Postings for the issuance of a loan are a reflection of transactions with borrowed funds in accounting. You can borrow money not only from a bank or other financial institution. The borrower of funds can also be a company that does not have a special license, for example, an employer or business partner.

Activities related to lending to citizens and organizations are subject to mandatory licensing. That is, banks, credit firms, and microfinance organizations can issue funds as a loan. In addition to licensed companies, ordinary companies whose main activity is not related to lending can also provide a loan (SCA of the Russian Federation dated 08/10/1994 No. S1-7/OP-555).

For example, founders or employees, business partners, individual entrepreneurs or ordinary citizens can receive company funds in the form of a loan. A license is not required if the loan issuance is not systematic or permanent (examples of entries for accounting for these transactions are provided below).

The concepts of “credit” and “loan”

Accounting for loans and borrowings in accounting is regulated by PBU 15/2008. The accountant should periodically recheck the document, since changes made to it entail adjustments to accounting. It is important to understand the difference between the concepts of “credit” and “loan”. A loan can only be issued by a specialized organization that has a license for this type of activity, for example, a bank (clause 1 of Article 819 of the Civil Code of the Russian Federation). It is issued only in cash and only at interest. The loan can be issued by any organization, individual entrepreneur or individual. There are no restrictions on the form of issuance for it: it can be either monetary or real. He may not have interest for use.

Providing a loan to a legal entity from a legal entity at interest

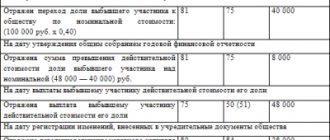

In accounting entries, the issuance of a loan to a legal entity at interest will be reflected with the appearance in the debit part of account 58, one of the subaccounts of which is allocated by the Chart of Accounts of the Accounting (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n) to reflect the funds issued as a loan. Analytics on it are organized by recipients of borrowings and each of the concluded agreements. Debts secured by bills of exchange should be reflected separately.

In the credit part of the transaction, a cash account will appear corresponding to its type:

- 51 - for non-cash transfers in rubles;

- 52 - when transferring funds in foreign currency.

Thus, the entry for accounting for a loan issued with interest will look like: Dt 58 Kt 51 (52).

Interest accrued monthly on the loan is not shown on account 58. Another account is intended for their accounting - 76, the debit of which will record the amount of income calculated at the rate stipulated by the agreement. The linking of entries for accounting for a loan issued by an organization and entries for reflecting interest accrued on it to different accounts is due to the different nature of the debt arising: on account 58 this is the amount of income-generating investments, and on account 76 - current settlements on payments associated with these investments.

In the credit part of the record reflecting the accrual of interest, a financial result account will appear:

- 90, if the issuance of loans in the accounting policy of a legal entity is designated as one of its usual types of activities;

- 91, if the provision of borrowed funds is not one of the usual activities.

That is, the fact of accrual of interest will be recorded as Dt 76 Kt 91 (90). The receipt of payment for them will be reflected by the entry Dt 51 (52) Kt 76.

When repaying the principal amount of the loan, a posting will occur Dt 51 (52) Kt 58.

You can find out how the lender calculates VAT and income tax from the Guide from ConsultantPlus. Trial access to the legal system is free.

Short-term and long-term loans

Accounting for loans in accounting depends on the time of use by the borrower. To make payments on short-term loans (issued for a period of up to 1 year), account 66 is used. For long-term loans (issued for a period of more than 1 year), account 67 is used. If it happens that long-term loans are repaid in less than 365 days, then they must be transferred to score 66.

Accounting for loans in accounting should be divided into analytics:

- by type of funds received;

- by sources of funds;

- for basic and additional costs.

Results

The provision of funds in debt by agreement between legal entities can be carried out both on the terms of payment of interest for this, and without additional payments.

For the lender, the loan in the first case takes on the character of a financial investment (i.e., it generates income), and in the second it is simply a receivable. Accordingly, the amount of funds issued as a loan must be taken into account in account either 58 or 76, reflecting this by posting either Dt 58 Kt 51 (52) or Dt 76 Kt 51 (52). Postings for interest accrued on the loan reflected in account 58 will be linked to account 76: Dt 76 Kt 91 (90) - accrual; Dt 51 (52) Kt 76 - payment. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Postings on loans and borrowings

Costs are reflected as part of other expenses of the enterprise. If they were received for the investment activities of the enterprise, then the costs for them are included in the cost of the asset being created until the asset is put into operation (this condition does not apply to small businesses on the simplified tax system).

