What debt is considered uncollectible? Is it possible to recognize a debt as bad if the taxpayer's debtor is in the process of bankruptcy?

According to the accounting rules, bad debts are recognized as debts in the presence of one of the following facts (clause 77 of the Regulations on accounting and financial reporting, approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n):

- the statute of limitations has expired;

- the debtor is liquidated;

- the debtor is excluded from the Unified State Register of Legal Entities as an inactive legal entity;

- The bailiff issued a decision to terminate the enforcement proceedings and return the writ of execution due to the impossibility of collection.

Bad debts (debts that cannot be collected) for tax accounting purposes are those debts to the taxpayer for which:

- the established limitation period has expired;

- in accordance with civil legislation, the obligation is terminated due to the impossibility of its fulfillment on the basis of an act of a state body or the liquidation of an organization (clause 2 of Article 266 of the Tax Code of the Russian Federation).

Bad debts (debts that are unrealistic for collection) are also debts, the impossibility of collection of which is confirmed by the decision of the bailiff on the completion of enforcement proceedings, in the event of the return of the writ of execution to the collector on the following grounds:

- it is impossible to establish the location of the debtor, his property or to obtain information about the availability of funds and other valuables belonging to him in accounts, deposits or deposits in banks or other credit organizations;

- the debtor does not have any property that can be foreclosed on, and all the legal measures taken by the bailiff to find his property were unsuccessful (Decision of the Moscow Arbitration Court dated June 2, 2015 No. A40-17590/2015).

WRITTEN OFF BAD TAX DEBT

Important!

The debts of a company that has actually ceased its activities may be considered bad from the date of exclusion of such a company from the Unified State Register of Legal Entities. In this case, the beginning of the limitation period falls on the date of exclusion of the organization from the Unified State Register of Legal Entities (Letter of the Ministry of Finance of the Russian Federation dated July 24, 2015 No. 03-01-10/42792).

Tax expenses cannot include the amount of receivables with an expired statute of limitations if the taxpayer's debtor is in the process of bankruptcy. The receivables of an organization declared bankrupt and in respect of which a bankruptcy management procedure has been introduced cannot be recognized as uncollectible until the completion of bankruptcy proceedings, provided that the creditor has declared his claims in the prescribed manner and is included in the register of creditors (Letters of the Ministry of Finance of the Russian Federation dated September 23, 2013 No. No. 03-03-06/2/39363, dated 03/04/2013 No. 03-03-06/1/6313 Resolution of the Moscow District Administrative Board dated 02/26/2015 No. A40-61183/2014, FAS North Caucasus District dated 05/16/2014 No. A25-1419/2013). That is, in this case, the taxpayer will be able to take into account receivables as expenses after the court declares the debtor bankrupt and excludes him from the Unified State Register of Legal Entities.

Accounts receivable subject to collection through enforcement proceedings may be recognized as uncollectible if the impossibility of collection is confirmed by a resolution of the bailiff on the completion of enforcement proceedings on the grounds specified in paragraph 2 of paragraph 2 of Article 266 of the Tax Code of the Russian Federation or in the event of liquidation organizations in the prescribed manner. In this case, the date of recognition of the debt as uncollectible will be, respectively, the date of drawing up the document, the date of making an entry in the Unified State Register of Legal Entities on the liquidation of the organization, the date of drawing up the act of the state body, the date of the bailiff's decision on the completion of enforcement proceedings (Letter of the Ministry of Finance of the Russian Federation dated October 5, 2015 No. 03-03-06/2/56751, dated 09/11/2015 No. 03-03-06/2/52390).

How debts are formed

Accounts receivable and payable are an obligatory component of the financial and economic activities of any organization. It is impossible to work without debt. This is not about loans, credits and borrowings. Debtor and creditor are formed during standard business transactions.

For example, the usual delivery of goods means the emergence of an obligation to the supplier to pay for the products provided. This is how a creditor is formed. But transferring an advance to suppliers or shipping goods to the buyer without payment is an example of the occurrence of receivables: a third-party entity has obligations to the organization.

