Enterprises and organizations use the 55 account in cases where separate accounting of funds is required, both in national and foreign currency. Today’s topic is devoted to how the designated position in the Chart of Accounts works, what kind of correspondence may take place, and what standard accounting records are kept when carrying out such operations. At the same time, we will look at examples of accounting entries when using checkbooks, how credit and debit card payments are made, as well as transactions on deposit accounts in a financial institution.

General characteristics of account 55

Account 55 in accounting is active and is called “Special accounts in banks”.

This follows from the Chart of Accounts for accounting financial and economic activities and the Instructions for its application (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n).

According to the Chart of Accounts, account 55 is intended to record information about the availability and movement of:

- funds in rubles and foreign currencies located on the territory of Russia and abroad in letters of credit, check books, other payment documents (except bills) on current, special and other special accounts;

- targeted financing funds (in that part that is subject to separate storage).

Making payments by debit card

Let’s imagine that a debit card was issued for the director of an enterprise for making payments during business trips, and therefore funds in the amount of 42,700 rubles were transferred to a special bank account.

During the next business trip, a payment for hotel accommodation was made using the designated card for a total amount of 12,700 rubles.

After the head of the enterprise returned from a business trip and provided a report, the accounting service made the following entries:

1) Dt 55

Kt 51 – 42,700 rubles, transfer of funds to the corporate account of the enterprise;

2) Dt 71

Kt 55 – 12,700 rubles, accounting for advance funds issued;

3) Dt 26

Kt 71 – 12,700 rubles, covering living expenses at the expense of travel allowances.

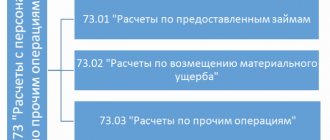

What are the subaccounts when maintaining account 55

You can open the following sub-accounts for account 55:

- 55-1 “Letters of credit”;

- 55-2 “Checkbooks”;

- 55-3 “Deposit accounts”, etc.

Let's consider each of them separately.

Subaccount 55-1 “Letters of credit”

This takes into account the movement of funds in letters of credit.

REFERENCE

When making payments under a letter of credit, the issuing bank, acting on behalf of the payer, undertakes to the recipient of funds (clause 1 of Article 867 of the Civil Code of the Russian Federation):

- make payments;

- accept and pay a bill of exchange issued by the recipient of funds;

- perform other actions to execute the letter of credit upon presentation by the recipient of funds of the documents provided for in the letter of credit and in accordance with the terms of the letter of credit.

The main typical transactions for account 55 may be as follows.

The crediting of funds to letters of credit is reflected in the debit of account 55 and the credit of accounts:

- 51 “Current accounts”;

- 52 “Currency accounts”;

- 66 “Settlements for short-term loans and borrowings”;

- other similar accounts.

Funds in letters of credit accepted for accounting under account 55 are written off as they are used (according to bank statements). Usually - in Dt 60 “Settlements with suppliers and contractors”.

Unused funds in letters of credit after restoration by the bank to the account from which they were transferred are reflected according to Kt 55 and Dt 51 or 52.

Analytical accounting for subaccount 55-1 is carried out for each letter of credit issued by the organization.

Subaccount 55-2 “Checkbooks

This shows the movement of funds in check books.

The deposit of funds when issuing check books is reflected in Dt 55 and the credit of accounts 51, 52, 66 and other similar accounts.

| Situation | Solution |

| Amounts from check books received from the bank | They are written off as checks issued by the organization are paid. That is, in the amounts of repayment by a credit institution of checks presented to it (according to bank statements) with Kt 55 to the debit of settlement accounts (76 “Settlements with various debtors and creditors”, etc.). |

| Amounts for checks issued but not paid by the bank (not presented for payment) | Remains on account 55. The balance on subaccount 55-2 must correspond to the balance on the bank statement. |

| Amounts of checks returned to the bank (remaining unused) | Reflected according to Kt 55 in correspondence with account 51 or 52 |

Analytical accounting for subaccount 55-2 is also carried out for each checkbook received.

Subaccount 55-3 “Deposit accounts”

This reflects the movement of funds invested by the organization in bank and other deposits.

| Situation | Solution |

| Transferring money to deposits | Reflected according to Dt 55 in correspondence with account 51 or 52 |

| Return of deposits by the bank | Doing reverse entries |

Analytical accounting for subaccount 55-3 is maintained for each deposit.

On separate sub-accounts to account 55, the movement of target financing funds separately stored in the bank is taken into account. In particular, received budget money, funds to finance capital investments accumulated and spent by the organization from a separate account, etc.

