all organizations that maintain accounting. An exception is organizations that have the right to use simplified forms of accounting and reporting. For example, these are small enterprises that are not subject to mandatory audit, as well as most non-profit organizations (clause 6 of Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n, parts 4 and 5 of Article 6 of Law dated December 6, 2011 No. 402 -FZ).

This is the general procedure for filling out the notes to the balance sheet. However, there are situations when small businesses must draw up explanations. For example, if an organization makes changes to its accounting policies. In this case, the relevant information must be provided in additional information as part of the explanations.

forma_5_obrazec.png

To detail the values of amounts for fixed assets, section 2 of the application is used, consisting of 4 blocks. The fact that the balance sheet contains a reference only to Table 2.1 indicates that during the reporting period the enterprise did not have cases of additional equipment, liquidation, or completion of fixed assets, and there are no assets in the form of unfinished capital construction.

Document form

Explanations can be made in text and (or) tabular form. They are usually presented in table form. You can decide what to include in such a table yourself, taking into account Appendix 3 to Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010 (clause 4 of Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010).

If you are filling out such Explanations for the statistics department or tax office, then after the column “Name of the indicator”, additionally enter the column “Code” into the tables. Enter line codes in accordance with Appendix 4 to Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010. This procedure follows from paragraph 5 of Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010.

Purposes and procedure for using the document

The book is kept by the senior cashier of the central division of the business entity. In the document, he notes the fact of transferring money to cashiers of other departments. Cash is issued at the beginning of the shift, and this fact is then noted in the book using the KO-5 form. The amount of the amount issued must correspond to the economic needs of the unit. In a situation where at the end of a working day or shift the money has not been completely spent, the balance is returned to the main cash register. This action is also recorded in the document.

The book allows you to quickly determine how much cash was issued and accepted, how much was left at the end of the working day, and how much the organization received in revenue.

For your information! The document was created and approved by Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88.

State aid

The section consists of one table, which reveals information on the following lines of the Balance Sheet:

- line 1410 “Borrowed funds”;

- line 1510 “Borrowed funds”;

- line 1530 “Deferred income”.

In the table, disclose information on received budget funds and loans for the reporting year and for the previous year (paragraph 1, clause 22 of PBU 13/2000). Disclose the amounts of budget loans in terms of their intended purpose (paragraph 2, clause 22 of PBU 13/2000).

Explanations in text form

It is advisable to include essential information in the text part of the explanations:

- about your company;

- about her financial situation;

- on the comparability of data for the reporting and preceding years;

- on valuation methods and significant items of financial statements;

- about deviations from the accounting rules, if following them did not allow you to reliably reflect the property status and financial results of your company (clauses 6 and 37 of PBU 4/99);

- about changes in the company’s accounting policies for the next reporting year;

- about financial activities, for example about the purchase of shares in other enterprises;

- about the investment activities of the company, for example, about the development of the material and technical base;

- on subsidiaries and dependent companies (Articles 105 and 106 of the Civil Code of the Russian Federation);

- about the reorganization of the company;

- about events after the reporting date.

Information about the company's activities

In this section you can give:

- a brief description of the size and structure of the company;

- a brief description of its usual activities;

- sales volumes of products, goods, works, services by type and geographic markets;

- data on emergency facts of economic activity and their consequences;

- information about the organization’s business activity;

- resource efficiency indicators, etc.

If possible, present the information over time (over several years). In this case, indicate the factors that influenced the financial results of the company in the reporting year.

The size of a company (scale of business) can be partly judged by the size of its authorized capital, number of employees, size of production space and other resources.

Briefly describe the production structure of the organization: its production, workshops, services, as well as separate divisions, including branches and representative offices.

When characterizing the company's activities by type, do not skimp on details. Provide information:

- on the range and volumes of products produced (work performed, services provided) for the reporting and previous years;

- about the directions of its investments;

- about plans to expand or change the industry and type structure of the company’s activities.

When disclosing information on sales volumes of products (goods, works and services) by type, provide not only general data, but also information broken down by the main geographic sales areas.

If extraordinary events occurred in the past year, describe them in the explanations. This could be a fire, flood, technological accident, theft of property and other similar situations.

Also reflect the economic consequences of these incidents: the amount of direct damage and liquidation costs, the amount of compensation received from guilty citizens and organizations or from insurance companies, etc.

