Recommendations for submitting payslips according to Form 4-FSS of the Russian Federation via the Internet

in electronic form using an electronic digital signature

Recommendations have been developed to assist policyholders in submitting payslips in accordance with Form 4 of the Federal Social Insurance Fund of the Russian Federation in electronic form, via the Internet using an electronic digital signature in accordance with federal laws No. 212-FZ of July 24, 2009, 1-FZ of January 10, 2002, 149-FZ dated July 27, 2006, as well as order of the Federal Insurance Fund of the Russian Federation dated February 12, 2010 No. 19 with the appendix “Technology for accepting payments from policyholders for accrued and paid insurance premiums in the system of the Social Insurance Fund of the Russian Federation in electronic form using an electronic digital signature "

You must have the following:

1. Internet access to the FSS RF website https://www.fss.ru, to the FSS RF Portal https://fz122.fss.ru, to the RF FSS reporting gateway https://f4.fss.ru, email box on any paid/free mail server;

2. Installed certified cryptographic protection tool, for example, Crypto Pro CSP or VipNet CSP (purchased from representatives of certification authorities - special communication operators). If you have already concluded an agreement with one of the special operators to transfer information to the Pension Fund of the Russian Federation or the Federal Tax Service of the Russian Federation, then most likely you already have a CIPF installed. Make sure that the CIPF you use satisfies the requirements of the Technology

.

3. A valid new digital signature key with the required fields OID.1.2.643.3.141.1.1

(RNS FSS - registration number of the policyholder) and

OID.1.2.643.3.141.1.2

(KP FSS - code of subordination of the policyholder) of a person authorized by the head of the organization to sign the payroll in accordance with Form 4 of the FSS of the Russian Federation. It can also be purchased from representatives of certification centers - special communication operators who are accredited with the certification center of the FSS of the Russian Federation or have cross-certification with a CA that is accredited with the CA of the FSS of the Russian Federation. The list of accredited CAs is posted on the website of the FSS of the Russian Federation https://www.fss.ru/uc.

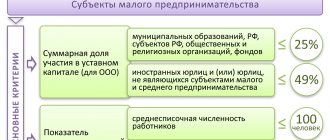

Who is required to report to the Social Insurance Fund electronically?

All organizations and individual entrepreneurs with employees are required to report to the Social Insurance Fund. Reports are submitted 4 times a year: based on the results of last year, the first quarter, half a year and 9 months of the current year.

By law, reports can be submitted both electronically and in paper form.

The form of submission depends on the number of employees. Organizations with more than 25 employees are required to submit reports to the Social Insurance Fund electronically. Attention : when calculating the average number of employees, employees on maternity leave and those who have written an application for parental leave are excluded.

Also, persons specified in Rosstat Order No. 772 dated November 22, 2017 (clause 79) are not taken into account. The same applies to both newly created and reorganized organizations (Article 15 of the Federal Law of July 24, 1998 No. 125-FZ).

Reports are submitted in the form approved by Order of the Social Insurance Fund of the Russian Federation No. 275 dated 06/07/2017 (Form 4-FSS). This form is submitted for contributions to insurance against accidents (injuries).

The electronic calculation format was approved by order of the Federal Tax Service of the Russian Federation No. 83 dated 03/09/2017.

Rice. 2. You only need to report to the Social Insurance Fund on contributions for injuries

Payment of insurance premiums

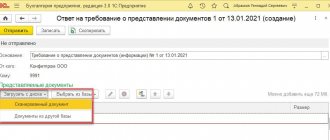

Let us remind you that the payment of insurance premiums can be carried out both in the 1C program, followed by uploading a payment order to the bank, and by downloading an extract from the bank-client system. In the second option, in order to correctly reflect the payment of the contribution in the reporting, it is necessary to create an electronic document “Write-off from the current account”.

Fig.9 Debiting from current account

What services can you use to submit your report online?

An organization has 3 ways to submit electronic reports to the Social Insurance Fund:

- on the FSS portal (free);

- through the State Services website (free);

- through a special intermediary operator (under agreement).