Typical transactions for account 55

By debit of the account

| Contents of a business transaction | Debit | Credit |

| Funds were deposited from the cash register into a special bank account | 55 | 50 |

| Funds from the current account were transferred to a special bank account | 55 | 51 |

| Funds from a foreign currency account were transferred to a special bank account | 55 | 52 |

| The funds overpaid to the supplier were returned to a special account | 55 | 60 |

| The advance paid by the supplier was returned to a special account | 55 | 60 |

| Payment from the buyer (customer) is transferred to a special account | 55 | 62 |

| An advance payment has been made for the upcoming delivery to a special account | 55 | 62 |

| Funds received into a special account under a short-term credit (loan) agreement | 55 | 66 |

| Funds received into a special account under a long-term credit (loan) agreement | 55 | 67 |

| Excess amounts of taxes and fees paid were returned to a special account | 55 | 68 |

| Unused funds issued on account were returned to a special bank account | 55 | 71 |

| Funds were transferred to a special bank account as a contribution to the authorized capital | 55 | 75-1 |

| Insurance compensation was received in a special bank account | 55 | 76-1 |

| Funds for the recognized (awarded) claim were credited to a special bank account | 55 | 76-2 |

| Funds were credited to a special bank account to account for dividends (income) due to the organization from participation in other organizations | 55 | 76-3 |

| Received free funds into a special account | 55 | 91-1 |

| Funds were transferred to a special bank account and accounted for as deferred income. | 55 | 98-1 |

By account credit

| Contents of a business transaction | Debit | Credit |

| The cash desk received funds from a special bank account | 50 | 55 |

| Funds from a special bank account were transferred to the current account | 51 | 55 |

| Funds from a special bank account were transferred to a foreign currency account | 52 | 55 |

| An advance was issued to the supplier from a special bank account | 60 | 55 |

| The amount of the used letter of credit is written off for settlements with the supplier | 60 | 55 |

| The funds overpaid by the buyer were returned from a special bank account | 62 | 55 |

| The advance paid by the buyer was returned from a special account | 62 | 55 |

| The short-term loan and interest on it were repaid from a special bank account | 66 | 55 |

| A long-term loan and interest on it were repaid from a special bank account | 67 | 55 |

| Taxes and fees were paid to the budget from a special account | 68 | 55 |

| Insurance fees paid from a special account | 69 | 55 |

| The salary was transferred by the employee from a special bank account | 70 | 55 |

| Funds were issued on account from a special bank account | 71 | 55 |

| The founder (participant) received funds by check against dividends (income) due to him from a special bank account | 75-2 | 55-2 |

| Deposited wages paid to employees from a special account | 76-4 | 55 |

| Own shares purchased from shareholders were paid from a special bank account | 81 | 55 |

| Expenses were paid from a special bank account using retained earnings | 84 | 55 |

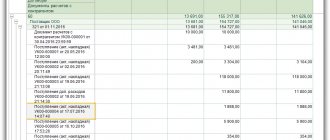

Credit card payments

Example

In April 2021, an agreement was concluded between Delovoy Profile LLC and Vympel Bank to issue a credit card. According to the bank agreement, a loan of 200,000 rubles was issued, the repayment period is 18 months, the interest rate is 16% per annum. Interest is calculated once a month on the amount actually spent.

In July, an employee of Delovoy Profile LLC was sent on a business trip with an advance payment of 5,000 rubles. Travel and travel expenses were paid by credit card.

Postings

At Delovoy Profile LLC:

| Dt | CT | Operation description | Sum | Document |

| 55 | 66 | Receipt of loan amount (withdrawn amount) | 5000 | Bank statement |

| 71 | 55 | Advance issued to accountable person | 5000 | Statement |

| 71 | Travel expenses included | 5000 | Advance report | |

| 91.2 | 66 | Interest for use written off as expenses (5000*16% /12) | 67 | Agreement with the bank |

| 66 | Payment of interest for using a credit card is reflected | 67 | Bank statement |

Transactions with a covered letter of credit

Example

LLC "Galfind" and LLC "Demiurge" entered into an agreement for the supply of materials in the amount of 1,200,000 rubles. The terms of the contract assume that payment for the delivery of LLC Galfind is made using a covered letter of credit. For this purpose, Demiurge LLC opens a letter of credit in the bank in the amount of 1,200,000 rubles.

The delivery was carried out only in the amount of 1,000,000 rubles. The remaining funds were returned to the settlement account of Demiurge LLC.

For servicing the letter of credit, the bank charged a commission of 0.% of the letter of credit amount.

