Bookmarked: 0

What is statistical reporting? Description and definition of the concept.

Statistical reporting is a centralized form of state control over the activities of organizations, enterprises, institutions through legally established statistical reports periodically supplied to the relevant authorities, containing data on the organization’s activities for a certain period. The accuracy of information in statistical reports is certified by the signatures of responsible persons. Options for providing statistical reporting: mail, teletype, fax, e-mail, and so on.

Statistical reporting is divided into current and annual.

Let's take a closer look at what statistical reporting means.

The essence of statistical reporting

Statistical reporting is a special form of organizing data collection, inherent only in state statistics. It is carried out in accordance with the federal statistical program. State statistics includes all types of statistical observations (regular and periodic reports, one-time records, various types of censuses, sample, questionnaire, sociological, monographic surveys, etc.), the forms and program of which are approved by the State Committee of the Russian Federation on Statistics or by bodies in agreement with it state statistics of republics within the Russian Federation, territories, regions, autonomous regions and autonomous districts, the cities of Moscow and St. Petersburg.

Information about the activities of enterprises and organizations is received by statistical authorities within the established time limits in the form of certain documents (reports). The forms of such reports are called statistical reporting forms. Each of them has its own code and name. For example, form No. 5-nt (samples) “Report on samples of a new type of machines, equipment, devices, devices created for the first time in Russia in 199 ...” or form No. 2 - innovation “Information on technological innovations of an industrial enterprise (association) for 199 ... year" and so on.

The reporting program, that is, the list of collected information, the methodology for determining it and the form of the reporting form, is developed and approved by the State Statistics Committee of the Russian Federation. Reporting forms, including financial results, are also approved by the Ministry of Finance of the Russian Federation.

Reporting varies in frequency:

- urgent – contains data for a month or less;

- quarterly – contains data for the quarter;

- semi-annual – contains data for half a year;

- annual – contains data for the year.

The most detailed is the annual reporting program.

Urgent reporting is often transmitted by telegraph (or email) and is called wire reporting; reporting for longer periods is by mail.

Statistical observation in the form of reporting uses only one data source - documents. First of all, these are accounting documents of enterprises and organizations.

Reorganization

In the case of business restructuring, the last reporting year lasts from January 1 of the year in which the last of the established companies was registered until the date of such registration (Part 1 of Article 16 of Law No. 402-FZ). The exception is cases of accession. Then the last reporting year is the period from January 1 to the date when a note on the termination of the activities of the affiliated company was entered into the Unified State Register of Legal Entities (Part 2 of Article 16 of Law No. 402-FZ).

For a reorganized company, the deadline for submitting the balance sheet for 2017 is no later than 3 months from the date that precedes (Part 3 of Article 16 and Part 2 of Article 18 of Law No. 402-FZ):

- date of state registration of the last established company;

- the date when an entry was made in the Unified State Register of Legal Entities about the termination of the activities of the affiliated structure.

Organizations created through reorganization draw up a balance sheet as of December 31 of the year in which the reorganization took place (Part 5, Article 16 of Law No. 402-FZ). It must be submitted no later than March 31 of the following year.

Also see “2-NDFL during reorganization and liquidation.”

Read also

19.04.2017

Features of the concept

The main feature of statistical reporting is a generalization of available information that relates to the financial position of an economic entity, as well as the results of its business activities.

The reporting includes filling out specialized forms specified by law or industry standards; numbers are entered by period, for example, by week, month, year.

Reporting should be built into a system formed by indicators that are closely related to each other. For example, revenue is usually combined with calculated tax figures.

Statistical reporting is an official document containing information about the work of the reporting object, which must be entered on a special form. Accounting data is the basis for statistical reporting.

Primary accounting includes the registration of various facts (events, processes and transactions) produced as they occur and, accordingly, on the primary accounting document. For example, you can take a child’s birth certificate. If this is trade, then the primary accounting documents include orders for the release of goods, invoices, and invoices. The functions of primary accounting include observation operations, meaning the calculation of totals and recorded data.

All enterprises or institutions submit established forms of statistical reporting that define various aspects of their activities. Only state statistics bodies have the right to approve existing forms of statistical reporting.

Current and annual reporting are distinguished by the period of time for which the reporting was provided. Annual reporting is if information is presented for a year. Reporting for all other periods within less than a year, respectively quarterly, monthly, weekly, is defined as current.

Statistical – this reporting is special, since it is a set of indicators that have both a quantitative and qualitative nature, which characterize the activity of an enterprise in a specific period of time. As a rule, it is used to monitor indicators on the volume of products produced (or services provided), the movement of funds, and aspects reflecting the personnel component.

The system of statistical reporting, for example in production, is characterized, first of all, by mandatory nature and is of an official nature, and those documents that relate to it have legal force. State statistics bodies are the object that provides relevant information.

