Why are they abandoning the simplified tax system?

Refusal from simplification can be voluntary or forced. We think it would be unnecessary to decipher these concepts in detail - in one case, we make a decision based on our own, and in the other, you are forced by law to abandon the simplified tax system. It’s better to take a closer look at the exact reasons why failure occurs in both options.

Voluntary refusal of the simplified tax system

Most often, entrepreneurs decide to switch to other taxation systems for the following reasons:

- problems with VAT when buying and selling;

- opening new branches or representative offices;

- the need to increase the number of employees;

- merger of companies;

- desire to join the partnership.

Of course, these are not all the reasons, but only the most common ones.

Example: A company begins to work with customers using OSNO and places its main emphasis on them. And for those, in turn, it is simply not profitable to cooperate with enterprises using the simplified tax system, because they cannot deduct VAT and therefore overpay taxes.

Forced refusal to use the simplified tax system

Forced refusal occurs due to the fact that the company loses the right to use the “simplified” system. Here are the cases in which this happens:

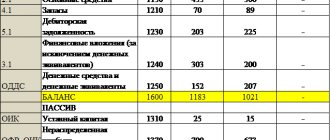

- Exceeding the income limit. When your income for the reporting period exceeds 112,500,000 rubles.

- Exceeding the residual value of fixed assets. It also should not be higher than 150,000,000 rubles in order to be eligible for the simplified tax system.

- Excess number of employees. During the reporting period, the number of employees should not exceed 100 people.

- Creation of branches. Companies with branches lose the opportunity to use the simplified tax system.

- Share of participation of other organizations. It is prohibited to apply the simplified tax system to organizations in which the share of participation of other organizations is more than 25%.

- Participation in a simple partnership agreement. Taxpayers who are parties to a simple partnership agreement (joint activity agreement) or a property trust management agreement use income reduced by the amount of expenses as an object of taxation.

Example: The company was doing well and had the opportunity to increase the number of sales points and expand production. The number of employees begins to exceed 100 people, which means that applying the simplified tax system further becomes impossible.

Refusal to apply the simplified tax system without notifying the tax inspectorate cannot serve as a basis for applying penalties to the company. Controllers think somewhat differently, which often leads to disputes. The courts often side with business. Organizations and individual entrepreneurs can switch to the simplified tax system or return to the general regime voluntarily in the manner established by the Tax Code *(1). A “simplified” person has the right to switch to a different taxation regime from the beginning of the calendar year by notifying the inspectorate no later than January 15 of the year in which he intends to switch to a different taxation regime * (2).

An organization that had been using the simplified tax system for three years switched to the general regime from the beginning of 2012, but for some reason did not send a notification to the inspectorate. At the end of the first quarter, the organization submitted a VAT return to the tax authorities, in which it declared a certain amount of tax to be reimbursed from the budget.

The controllers conducted a desk audit of the submitted declaration, as a result of which the tax refund was denied. Moreover, the inspectors made a decision against the company to hold it liable for non-payment (incomplete payment) of tax * (3). The company was charged additional VAT and fines and penalties were imposed.

The basis for the decision was the conclusions of tax inspectors about the company’s unlawful declaration of VAT tax deductions, since it applies the simplified tax system.

The company did not agree with the decision of the tax inspectorate and, after an unsuccessful attempt to resolve the dispute in a higher tax authority, went to court. Courts of all instances overturned the inspectorate's decision to hold the company liable for taxation and to refuse to reimburse VAT from the budget. The decision of the courts of first and appellate instances was approved by the FAS of the Central District * (4).

Further disputes on this issue and attempts to revise adopted judicial acts can be considered unproductive. By the ruling of the Supreme Arbitration Court of the Russian Federation, the request for a supervisory review of judicial acts in the case of invalidating the decision of the tax inspectorate in terms of additional VAT assessment was rejected and the transfer of the case to the Presidium of the Supreme Arbitration Court of the Russian Federation was refused *(5).