Postings

At Demiurge LLC:

| Dt | CT | Operation description | Sum | Document |

| 55.1 | The amount of funds for the covered letter of credit is reflected | 1200000 | Bank statement | |

| 10 | 60 | Materials accepted for accounting | 1000000 | TORG-12 |

| 60 | 55.1 | Funds transferred to pay for equipment | 1000000 | Payment order |

| The amount of bank commission is included in costs (1200000*0.05%) | 600 | Bank statement | ||

| 55.1 | The unused balance of the letter of credit was returned to the account | 200000 | Bank statement |

Transactions on deposit accounts

Let’s assume that a certain company placed a deposit in one of the banks in April 2021 under the following conditions:

- placement period – 9 months;

- deposit amount – 137,000 rubles;

- interest on deposit – 21% per annum.

The company's accountant made the following entries:

1) Dt 55.3

Kt 51 – 137,000 rubles, transfer of funds to a bank deposit;

2) Dt 76

Kt 91.1 – 21,578 rubles, interest income on deposit;

3) Dt 51

Kt 76 – 21,578 rubles, crediting accrued interest to the company’s account.

Account 58 “Financial investments”

Order 94n established the following list of subaccounts of account 58:

- 58.1 - shares and shares;

- 58.2 - debt securities;

- 58.3 - loans provided;

- 58.4 - contributions under a simple partnership agreement.

However, the law does not prohibit enterprises from independently establishing a list of subaccounts in accordance with the goals of their accounting policies. At the same time, Order 94n clearly states that the enterprise is obliged to ensure a breakdown of financial investments into long-term and short-term.

Therefore, if the enterprise has financial investments with a period of up to 12 months or more than 12 months, it is necessary to organize their separate accounting, which allows separating the amounts of long-term financial investments from short-term ones.

More information about the procedure for organizing accounting of financial investments can be found in the article “Accounting for financial investments - PBU 19/02”.

Postings for transactions with financial investments in account 58 may look like this:

| Dt | CT |

| Shares were added to the authorized capital of the enterprise | |

| Received funds for securities (sale of shares) | |

| Purchased bills (debt securities) with cash payment | |

| Debt securities are included in the authorized capital of the enterprise | |

| 58.1(58.2) | The securities were received by the company free of charge |

Subaccounts according to the Chart of Accounts, reflected in the reporting

Instructions for using the Chart of Accounts for account 55 for accounting for each type of monetary document / special account offers the following sub-accounts for accounting:

- letters of credit - 55.1;

- check books - 55.2;

- deposits - 55.3, etc.

If the company also has an electronic wallet and a corporate card, then the next numbered subaccounts are opened. It is important that separate accounting is required for each open letter of credit or check book. To do this, second-order subaccounts should be added to these subaccounts - this is the analytics of account 55.

You can open monetary documents or special accounts in foreign currency. This requires the same separate accounting. In addition, do not forget about converting into rubles on the day of the operation and at the end of the month and taking into account exchange rate differences.

At the end of the period, the debit balance on account 55 in rubles is included in the amount on line 1250 “Cash and cash equivalents” of the balance sheet.

Movement in the account is also reflected in the Cash Flow Report according to PBU 23/2011.

Deposit accounts fit the definition of financial investments and can be reflected in accounting in account 55 or 58 - the company approves its choice in its accounting policy. It also indicates whether the financial investment is classified as cash equivalents. If yes, then they are reflected in line 1250 of the balance sheet (according to PBU 23/2011). If not (in accordance with PBU 19/02), then they are reflected in the amount of financial investments on line 1240.

Accounting for funds in other special accounts

On account 55, subaccount 4, the movement of funds through other special accounts opened in banks for accounting is taken into account:

- targeted funds coming from the budget through higher organizations;

- revenue coming from procurement organizations for the sale of livestock and poultry accepted from the population for sale;

- funds received for the maintenance of children's institutions from parents and other organizations;

- funds to finance capital investments, in order to record them in a separate account, etc.

| № | Contents of business transactions | Source documents | Corresponding accounts | |

| Debit | Credit | |||

| 1 | 2 | 3 | 4 | 5 |

| 1 | Targeted budget funds have been received and credited to a special bank account | Application for opening an account, bank statements | 55/4 | 86 |

| 2 | Targeted funds written off as intended | Bank statements | 60, 68, 69 | 55/4 |

| 3 | Revenue was received from procurement organizations for livestock and poultry accepted for sale from the population | Bank statements | 55/4 | 62 |

| 4 | Proceeds from sold products and livestock were transferred to the population | Bank statements | 76/7 | 55/4 |