The following data indicates the business activity of the company:

- the presence of contracts for export supplies, indirectly confirming the quality of products (works, services) and the breadth of sales markets;

- the presence of well-known clients purchasing the company’s products, works and services;

- participation of the company in research and development work, the effectiveness of such activities;

- carrying out environmental and other similar activities.

Production costs

The “Production Costs” section is presented in one table, which discloses information on the following lines of the Income Statement:

- line 2120 “Cost of sales”;

- line 2210 “Business expenses”;

- line 2220 “Administrative expenses”.

In the table “Production costs”, disclose information about the composition of costs in the context of their elements (paragraph 12, paragraph 27 of PBU 4/99, paragraph 2, paragraph 22 and paragraph 8 of PBU 10/99). Indicate the cost amounts for two periods: the reporting period and the previous period.

Accounts receivable and payable

In this section, disclose information on the following lines of the Balance Sheet:

- line 1230 “Accounts receivable”;

- line 1410 “Borrowed funds”;

- line 1450 “Other obligations”;

- line 1510 “Borrowed funds”;

- line 1520 “Accounts payable.”

The section consists of two tables for information on accounts receivable and two for accounts payable.

In table 5.1 “Availability and movement of accounts receivable” for long-term and short-term accounts receivable by their types, indicate information on the availability of accounts receivable at the beginning and end of the period, its changes during the period (receipt, disposal), as well as information on the reserve for doubtful debts

In the column “At the beginning of the year”, reflect in aggregate the debit balance of accounts 60, 62, 66, 67, 68, 69, 70, 71, 73, 75, 76 as of January 1 of the reporting year.

In the “At the end of the period” column, indicate the balance of accounts receivable as of the end of the reporting year.

In the “Changes during the period” column, reflect the receipt and disposal of debts, as well as the transfer of debt from long-term to short-term.

Indicate the amounts of receivables in full according to the terms of the contracts (i.e., without taking into account the reserve for doubtful debts created for it) (clause 35 of PBU 4/99).

In Table 5.2, Overdue Receivables, disclose information on overdue receivables (that is, debts that have expired) as of the reporting date and as of December 31 of the previous two years. Indicate the amounts of debt by type in two estimates: according to the terms of the contracts (i.e., in full) and in the balance sheet estimate (i.e., minus the reserve for doubtful debts created for it).

An example of how to prepare explanations for the Balance Sheet and the Statement of Financial Results regarding accounts receivable

Before preparing the annual financial statements, the accountant of Alpha LLC carried out an inventory of accounts receivable.

Data for 2015

On the debit of account 62:

- 400,000 rub. – debt for goods shipped to Delta on December 27, 2014 under supply contract No. 125 dated December 20, 2014 (payment due until February 1, 2021) – current, short-term debt;

- 50,000 rub. – debt for goods shipped to Gamma on May 21, 2015 under supply contract dated May 16, 2015 No. 86 (payment due until June 1, 2015); – debt is overdue, short-term, doubtful (not secured by guarantees), a reserve was created for doubtful debts;

- 50,000 rub. – debt for goods shipped to Omega on April 5, 2015 under supply contract dated March 31, 2015 No. 67 (payment due until June 1, 2015); – debt is overdue, short-term, doubtful (not secured by guarantees), a reserve was created for doubtful debts;

- 100,000 rub. – debt for goods shipped to Beta on October 10, 2015 under supply contract No. 95 dated October 1, 2015 (payment period until December 31, 2015) – the debt is overdue, short-term, a reserve for doubtful debts was not created.

On the credit of account 62:

- 50,000 rub. – the debt for goods shipped to Gamma on May 21, 2012 under the supply agreement dated May 16, 2015 No. 86 was repaid;

- On June 29, 2015, Gamma paid the debt in full. The provision for doubtful debts was restored in the amount of RUB 50,000;

- 50,000 rubles – the debt for goods shipped to Omega on April 5, 2015 under the supply agreement dated March 31, 2015 No. 67 was written off from the reserve for doubtful debts.

“Alpha” carried out claims work and tried to collect the debt from “Omega” in court. It was not possible to collect the debt. On November 6, 2015, Omega was declared bankrupt by a court decision. As a result, this receivable was recognized as uncollectible and was written off in December 2015 against the provision for doubtful debts;

- 100,000 rub. – the debt for goods shipped to Beta on October 10, 2015 under the supply agreement dated October 1, 2015 No. 95 was repaid;

- On February 1, 2015, Beta paid the debt in full.