The Supreme Arbitration Court of the Russian Federation in its ruling, in particular, indicated that the courts correctly concluded that refusal to apply the simplified tax system is the right of the company and is of a notification nature, the company conducted business activities, prepared primary documents and submitted tax returns that comply with the general taxation system, in connection with which its use of this tax regime and VAT deductions is justified.

When refusal is not possible

Firstly, voluntary refusal of the simplified system, even if the inspectorate is notified, is impossible until the end of the tax period * (6). For example, an organization decided to voluntarily abandon the use of the simplified tax system in the middle of the calendar year, notified the tax office about this in June, then defended its position in court and predictably lost*(7).

Please note that in the situation discussed at the beginning of the article, the organization voluntarily switched to the general taxation regime from the beginning of the new tax period (calendar year), and therefore was able to successfully defend its position in court, despite the fact that it did not notify the tax authority about this.

Secondly, it is impossible to partially abandon the use of the simplified tax system for certain types of activities. Let's consider a specific situation.

An individual entrepreneur carries out retail distribution trade under supply contracts, applying the general tax system (payment of personal income tax). In relation to trade through a tent, the entrepreneur applied a system in the form of a single tax on imputed income for certain types of activities (hereinafter referred to as UTII). In 2011, he submitted an application to the tax office to switch next year from paying UTII in relation to trade through a tent to using the simplified tax system with the object of taxation “income”. The Tax Inspectorate has also transferred delivery trade to the simplified tax system. The entrepreneur’s request to remain on the general regime in 2012 in relation to delivery retail trade was refused.

The entrepreneur turned to the Russian Ministry of Finance with a request to explain why it is impossible to combine different taxation regimes. And this is the answer an individual entrepreneur received from the Russian Ministry of Finance*(8).

First of all, in this answer, attention is drawn to the position of the Russian Ministry of Finance, which boils down to the essentially permissive nature of the refusal to apply the simplified taxation system on the basis of a written notification. However, as stated at the beginning of the article, this position is not supported by the courts, and, in our opinion, the interpretation of the rules of tax law given by the court is a priority (since 2013, notification of the tax office about the transition to the general regime is a prerequisite for changing the regime).

As for the combination of different tax regimes, such a combination is possible only for UTII and the general regime or UTII and the simplified system or patent and simplified taxation systems. This is explained by the very nature of the single tax on imputed income for certain types of activities. If, under the general or simplified system, all types of activities of the taxpayer are subject to taxation, under UTII - only those that are named in the Tax Code *(9).

In conclusion, we recall that the transition from a simplified system to a general system may be mandatory. Such a transition is required if, at the end of the reporting (tax) period, the company’s taxable income exceeded 60 million rubles and (or) during the reporting (tax) period there was a discrepancy with other requirements established by law. Such a company is considered to have lost the right to apply the simplified tax system from the beginning of the quarter in which the specified excess and (or) non-compliance with other requirements occurred *(10).

How and when can you switch from the simplified tax system to the general tax regime

┌─────────────────────────────┐ │ Refusal from the simplified tax system │ └─┬ ──────────────────────┬────┘ ▼ ▼ ┌───────── ────────┴─ ──────┐ ┌───────────┴──────────────────── ─────┐ │ From the beginning of a new │ │ During the tax period ───────── ──────────┬─────────────────┘ ▼ ▼ ┌──────── ────┴───── ───────┐ ┌───────────────────┴─────────── ──────┐ │if the company notified │ │if the conditions for applying the simplified tax system have been violated, │ │about this │ │established by the Tax Code. In │ │the tax inspectorate │ │in particular: │ │ │ │ - the cost of fixed assets according to │ │ │ │accounting data exceeded │ │ │ │100 million rubles │ │ │ │ - income from the beginning of the tax period │ │ │ │exceeded 60 million rubles │ │ │ │ - the number of employees exceeded │ │ │ │100 people │ └─────────────────────── ──┘ └──── ─────────────────────────────────┘

Pros and cons of refusing the simplified tax system

| pros | Minuses |

| If we are talking about switching to OSNO, then you get a pool of clients who have not worked with you before due to the VAT issue | Accounting becomes more difficult for you |

| You can expand your staff and recruit more than 100 employees | Additional specialists may be required for proper reporting |

| You have the opportunity to join the partnership | You will need to pay VAT, property tax and income tax. |

