Arrears is the amount of tax, fee or insurance premium not paid on time or the amount of tax that was over-reimbursed. These definitions are contained in Article 11 of the Tax Code of the Russian Federation and in paragraph 4 of paragraph 8 of Article 101 of the Tax Code of the Russian Federation. Thus, it becomes clear that debt on penalties and fines does not belong to the concept of arrears.

Accordingly, if an organization or individual entrepreneur (IP) did not pay a tax, fee or insurance premium on time and they incurred arrears, then the organization or individual entrepreneur is responsible for this. Arrears entail penalties for late payment of taxes, fees or insurance premiums, as well as fines. This is stated in subparagraph 9 of paragraph 1 of Article 31 of the Tax Code of the Russian Federation. The arrears appear the day after the tax payment deadline. If the arrear is an excessively refunded amount of tax, then it is formed:

- or on the day of receipt of this amount to the current account;

- or on the day of offset of this amount (if a tax offset was carried out).

New criteria for the deadline for sending a tax request

From 04/01/2020, inspectors received the right to send tax demands in the amount of 500 to 3,000 rubles to the debtor during the year. That is, when the amount of arrears from an organization or individual entrepreneur does not exceed 3,000 rubles. In this case, tax authorities will be able to issue a demand for payment no later than 1 year from the date of detection of the arrears.

Please note that until April 1, 2021, this period is valid if the tax arrears are less than 500 rubles. The usual deadline for submitting a claim is 3 months from the date of discovery of the arrears.

Thus, legislators increased the amount of tax debt to 3,000 rubles (new edition of paragraph 1, clause 1, article 70 of the Tax Code of the Russian Federation). Simply put, everything that is less than this amount from 04/01/2020 is not a priority for tax authorities in order to quickly collect it in favor of the budget.

The corresponding changes to the Tax Code of the Russian Federation were made by Federal Law No. 325-FZ of September 29, 2019, with numerous amendments and additions to the Code.

Also see “The court allowed the collection of company debts from accountants (it’s true).”

If the arrears are identified independently by the organization or individual entrepreneur

Important! An organization or individual entrepreneur can identify and pay the arrears on their own. In this case, it must also be paid to the budget, but at the same time it is also necessary to pay a penalty for the number of overdue days.

In paragraph 4 of Article 75 of the Tax Code of the Russian Federation, it is written that the penalty for each day of delay is determined as a percentage of the unpaid amount of the debt. In this case, the interest rate is determined:

- for individual entrepreneurs as 1/300 of the refinancing rate of the Central Bank of the Russian Federation in force during this period;

- for organizations as 1/300 of the refinancing rate of the Central Bank of the Russian Federation in force during this period, if the delay is up to 30 calendar days and 1/150 of the refinancing rate of the Central Bank of the Russian Federation in force during this period, if the delay is more than 30 calendar days. In this case, the countdown begins from 31 days of delay.

Here you need to know that if during the period of delay the refinancing rate of the Central Bank of the Russian Federation changed, then the penalty will have to be calculated at different rates.

Example. The Zvezda organization was overdue from 01/12/18 to 03/27/18. Thus, in the period from 01/12/18 to 02/11/18 the rate will be 7.75%, from 02/12/18 to 03/25/18 the rate will be 7.5%, and in the period from 03/26/18 to 03/27/18 the rate will be 7. 25%.

| Period | Refinancing rate, % |

| 18.12.17 – 11.02.18 | 7,75 |

| 12.02.18 – 25.03.18 | 7,5 |

| Starting from 03/26/18 | 7,25 |

That is, from 01/12/18 to 02/11/18 there will be 31 calendar days, which means from 01/12/18 to 02/10/18 (30 calendar days) the rate will be 1/300 x 7.75%, from 02/11/18 the rate will be 1/150* 7.75%, from 02/12/18 to 03/25/18 the rate will be 1/150*7.5%, and from 03/26/18 to 03/27/18 the rate will be 1/150*7.25%.

In 2021, changes have been made regarding the payment of penalties. Now the accrued amount of penalties cannot be greater than the tax itself. This applies to arrears that arose after November 27, 2021, and the rule itself begins to apply from December 28, 2021. Also, the Tax Code of the Russian Federation now clearly indicates the moment of payment of penalties. Previously, the Tax Code of the Russian Federation only precisely determined the day from which the penalty should have been accrued, but now the day on which the accrual of the penalty stops is also designated. Now it says that penalties are accrued up to and including the day the obligation to pay tax is fulfilled.

New rules for collecting small debts

From April 1, 2021, the deadline for making a decision on collection depends on two criteria:

- amounts of arrears;

- prescription of arrears.

Thus, if the amount of arrears does not exceed 3,000 rubles, the Federal Tax Service Inspectorate makes a decision on collection within 2 months from the date that occurs first:

- the total amount of the payer’s debt to the budget exceeds 3,000 rubles;

- 3 years will pass after the earliest outstanding claim has expired.

Please note that if the amount of arrears is from 3,000 rubles, the period remains the same - 2 months after the expiration of the deadline for fulfilling the payment requirement.

