Depreciation of fixed assets is the inclusion of the cost of fixed assets in the cost of the good or service produced. In accounting entries, depreciation of fixed assets is taken into account in accounting account 02. Depreciation allows the manufacturer to include all production costs in the cost of products. In fact, capital turnover occurs due to depreciation.

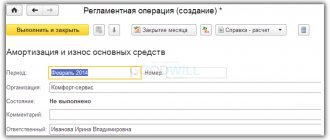

Depreciation can be stopped only if the equipment is idle for at least three months and if the facilities are modernized for a period of at least 12 months. Amounts are accrued from the month following the month the facility was put into production and are not accrued from the month following the removal of the equipment from production.

Depreciation cannot be charged on the following items:

- livestock;

- roads;

- natural objects;

- Earth;

- housing facilities.

Account 02 Depreciation of fixed assets

Depreciation of fixed assets can be calculated in the following ways:

- in a linear way;

- reducing balance method;

- the method of writing off the cost by the sum of the numbers of years of useful life;

- by writing off the cost in proportion to the volume of products (works).

The chosen method is fixed in the accounting policy. You can use different depreciation methods for different groups of homogeneous fixed assets.

Depreciation is accrued monthly starting from the month following the one in which the property was accepted for accounting as a fixed asset.

The amounts of accrued depreciation are written off as expenses for ordinary activities, these are:

Debit 20,23,25,26,29 - Credit 02.

Or included in other expenses (if the object is of a non-production nature or is intended for rent, if rent is not a normal activity):

Debit 91-2 - Credit 02.

If a fixed asset is used to create, modernize or reconstruct another non-current asset, then:

Debit 08 - Credit 02.

Results

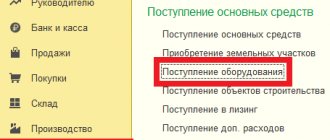

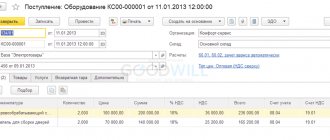

Thus, asset accounting is quite diverse, as it accompanies many situations related to the acquisition, use, write-off, and modernization. Acceptance of an asset for accounting (account 01) occurs through accounts 07 and 08, which accumulate expenses associated with acquisition, installation, delivery, etc. Disposal of fixed assets occurs by writing off the residual value for other expenses of the organization.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Instructions 02 count

According to the instructions for using the chart of accounts for accounting the financial and economic activities of organizations in accordance with Order No. 94n dated October 31, 2000:

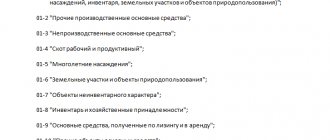

Account 02 “Depreciation of fixed assets” is intended to summarize information on depreciation accumulated during the operation of fixed assets.

The accrued amount of depreciation of fixed assets is reflected in accounting under the credit of account 02 “Depreciation of fixed assets” in correspondence with the accounts of production costs (sales expenses). The lessor organization reflects the accrued amount of depreciation on leased fixed assets as a credit to account 02 “Depreciation of fixed assets” and a debit to account 91 “Other income and expenses” (if rent forms other income).

Upon disposal (sale, write-off, partial liquidation, transfer free of charge, etc.) of fixed assets, the amount of depreciation accrued on them is written off from account 02 “Depreciation of fixed assets” to the credit of account 01 “Fixed assets” (sub-account “Disposal of fixed assets”). A similar entry is made when writing off the amount of accrued depreciation for missing or completely damaged fixed assets.

Analytical accounting for account 02 “Depreciation of fixed assets” is carried out for individual inventory items of fixed assets. At the same time, the construction of analytical accounting should provide the ability to obtain data on the depreciation of fixed assets necessary for managing the organization and drawing up financial statements.

How is the excess accrued amount for the previous period reflected?

If depreciation for the previous period was accrued incorrectly in an excessive amount, then the errors must be corrected. It is important in what period they were admitted - the current year or the past.