Loan entries in this article imply loan entries, since commercial organizations, as already mentioned, cannot issue loans.

It is necessary to create subaccounts for accounts 66 and 67 to account for the amount of principal and interest debt. For example, to account for the principal debt, use account 66-1 (67-1); to account for interest debt, use account 66-2 (67-2).

Credit received, posting:

- Debit 51, 50, 41, 08, 10 Credit 66-1, 67-1 - loan received (long-term loan, transactions);

- Debit 91-2 Credit 66-2, 67-2 - the amounts of basic costs are included in operating expenses;

- Debit 67-1 Credit 66-1 - long-term loan transferred to short-term;

- Debit 91-2 Credit 60, 76 - the amounts of additional costs are taken into account;

- Debit 60, 76 Credit 51 - additional costs paid.

Loan repaid, posting:

- Debit 66-1, 67-1 Credit 51, 50, 41, 08, 10 - loan repaid (loan repayment, posting);

- Debit 66-2, 67-2 Credit 51 - interest on loans repaid.

Regulations PBU 15/2008 do not contain precise instructions on what date must be indicated when reflecting debt. Typically, accountants use the date the contract was signed or the date the loan was actually received. Both options are correct. When receiving a loan in kind, there is no difference from a tax point of view. But some nuances are worth noting.

An interest-free loan was issued - how to reflect this in transactions

However, a loan issued in cash may also be interest-free (Articles 809, 810 of the Civil Code of the Russian Federation). In such a situation, it loses the main feature (the ability to generate income), which allows it to be included in financial investments. How to show the borrower's debt in this case? It should be reflected as a regular debt of the counterparty for settlements not related to sales to him, i.e. using account 76.

Find out whether an interest-free loan is subject to income tax here.

Depending on whether the transfer of funds issued as a loan is made in rubles or in foreign currency, the entry - a loan was issued to another organization - without interest will take the form Dt 76 Kt 51 or Dt 76 Kt 52.

Since accrual of income is not provided, records of transactions for recording interest and for their payment will not appear. That is, until the debt is repaid, its amount will be listed in the debit of account 76. The return will be reflected by the reverse entry to the one with which the debt was registered: Dt 51 (52) Kt 76.

Thus, in a situation where another organization has been issued an interest-free loan, the entries for it will only reflect its occurrence in accounting and write-off when the funds are returned.

Features of a loan in kind

When receiving a loan in kind, an enterprise is forced to purchase consumables or fixed assets associated with the use of the loan received. They should be taken into account in the amount of actual costs without including VAT. When returning, the cost of the property must be calculated equal to the expenses at the time of purchase. Thus, there will be a price difference between the assets received and the assets reimbursed to the borrower.

The accountant must include this difference in other expenses or income:

- Debit 91-2 Credit 66, 67 - the price difference that arose as a result of an increase in the value of property was written off;

- Debit 66, 67 Credit 91-1 - the price difference resulting from a decrease in the value of the property is written off.

Features of accounting for interest-free loans.

The requirements for interest-bearing loans were previously listed. According to the third of them, the loan must generate income, which, however, does not happen when issuing an interest-free loan. Based on this, an interest-free loan cannot be considered a financial investment. Therefore, it must be accounted for in another account. Such an account is account 76-3 “Calculations for due dividends and other income.”

The amount of borrowed funds in kind is determined by the book value of assets.

Important! Also in this case, do not forget about VAT, which is charged at the time the loan is issued.

Control points when accounting for a loan

There are nuances to consider:

- The accrued interest must correspond to the refinancing rate established by the Central Bank for the write-off period.

- The amounts and conditions for writing off interest must be comparable to credit obligations and loans under the terms of the agreements.

- The tax difference and the amount of tax liabilities must be calculated in accordance with PBU 15/2008 and reflected in accounting and reporting documentation.