The debtor company ceased to exist due to a merger with another organization

If the debtor organization has undergone reorganization in the form of a merger, then formally it has ceased to exist. But this does not mean that the debts of such a company automatically become bad. The fact is that when legal entities merge, all rights and obligations of each of them are transferred to the newly created organization (Clause 1 of Article of the Civil Code of the Russian Federation). Consequently, the creditor has the right to demand repayment of the debt from the legal successor. And if so, then it is impossible to write off the “receivable” due to the reorganization of the debtor (letter of the Ministry of Finance of Russia dated 09/06/16 No. 03-03-06/1/52041; see “Receivables cannot be recognized as uncollectible if the debtor ceased operations due to merger with another legal entity").

Why is this necessary?

When conducting an inventory of liabilities, accountants often identify debts whose status has not changed for a long time. And it is not possible to collect such debt due to various factors. There is no point in leaving the delay in accounting. The amount can be written off as expenses of the organization.

The essence of such a decision as recognizing a debt as uncollectible is the ability to take into account the company’s losses for taxation (clause 2, clause 2, article 265 of the Tax Code of the Russian Federation). It is impossible to collect an uncollectible debt. Consequently, part of the organization's money or assets is completely lost. And this is a loss.

But not all types of delays can be taken into account for tax purposes. An exhaustive list of situations is enshrined in paragraph 2 of Art. 266 Tax Code of the Russian Federation. Consequently, if a company has a debt in its accounting that does not comply with the norms of fiscal legislation, then the recognition of bad receivables on it is not allowed, which means that losses cannot be taken into account when calculating income tax.

Features of debt write-off

Some people mistakenly believe that if an entrepreneur took out a loan and then deregistered, then he is released from financial obligations. But cancellation of activity does not cancel obligations to the bank and does not make non-payments irrevocable.

If the debtor dies, then his obligations pass to his heirs. But if the heirs completely abandon the property of the deceased, then the debt obligations are transferred to federal or regional authorities.

In accordance with Russian legislation, withdrawn obligations are the debtor’s income, on which taxes are charged. But if the bankers transfer the obligations to collectors or the debtor challenges the loan agreement, then a new debt will not arise.

Bad debt requirements

Let us outline the key conditions in accordance with the Tax Code of the Russian Federation.

| Conditions for recognizing a debt as unrecoverable | Expiration of the limitation period, more details: “Limitation period for debt: main points” |

The obligation has been terminated according to the provisions of the Civil Code of the Russian Federation:

| |

The inability to fulfill obligations was confirmed by the bailiff. Wherein:

| |

| A citizen-debtor (individual) is declared bankrupt in court. At the same time, all his obligations were recognized as repaid, that is, freed from the claims of creditors. |

IMPORTANT!

Similar conditions for recognizing debt as bad in accounting are not established at the legislative level. The regulations contain a reservation only regarding the limitation period. But for work it is advisable to use a tax list of conditions. It is important for an organization to establish the conditions and procedure for recognizing bad debts in its accounting policies.

When should a bad debt be written off?

The main condition for writing off a bad debt is the expiration of the statute of limitations.

The limitation period for bad debts is 3 years, but it can be extended. The maximum duration is up to 10 years. The limitation period begins on the 8th day from the moment of demand. After the expiration date, bad debts can be written off.

Before reflecting the procedure on the balance sheet, the financial institution must obtain certificates and papers that confirm the impossibility of return.

The expiration of the limitation period is confirmed by documents for the shipment of goods to the person who has not paid the invoice, and by certificates of advance payment to the supplier. If the period is still valid, then the basis for writing off the debt is a court decision, an extract from the Unified State Register of Legal Entities, or a certificate declaring the debt uncollectible.

What debts cannot be considered bad

In addition to the conditions for recognizing receivables as uncollectible, the Federal Tax Service has outlined a number of additional rules. If they are not observed, then the debt cannot be taken into account as a bad debt. This means that it cannot be counted as an expense for tax purposes.

