Part of the income received in the bank accounts of enterprises (organizations, institutions) is not related to their core activities. For tax purposes they are called “non-operating income”. When calculating the amount of income tax, such income is taken into account in a separate line. In this article we will look at how accounting and tax accounting of other income is carried out.

Income received by the income tax payer from sources not related to the main activity is called non-operating income.

In accordance with the requirements of the Tax Code, to account for income not included in the list of Article 249 (income from sales), a separate article is used - 250th. The list of other income (this is the name that should be used in accounting) is given in PBU 9/99:

- income received after the sale of fixed assets;

- exchange difference;

- income from the gratuitous transfer of property;

- expired contract or contract.

In addition to the above, the Ministry of Finance of the Russian Federation allows the inclusion of other revenues that are not directly related to the main activities of the enterprise. In this case, only one condition is set: before the start of the audit by the tax authority (that is, within the audited period), information about this must be included as a separate paragraph in the current order on accounting policies.

List of non-operating income

Another approach to determining this form of profit is to list the possible types of income that Art. 250 Tax Code classifies as non-operating:

- profit received from equity participation in other associations (if additional shares are purchased with dividends, then this income is excluded from non-operating income);

- penalties, fines, penalties paid to the company under contracts (or even not yet paid, but only awarded or recognized by the debtor);

- compensation received for damage or loss;

- insurance payments;

- profit from leasing or subletting tangible assets or real estate (except for those situations when this activity is the main activity for the company - then this is already income from the provision of services);

- assets received free of charge, for example, as a gift;

- past profit for the reporting year;

- the cost of surplus property credited to the balance sheet based on the results of the regular inventory;

- payment of debts on loans and deposits, the statute of limitations of which has already expired (“unexpectedly returned debt”);

- profit from differences in exchange rates;

- the result of revaluation of assets;

- some others.

Procedure for closing the 91st account

Every month, other income and expenses from account 91-01 form a balance on account 91-09, which is reflected on account 99-01, which forms the financial result. Thus, the 91st account without expansion into subaccounts at the end of each month has no balances; balances are present only in the analytics of the 91st account on subaccounts 91-1,91-2 and 91-9. If the balance on accounts 91-1,91-2 is formed during the month when other income/expenses are entered by a specialist, then the balance on account 91-9 appears when the month-closing operation is carried out, which posts to account 99-01.

If income exceeds expenses, as a result, the balance of account 99-01 will be a credit, which indicates profit; if other expenses exceed income, the balance of account 99-01 will be debited, which will ultimately increase the amount of loss. At the end of the year, when carrying out the balance sheet reformation procedure that forms account 84, the balance of account 99 is written off to account 84, determining the amount of retained profit/loss.

The financial result from sales is also written off monthly (with final turnover) from subaccount 90-9 “Profit / loss from sales” to account 99 “Profits and losses”. Thus, synthetic account 90 “Sales” does not have a balance at the reporting date.

At the end of the reporting year, all subaccounts opened to account 90 “Sales” (except for subaccount 90-9 “Profit / loss from sales”) are closed with internal entries to subaccount 90-9 “Profit / loss from sales”

An example of the formation of a financial result from sales and from the receipt of other income and expenses:

| No. | Contents of operation | Corresponding accounts | Amount (rub.) | |

| Debit | Credit | |||

| MONTHLY: | ||||

| 1 | Interest accrued on loan agreements received | 91-02 | 66-04 | 50000,00 |

| 2 | Received compensation for loss from the insurance company | 76-01 | 91-01 | 26000,00 |

| 3 | Sales income reflected | 62-01 | 90-01 | 1000000,00 |

| 4 | Selling expenses reflected | 90-04 | 44 | 500000,00 |

| 5 | The balance of the 91st account at the close of the month formed a loss from transactions with other income/expenses | 99-01 | 91-09 | 24000,00 |

| 6 | The balance of the 90th account at the close of the month formed the profit from sales | 90-9 | 99 | 500000,00 |

| AT THE END OF THE YEAR | ||||

| 7 | Account 91-01 is written off to account 91-09 | 91-01 | 91-09 | 26000,00 |

| 8 | Account 91-02 closed to account 91-09 | 91-09 | 91-02 | 50000,00 |

| 9 | Account 90-01 is closed to account 99-01 | 90-01 | 99-01 | 1000000,00 |

| 10 | Account 90-07 closed to account 99-01 | 99-01 | 90-07 | 500000,00 |

| 11 | Account 91-09 is closed on 99-01 - the loss from the operation on the 91st account is reflected | 99-01 | 91-09 | 24000,00 |

| 12 | The 99th account was written off when reforming the balance sheet - retained earnings were reflected. | 99-01 | 84 | 476000,00 |

