A certificate stating profit in any form is one of the forms of confirmation of the paying ability of the company’s employees. The 2021 sample remains the same as previous years. Of course, there are strict requirements for filling out and drawing up such a certificate, but there is no general standard format.

Such a document also helps confirm the frequency of remuneration and a permanent workplace. Such documents are common because they are indicators of the company to present to new employees.

There is a ready-made sample from the Government of the Russian Federation, but such a certificate can be made in any form. If the employer makes the necessary points in it, then the amendment is considered legal. This document can be safely brought to the employer if the employee himself compiled it according to special criteria.

Below we will present the types of certificates, basic rules for filling out and formatting.

Where is a 3 month salary certificate required?

To be recognized as unemployed at the labor exchange, you will need to submit a package of documents, which includes a certificate of average earnings for the last three consecutive months of work. This is also stated in paragraph 2 of Art. 3 of the Law “On Employment...” of April 19, 1991 No. 1032-1.

A certificate of average earnings in 2021 for the employment service has not been approved at the federal level, but there is a form recommended by the Ministry of Labor of the Russian Federation. It is given in the department’s letter dated January 10, 2019 No. 16-5/B-5. In the same letter, the Ministry of Labor warned that if the certificate was drawn up by the employer in any form and contains information necessary to determine the amount and timing of payment of unemployment benefits, there are no grounds for refusing to accept it.

If you have access to ConsultantPlus, check whether you have correctly filled out the average earnings certificate to determine unemployment benefits. If you don’t have access, get trial online access to the K+ legal system for free.

In the certificate for the employment center, the average earnings are calculated according to the rules given in the resolution of the Ministry of Labor of the Russian Federation “On approval of the Procedure for calculating average earnings to determine the amount of unemployment benefits and scholarships paid to citizens during the period of professional training, retraining and advanced training in the direction of the employment service authorities” dated 12.08.2003 No. 62.

The employer must issue this certificate, like any other documents related to work, within 3 days after receiving a written request from the employee (Article 62 of the Labor Code of the Russian Federation).

Applying for loans, subsidies and visas

Credit institutions usually do not require a certificate of average earnings to determine the amount of unemployment benefits, but bankers need a document on the average salary for the last three to six months. Existing legislation does not establish a unified form for such a document and does not specify what information it includes. But banks require that it contain:

- name of company;

- Contact details;

- employee's length of service;

- job title;

- monthly data on wages.

A similar document is sometimes requested to apply for subsidies.

Certificate of average earnings for the last three months at the last place of work for subsidies

When applying to visa centers and foreign embassies to obtain a visa, you also need this document. It must be printed on company letterhead. Its form is not defined by law, but in practice it is recommended to indicate:

- name of the enterprise;

- Contact details;

- employee position;

- monthly salary for the last six months.

There must also be wording that during the trip abroad the employee retains his job and salary. Embassies of some countries, when considering a visa package of documents, give preference to the 2-NDFL form, since it is real evidence that the visa applicant is legally employed.

Read more: Reporting rules and sample of filling out the 2-NDFL certificate

Where is a 6 month salary certificate required?

Typically, documents confirming the amount of salary for a specified period are required by banking institutions to issue loans.

Important! The certificate must indicate the name and contact details of the organization, the length of time the employee has been working in the position held (with its indication) at the given enterprise, as well as the monthly breakdown of the accrued wages.

The same certificate may be required to be submitted to the social security department when applying for a subsidy for utility bills.

There is no strict form for such a certificate. Usually banks and social agencies offer their own form to fill out.

Help contents

Regardless of what form the certificate has, the following mandatory information must be present:

- name of the organization that issued the document and its details;

- passport details;

- average monthly salary;

- the amount of accruals and funds actually received;

- date of issue of the document;

- the locality in which the organization is located;

- confirmation that the person is an employee of this company;

- job title.

In addition, here you can indicate the amount of deductions of insurance premiums and taxes. If you need a “net” salary, this information can be omitted. If the organization has some kind of debt to an employee, it would also be useful to indicate it.

Information about income can be specified in a list. However, it is more convenient to read by drawing up a table. Here the amounts received can be listed monthly. After the table, the validity period of the employment contract concluded with the employee is indicated. Even if an open-ended contract was concluded, this must be indicated in the certificate.