These are new provisions of paragraph 3 of Art. 46 of the Tax Code of the Russian Federation, introduced by Law of September 29, 2019 No. 325-FZ.

KEEP IN MIND

All of the above applies to the collection of not only taxes, but also fees, insurance premiums, penalties, fines (the total amount of mandatory payments).

Also see “When the collection of debts from pensions and benefits will be prohibited.”

Common mistakes when calculating penalties

Error. The accountant reflected the penalties and fines paid to the budget in account 91 “Other income and expenses.”

How right. Penalties and fines paid to the budget due to late payment of taxes should be reflected in debit 99 of the “Profit and Loss” account. Account 91 “Other income and expenses” reflects penalties or fines applied to counterparties (customers, suppliers, etc.).

The correct wiring would be:

Debit 99 “Profits and losses” / Credit 68 “Calculations for taxes and fees” - penalties and fines have been accrued.

Debit 68 “Calculations for taxes and fees” / Credit 51 “Current account” - accrued penalties and fines have been paid to the budget.

Such amounts are not taken into account as expenses when calculating income tax, and the amounts of penalties and fines do not reduce the expenses of organizations and individual entrepreneurs under the simplified taxation system.

New rules for large arrears

From April 1, 2021, when collecting large arrears, tax officials will have more powers.

If the tax authority has made a decision to collect arrears in the amount of more than 1 million rubles and it is not executed within 10 working days, then it has the right (new edition of Article 92 of the Tax Code of the Russian Federation):

- inspect, with consent, the territory, premises, documents and property of the organization;

- outside the inspection, request documents (information) about the property, property rights and obligations of the company (their list is regulated by the order of the Federal Tax Service).

This amendment was also introduced by Law No. 325-FZ of September 29, 2019.

Read also

17.12.2018

How is the statute of limitations for tax liability calculated?

As mentioned above, Article 113 of the Tax Code of the Russian Federation establishes that after 3 years after the commission of a tax offense, the payer can no longer be held accountable for this.

However, determining the point from which these 3 years are counted is not so easy. The Tax Code of the Russian Federation requires counting 3 years from this moment:

- in case of violation of the rules for accounting for income and expenses (that is, when the object of taxation is understated) or non-payment (incomplete payment) of tax - from the first day following the end of the tax period in which the offense occurred;

- in all other cases - from the day the law was violated.

In simple terms, if tax is not paid, 3 years are counted starting from the next tax period.

Let's look at this using specific taxes as an example. For taxes paid by individuals (not individual entrepreneurs) - land, transport, property and income tax, which a person pays independently - the period is a year.

According to legal requirements, these taxes must be paid by December 1 of the following year. Accordingly, the timing will be calculated as follows:

- 2018 – tax period;

- You must pay tax for 2021 by December 1, 2021;

- If there is no payment on December 1, 2021 (more precisely, December 2, since the 1st day falls on a day off), a tax violation arises. 3 years begin to count down;

- 2020 is the first year;

- 2021 – second year;

- 2022 – third year;

- from January 1, 2023 – the debtor can no longer be held accountable for failure to pay taxes for 2021.

As you can see, the payer cannot be punished for non-payment of tax for 2021 only starting from January 1, 2023. But this applies only to the amount for 2021, and if the tax is not paid for 2021, a separate period is calculated for it.

However, as stated above, the obligation to pay is not removed from the debtor. The debt will be registered with him up to such moments as:

- payment of the amount owed;

- liquidation of a legal entity or bankruptcy of an individual;

- death of an individual;

- adoption by the court of a decision by which the tax authority loses the ability to collect the debt (that is, recognizing the debt as bad).

However, the tax office can only collect a debt for 3 years, which in some cases seriously reduces the amount of tax service requirements (for example, when they calculate the tax for an apartment for 5-10 years, they can only demand payment of the tax for 3 years).

It is important that if the tax service or the court made a decision to hold the debtor accountable, and at the time of making this decision 3 years have not passed, then the decision will have to be executed. It is believed that the very fact of making a decision to prosecute interrupts the 3-year period.

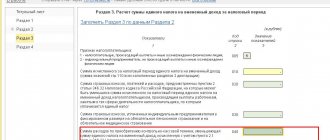

Tax calculation procedure

The amount of tax is calculated using the tax rate. From the income of an individual, in this case it will be the tax base, the percentage of the tax rate imposed on a specific payer is calculated and thus the amount of the monthly tax is calculated. The Tax Code of the Russian Federation provides for 5 types of tax rates. They differ in relation to the types of income on which the tax is levied, as well as in relation to the various taxpayers. Rates:

- Tax rate of 9%

- Tax rate of 13%

- Tax rate of 15%

- Tax rate of 30%

- Tax rate of 35%

Failure to fulfill the duties of tax agents: liability

In accordance with Article 123 of the Tax Code of the Russian Federation, failure by a tax agent to fulfill the obligation to withhold and (or) transfer taxes can be expressed in the fact that he: – did not withhold the tax (withheld it incompletely); – did not transfer (incompletely transferred) the tax amounts subject to withholding and (or) transfer.