Accounting

Clause 10 of the Accounting Regulations 9/99 establishes that the amount of proceeds from the sale of fixed assets, interest for the use of the enterprise’s finances, and income from participation in the capital of other legal entities is determined in a manner similar to income from core activities. Fines are taken into account in the amounts specified in the court decision or settlement agreement with the debtor. The value of gratuitously received assets is accepted as market value.

Creditor amounts are included in income at the price indicated in the accounting records. Other income is accounted for based on the actual amounts appearing in the accounting documentation at the time of declaration. Additional assessment of assets is carried out according to the rules established for such cases.

An example of how income received by an enterprise from renting out property is accounted for in accounting.

Dt 76.5, 62.1 Kt 91.1 – the amount of income for the leased property was accrued

Dt 91.2 Kt 68.2 – VAT charged

Dt 50.1 Kt 76.5 – accounting of cash receipts to the company’s account from the tenant of the property was made.

However, there are exceptions to the accounting rules that apply to some cases of non-core income of the enterprise. For example, fixed assets received free of charge are accounted for in account 98. That is, account 91 is used to account for income that has a direct monetary value. Ideally, the amounts of non-operating income (tax accounting) should coincide with similar income included in PBU as other income. This should be carefully monitored due to the fact that regulatory organizations have the right to verify the correctness of the attribution of income to tax and accounting records.

The difference, that is, those other accounting incomes that are not included in non-operating income for tax accounting, is the amount under Article 251 of the Tax Code. From an economic point of view, the income indicated in it does not increase the company’s benefits from directly conducting business, that is, they are not taken into account when determining the income portion and drawing up a declaration.

Other income in accounting

The list of other income is given in paragraph 7 of PBU 9/99 and is open. Other income is:

- receipts related to the provision of the organization’s assets for temporary use for a fee;

- receipts related to the provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property;

- proceeds related to participation in the authorized capitals of other organizations (including interest and other income on securities);

- profit received as a result of joint activities;

- proceeds from the sale of fixed assets and other assets other than cash (except foreign currency), products, goods;

- interest received for providing the organization's funds for use, as well as interest for the bank's use of funds held in the organization's account with this bank;

- fines, penalties, penalties for violation of contract terms;

- assets received free of charge, including under a gift agreement;

- proceeds to compensate for losses caused to the organization;

- profit of previous years identified in the reporting year;

- amounts of accounts payable and depositors for which the statute of limitations has expired;

- exchange differences;

- the amount of revaluation of assets;

- Other income.

The chart of accounts for accounting the financial and economic activities of organizations and the Instructions for its application, approved by the Order of the Ministry of Finance of Russia dated October 31. 2000 No. 94n, account 91 “Other income and expenses” is intended to summarize information on other income and expenses of the reporting period.

It is recommended to open the following sub-accounts for account 91 “Other income and expenses”:

- 91–1 “Other income”;

- 91–2 “Other expenses”;

- 91–9 “Balance of other income and expenses.”

Receipts of assets recognized as other income are recorded in subaccount 91–1 “Other income”. Subaccount 91–9 is intended to identify the balance of other income and expenses for the reporting month.

Accounting for account 91 is carried out as follows. Cumulatively during the reporting year, entries are made in subaccounts 91–1 and 91–2. Each month the balance of other income and expenses is determined by comparing the turnover in the debit of subaccount 91–2 and the credit of subaccount 91–1, which is then written off from subaccount 91–9 to account 99 “Profits and losses”. That is, account 91 does not have a balance at the reporting date.

How to account for income and expenses under securities lending agreements?

Based on Article 282.1 of the Tax Code of the Russian Federation, taxpayers are required to maintain separate tax records for securities transferred/received as part of securities loans. As with repo transactions, records must be kept for each such loan separately. At the same time, obligations (claims) to repay a loan issued/received in foreign currency arising from the borrower (lender) are not subject to revaluation due to changes in the Central Bank's official foreign exchange rates to the Russian ruble. At the same time, in order to keep records under this article, the securities loan agreement must meet two requirements:

- it provides for the payment of interest in cash;

- its validity period is no more than one year.