An accountant should monitor changes in regulatory documents, since new rules may be introduced by law regulating the accounting of loans and borrowings, canceling previously existing ones. If the accounting of loans and borrowings is carried out incorrectly, then the tax authorities may regard this as incorrect accounting with the application of appropriate penalties.

Issuing an interest-free loan to an employee: postings

Borrowed resources provided to the company's employees are accumulated in account 73. The loan may be interest-bearing or interest-free. When an interest-free loan has been issued, transactions are drawn up on the basis of expenditure documentation:

- if funds are transferred to the employee in cash, then the confirmation is an expense cash order;

- When making a non-cash transfer of borrowed amounts, the transaction is recorded in accounting through a bank statement and payment order.

Typical correspondence:

- D73.1 – K50 – an interest-free loan to an employee is reflected, the entries indicate cash payments.

- D50 - K73.1 - the employee repaid the loan debt to the enterprise by depositing money into the cash register.

- If an interest-free loan is carried out by bank transfer, accounting entries are made between the debit of 73.1 and the credit of 51 accounts.

- D51 – K73.1 – repayment of debt by money transfer from an employee.

Accounting for an interest-free loan and the entries for its registration are associated with the emergence of obligations for an individual to pay personal income tax. The norms of tax law classify lending operations on an interest-free basis as a group of material benefits for the borrower. An exception is made for cases where a loan was taken out to purchase a home, and an individual has a confirmed right to a property deduction (Article 212 of the Tax Code of the Russian Federation).

If the subject of lending is non-monetary assets, then the enterprise has VAT obligations. When an interest-free loan is issued to an employee, entries are made with the debit of account 73.1 and the credit of the account for accounting for the transferred property - 10, 41, 01. The accrued VAT on the transaction amount is shown by entry D73.1 - K68/VAT.

Documentation required for obtaining a loan

Since the company provides an interest-free loan to an employee for the purchase of housing, the accounting department handles the loan processing documents.

She will study the financial capabilities of the loan applicant, prepare all the necessary documentation, and draw up a loan repayment schedule.

List of documents:

In order to confirm unfavorable living conditions, it is necessary to provide information about the family, its composition, and the current state of living conditions.

Conditions for issuing a loan

Approval for the provision of a loan is made by the manager. Before executing an agreement, management puts forward a number of requirements to the borrower:

Documents required for issuing a loan:

The big advantage of a loan in this category is the absence of interest. As a rule, the issuance of credit money does not have consequences in the form of tax payments for either party.

Loan repayment: payment order

When repaying a debt through a bank transfer, the payment order must indicate the details of the loan agreement (the date of its conclusion and the assigned registration number). For interest-free loans, the payment document must contain a reference to the borrower’s lack of interest obligations. When a loan is repaid, the purpose of payment can be formulated as follows:

- repayment of an interest-free loan under agreement dated (date) No....;

- partial repayment of an interest-free loan under the agreement (details of the agreement are provided).

At the end of the payment purpose text, the phrase “Without VAT” or “VAT not subject to” is written. Without these words, the bank will not be able to process the payment order.

spmag.ru

Loans to employees: from provision to repayment

- home

- about the author

- Services

- All articles Salaries and personnel Remuneration, vacation pay

- Benefits

- Other settlements with personnel

- Personnel accounting

- Occupational Safety and Health

- Capital and reserves

- Income tax

- Tax reporting

- Useful sites

December 6, 2014 · admin

From the article you will learn:

1. How to properly formalize the provision of borrowed funds to employees.

2. What is the procedure for taxation and accounting of loans to employees.

3. What consequences does forgiveness of an employee’s loan debt entail?

According to the legislation of the Russian Federation, issuing loans is not the exclusive right of credit institutions, so nothing prevents employers from “supporting” their employees with borrowed funds. The conditions for providing loans at the place of work may differ significantly from bank ones: a lower or even zero interest rate, a longer repayment period or an open-ended loan (on demand), etc. Thus, for employees the benefits of receiving such loans are obvious. However, for an employer, providing loans to employees has its advantages, for example, increasing loyalty and additional motivation of employees, a way to retain good specialists. Therefore, employers with sufficient financial resources, as a rule, do not refuse to issue a loan to their employees. Read the article about what an accountant (and others) needs to know about loans to employees.