If inspectors identify improperly written off arrears, the company will face sanctions. Firstly, tax authorities will restore the income tax base or simplified tax system to 15%. And, of course, additional tax will be charged on the restored amount. Secondly, the company faces a fine of 20% of the underpaid tax amount. Thirdly, penalties. Well, for dessert: if the Federal Tax Service admits that the taxpayer deliberately underestimated the base, then the amount of the fine will double - 40% of the debt.

The following cannot be classified as bad debts:

- Not documented. Moreover, a supply agreement alone is not enough. Invoices, certificates of completed work, payment slips and checks are required. That is, documents confirming that the debt exists.

- Related to the sale of goods, works or services. For example, arrears arising from securities or from the assignment of rights are quite difficult to offset. Such an operation requires a written explanation from the Federal Tax Service. But over time, controllers became more loyal to such debts.

- Needed to be collected. If the creditor has not taken any action to get his money or assets back, then such a delay cannot be recognized in tax accounting.

- Pardoned by settlement agreement. If the creditor forgave the debt or received at least something in return and a settlement agreement was concluded about this, then the delay cannot be considered hopeless.

- They have a guarantee. Obligations with a guarantee cannot be considered hopeless. If the main debtor is unable to pay, then collection should be directed to the guarantors.

- They are in solidarity. This means that the obligations under the contract are divided between several persons, without singling out the main debtor. Then the delay cannot be recognized as hopeless until at least one defendant has the opportunity to pay the bills.

All cases are individual. It is necessary to approach the issue of debt write-off thoroughly. Establish the procedure for recognizing debt as uncollectible in your accounting policies.

The debtor-entrepreneur has lost his individual entrepreneur status

We are talking about a situation where an individual entrepreneur who is in debt to an organization has ceased to operate as an individual entrepreneur. At the same time, none of the criteria for bad debts given in paragraph 2 of Article 266 of the Tax Code of the Russian Federation is met in relation to his debts. Does an organization have the right to write off the “receivables” of a former entrepreneur based on the corresponding extract from the Unified State Register of Individual Entrepreneurs? No, you have no right. Indeed, by virtue of an article of the Civil Code of the Russian Federation, even after losing the status of an individual entrepreneur, a citizen continues to bear property liability to his creditors. This means that the company still has a chance to collect the debt, regardless of whether the debtor is excluded or not excluded from the register of entrepreneurs. Such conclusions were made by the Russian Ministry of Finance in letter dated April 27, 2017 No. 03-03-06/1/25384 (see “Receivables cannot be considered uncollectible only on the grounds that the debtor has ceased to operate as an individual entrepreneur”).

However, there is one important nuance here. If the status of an individual entrepreneur is lost due to bankruptcy, then the former entrepreneur will no longer be able to repay his debt. And in this case, the creditor organization has the right to recognize the debt as bad. It can be written off based on a court decision declaring an individual entrepreneur bankrupt. Officials also share the same opinion (letter of the Ministry of Finance of Russia dated May 25, 2015 No. 03-03-06/1/29969; see “The Ministry of Finance explained when an organization can write off the debts of a bankrupt entrepreneur”).

How to complete the operation

Any accounting transaction must have documentary evidence. Writing off hopeless overdue payments is no exception. But what documents should be used to document the situation? We follow the instructions:

- Prepare documentation confirming the actual existence of the debt. This is a supply or contract agreement. We also need acts of completion of work, delivery notes, invoices, payment orders for the transfer of advance payments, and bank account statements.

- Now prepare forms confirming the grounds for write-off. These may be acts of reconciliation, an order to liquidate a company, a court decision on bankruptcy, an extract from a bailiff on the termination of enforcement proceedings and other certificates.

- Based on the collected documents, prepare an order to write off the bad debt. A sample is shown in the illustration.

- Reflect the transaction in accounting and tax accounting. Draw up an accounting statement or other accounting form provided for by the accounting policies.

