To reduce the tax burden on the Russian population, the state uses several specially developed mechanisms that allow

Characteristics of account 75 According to the Chart of Accounts, account 75 summarizes data on

In the commercial activities of many manufacturing enterprises, there is such a thing as material costs. Not a secret,

Salary reports in 2021: to the Federal Tax Service for personal income tax and insurance contributions;

Form T-60 is standard and in official language is called a note-calculation on granting leave to an employee.

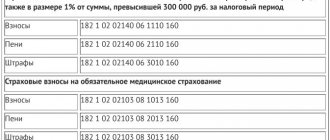

Individual entrepreneurs are required to pay insurance premiums “for themselves.” Even if there is no income, contributions

Depreciation of fixed assets is the inclusion of the cost of fixed assets in the cost of manufactured goods or

Dismissal upon expiration of the employment contract On termination of employment contract due to expiration of the term

Documentation is the main principle of accounting. Documents can be primary and accounting, then

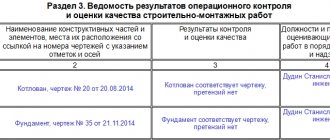

The unified form KS-6a is one of the main documents that is created to control