Responsible persons must sign the document. These are the director of the company and its chief accountant. By putting their signatures here, they confirm that the information provided is correct. Naturally, all information must correspond to reality. Supervisory authorities can freely check the data. If they are indicated incorrectly, the responsible persons, namely the director of the company and the chief accountant, will be fined a fairly large amount.

Salary certificate in form 182n: sample filling in 2021

This certificate is issued to the employee so that he can receive social benefits at his new place of work. The information in it is provided for the two years preceding the dismissal.

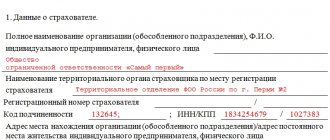

Unlike the two previous types of certificates, this one has a normatively approved form, which is contained in the order of the Ministry of Labor and Social Protection dated April 30, 2013 No. 182n. Now it is applied as amended by Order of the Ministry of Labor dated 01/09/2017 No. 1n (valid from 02/06/2017). You can also find a sample of filling out a certificate in form 182n on our website.

ConsultantPlus experts spoke about the nuances of filling out a certificate in form 182n. Get trial access to the K+ system and upgrade to the ready-made solution for free.

The most common errors

The most popular mistakes include:

- spelling errors, punctuation;

- incorrect codes and details;

- typo errors;

- incorrect calculations of the amount of income.

Such mistakes cannot be made. The responsibility for compilation lies with the accountant or other important person. A document with errors will simply not be accepted in place of the requirements and that’s all. Therefore, before submitting the paper for signature, you must check it for errors, correctness of codes, details, accuracy of filling, etc.

It is worth consulting with an accountant in advance so that he can also check everything and clarify the purpose of filling it out. Certificates can be asked for at any institution, so you should not delay filling it out.

How to issue a certificate of average monthly salary

To obtain a certificate of average earnings for 3 or 6 months, sample 2021, the employee must contact the employer with a corresponding application. He can do this both immediately upon dismissal and at any time after. The certificate is issued within 3 days after receiving a written request from the employee (Article 62 of the Labor Code of the Russian Federation).

A certificate of earnings for the last 2 years of work is issued to the employee upon dismissal, even if the employee did not request it. By written agreement with the dismissed employee, the certificate can be sent by mail or provided at another time.

You may also find information related to the dismissal of an employee useful, which can be found in the article “Deduction for unworked vacation days upon dismissal .

Information for credit institutions

Most banking organizations providing loans, installment plans and financial loans have abandoned individual forms in favor of 2-NDFL. Why? Tax form KND 1151078 contains all the necessary details and data not only about the individual and his income, but also about his employer. Moreover, administrative liability and fines are provided for errors and inaccuracies in the tax document.

Please note that officials have developed and approved a new reporting structure in form 2-NDFL, according to Order of the Federal Tax Service of Russia dated 10/02/2018 No. ММВ-7-11/ [email protected] Now two forms are filled out: one for the tax inspectorate, and the second for for an employee. To provide information to the bank, for example, to obtain a mortgage or consumer loan, use the new 2-NDFL form (for an employee).

Results

Salary certificate is a generalized name for certificates that may be required by various authorities. Its form and design rules depend on the situation in which it is needed.

Sources:

- Order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n

- Law of the Russian Federation of April 19, 1991 No. 1032-1 “On employment in the Russian Federation”

- Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

For a subsidy for utilities

In our difficult times, many receive salaries on the verge of the subsistence level, so they spend most of their money on food and utilities. For such categories, various subsidies are provided, in particular utility subsidies.

According to the Housing Code of the Russian Federation (Article 159), the subsidy is provided to citizens whose housing costs exceed 22% of income. And for family ones, the total income of all employed members is taken into account.

The following may apply for a subsidy:

- home owners;

- tenants;

- family members of owners and tenants who live with them on a permanent basis.

If you fall into the above categories and utility costs are more than 22%, then you will need the following documents:

- the most important thing is a salary certificate for 6 months;

- certificate of family composition;

- photocopies of family members’ passports;

- certificates confirming the degree of relationship (marriage certificate, birth certificate of a child, etc.);

- documents indicating the living space and the right to it (extract from the Unified State Register, lease agreement, etc.);

- certificate of no debt to utility services.

At the same time, the composition of the package of documents provided will be different for pensioners, students and the unemployed. Each officially employed family member must provide a sample salary certificate. Otherwise, the subsidy will be denied.