On the debit of account 76:

- 1,000,000 rub. – debt under the interest-free loan agreement dated July 19, 2015 No. 1 with A.S. Kondratyev (loan issued on July 19, 2015 for a period until July 18, 2021, repaid in a lump sum in full upon expiration of the contract) – current, long-term debt.

On the debit of account 60:

- RUB 1,500,000 – an advance payment was transferred under the supply agreement No. 55 dated December 22, 2015 with Hermes (delivery period of goods until January 20, 2021) – the debt is current, short-term.

There are no other types of receivables.

On the debit of account 63:

- 50,000 rub. – the reserve for Gamma’s debt under the supply agreement dated May 16, 2015 No. 86 was restored;

- 50,000 rub. – Omega’s debt under the supply agreement dated March 31, 2015 No. 67 was written off from the reserve.

Total as of December 31, 2015:

- accounts receivable accounted for under contracts – RUB 2,900,000, including:

- 400,000 rub. – customer debt (short-term);

- RUB 1,500,000 – debt of suppliers (short-term);

- 1,000,000 rub. – debt on interest-free loans issued (long-term);

- amount of reserve for doubtful debts – 0 rub.;

- balance sheet data on line 1230 “Accounts receivable” – RUB 2,900,000. (RUB 400,000 + RUB 1,500,000 + RUB 1,000,000).

Data for 2014

On the debit of account 62:

- 50,000 rub. – debt for goods shipped to Gamma on May 21, 2014 under supply contract dated May 16, 2014 No. 86 (payment due until June 1, 2014); – debt is overdue, short-term, doubtful (not secured by guarantees), a reserve was created for doubtful debts;

- 50,000 rub. – debt for goods shipped to Omega on April 5, 2014 under supply contract dated March 31, 2014 No. 67 (payment due until June 1, 2014); – debt is overdue, short-term, doubtful (not secured by guarantees), a reserve was created for doubtful debts;

- 100,000 rub. – debt for goods shipped to Beta on October 10, 2014 under supply contract No. 95 dated October 1, 2014 (payment period until December 31, 2014) – the debt is overdue, short-term, a reserve for doubtful debts was not created.

There were no other types of receivables.

On the credit of account 63:

- 50,000 rub. – a reserve for doubtful debts was created in relation to Gamma’s debt under the supply agreement dated May 16, 2014 No. 86.

Total as of December 31, 2014:

- accounts receivable accounted for under contracts – RUB 200,000. (customer debt, short-term), including overdue – RUB 200,000. (book value – 100,000 rubles);

- amount of reserve for doubtful debts – 100,000 rubles;

- balance sheet data on line 1230 “Accounts receivable” – 100,000 rubles. (200,000 rub. – 100,000 rub.).

Data for 2013

On the debit of account 62:

- 50,000 rub. – debt for goods shipped to Gamma on May 21, 2013 under supply contract No. 86 dated May 16, 2013 (payment due until June 1, 2013) – the debt is overdue, short-term, a reserve for doubtful debts was not created;

- 50,000 rub. – debt for goods shipped to Omega on April 5, 2013 under supply contract dated March 31, 2013 No. 67 (payment due until June 1, 2013); – debt is overdue, short-term, doubtful (not secured by guarantees), a reserve has been created for doubtful debts.

According to the terms of the agreements with Omega and Gamma, interest is not provided for late payments.

There were no other types of receivables.

On the credit of account 63:

- 50,000 rub. – a reserve for doubtful debts was created in relation to Omega’s debt under the supply agreement dated March 31, 2013 No. 67.

Total as of December 31, 2013:

- accounts receivable accounted for under contracts - 100,000 rubles. (customer debt, short-term), including overdue – RUB 100,000. (book value – 50,000 rubles);

- the amount of reserve for doubtful debts is 50,000 rubles;

- balance sheet data on line 1230 “Accounts receivable” – 50,000 rubles. (100,000 rub. – 50,000 rub.).

Based on these indicators, the accountant deciphered the data in the section “Accounts receivable and payable” of the Explanations to the Balance Sheet and the Statement of Financial Results.

Fill out Table 5.3 “Availability and movement of accounts payable” separately for long-term and short-term accounts payable by their types. Disclose information on debt balances at the beginning and at the end of the period, changes during the period (receipt, disposal) with the distribution of amounts of accounts payable arising within the framework of business activities and from accrued interest and fines (paragraph 10, paragraph 27 of PBU 4/99, p 2 and 17 PBU 15/2008).