The mechanism for correcting accounting errors is prescribed in PBU 22/2010.

If the amount of depreciation has been excessively accrued, then it is necessary to reverse the excess accruals using red entries for those accounts for which incorrect entries were made.

If an error was made in the current year

Depreciation is corrected until accounts 20 or 44 are closed (depending on where savings are taken into account):

Posting reversal: Dt 20 (44) Kt 02 - for the amount of excess depreciation.

Correction after closing account 20 (or 44):

In addition to the above reversal operation, you need to adjust account 90 to reflect expenses that are not accepted for tax accounting.

Posting reversal: Dt 90.3 Kt 20 for the overcharged amount.

If the excess accrual occurred in the year ended

Adjustments must be made to account 91 - posting: Dt 02 Kt 91.

Typical postings for account 02

By debit of the account

| Contents of a business transaction | Debit | Credit |

| Write-off of depreciation on fixed assets disposed of as a result of sale, liquidation, gratuitous transfer to reduce the original cost | 02 | 01 “Disposal of fixed assets” |

| Depreciation on a fixed asset item included in property intended for rental was transferred to a separate subaccount | 02 | 02 |

| Depreciation on property previously intended for rental and transferred to fixed assets was transferred to a separate subaccount | 02 | 02 |

| Depreciation on retired fixed assets intended for rental is written off to reduce its original cost | 02 | 03 |

| Depreciation of exploration assets transferred to fixed assets or intangible assets is written off as a reduction in initial cost. | 02 | 08 |

| Depreciation on fixed assets transferred to a branch allocated to a separate balance sheet was written off (posting in the accounting of the head office) | 02 | 79-1 |

| Depreciation on fixed assets transferred to the head office was written off (posting in the branch accounting) | 02 | 79-1 |

| Depreciation on fixed assets transferred to trust management was written off (in the accounting of the management founder) | 02 | 79-3 |

| Depreciation on fixed assets previously received for trust management and returned to the founder of the management was written off (on a separate balance sheet of the trust) | 02 | 79-3 |

| The amount of depreciation is reduced when the value of fixed assets decreases as a result of revaluation | 02 | 83 |

By account credit

| Contents of a business transaction | Debit | Credit |

| Depreciation has been accrued for fixed assets used in the reconstruction or modernization of other fixed assets | 08 | 02 |

| Depreciation has been calculated on fixed assets used to create intangible assets | 08 | 02 |

| Depreciation was accrued for fixed assets used during the construction of the facility for the organization’s own needs | 08-3 | 02 |

| Depreciation was calculated on fixed assets used in the main production | 20 | 02 |

| Depreciation was calculated on fixed assets used in auxiliary production | 23 | 02 |

| Depreciation has been accrued on fixed assets for general production purposes | 25 | 02 |

| Depreciation has been accrued for general purpose fixed assets | 26 | 02 |

| Depreciation was calculated on fixed assets used in service production | 29 | 02 |

| Depreciation was accrued on fixed assets intended to support the sales process | 44 | 02 |

| Depreciation has been calculated on the fixed assets of a trading organization | 44 | 02 |

| Depreciation was taken into account on fixed assets received from the head office of the organization, allocated to a separate balance sheet (posting in the branch accounting) | 79-1 | 02 |

| Depreciation on fixed assets received from a branch allocated to a separate balance sheet is taken into account (posting in the accounting of the head office) | 79-1 | 02 |

| Additional depreciation was accrued on fixed assets, the cost of which increased as a result of revaluation | 83 | 02 |

| Depreciation has been accrued on fixed assets leased (renting is not the subject of the organization’s activities) | 91-2 | 02 |

| Depreciation has been accrued on fixed assets used in the performance of work, the costs of which are taken into account as deferred expenses. | 97 | 02 |

The procedure for determining the useful life of property

When determining the period of use of an OS object, a business entity must be guided by the following rules:

- First of all, it is necessary to use the approved OKOF classification. It is a table that lists all kinds of OS groups and the corresponding period of use. Typically the period is specified as an interval (for example, 10 to 15 years). A business entity has the right to choose any number of years included in this period.