To submit the form through the FSS portal, you need to register on the website fz122.fss.ru and install certificates. The report is generated directly on the website. Then you need to download it, save it on the policyholder’s work computer, sign the completed calculation with an enhanced qualified electronic digital signature (EDS) and upload it to the portal.

After loading the data, the electronic digital signature is checked to ensure that the file complies with current formats and compliance with the requirements for filling out the calculation. If the check is successfully completed, a receipt of acceptance is sent, if errors are detected, a receipt of receipt of the calculation with errors is sent. In both cases, the form is considered submitted.

If there are errors in the format and digital signature, a verification protocol is sent, in which case the calculation must be sent again.

You must also register on the State Services website, in the section for legal entities, select “Ministry of Labor/FSS” and. The uploaded file with the calculation is also signed with a qualified digital signature.

You can send electronic reports to 4-FSS through a special operator - a company that has a certificate with the right to sign reports to the funds. To do this, you will have to connect to a special program, in which you can immediately fill out a report form. You can also download a pre-prepared file downloaded from an accounting program.

Note: if the employee did not have income during the reporting period, reporting must still be submitted with zero figures.

Rice. 3. Submitting reports electronically saves time

Control over the preparation and presentation of reports in 1C

The 1C system provides for a whole system of control over the preparation and presentation of reports. In the menu “Main” - “Tasks” - “List of tasks” there is a system of reminders about the need to compile and submit certain reports.

Fig.20 Task list

In addition, the head of the accounting and reporting department can check the status of the report at any time: prepared, submitted or accepted by the regulatory authority.

Procedure for filling out form 4-FSS

Starting from 2021, you need to report using a new form (Order of the Federal Tax Service of the Russian Federation No. 381 dated September 26, 2016).

The form consists of a title page and 6 tables.

All organizations must fill out the title page, tables No. 1, 2 and 5. Other indicators are entered only if available, and they are not required to be submitted if data is not available. Blank lines of the form are always crossed out. Important! On each page it is necessary to indicate the registration number and five-digit subordination code, which are assigned to the organization upon registration with the Social Insurance Fund at the beginning of its activities.

The first sheet indicates the basic data of the organization, which can be taken from the registration certificate or extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs.

Table 1 contains data on payments to employees for the last three months. Table 2 contains data on accrued and paid contributions for the reporting period, reflecting the debt at the beginning of the year (line 1) and the end of the period. Line 19 reflects the debt at the end of each reporting period (quarter, half-year, 9 months and year). To fill out table 2, the SALT for account 69.11 is used.

Table 3 reflects the amount of sick leave paid in connection with occupational diseases or industrial accidents.

Table 4 reflects the declared number of victims based on acts N-1 and acts on occupational diseases

Table 5 reflects the results of the assessment of working conditions and medical examinations.

For more information about filling out the form, watch the video:

When should the report be submitted?

The previous 3 reporting forms that were required to be submitted in 2021 have already been submitted by organizations. Next up is the report for 9 months of 2018. If submitted online, it must be submitted by October 25, 2018.

The 4-FSS report for the full year 2021 will need to be submitted by January 25, 2019.

Table 1. Deadlines for submitting reports to the Social Insurance Fund

| Reporting period | Electronic submission deadlines |

| 9 months 2021 | Until October 25, 2021 |

| 2018 | Until January 25, 2021 |

Top 5 services for submitting financial statements via the Internet

We have selected several services that help you submit reports online. We’ll also tell you which of them you can use for free.

Kontur.Extern - 3 months of free work

Kontur.Extern is one of the products of the SKB Kontur company. The service allows you to submit reports to all regulatory authorities: Federal Tax Service, Pension Fund of Russia, Rosstat, Social Insurance Fund, Federal Service for Regulation of the Alcohol Market and Rosprirodnadzor. To work, you will need an electronic signature.

The service does not need to be installed or updated. It works via the Internet and is regularly updated itself - reporting forms and control ratios are always up to date. In addition, the service notifies you of upcoming reports via SMS, creates a calendar for you, and checks reports before sending.