Sample order to write off irrevocable debt

Mechanisms of influence on the debtor

The legislation very clearly defines the mechanisms of influence on the debtor in order to fulfill loan obligations. As a rule, the issue can be resolved in several ways. Let's look at them:

- work of a specialized collection service with the debtor directly;

- mutual consent of all interested parties in order to change the terms of the contract;

- appeal to the judicial authorities, at this stage a settlement agreement is possible;

- making a decision by the court for the purpose of recovery and transferring the proceedings to the bailiff service.

It is worth saying that after exhausting all possible methods of collection, banks decide to write off the debt. However, this approach between legal entities is not entirely appropriate, namely in terms of the work of the debt collection service. The most common interaction between company lawyers is in pre-trial and judicial modes.

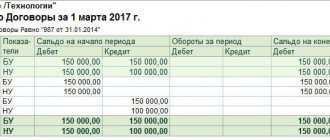

Accounting and tax accounting

When working with irrevocable overdue payments, it is important to take into account the opinion of officials about write-offs and reserves. If the company has a reserve for doubtful debts, the amount of bad debt is written off against this reserve. If the non-refundable delay is greater than the reserve, then the difference is taken into account as part of other expenses for taxation.

We described in the article “Reserves for doubtful debts in accounting” how a debt is recognized as doubtful and what are the rules for forming a reserve fund.

After the amount of the irrecoverable overdue amount is written off from the balance sheet accounts, it must be reflected on the balance sheet. For this purpose, account 007 “Debt of insolvent debtors written off at a loss” is used. It is mandatory to keep off-balance sheet accounting of written-off amounts in case the creditor restores its solvency and is able to pay. In this case, the income tax will have to be reinstated.

Let's consider the procedure for recording the main situations of writing off bad debts.

The debtor has a guarantor

Debts that are secured by a guarantee cannot be considered hopeless. The reason is that, according to Article 361 of the Civil Code of the Russian Federation, the guarantor is responsible to the creditor of another person for the latter’s fulfillment of his obligations. And even if it is not possible to collect debts from the debtor himself, there remains a chance that the obligation will be repaid by the guarantor. The Ministry of Finance of Russia recalled this in letter dated October 28, 2013 No. 03-03-06/2/45483 (see “A creditor organization cannot recognize a debt under an obligation as bad in the presence of a guarantor”).

Goods, work or services not paid for by the buyer

The seller will have to write off the entire debt amount along with the amount of value added tax. It is impossible to claim VAT for deduction in such a situation. We reflect transactions in accounting:

| Operation | Debit | Credit |

| The goods have been shipped to customers | 62 | 90-1 |

| The cost of shipped products is taken into account | 90-2 | 41 |

| VAT charged | 90-3 | 68 |

| On the date of debt write-off | ||

| Write-off of bad debt reflected | 91-2 | 62 |

| The amount written off is reflected on the balance sheet | 007 | |

Taxes

The described procedure often becomes the subject of a dispute between the tax office and the taxpayer. Tax authorities may recognize the write-off procedure as unlawful. After all, carrying out the process helps reduce the income tax payment. In this case, the company faces the risk of debt to the budget.

Therefore, before you decide to start the process, you should carefully study all the standards established by tax legislation regarding this issue.

So, if a debt is recognized as bad due to the expiration of the period, then it should be taken into account as part of non-operating expenses in the same period when the repayment period ended. Moreover, accounting occurs on the final day of the payment period.

If the message was the liquidation of the enterprise, then the debt is taken into account in the expenses of the period when an entry was made to exclude the debtor organization from the register of legal entities.