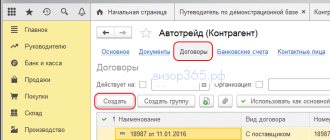

Loan agreement with employee

The provision of borrowed funds to an employee is formalized by an agreement, according to which the lender (employer) transfers a certain amount of money into the ownership of the borrower (employee), and the latter undertakes to return it. When drawing up a loan agreement with an employee, the following important conditions must be taken into account:

- The form of the loan agreement is always written, since one of the parties (the employer) is a legal entity (IP) (clause 1 of Article 808 of the Civil Code of the Russian Federation).

- The date on which the agreement comes into force is determined by the date of the actual transfer of money (clause 1 of Article 807 of the Civil Code of the Russian Federation).

- The loan amount is established in the agreement. The legislation does not contain restrictions on the amount of loans issued by employers to their employees. However, if the issuance of a loan is a major transaction for the organization (the loan amount is 25% or more of the value of the property according to the financial statements for the last reporting period), then the decision to approve the issuance of such a loan is made not by the director, but by the general meeting of the company’s participants (LLC), board of directors (supervisory board) or general meeting of shareholders (JSC).

- The loan currency is rubles. Loans and credits in foreign currency can only be issued by credit organizations (Article 9 of the Federal Law of December 10, 2003 No. 173-FZ “On Currency Regulation and Currency Control”).

- Interest under the agreement for using the loan may or may not be provided for.

! Please note: If the interest rate is not specified in the agreement, by default it is considered equal to the refinancing rate in effect at the time of repayment of the loan (part of the loan) (clause 1 of Article 809 of the Civil Code of the Russian Federation). In order for the loan to be interest-free, the contract must contain a clause on non-accrual of interest, for example: “no interest is accrued for the use of borrowed funds under this agreement.”

- The term and procedure for repayment of the loan and interest are established in the contract by agreement of the parties. If such a procedure is not fixed in the agreement, the borrower is obliged to pay interest monthly, and repay the loan amount within 30 days from the date of presentation of the claim by the lender (clause 2 of Article 809, clause 1 of Article 810 of the Civil Code of the Russian Federation).

- The possibility of early repayment of the loan is fixed in the contract. In the event that the conditions for early repayment of the loan are not specified in the agreement, the interest-free loan can be repaid by the borrower ahead of schedule at any time, and the interest-bearing loan - no earlier than 30 days from the date of notification of the lender about early repayment (clause 2 of Article 810 Civil Code of the Russian Federation).

A loan agreement with an employee is drawn up in any form, usually based on the employee’s application. In addition to the listed conditions, the loan agreement must specify the period for which the loan is issued, the method of transferring the loan amount (from the organization’s cash desk, transfer to the employee’s account), the method of repaying the loan (deduction from wages, transfer to the organization’s current account, deposit in the cash register), as well as the purpose of the employee receiving the loan. It is especially important to state in detail and clearly the purpose of an employee’s loan if it is related to the purchase of housing, as well as land plots for housing construction. The procedure for taxing personal income tax on material benefits when using borrowed funds depends on the purpose of the loan, which will be discussed below.

Sample loan agreement with an employee

Personal income tax when providing a loan to an employee

Correctly drawing up a loan agreement with an employee is half the battle: the most “interesting” for an accountant begins after the actual issuance of the loan. First of all, it is necessary to determine whether the employee has a material benefit from saving on interest for using borrowed funds. Income in the form of material benefits appears when the interest rate under the loan agreement is less than 2/3 of the refinancing rate in effect on the date the income is received. The amount of material benefit can be calculated using the following formula:

MV = SZ x (2/3 st. ref. - st. z.) / 365 (366) x t, where

- MB – material benefit under a loan agreement with an employee (rub.)

- SZ – loan amount under the agreement (RUB)

- Art. ref. – refinancing rate (%) effective on the date of repayment (partial repayment) of the loan (for an interest-free loan) or repayment of interest on the loan (for an interest-bearing loan).

- Art. h. – interest rate on the loan established in the agreement

- t – period of time (calendar days) for which interest is accrued (for an interest-bearing loan) or for the use of borrowed funds (for an interest-free loan).