The procedure for refusing the simplified tax system

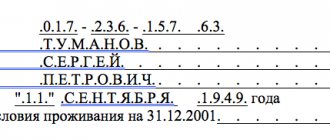

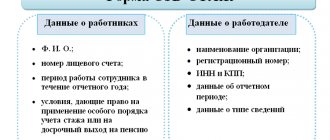

First, you need to notify the tax authority of the refusal. The application is submitted at the place of registration, if we are talking about an individual entrepreneur, or at the location, if a legal entity wants to issue the refusal. The notification is filled out in accordance with the established form No. 26.2-3 (). The form must indicate the full name of the entrepreneur or the name of the organization, as well as the date from which the taxpayer plans to switch to another tax regime.

Deadline for refusal of the simplified tax system

The application for refusal can be submitted until January 15 of the year in which you decide to switch to another regime.

Take notice deadlines seriously! If you are late, you will have to wait until next year.

Income tax

When changing the taxation system, the former “simplified” must take into account a number of “transitional” points. If the taxpayer calculates income and expenses using the cash method (Article 273 of the Tax Code of the Russian Federation), then in the month when the transition to the general taxation system is made, no “transitional” rules need to be taken into account.

However, when using the accrual method (Articles 271, 272 of the Tax Code of the Russian Federation), the procedure established in paragraph 2 of Art. 346.25 Tax Code of the Russian Federation:

- previously unaccounted for (unpaid) revenue from the sale of goods (performance of work, provision of services, transfer of property rights) is recognized as income;

- Expenses include previously unaccounted for (unpaid) expenses for the purchase of goods (work, services, property rights).

In other words, if income and expenses were taken into account in the “simplified” tax base, then they are not taken into account again (clause 2 of Article 346.25 of the Tax Code of the Russian Federation), and on the contrary, if income and expenses were not taken into account in the base, then they are subject to accounting when general taxation system.

Thus, when determining the income tax base, the former “simplifier” takes into account as part of his income the amount of debt owed by customers for the goods he sold in the first reporting (tax) period, regardless of the time of repayment of the debt. And expenses are recognized as expenses of the month in which the taxpayer switched to calculating the income tax base using the accrual method. At the same time, the income should not include amounts of accounts payable that were formed on the date of transition to the general taxation regime for goods received by the organization during the period of application of the simplified tax system with the object of taxation in the form of income (letter of the Ministry of Finance of Russia dated April 4, 2013 No. 03- 11-06/2/10983).

How not to make a mistake when choosing a tax regime?

It is most effective to contact a company that professionally provides consulting services on tax payments and reporting or immediately order full support. We invite you to visit us!

Why do they trust us?

- Extensive work experience. It helps us know in advance all the pitfalls of taxation and reporting, as well as avoid many common mistakes.

- Multidisciplinary. We employ not only accountants, but also lawyers.

- Services from a team of specialists. You do not depend on one person and receive multi-level verification of work.

Call us at the phone number listed on the website or fill out the feedback form so that the company’s employees can advise you on the exact cost and tell you how to start cooperation.

Sample notification of termination of simplified tax system 2021

Compared to 2021, the notice of termination of the simplified tax system 2021 has not undergone any changes. The same standard form is filled out and submitted to the territorial branch of the Federal Tax Service. Form 26.2-8 was established by order of the Federal Tax Service in 2012. A sample notification of termination of the simplified tax system can be found at the link below

.

It is important to know not only how to send a notice of termination of the simplified tax system, but also how further interaction occurs. Regardless of whether the entrepreneur delivers the application personally, asks for it to be handed over to a proxy, or sends it by mail, all the same, only the delivery mark on the second copy remains. The application is for notification purposes only; no verification by tax specialists is required.

If you meet the deadlines and fill out the form correctly, the Federal Tax Service accepts the application, and the special regime ceases to operate without any punitive consequences.