- If an OS object is not assigned to any group according to the classifier, then it is necessary to establish the time of its use based on technical documentation or recommendations of the manufacturer (an indication of this is established by the Tax Code);

- If this information cannot be obtained, then you must contact the Ministry of Economic Development.

Attention! The established useful time must be secured at the disposal of the manager, or recorded in the transfer and acceptance certificate OS-1.

When determining the period of use for an OS that has already been in use, it is necessary to determine its period according to the group and subtract from it the time of operation at the previous place of work.

If the last period cannot be determined, then the company sets the time of use independently, but taking into account safety requirements. The law establishes the conditions under which it is possible to change the period of use of the OS after its commissioning.

This can be done in the following cases:

- Upon completion;

- When retrofitting;

- During reconstruction;

- During modernization.

Attention! The main conditions for extending the period are the fact that the characteristics of the OS object have changed so that it can be used longer than the previously determined period. However, the application time can only be extended to the previously accepted time of use.

What is this method?

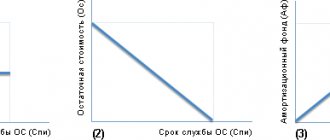

The straight-line method is an accrual method in which the cost of fixed assets is transferred to finished products evenly throughout the entire period of operation .

The basis for such calculations is the initial cost. It is the sum of all costs spent on purchasing the asset, its delivery, installation and commissioning.

If the company revalued its property, then the replacement cost is used in the calculations.

Calculating the amount of depreciation is impossible without establishing the duration of the service life. It is recommended that its duration be determined in accordance with the state-developed classification of fixed assets. However, it is possible to independently forecast the period of operation of the property. To do this, the following factors are analyzed:

- physical wear and tear, which is associated with the mode and working conditions;

- possible period of use corresponding to the power of the equipment;

- regulations and other legal restrictions on the time of use of the asset.

The positive aspects of using this method include the following:

- simplicity of calculations, no need to do lengthy calculations and understand complex formulas;

- the value of the property is transferred evenly to the finished product;

- depreciation is calculated for each object;

- this method is used in tax accounting;

- no regular recalculations are required;

- suitable for calculating depreciation of real estate.

Along with the advantages, there are also a number of disadvantages due to the peculiarities of production:

- the deterioration of the original condition of the equipment over time is not taken into account;

- obsolescence is not taken into account;

- not suitable for large organizations that use equipment unevenly, that is, when some machines are idle;

- the load on the means of production is not taken into account.

The negative consequences of using the linear method are inferior to the advantages. That is why the vast majority of enterprises choose it for accounting.

You can find out detailed information about all counting methods in the following video:

Calculation with examples

Calculation using the linear method is not particularly difficult and does not require much time.

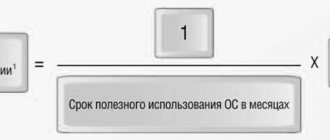

Formula for determining the annual depreciation amount:

Where:

- First, the initial cost;

- Na is the depreciation rate as a percentage.

The rate is calculated as follows:

Where:

- n is the service life expressed in months.

Example No. 1

Let the company Zamok LLC purchase equipment worth 210 thousand rubles. without VAT. The service life is determined to be 5 years, which is 60 months.

- Monthly rate: 1 / (5 * 12) * 100 = 1.66667%

- Amount of deductions for the month: 210 * 1.66667 / 100 = 3.49986 thousand rubles.

- Amount for the year: 3.49986 * 12 = 42 thousand rubles.

Residual value by year:

- 210 – 42 = 168 thousand rubles.

- 168 – 42 = 126 thousand rubles.

- 126 – 42 = 84 thousand rubles.

- 84 – 42 = 42 thousand rubles.

- 42 – 42 = 0 rub.