The financial result of concluding such an agreement should be determined not by the lender, but by the borrower. In this case, the interest to be received (paid) must be recognized by the lender as non-operating income, and the borrower – as non-operating expenses. A slightly different procedure for accounting for expenses and income is applied in the case where the loan agreement does not have a specific term for the return of securities or a loan agreement has been concluded with an open date (on demand), and more than one year has passed from the start date of the loan. Then the lender receives income from the sale of securities transferred under the loan agreement. They are calculated based on the market (calculated) price of securities, which is determined on the loan start date in accordance with Article 280 of the Tax Code of the Russian Federation. The borrower, meanwhile, for tax purposes uses non-operating income calculated on the basis of the market (calculated) value of securities at the start date of the loan. Upon subsequent sale of these securities, the costs of their acquisition are recognized as equal to the amount of income included in the tax base in accordance with Article 250 of the Tax Code of the Russian Federation. In the same way, you need to take into account expenses and income if:

- the annual term for the return of securities has been exceeded, that is, the terms of the loan agreement have been violated;

- instead of securities, the creditor received from the borrower cash or other property other than securities to fulfill obligations.

Moreover, in the event of non-fulfillment or incomplete fulfillment of obligations to return securities, taxpayers are required to use the accounting rules prescribed in paragraph 1 of Article 282 of the Tax Code of the Russian Federation for repo transactions.

What is included in non-operating income?

Income is an economic benefit received by a participant in economic relations (business) in kind or in monetary terms (clause 1 of Article 41).

All receipts to the company’s accounts that are not directly related to revenue from the sale of goods and products of its own production are considered other receipts. This category has its own definition - non-operating income.

They appear in tax accounting in accordance with the list given by the legislator in Article 250 of the Tax Code. Here is a complete list of cases when income is recognized as non-operating and is included in the income declared by the enterprise for the reporting period. Which receipts relate to non-operating income are indicated in table No. 1.

| No. | Non-operating income |

| 1 | equity participation in legal entities and organizations (dividends); |

| 2 | exchange rate differences after foreign currency transactions; |

| 3 | fines, penalties, penalties recognized by the debtor or awarded by a court decision; |

| 4 | property rental; |

| 5 | rights to use intellectual property; |

| 6 | interest on loans, credits, accounts and deposits in a bank institution; |

| 7 | restored reserves; |

| 8 | gratuitously received property or rights to it; |

| 9 | participation in a partnership; |

| 10 | newly identified income from previous periods; |

| 11 | positive difference from the revaluation of the currency value of the property; |

| 12 | fixed assets and intangible assets received free of charge under international agreements of the Russian Federation; |

| 13 | the cost of materials after dismantling (disassembling) fixed assets that are being taken out of service; |

| 14 | misuse of funds received in the form of a charitable contribution or earmarked proceeds, as well as funds aimed at creating financial reserves for radiation and nuclear safety; |

| 15 | reduction in the value of the authorized capital in the reporting period with the condition of refusal to return a certain amount of contributions to participants; |

| 16 | return of deposits previously included in the expenses of the tax base for the reporting period, starting from 01/01/2018; |

| 17 | overdue accounts payable; |

| 18 | income from transactions with derivative financial instruments (forwards, futures, options, swaps) that meet the requirements of the legislation that forms the securities market; |

| 19 | surplus inventories of goods and materials for industrial purposes after recalculation; |

| 20 | the cost of the results of operations of media products that are replaced when written off or returned; |

| 21 | profit adjustment in accordance with Articles 105.12 and 105.13 of the Code; |

| 22 | return to the donor the equivalent of property or securities in cash; |

| 23 | the difference in the amount that is subtracted from the excise tax; |

| 24 | profit of a non-resident company controlled by a resident of the Russian Federation. |

As a rule, the amount at which the above revenues are taken into account in tax accounting is similar to the accounting requirements. But there are some exceptions, for example, the sale of fixed assets with different monthly depreciation amounts.

