The article presents possible options for filling out an advance invoice in 1C using the example of receiving a non-cash

Accounts receivable is one of the most significant indicators of financial statements. The write-off of accounts receivable is preceded by a large

By receiving an official salary, any employee not only improves his financial situation, but also

Frequent amendments made to legislation sometimes lead to the emergence of many issues, including especially

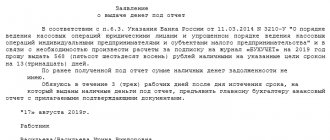

The organization carries out most of its payments through a legal entity's bank account. But often when

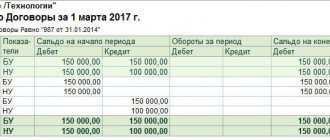

The word “balance” has its roots in the Latin phrase “bis lanz,” which literally means “two scales,”

Tax holidays have existed since 2015. At first it was assumed that they would operate for only three

The state returns 13 percent of the costs of residential real estate, provided that the person has paid

When the employment relationship with an employee is terminated, a full settlement must be made. The departing employee must receive

All legal entities and individuals are required to pay taxes regularly. For individuals the most important tax