Kontur has a “Test Drive” for 3 months. All this time, you will be able to send reports for free and use other features: preparation of payments, financial analysis, tax audit risk assessment, reference and legal system, verification of counterparties, etc.

Then you will have to choose one of the tariffs and pay for the work in the service. The cost of the “Optimal Plus” tariff for individual entrepreneurs in a special mode is 5,290 rubles, for an LLC in a special mode – 12,540 rubles. The calculation will be carried out for you individually depending on the size of the company, the taxation system and your needs.

BukhSoft - free access for two weeks

BukhSoft reporting is a special service for sending reports via the Internet. The service interacts with all regulatory authorities: Pension Fund, Social Insurance Fund, Federal Tax Service, Rosstat, RAR, Rosprirodnadzor.

Working with BukhSoft is easy; sending a report takes 4 steps:

- connect your electronic signature to your computer;

- upload the report to the program or prepare it in BukhSoft;

- go through the automatic report check before sending and make corrections;

- wait for confirmation that the authorities have received and accepted the report.

The service has additional services: 24/7 technical support, a help system for an accountant, a contractor verification service, and electronic document management.

BukhSoft has a trial period of 2 weeks. Then you need to choose one of two tariffs: “Start” for 2,784 rubles per year or “Comfort” for 9,937 rubles per year. The Comfort tariff offers inter-document checks, electronic document management, a help system and verification of counterparties.

VLSI - all reports with demo access

SBIS is one of the largest accounting companies. It has a separate service for preparing, checking and submitting electronic reports via the Internet. All possible reports are available in the system, including reporting to the Migration Service and the Central Bank.

The system is suitable for businesses of any size. The price of the service includes assistance in filling out reports, a reporting calendar, a robot for submitting zero reports, financial analysis, recommendations for tax optimization, tax reconciliation, etc.

There is no free period for sending reports in the service. But you can use demo access and evaluate the functions and capabilities of the program. To send reports, you need to connect a license. For submitting reports, commercial individual entrepreneurs and organizations are offered two tariffs: “Easy” and “Basic”. In addition, you will need a VLSI account for 500 rubles.

Taxnet - Declaration.Online with demo access

Taxnet supports sending reports in six main areas: Federal Tax Service, Pension Fund of the Russian Federation, Rosstat, FSS, FSRAR and RPN. In the program you can create documents and edit those already downloaded; the service, like everything else, checks reports for compliance with control ratios.

Declaration.Online works in a browser and is accessible from any computer with the Internet. There is no need to download or update the program.

Separately, we can praise their notification system - information about the status of reports, tax requirements and delivery reminders are sent via SMS and email.

The “Declaration” can be tested in test mode. You cannot submit reports there, but you can try to download and edit a report, create a new one, sort reports, study available documents, etc.

The cost of the service for one company per year is only 1,500 rubles. If you buy for three years at once, you can pay 3,600 and save 900 rubles. Please note that this price does not include a Taxnet-Operator account, the issuance of an electronic signature and the function of verifying counterparties.

Astral Report 5.0 - reporting without trial period

In Astral, reports are available to the Federal Tax Service, the Pension Fund of the Russian Federation, the Social Insurance Fund, the FSRAR and Rosstat. The service is suitable for individual entrepreneurs and organizations under all taxation regimes. In the program, without additional modules, electronic work books and work with electronic sick leave are available. The service reminds you of missed Federal Tax Service requirements in your personal account and provides additional notifications asking you to confirm receipt.

Additional features include exchanging documents with the Federal Tax Service and the Pension Fund of the Russian Federation, checking reports for errors, importing reports from other systems, and smart hints for each field of the reporting form.

This product does not have a trial period. You can register by mail, familiarize yourself with the interface and capabilities of the service, but you will not be connected to the service, and you will not be able to send reports. Connecting to the service is exclusively paid.

The cost of connecting an individual entrepreneur for a year is 1,500 rubles, for legal entities - 3,900 rubles.