In the column “At the beginning of the year”, reflect in aggregate the credit balance of accounts 60, 62, 66, 67, 68, 69, 70, 71, 73, 75, 76 as of January 1 of the reporting year.

In the “At the end of the period” column, indicate the balance of accounts payable as of the end of the reporting year.

In the “Changes during the period” column, reflect the receipt and disposal of debts, as well as the transfer of debt from long-term to short-term.

In table 5.4 “Overdue accounts payable,” disclose information on the balances at the end of the reporting period and as of December 31 of the previous two years of overdue accounts payable (i.e., debt that has expired) by type.

What is the importance of accounting explanations?

An accountant is also a financial specialist in order to see much greater meaning behind the dry numbers on the balance sheet. However, for other interested parties - a bank making a decision about the reliability of the borrower, an investor assessing the profitability of investments, a shareholder making management decisions - everything is not so obvious. To get a more comprehensive and clear picture of the company's financial situation, users can read the notes to the balance sheet (formerly Form 5 of the balance sheet appendix).

Simplified organizations can submit a shortened application without a detailed transcript. The main thing is that the information presented always satisfies the basic principles of reporting, which include relevance, materiality, reliability, reliability, usefulness, etc.

Intangible assets and R&D expenses

In this section, disclose information on the following lines of the Balance Sheet:

- line 1110 “Intangible assets”;

- line 1120 “Results of research and development”;

- line 1190 “Other non-current assets”.

The section “Intangible assets and R&D expenses” consists of five tables.

In Table 1.1 “Availability and movement of intangible assets”, disclose information on the original cost and accumulated depreciation (at the end and at the beginning of the period), receipts and disposals for the period, the results of revaluation, as well as information on the value of intangible assets subject to impairment in the reporting year , the amount of impairment loss recognized. Reflect the data both in general for all intangible assets and in the context of their individual types (paragraph 2, 3, 6, 8, paragraph 41 of PBU 14/2007, paragraph 35 of PBU 4/99).

Indicate the data for the reporting year and for the previous one (notes 1 and 2 to Appendix 3 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

When revaluing, in the column “Original cost” the current market value or current (replacement) value is given (Note 3 to Appendix 3 to Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

In Table 1.2 “Initial cost of intangible assets created by the organization itself,” disclose information on intangible assets that the organization created independently (paragraph 11, clause 41 of PBU 14/2007). Indicate the data as of the reporting date, the previous year and the year that precedes the previous one (notes 2, 4 and 5 to Appendix 3 to Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

In Table 1.3 “Intangible assets with fully amortized cost”, indicate the name and initial cost of those tangible assets whose cost is fully depreciated, but the organization continues to use them (paragraph 9 of clause 41 of PBU 14/2007). Indicate the data as of the reporting date, the previous year and the year that precedes the previous one (notes 2, 4 and 5 to Appendix 3 to Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

In Table 1.4 “Availability and movement of R&D results”, indicate information on the amount of R&D expenses (clause 16 of PBU 17/02).

Indicate the data for the reporting year and for the previous one (notes 1 and 2 to Appendix 3 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

In Table 1.5 “Unfinished and unregistered R&D and unfinished transactions for the acquisition of intangible assets,” write down the amount of costs both in general and by type for the reporting and previous year according to:

- unfinished research and development (balance at the beginning of the year, amount of expenses for the year, amount of written-off costs that did not give a positive result, amount of expenses accepted for accounting, balance at the end of the year);

- unfinished transactions for the acquisition of intangible assets (balance at the beginning of the year, amount of expenses for the year, amount of written-off costs that did not give a positive result, amount of expenses accepted for accounting, balance at the end of the year).

Indicate the data for the reporting year and for the previous one (notes 1 and 2 to Appendix 3 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

Reserves

This section discloses information on line 1210 “Inventories” of the Balance Sheet.

The section includes two tables, information in which must be reflected by type of inventory (clause 23 of PBU 5/01).

In table 4.1 “Availability and movement of inventories”, indicate the cost and the amount of the reserve for reduction in value (at the beginning and at the end of the period), as well as changes during the period (clause 27 of PBU 5/01). In table 4.2 “Inventories as collateral”, indicate unpaid inventories and inventories as collateral under the contract (as of the reporting date) (clause 27 of PBU 5/01).