To make it easier to comply with the requirements, the legislator has included in a separate article in the Tax Code (Article 251) income that cannot be included in the income portion when preparing the income tax return. Income corresponding to the list specified in the article cannot be considered non-operating.

Property received upon liquidation

Situation: when calculating income tax, is it necessary to include in income the property received by the founder during the liquidation of a subsidiary?

Yes need.

When an organization is liquidated, the founder receives part of the property that remains after the completion of settlements with creditors (Clause 8, Article 63 of the Civil Code of the Russian Federation).

When calculating income tax, distributed property is recognized as the income of the founder. Such income is determined based on the market price of the property received minus the actually paid value of the shares (shares, shares) (Clause 2 of Article 277 of the Tax Code of the Russian Federation).

Property received by the founder within the limits of his contribution to the authorized capital does not increase the tax base for income tax (subclause 4, clause 1, article 251 of the Tax Code of the Russian Federation). Income in the form of property received in excess of the amount of the contribution to the authorized capital is included in non-operating income and increases the tax base (letters of the Ministry of Finance of Russia dated March 6, 2014 No. 03-08-RZ/9680 and dated January 14, 2013 No. 03- 08-05). Therefore, when calculating income tax, they must be taken into account as part of non-operating income (Clause 1, Article 250 of the Tax Code of the Russian Federation). The legality of this approach is confirmed by arbitration practice (see, for example, the ruling of the Supreme Arbitration Court of the Russian Federation dated May 17, 2012 No. VAS-5633/12, the resolution of the Federal Antimonopoly Service of the West Siberian District dated January 16, 2012 No. A03-13090/2010).

In accounting, the cost of shares (shares, shares) of a liquidated subsidiary is reflected as part of other expenses (clause 11 of PBU 10/99, clause 28 of PBU 19/02). And the cost of the property received during the distribution is included in other income (clauses 6, 7, 10.1 of PBU 9/99).

An example of how transactions to receive property during the liquidation of an organization are reflected in accounting and tax accounting

Alpha is a shareholder of Proizvodstvennaya LLC and owns 50 shares with a total value of 250,000 rubles. "Master" is liquidated. As a result of the distribution of his property between shareholders, Alpha received production equipment with a market value of 300,000 rubles.

In Alpha's accounting, the value of the shares of the liquidated organization is 250,000 rubles. reflected in other expenses. At the same time, the cost of the property received in the amount of 300,000 rubles is included in other income.

Alpha's income, which is reflected in tax accounting, is 50,000 rubles. (300,000 rub. – 250,000 rub.).

Alpha's accountant made the following entries in accounting:

Debit 76-3 Credit 91-1 – 300,000 rubles. – reflects the cost of equipment received as a result of the liquidation of “Master”;

Debit 91-2 Credit 58-1 – 250,000 rubles. – the cost of shares of the liquidated organization is reflected in other expenses;

Debit 08 Credit 76-3 – 300,000 rub. – the equipment received during the liquidation of “Master” was capitalized.

Since the financial result generated in accounting (50,000 rubles) is equal to the amount of income reflected in tax accounting, the differences provided for by PBU 18/02 do not arise.

Don't forget to include these incomes in non-operating income

Taxpayers often miss out on certain types of profit, which are also considered non-operating, thereby, wittingly or unwittingly, underestimating the tax base. However, these revenues to the organization’s budget are included in non-operating income:

- interest on issued loans, deposits, promissory notes (both in relations with counterparties and with the Central Bank);

- market value of materials obtained as a result of dismantling written-off property;

- charitable contributions received by the company and targeted donations used for the stated purpose;

- assessment of written-off and returned printed products;

- correction of calculated profit due to changes in calculation methods;

- plus the difference between deductions and excise taxes.

NOTE! Understating profits due to the omission of certain items of income, committed due to intent or lack of knowledge, is fraught with troubles on the part of the regulatory tax authorities: this may well be regarded as tax evasion.

Don't make a mistake when accounting for non-operating income

Determining all profit items is a rather complex and cumbersome task in which it is not easy to avoid mistakes. Let's look at the most common difficulties that arise when recognizing non-operating income, and also analyze how to more effectively avoid them.

