in 1C: Accounting 3.0 Many users of “1C: Accounting 3.0” need to print using forms MX-1, MX-3

Vehicles for which tax benefits can be issued Question about providing benefits for payment

Payers of this tax and tax agents are required to report on VAT (Article 143 of the Tax Code of the Russian Federation).

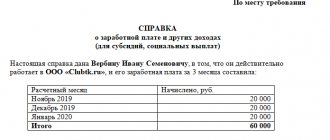

A certificate stating profit in any form is one of the forms of confirmation of payment

Recommendations for submitting payslips according to Form 4-FSS of the Russian Federation via the Internet in electronic form

The concept of “total length of service” (GTS) cannot be found in the current legislation of the Russian Federation. This is a certain

The inability to make payments to suppliers can stop the work of any enterprise and cause huge losses and

Concept First of all, we note that in tax legislation quite a lot of attention is paid to the signs of interdependent

A matching statement is a document on the basis of which the head of an organization can obtain information about

The short designation P-2 hides a statistical type of reporting, namely, a report form