Advance payment to supplier without subsequent shipment

| Operation | Debit | Credit |

| An advance was transferred to the supplier for future delivery of goods and provision of services | 60 | 51 |

| VAT on advance payment is deductible | 68 | 76 |

| On the date of debt write-off | ||

| The debt is written off, including VAT | 91-2 | 60 |

| VAT on advance has been restored | 76 | 68 |

| The debt is reflected in the off-balance sheet account | 007 | |

The debtor bank has gone bankrupt, but bankruptcy proceedings have not yet been completed

If the debtor is a bank that has been declared bankrupt by the court, then until the bankruptcy proceedings are completed, its debts cannot be included in the category of bad debts. This rule continues to apply even in a situation where bankruptcy proceedings last for several years and the creditor has lost hope of getting his money back. The fact is that formally, before the end of bankruptcy proceedings, the likelihood of repaying the debt exists, and it is too early to talk about hopelessness. This approach is followed by the Russian Ministry of Finance (letter dated 03/04/13 No. 03-03-06/1/6313; “An organization cannot write off the debt of a bankrupt bank until bankruptcy proceedings against the bank are completed”).

Sanctions for violation of contract terms

| Operation | Debit | Credit |

| On the date of recognition of sanctions by the debtor or the court | ||

| Penalties and fines for non-fulfillment of contract terms are taken into account | 76-3 | 91-1 |

| On the write-off date | ||

| A penalty or fine has been written off due to impossibility of collection. | 91-2 | 76-3 |

| The amount is reflected on the balance sheet | 007 | |

The receivables were transferred to the taxpayer under an assignment agreement

An assignment agreement provides for one company to acquire the debts of another company and become a new creditor for the debtor. At the same time, the new creditor does not have the right to declare that the received debt is bad, since he can subsequently resell this debt. And at the time of resale, it will generate income in the form of revenue, and will also reflect expenses in the form of the amount spent on the purchase of this debt (clause 3 of Article 279 of the Tax Code of the Russian Federation).

Until the resale has taken place, it is unacceptable to show expenses. In particular, it is impossible to write off the received “receivable” as part of bad debts. The Ministry of Finance of Russia has repeatedly pointed this out (see, for example, letter dated October 20, 2015 No. 03-03-06/1/60050; “Receivables “acquired” under an agreement for the assignment of the right of claim are not recognized as uncollectible”).

Postings and documents

To write off a bad debt, internal inventory and an order from the manager are not enough. Other documents are required to confirm the bad nature of the debt. In addition to the agreement with the counterparty, invoices, acceptance certificates and documents confirming payments, they may be an extract from the debtor’s Unified State Register of Legal Entities, court decisions, decisions of government authorities, etc.

Write-offs are made using one of the following account correspondences:

- Dt 63 Kt 62, 76 - if bad debts can be written off at the expense of the created reserve;

- Dt 91/2 Kt 62, 76 - if the reserved funds are insufficient or the reserve has not been created.

The written-off amount must also be taken into account on the balance sheet on Dt 007. Analytical accounting is carried out in the context of debtors. Documents must be stored for 5 years. Companies operating on the simplified tax system cannot recognize bad debt for tax purposes.

Results

- Bad accounts receivable differ from doubtful accounts receivable in that they are completely impossible to collect.

- If there are several reasons for the occurrence of an uncollectible receivable, the amount is recognized as such based on the first one that arises.

- You can write off a debt by creating a reserve, or you can write it off as a loss.

- When recognizing a “debt” as uncollectible, it is important to rely not only on the company’s internal documents, but also on decisions of government, judicial, and regulatory authorities.

- If there are counterclaims in mutual settlements with the debtor, it is safer to begin to offset them, and then recognize the debt as bad. Otherwise, claims may arise from the Federal Tax Service.

- Bad debt is accounted for on account 63, account 91/2, depending on the source of repayment. Such debt is also taken into account in the balance on account 007.

Recognition of the hopelessness of debt collection

- Setting the limitation period

The limitation period is the period of time during which a claim can be defended against a person whose right has been violated. In accordance with Art. 196 of the Civil Code of the Russian Federation, in the general case, it is equal to three years.

Its beginning should be considered the day following the payment date specified in the contract. If a specific time frame is not specified in the contract, the start date will be the day following the presentation of claims against the debtor.