- Dating problems. Income tax is “tied” to a certain accounting period, usually a year. Therefore, it is very important what date a particular receipt will be assigned to. Sometimes the issue of determining the date can be controversial. For example, insurance compensation was paid - undoubtedly non-operating income. To what period should this profit be attributed? There are two different possible answers, depending on which tax calculation method the taxpayer uses:

- with the cash method, the date of transfer of funds from the insurance company will be important (clause 2 of Article 273 of the Tax Code of the Russian Federation);

with the accrual method, the key date will be the day when the insurer made the decision to pay (subclause 4, clause 4, article 271 of the Tax Code of the Russian Federation).

- Issues of reimbursement and compensation. Often, compensation obtained legally does not cover the damage received by the company. The businessman believes that since he actually suffered a loss, which was not covered by the funds received, they will not be included in profit, and therefore no tax is due on them. The letter of the law says something else: any insurance compensation is subject to taxation, even if the property cannot be restored or there is absolutely nothing to take from the person convicted of its theft (letter of the Federal Tax Service dated November 15, 2005 No. 22-2-14-2096).

- Free services. If the company was provided with certain services free of charge, this is not a personal matter of the managers at all, but a change in the balance. These services must be reflected in non-operating income at the average market value (Article 105.3 of the Tax Code of the Russian Federation). The value of the asset itself, in which the gratuitous services were “invested,” will not increase - after all, the owner did not spend his own money on it.

- Reduction of authorized capital . When the authorized capital becomes less than net assets, the resulting difference must either be divided among all participants or attributed to non-operating income. If the capital reduction is triggered by legal requirements, no adjustment is required.

- A debt that will no longer be called upon . If the creditor is overdue on your debt or the counterparty company was liquidated without demanding payment of obligations, this is again non-operating income. You should not try to hide an unexpectedly generated surplus of funds - tracking such “delays” is the responsibility of the taxpayer. If the tax office finds this, you will be charged with a violation, even if there is no director’s order to write it off (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 8, 2010 No. 17462/09).

- Money received from penalties . Any contract usually contains obligations in case of violation of any provisions. If the counterparty “got” a fine, this does not mean that your company has already automatically received this income. These funds will become accountable non-operating profit only when the debtor recognizes the required amount or there is a corresponding court decision.

The same difficulties may arise when setting the date for receipt of rental income. According to the agreement, rent is paid at one frequency or another, and the accounting date may be shifted from that specified in the agreement to the day the money is actually received.

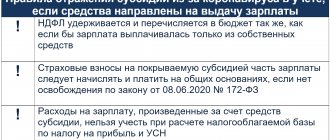

How to take subsidies into account when calculating income tax

The subsidies you receive (except for cases of receiving subsidies under a reimbursable agreement) are included in non-operating income.

The method of accounting for income and expenses (accruals or cash) does not affect the moment of recognition of subsidies. The procedure for accounting for them depends on the purposes for which the subsidies were allocated to you (clause 4.1 of article 271, clause 2.1 of article 273 of the Tax Code of the Russian Federation).

A subsidy that was paid for the purpose of acquiring (renewing) depreciable property and acquiring property rights. The accounting treatment differs depending on the financing procedure.

What is renewal of depreciated property?

Renewal of depreciated property means the creation, reconstruction, modernization and technical re-equipment of depreciable property.

If it is received to finance future expenses, then include it in income as you recognize the costs of acquiring (renewing) depreciable property or acquiring property rights from this grant.

Upon sale (other disposal) of such property or property rights, the amount of the subsidy not taken into account at this time is included in non-operating income on the last date of the reporting (tax) period in which the sale (disposal) occurred.

In the case where the subsidy was issued to compensate for previously incurred expenses, include the amount of the subsidy at a time on the date of its crediting in the amount of accrued depreciation on acquired (renewed) depreciable property or acquired property rights. The difference between the subsidy received and the amount you accounted for on the date the subsidy was accrued is reflected in income, as is the subsidy that is issued to finance future expenses.

A subsidy that is not related to the acquisition (renewal) of depreciable property or the acquisition of property rights. The procedure for its accounting also depends on the financing procedure.

If it is issued to finance future expenses, include it in income within three tax periods (including the year in which it was received) as expenses actually incurred through the subsidy are recognized. If during this time you have not taken into account the entire amount of the subsidy, then take into account the remainder of the subsidy in non-operating income as of December 31 of the third tax period.

If the subsidy was issued to compensate for previously incurred expenses, then take it into account at a time on the date of enrollment.