What is this

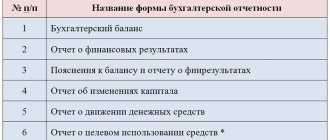

The standard package of documentation for any financial statements is the enterprise’s balance sheet, financial performance report, and the necessary appendices to them. The main task is to consolidate accounting data for a certain period. They are presented in a visual form to interested structures.

In fact, this is the final stage of the accounting stage. All reporting is reflected as a set of totals with an increase. It means leaving in the currency of the Russian Federation, in Russian. The provided indicators are systematized into groups to facilitate their use.

By order of Rosstat, a complete list of documents subject to mandatory certification has been approved. The Ministry of Finance has established and put into effect special forms.

Classification

Let's consider the main types of statistical reporting. In the practice of the Russian state, there are two forms of reporting. Firstly, this is standard statistical reporting (or general), and secondly, specialized. Both of them, as a rule, are provided to departments within a single system.

General reporting is a type of reporting that contains the same data for a certain area of the national economy and for enterprises (institutions) of the national economy as a whole.

The content of specialized reporting includes specific indicators of individual industries and agriculture.

In accordance with documentary recording, all types of statistical reporting usually look like a form drawn up according to standards defined by law. Let's look at what they are.

Fines

In case of failure to provide or untimely submission of reports to the Rosstat department, penalties are provided for the reporting persons:

- officials - from ten to twenty thousand rubles;

- legal entities – from twenty to seventy thousand.

If an administrative offense is not committed for the first time, a fine in the amount of up to fifty thousand will be imposed on the managerial person, and from one hundred to one hundred and fifty thousand for a legal offense. Also, liability is provided for displaying false information in statistics.

Basic forms

Statistical reporting forms were developed and published in accordance with legal acts by two departments - the Ministry of Finance of the Russian Federation and the State Statistics Committee. In addition to these sample documents, instructions for correct completion are always published. Types of technological documents: paper and electronic. These forms are used by state statistics agencies.

Does the size of the company matter? Today, many Russian companies classify themselves as “small enterprises”. In such a situation, it is imperative for the management of the organization to send data reflecting information about the main performance indicators to the statistical authorities.

The required form must be filled out on a cumulative basis. It must be sent quarterly, before the 29th day of the month following the reporting period. The main document used to submit statistical reporting for SMEs is Form No. PM (taking into account adjustments in accordance with Rosstat Order No. 470, which was approved on August 29, 2012).

Statistical reporting of the organization is a mandatory procedure. If an enterprise does not provide information to Rosstat, then it is guaranteed a legal penalty of an administrative nature. This penalty may be a fine or a warning.

An important criterion for the mentioned procedure, that is, statistical reporting, is the timing. And if an enterprise submitted information to Rosstat, for example, being more than a day late relative to the settlement date, this may be regarded as a failure to provide the appropriate forms. The result may also be a fine or a warning.

Liquidation: when is the balance sheet for 2021 due?

For companies that have ceased to exist, the last reporting year is from January 1 to the date of entry on liquidation in the Unified State Register of Legal Entities (Article 17 of Law No. 402-FZ). In this regard, accounting reports must be submitted within three months after this date.

EXAMPLE

The entry on the liquidation of Guru LLC was made to the Unified State Register of Legal Entities on November 21, 2017. This means that the reporting period for LLC is from January 1 to November 21, 2017. And for the balance sheet for 2021, the deadlines are: no later than February 28, 2021.

Data accuracy

It is important to remember that the statistical reporting of an enterprise must reflect reliable information. Distortion of information is unacceptable by law. It is important to build a statistical reporting system at an enterprise so that the data provided to official departments undergo a thorough check for reliability.

A serious condition for verifying information sent to Rosstat is the obligation (in accordance with the relevant provisions of the law) to transfer constituent documents to government agencies along with standard forms. Information from there is used to assign special types of codes and include information about the company in the unified register of enterprises, which is controlled by the department.

Based on the above, reporting provides government authorities with much-needed information. Such reports make it possible to monitor the dynamics of the volume of industrial production and products of various sectors of the national economy, assess the comprehensive development of the country and regions, study the ratio of different forms of ownership by industry and region, and compare the effectiveness of the activities of state and non-state organizations and enterprises.

Submission methods

A completed copy of financial statements can be submitted in several ways:

- Deliver the documentation personally to the TOGS department;

- Use postal services by sending by registered letter with acknowledgment of receipt;

- Via electronic sending via the Internet. In this case, the document must be executed in the prescribed manner with an electronic signature.

Based on the information published on the official website of Rosstat, financial statements for 2021 are submitted electronically to the statistics department and the tax service in the same format.

The use of identical methods of sending to these departments makes the work easier. It is enough to generate a report in the electronic system, sign it, and send it to two addresses at once.