Sick leave certificates in electronic form are documents that are introduced to simplify paperwork and

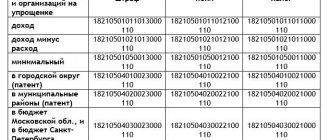

All payers of taxes and mandatory contributions are required to use the KBK when filling out payment orders. For this purpose specifically

Stages of calculating depreciation Methods of depreciation Optimization of costs for depreciation of equipment With questions of calculating depreciation

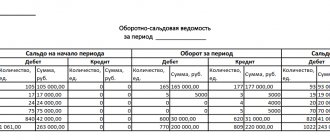

The concept of materials and raw materials in accounting These item groups include assets that

A strict reporting form is an alternative to a cash receipt, or a document that certifies the fact of cash

As part of this consultation on maintaining 1C on the topic of how to close account 20,

According to the legislative acts in force in the country, the use of land is carried out on a paid basis. Even

General business expenses (OCC) - costs not directly related to the production of products or other main

The Federal Tax Service has approved new forms for registering and liquidating a business. Among others accepted

Legal basis There is no separate Federal Law on personal income tax benefits. Regulates personal income tax benefits for a whole