If the conditions for receiving subsidies that are not received within the framework of a reimbursable agreement are violated, all amounts of subsidies received are reflected in full in non-operating income of the tax period in which the violation was committed (clause 4.1 of Article 271, clause 2.1 of Article 273 of the Tax Code of the Russian Federation).

Subsidies, the payment of which is provided for in a compensation agreement , should be taken into account in the generally established manner, that is, after the provision of services or completion of work (Letter of the Ministry of Finance of Russia dated May 16, 2016 N 03-03-05/27752).

The exception is subsidies, which are not taken into account in income due to paragraphs. 14 clause 1 art. 251 Tax Code of the Russian Federation. For example, subsidies that are provided to budgetary institutions and autonomous institutions (clause 14, clause 1, article 251 of the Tax Code of the Russian Federation).

Recognition of expenses as non-operating

The importance of attributing expenses specifically to this type of expense helps in reducing the tax base for income tax.

Write-off of expenses is carried out using one of two methods, and for each the Tax Code of the Russian Federation has its own procedure:

- When using the accrual method, you need to use clause 7 of Art. 272 Tax Code of the Russian Federation;

- for the cash method , the procedure described in paragraph 3 of Art. 273 Tax Code of the Russian Federation.

The moment of recognition of expenses depends on the choice of method: in the first case, this is the date of documentary confirmation of the basis, and in the case of using the cash method, the actual occurrence of the event.

It is necessary that expenses have mandatory documentary evidence; this requirement is clearly stated in the Tax Code of the Russian Federation. What kind of confirmation this will be will have to be decided on a case-by-case basis.

For example, when writing off as a non-operating expense losses from a fire that occurred in a given period, one of the documents can serve as confirmation:

- a certificate issued by the fire service (government body);

- report from the scene of the incident;

- act of establishing the cause of the fire;

- inventory acts, etc.

What income is usually forgotten to be classified as non-operating income?

Having clarified the enormous importance of non-operating income in determining the base for calculating taxes (after all, if it is underestimated, charges of tax evasion will arise), it is worth considering situations where taxpayers, either out of ignorance or deliberately, overlook certain items of income.

So, income not received from sales includes (Article 250 of the Tax Code of the Russian Federation):

- income related to participation in other organizations (clause 1);

- positive exchange rate difference (items 2, 11);

- fines, penalties and other sanctions (including insurance compensation) awarded or recognized by the debtor, expressed in material form (clause 3);

- income from leasing property (clause 4) and granting rights to use intellectual property (clause 5), if this type of activity is not the main one, taken into account according to the rules of Art. 249 Tax Code of the Russian Federation;

- interest on deposits, loans issued, including on the Central Bank or other promissory notes (clause 6);

- income arising from the restoration of reserve amounts (clause 7);

- the cost (according to market valuation) of property or property rights received free of charge, as well as work or services (clauses 8, 12);

How to determine the amount of income from the gratuitous use of property, see here.

- income arising from participation in a simple partnership (clause 9);

- income from previous years discovered in the current period (clause 10);

- the cost of materials that were obtained during disassembly (dismantling) of assets taken out of use (clause 13);

- contributions and donations used for other than intended purposes, both within the framework of charity and aimed at targeted financing (clauses 14, 15);

- amounts of deposits in the management company that were not returned to participants when capital was reduced (clause 16);

- deposits returned from NPOs (clause 17) or donations (clause 23);

- written off accounts payable (clause 18);

- income from transactions with securities (clause 19);

- surpluses discovered during inventory (clause 20);

- the cost of written-off or returned printed products (clause 21);

- the amount of profit adjustment as a result of applying various calculation methods for tax accounting (clause 22);

- positive difference between deductions and excise taxes (clause 24);

- profit of a controlled foreign organization (clause 25).

Examples of errors in determining non-operating income

- Compensation for losses

Taxpayers often have great difficulties when calculating tax (income tax or simplified tax system) on the insurance compensation received. These amounts are quite often not taken into account by taxpayers as part of non-operating income, since they believe that, having lost property or suffered losses from an insured event and received (often only partial) compensation from the insurer, they do not have to pay tax.