Material benefits received by an employee when using borrowed funds are subject to personal income tax at a rate of 35%. Personal income tax must be withheld on the day the employee receives income in the form of material benefits, namely:

- for an interest-bearing loan - on the day of repayment of interest on the loan (clause 3, clause 1, article 223 of the Tax Code of the Russian Federation);

- for an interest-free loan - on the day the borrowed funds are repaid. If the loan is repaid in installments, then the material benefit is calculated for each repayment date (Letters of the Ministry of Finance of Russia dated March 26, 2013 No. 03-04-05/4-282, dated February 27, 2012 No. 03-04-05/9-223, dated March 26. 2013 No. 03-04-05/4-282 and dated 02/27/2012 No. 03-04-05/9-223).

To better understand how material benefits and personal income tax on them are calculated when providing a loan to an employee, I suggest using an example.

***

An example of calculating material benefits under a loan agreement with an employee

The organization Omega LLC entered into a loan agreement with its employee A.N. Egorov. According to the terms of the agreement, a loan in the amount of 30,000 rubles. issued on September 1, 2014 for 3 months at 5% per annum *. The loan is repaid monthly in equal installments (RUB 10,000 each), interest is also repaid monthly.

The employee deposited money to repay the loan through the cash register on the last day of each month. The refinancing rate as of 09/30/14, 10/31/14, 11/30/14 was 8.25%, that is, 2/3 of the refinancing rate - 5.5%.

- Material benefit for September: 30,000 x (5.5% - 3%) / 365 x 30 = 61.64 rubles.

- 09/30/14 personal income tax accrued for September: 61.64 x 35% = 22 rubles.

- Material benefit for October: (30,000 - 10,000) x (5.5% - 3%) / 365 x 31 = 42.47 rubles.

- 10/31/14 personal income tax accrued for October: 42.47 x 35% = 15 rubles.

- Material benefit for November: (20,000 - 10,000) x (5.5% - 3%) / 365 x 30 = 20.55 rubles.

- 11/30/14 personal income tax accrued for November: 20.55 x 35% = 7 rubles.

* If an employee was provided with an interest-free loan, then when calculating the material benefit, the loan amount had to be multiplied by 2/3 of the refinancing rate, and not by the difference in interest rates. For example, the material benefit for September was: 30,000 x 5.5% / 365 x 30 = 135.62 rubles.

***

Personal income tax accrued on material benefits is withheld from any immediate payments to the employee (for example, from wages).

! Please note: Material benefits received from savings on interest for the use of borrowed funds are not subject to personal income tax if the loan was issued to an employee for new construction or the acquisition in the territory of the Russian Federation of a residential building, apartment, room or share(s) in them, as well as land plots for individual housing construction, and land plots on which the purchased residential buildings are located, or shares (shares) in them (paragraph 3, paragraph 1, paragraph 1, article 212 of the Tax Code of the Russian Federation). To do this, the following conditions must be met:

- the purpose of the loan under the agreement must correspond to one of the listed grounds;

- the employee must provide a letter from the tax authority regarding receipt of the right to a property tax deduction. In this case, the letter must indicate the tax agent, that is, the organization that issued the loan, as well as the details of the loan agreement - these are the requirements of the Ministry of Finance of Russia (Letter No. 03-04-06/21233 dated 06/07/2013).

Income tax, simplified tax system when providing a loan to an employee

Funds issued to an employee as a loan are not included in the expenses taken into account when calculating income tax and the single tax under the simplified tax system. Accordingly, loan repayment is not income either under the general or simplified tax system.

However, if an employee is provided with an interest-bearing loan, the amount of accrued interest is included in non-operating income and is subject to taxation (paragraph 2, paragraph 4, article 328, paragraph 6, article 250, paragraph 6, article 271 of the Tax Code of the Russian Federation).

Forgiveness of an employee's debt under a loan agreement

In some cases, the employer may meet the employee halfway and forgive him the debt under the loan agreement, for example, due to a difficult financial situation. There are at least two options for formalizing such a decision: through an agreement of the parties on debt forgiveness or under a gift agreement.