Naturally, the salary certificate form for a subsidy must contain elements typical for such documents:

- name of the legal entity/individual entrepreneur;

- his details;

- date and number of the outgoing document;

- FULL NAME. employee, his position;

- salary data for the 6 months preceding the month in which he applied to the accounting department.

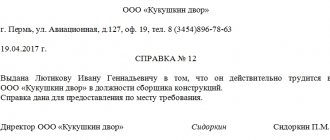

Below is a sample salary certificate for 2021, which can be issued on the employer’s letterhead.

Also see “What to do if a 2-NDFL certificate is not issued.”

Read also

26.07.2019

What will happen to the employer for failure to issue a certificate?

Refusal to issue a former employee with a certificate for the employment service is an unlawful act for the employer. Therefore, a citizen has the right to contact the supervisory authorities with a corresponding complaint. You can submit it to the state labor inspectorate, the prosecutor's office, or both bodies at once.

Then the employer’s actions will be subject to verification and punishment in accordance with the provisions of paragraph 1 of Art. 5.27 Code of Administrative Offences. This is a warning or fines in the amount of:

- for a legal entity 30-50 thousand rubles;

- to an official 1-5 thousand rubles.

Repeated similar violations increase the punishment to a fine of 50-70 thousand rubles for a legal entity and 10-20 thousand rubles for an official.

Procedure and deadline for issuing the form at the place of work

| Writing a written request addressed to the manager that you need a certificate of income. To do this, you need to approach the secretary, a HR specialist, or immediately the responsible accountant. For a civil servant in 2021, the same rules for requesting a certificate of income (available on this page). | If the institution to which the certificate will be submitted has provided an approximate form, attach it to the application. Typically, employees verbally request the document immediately from an accountant or HR specialist. By law, this must happen in writing in order to protect yourself in case the employer refuses to provide a certificate |

| It takes three days to review the application and prepare the initial data. | The time is calculated from the moment the application is received by the employer. Refusal to submit a certificate, delaying deadlines are illegal on the part of the employer |

| A completed certificate can be obtained from the secretary, the human resources department or an accountant. | The document can also be handed over to the applicant’s immediate supervisor. |

| Usually one copy of the paper is prepared, but upon request, the contractor will prepare the quantity that the applicant needs | An employer cannot refuse a certificate even if this is not the first request in a year. |

If an institution or government agency does not establish strict requirements, download the income certificate and enter it into the accounting department.

The document does not have an official validity period; its relevance is determined by the institution for which the certificate is prepared. Since the document certifies recent income, it is considered to be valid for 30 days. Therefore, it is more advisable to take the paper at the beginning of the month, when the accruals are ready and the financial statements are submitted.

Important! If the employer refuses to provide information for any reason or delays the provision, causing the recipient to suffer, the latter has the right to file a complaint with the labor inspectorate and even file a lawsuit in court. But this can only be done if the citizen has documented the application.

Where else do you need information about average earnings?

Information about income received is required not only for calculating sick leave. Confirmation of income may be required in different cases. Let's consider what documents will have to be prepared for different cases.

Receive a subsidy or scholarship

To apply for scholarships, financial support for low-income families, as well as other subsidies from the state (for example, to reimburse part of utility costs), a free form of income certificate is suitable.

Such a document is filled out in a similar manner. It is permissible to indicate the generalized amounts of accruals for the calendar year. If there were no sick leave or maternity leave or child care leave during the required periods, then a corresponding entry is made in the form in free form. If there were cases of disability during the period of work, they should be described.

When such a salary certificate is drawn up, a free-form sample may look like the one shown below.

Features of calculations

- All types of earnings in the organization are taken into account, regardless of financing;

- when calculating the average salary, time and amounts transferred for it are not taken into account if the worker was released from duties;

- if a person was not actually paid a salary during the billing period, the average amount is assigned based on the salary received by the employee in the previous period, equal in time to the billing period;

- to determine average earnings, use the amount of average daily earnings;

- When calculating for an employee for whom summarized recording of working time has been introduced, the average earnings per hour are applied.

One-time payment from the funded part of the pension - how to arrange it? Find out in our material! The entire list of documents required to apply for a pension is here.

Read about raising the retirement age and related changes in payments in this article. We have the most detailed information!