But this is not so: even if, as a result of an insured event, property was completely lost or it was recognized as not subject to restoration, the insurance compensation received must be included in income and taken into account when determining the tax base. In support of this position, there are explanations from the fiscal authorities contained in the letter of the Federal Tax Service dated November 15, 2005 No. [email protected]

A similar situation arises in the case of compensation to a taxpayer who has suffered from theft for damages to those convicted of this crime.

- Free transfer

If a taxpayer receives services for the reconstruction of assets on his balance sheet free of charge, he is obliged to reflect these services as part of non-operating income. The cost of services is calculated as the market average, but not lower than the costs incurred in accordance with Art. 105.3 Tax Code of the Russian Federation. However, the taxpayer will not be able to increase the value of the assets improved as a result of the reconstruction, since he did not actually incur any costs.

- Decrease in capital

Taxpayers have many questions in situations where the size of the authorized capital (hereinafter referred to as the authorized capital) is reduced to a value less than the value of net assets. The position here is ambiguous, not only because of the existing nuances, but also due to the existing ambiguous judicial practice.

In the event of a decrease in the authorized capital and non-repayment of the cost of correction (reduction in the price of shares or shares) to participants, the tax payer company has an obligation to reflect the resulting difference in the composition of non-operating income. The arbitrators also adhere to the same position - a similar explanation can be found in the ruling of the Supreme Arbitration Court of the Russian Federation dated October 13, 2009 No. VAS-11664/09.

By paying the participants/shareholders the difference in the value of shares/shares, the taxpayer company is relieved of the obligation to accrue non-operating income from these amounts.

An exception to the rules is the situation when such a reduction of the capital (to the amount of net assets) is carried out as required by law (letter of the Ministry of Finance dated 08/06/13 No. 03-03-10/31651).

If the size of the capital decreases below the value of the company’s net assets, in any case, non-operating income will arise in the amount of this discrepancy. There is a position of the fiscal authorities on this matter (letter of the Federal Tax Service dated 09/06/12 No. AS-4-3/ [email protected] ) and positive judicial practice (resolution of the Federal Antimonopoly Service of North Kazakhstan Region dated 04/07/08 No. F08-1417/08-503A).

Although the letter of the Ministry of Finance dated 08/06/13 No. 03-03-10/31651 indicates that in this case there is no need to accrue non-operating income. Therefore, in order to avoid the emergence of controversial situations, the size of the charter capital should not be allowed to decrease below the value of net assets.

- Overdue accounts payable

Any overdue or unclaimed accounts payable by the liquidated counterparty must be reflected as part of non-operating income. At the same time, it is the direct responsibility of taxpayers to track and inventory such debt. As evidence of this position, one can cite a court decision - resolution of the Federal Antimonopoly Service of the Central District dated June 18, 2015 No. F10-1759/2015.

At the same time, the inspectors do not take into account the absence of an order from the director to write off such accounts payable while simultaneously recording the amount as income. This is stated in the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 06/08/2010 No. 17462/09.

- Penalties under the contract

The situation with the penalties specified in the contract is also ambiguous. Thus, in case of failure to fulfill contractual obligations, one of the parties has the right to impose a fine on the violator. At the same time, the specified amounts of fines are included in income only if the debtor recognizes the calculated amount of fines or there is a corresponding court decision.

The position of the inspection authorities is that if the parties have signed an agreement containing a provision for the application of penalties, then in the event of failure to fulfill obligations, the amount of the penalty is calculated automatically (letter dated August 26, 2013 No. 03-03-06/2/34843). This position was recognized by the court as illegal (decision of the Supreme Arbitration Court of the Russian Federation dated August 14, 2003 No. 8551/03).

In addition, the court decision (resolution of the 12th AAS dated February 17, 2015 No. 12AP-12462/2014) indicates that fiscal officials cannot recognize accounts payable without the necessary primary documents.