If the defendant acknowledges his obligations, the claim period may be interrupted. This is possible in the following cases:

- he can repay part of the amount or interest;

- a request for an installment plan or mutual settlement may be satisfied;

- With mutual consent, it is possible to change the contract.

In this case, the limitation period is calculated anew. Before the end of the claim period, the creditor company must provide evidence that it tried to collect the money in all possible ways. In this case, it is advisable to have documentary justification for your actions, namely a judicial act or acts that do not satisfy the plaintiff’s claims.

- Confirmation of impossibility of debt collection

Guided by paragraph 1 of Article 416 of the Civil Code of the Russian Federation, obligations are recognized as impossible to fulfill if cases arise in which neither party is to blame. Such cases include natural disasters, emergencies, fires, floods, etc., as a result of which the debtor lost property and the opportunity to pay off debts by selling it.

If a private person has a debt to a legal organization and dies, then the debt of the former may also be considered impossible to repay. Here you should be guided by Article 418 of the Civil Code. According to it, the obligations of a private person are usually inextricably linked with his personality. The only exception is if the debtor has heirs to the property, for whom, in the event of inheritance, an obligation to fulfill the debt repayment also arises.

- Liquidation of the debtor organization

After several hearings and production processes, the arbitration court announces the end of the bankruptcy process, and an entry about the liquidation of the debtor enterprise is made in the Unified State Register of Legal Entities. The day this entry is made ends bankruptcy proceedings, in accordance with paragraphs 3 and 4 of Article 149 of the Bankruptcy Law.

When external bankruptcy administration is introduced, the debt obligations of a bankrupt do not become hopeless for collection until the end of bankruptcy proceedings is recorded. This is possible when the creditor counterparty stated its claims in a legal manner and was entered into the register of creditors on time.

If only part of the receivables is entered in the register of creditors for the debtor company, and the legal entity itself is declared bankrupt with the corresponding entry in the register, then, as a rule, the creditor has the right to write off all existing debt. The practice of arbitration courts confirms this version.

If there is an agreement of joint liability, including for debt obligations, according to documents, with other legal entities, the creditor, even if the main counterparty is declared bankrupt, does not have the right to write off the receivables as bad by the tax authorities. There is an opportunity to return funds by receiving them from the parties to the joint liability agreement.

- Bankruptcy of a debtor-citizen

On January 1, 2021, paragraph 2 of Article 226 of the Tax Code of the Russian Federation came into force, which states that the debts of a private person officially declared bankrupt are considered hopeless for return. The bankruptcy law itself prescribes the release of such a person from all claims from creditors. Debts are considered written off. The accounting department of the creditor company must record this debt as unrecoverable.

If an individual has such an unpaid debt obligation to a legal entity and is declared bankrupt, the latter can write off the debt and take this written off debt into account when calculating the tax base.

Results

In order for tax debt to the budget to be written off, it must first be recognized as uncollectible.

This happens both in a number of situations of actual impossibility of collection (during liquidation, bankruptcy, death of the debtor, completion of enforcement proceedings with a conclusion on the impossibility of collection), and through the court. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The procedure for writing off arrears and debts on penalties and fines recognized as uncollectible

The current position and procedure for writing off arrears are established by the tax norms of the legislation of the Russian Federation. Only the relevant body with the necessary powers can create an order, resolution or other act of write-off. Most often, this body is played by the tax inspectorate. Based on the available data on the amount of debt, its duration and date of formation, an appropriate order is issued.

An appendix to it is a statement or certificate from the tax authority, which reflects in as much detail and accuracy as possible all financial receipts from the taxpayer, the amount of penalties and existing fines and other information.

The created order or other write-off act must be sent to the taxpayer.

If, for some reason, a representative of the tax authority had to go to court in order to write off, the statement of claim must also contain all the important information and a list of circumstances.

A decision to recognize a particular debt as bad must be made by the authorized body within one day from the moment when all the necessary documents - a certificate, act, orders or legal action have been properly drawn up.