If debt forgiveness is formalized by agreement:

- From the moment the agreement is signed, the employee has income equal to the forgiven amount of debt, which is subject to taxation at a rate of 13%. In this case, there is no material benefit from saving on interest (Letter of the Ministry of Finance of Russia dated January 22, 2010 No. 03-04-06/6-3).

- The creditor organization does not have the right to include the amount of the forgiven debt in expenses for tax accounting purposes.

- Insurance premiums must be calculated from the unrepaid amount of the employee's debt (Letters of the Ministry of Health and Social Development of Russia dated May 21, 2010 No. 1283-19 and dated May 17, 2010 No. 1212-19).

If the unrepaid loan amount is formalized by a gift agreement:

- In this case, the employee will also have income subject to personal income tax at a rate of 13%, but will also have the right to a tax deduction in the amount of 4,000 rubles. from the amounts of gifts.

- The amount of outstanding debt donated to the employee is not subject to insurance premiums (Letter of the Ministry of Health and Social Development of Russia dated February 27, 2010 No. 406-19 and clause 1 of Article 7 of Law No. 212-FZ).

- As is the case with debt forgiveness under the agreement, the amount of the non-repaid loan “gifted” to the employee is not included as an expense for tax purposes.

Thus, it is more profitable for both the employer and the employee to terminate obligations under the loan agreement through a gift agreement. You can read more about how to properly prepare a gift for an employee and what to pay attention to in the article Gifts to employees: registration, taxation, accounting.

How is a loan repaid to the founder of an enterprise?

In some cases, there are situations when the financial situation of an organization becomes difficult, which requires an immediate replenishment of the balance through credit funds or other investments. If such financial support is not possible, the only way out of the situation may be a loan from the founder.

Corresponding lending provides for the repayment of the loan to the founder within the terms established by the agreement. This cooperation occurs quite often, but has certain nuances that must be taken into account when drawing up an agreement.

To understand the characteristic nuances of repaying debt obligations, it is necessary to familiarize yourself with the current legal framework, the important points of the document, the established repayment procedure, the features of debt forgiveness, taxation, as well as existing accounting entries.

In 2021, both interested parties must sign a special agreement when applying for a loan. If necessary, additional agreements can be drawn up that provide additional guarantees for the repayment of obligations to the founder.

Among the ways to ensure repayment, it is worth highlighting the following:

Below are the basic parameters that must be included in the contract or payment order for the correct execution of the relevant transaction:

- method of selling loan funds - such loans can be provided and repaid in cash or any non-cash means;

- lending terms - the agreement does not define the exact terms of its validity, but, in any case, it is necessary to fix the time during which the client undertakes to return the money to the founder upon first demand (usually this period does not exceed 30 days);

- current interest rate;

- established payment schedule;

- procedure for repaying interest-bearing loans.

The procedure for concluding the agreement in question is much simpler than when carrying out a similar operation in any financial institution. It is worth noting the fact that if the same person acts as the founder and general director of the company, then he can also draw up an agreement legally.

To conclude a contract, the following documents may be required:

- Russian civil passports of both parties;

- constituent documentation of the company;

- organizational seal.

As for the procedure for repaying debt obligations to the founder, in this case it is necessary to prepare the borrower’s passport.

Any other document can also be used to verify a person's identity. A passport is required in situations where debt repayment is carried out from the company's cash desk.

In addition, it is important to provide up-to-date information about the founder's credit or debit card details. The choice of this repayment method directly depends on the conditions specified in the original agreement.

How and by whom is the contract drawn up?

The document is drawn up by the lender, in this case, the organization that provides the loan. The representative of the organization can be a director or an authorized person. They also sign the order to issue a housing loan. The document must contain sections - “responsibility of the parties”, “force majeure”, “confidentiality”, “dispute resolution”, “final provisions”.

Attached to the document is a payment schedule within a strictly specified time frame. If the borrower does not comply with the terms of the agreement, he will be charged penalties and interest. If the contract is extended, an additional agreement is drawn up. The amount of the fine or penalty must be specified in the contract. If the lender fails to pay the money, he also pays a penalty, which is specified in the agreement.

The agreement comes into force when the borrowers receive funds. In some situations, the borrower provides a receipt indicating passport details, place of work and the date the agreement was concluded.