Recognition of punitive damages

Penalties are taken into account as part of non-operating income on the basis of clause 3 of Art. 250 of the Tax Code of the Russian Federation, provided that the amounts are recognized by the debtor or there is a court decision to recover from the debtor amounts of loss or damage that has entered into legal force. In a situation where there is a delay in fulfilling obligations, but the debtor’s liability has not yet been recognized, both voluntarily and in court, the amount of penalties does not form non-operating income. In other words, the presence of arrears is not the basis for the formation of non-operating income. Similar conclusions are contained in letters from the Ministry of Finance of Russia dated August 16, 2010 No. 03-07-11/356 dated December 31, 2008 No. 03-03-06/4/103 (clause 2) and the Federal Tax Service of Russia for Moscow dated January 21, 2010 No. 16-15/004664.2

Reflection in the VAT return

Differences in the amounts of income according to profit and VAT declarations may be due to the fact that the first includes income items, receipts for which to the accounts of the enterprise should not appear in the second:

- transfer of goods into ownership or use free of charge;

- fines not related to payment of the cost of goods;

- write-off of a bad creditor;

- providing a discount that is not related to a change in the price of the product;

- bank interest on the account balance;

- positive exchange rate differences;

- dividends;

- reserve restoration;

- capitalization of inventory items after dismantling or inventory.

There is no direct connection between profit reporting and VAT in terms of indicating the amounts considered in the income item of the reporting period in the latter.

This is confirmed by the form of this document of the Federal Tax Service, approved by order dated October 29, 2014 No. MMB-7-3/ [email protected] (as amended on December 28, 2018 No. CA-7-3/ [email protected] ).

But some types of receipts to the accounts of an enterprise, classified under Article 250 of the Tax Code, are still subject to VAT. In particular, one of such income is interest on loans previously received by the payer.

This amount is included by the payer in Section 7 in the period when interest was accrued, but is not the tax base. In this section, the payer reflects transactions that should not be taxed, performed outside the territory of the Russian Federation. In addition, this section may include amounts of advance payments for goods for the production of which, using approved technology, the enterprise needs to spend more than six months.

To calculate what taxes is Article 250 of the Tax Code of the Russian Federation used?

As non-operating income Art. 250 of the Tax Code of the Russian Federation recognizes such income from the taxpayer’s business activities that are not reflected in Art. 249 Tax Code. As is known, Art. 249 of the Tax Code of the Russian Federation is devoted to income from the sale of goods (products) and the provision of services (work).

The importance of non-operating income in tax accounting is difficult to overestimate, because taxes are withheld from them, just like from proceeds from the sale of goods.

Thus, the formula “income under Art. 249 Tax Code + income under Art. 250 of the Tax Code " is used when calculating the tax base when determining income tax (Articles 247, 248 of the Tax Code of the Russian Federation). This formula is also needed to determine the tax base for the simplified tax system (Article 346.16 of the Tax Code of the Russian Federation) and for the Unified Agricultural Tax (Article 346.5 of the Tax Code of the Russian Federation).

Obtaining property for the execution of a contract

Situation: when calculating income tax, does the contractor need to include in income the cost of property (for example, tools, equipment) provided by the customer for free use to perform work under a contract?

The answer to this question depends on the terms of the contract.

For tax purposes, property received free of charge is recognized as property in respect of which the receiving party does not have any counter-obligations to the transferring party (Clause 2 of Article 248 of the Tax Code of the Russian Federation).

In the situation under consideration, the contractor cannot use the received property at his own discretion: it is intended only for performing the work provided for in the contract, the results of which belong to the customer (clause 1 of Article 703 of the Civil Code of the Russian Federation). Moreover, since the property is provided for use, the contractor is obliged to return it after the execution of the contract.

There is no basis for recognizing such property as received free of charge. However, in order for the contractor to not include its cost in taxable income, the contract must establish that the work is performed at the expense of the customer (that is, with the help of tools, equipment and other property provided to the contractor for free use during the execution of the contract). This possibility is provided for in paragraph 1 of Article 704 of the Civil Code of the Russian Federation.

Thus, if the contract stipulates that the customer transfers his property for use to perform the work ordered by him, the cost of such property is not included in the calculation of the contractor’s income tax base. Similar clarifications are contained in letters of the Ministry of Finance of Russia dated September 12, 2012 No. 03-07-10/20, dated August 17, 2011 No. 03-03-06/1/496 and dated January 14, 2008 No. 03-03- 06/1/4. The legality of this approach is confirmed by arbitration practice (see, for example, decisions of the FAS Moscow District dated July 6, 2011 No. KA-A41/6674-11 and dated December 22, 2010 No. KA-A40/15811-10).

If the customer transfers property to the contractor to perform work, but the contract does not provide for such conditions, during an audit the tax inspectorate may recognize such property as received free of charge and charge the organization additional income tax.