The inability to make payments to suppliers can stop the work of any enterprise and cause huge losses and reputational damage not only to it, but also to its partners. Especially big troubles can come from a credit institution's unexpected refusal to execute an order when it is urgent to pay suppliers. Blocking an organization's account is a collective concept that means restrictions on the disposal of a bank client's own funds. Such restrictions may be imposed by various authorities:

- seizure of deposits - by the bailiff service or the court

- refusal to carry out a transaction or freezing of money - by credit institutions in accordance with Law 115-FZ in order to combat money laundering and the financing of terrorism

This article discusses the most common type of blocking - suspension of transactions by the Federal Tax Service.

Termination of operations as a way to ensure payment of taxes

Typically, the Federal Tax Service “blocks” accounts in order to ensure the collection of additional tax. Moreover, most often, we are talking about debts of several million or more. Having added additional payments, the inspection immediately suspends operations on the company’s account, sending a Decision to the bank for this purpose. There are two ways to remove restrictions: pay taxes or cancel the decision in a higher authority or court.

At the same time, for some reason, many business entities are confident that if they achieve a reduction in fines and taxes in arbitration, then the Federal Tax Service will be obliged to cancel the decision to suspend operations. This is not far from the case. The law does not link the lifting of the suspension to a judicial decision that reduced the amount of tax debt.

For example, the company achieved a reduction in additional taxes through legal proceedings. However, the fiscal authorities immediately appealed the court's decision and at the same time (!) blocked the taxpayer's bank accounts. The appellate instance upheld the judicial act and only the cassation overturned it, recognizing the correctness of the tax inspectorate. All this time the account was blocked. (AC of the Udmurt Republic case No. A71-17342/2016). And only after receiving a ruling from the cassation court, the Federal Tax Service lifted all restrictions.

Thus, the suspension of operations does not depend on the fact whether the arbitration court reduced the amount of the penalty or upheld the decision of the Federal Tax Service. In this case, going to court makes sense only when it, in principle, recognizes the actions of the Federal Tax Service as illegal and unfreezes the accounts.

Suspension by the tax authority of transactions on bank accounts

Suspension of account transactions is one of the most effective measures to ensure that organizations and individual entrepreneurs fulfill the obligations provided for by the Tax Code of the Russian Federation. In 2021, there are more reasons to use this measure. An interview with Sergei Razgulin, 3rd Class Actual State Advisor of the Russian Federation, is devoted to specific issues related to the suspension of account transactions.

What is the regime for suspending account transactions?

Suspension of account transactions is a special procedure for performing debit transactions.

All debit transactions on the account are prohibited, except those expressly permitted by Article 76 of the Tax Code of the Russian Federation.

Funds are credited to the account as usual.

What payments are made during the period of validity of the decision to suspend operations?

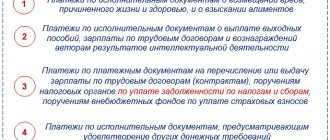

Payments to budgets for taxes, insurance premiums and payments, the order of execution of which precedes the fulfillment of the obligation to pay taxes.

The order of execution of payments is established by Article 855 of the Civil Code of the Russian Federation.

The third stage includes the write-off of funds:

- in wages (an exception to the general rule on the priority of executive documents),

- on instructions from tax authorities to write off and transfer debts for the payment of taxes, fees, as well as on instructions from authorities monitoring the payment of insurance premiums to write off and transfer amounts of insurance premiums (in this case, we mean forced repayment of debts on mandatory payments).

The fourth stage is other executive documents.

The fifth priority is other payments, including tax transfers based on the taxpayer’s instructions.

Thus, during the period of suspension of transactions on accounts, regardless of the date of presentation to the account, the taxpayer’s orders are not executed, with the exception of his calculations for wages, taxes, and insurance contributions.

How are requirements related to one queue fulfilled?

In calendar order of receipt of payment documents. This means that if instructions from the tax authority to write off funds to pay taxes were not presented to the account, the taxpayer’s payments for labor costs are executed without restrictions.

The taxpayer's order to transfer wages will have priority in execution over the tax authority's order to write off the debt if it was received by the bank earlier than the tax authority's order.

But the corresponding payments must actually relate to labor costs. According to the decision of the Supreme Court No. 309-KG18-1269 of March 23, 2021, if the disputed transfers were not the payment of wages, the bank, which should have known about the actual purpose of the funds, will be held liable under Article 134 of the Tax Code of the Russian Federation.

During the period of suspension of operations, the bank will exercise additional control over the purpose of the payment specified by the taxpayer in order to prevent violations when writing off funds.

In what order will the taxpayer’s instructions to pay the tax and the tax authority’s instructions to collect the tax from the same taxpayer be executed?

The instructions of the tax authority (that is, forced payments) are subject to execution in the third place. Tax payments made on the basis of taxpayer orders are in fifth place.

This position is confirmed by letter of the Ministry of Finance No. 03-02-07/2/28207 dated May 17, 2021.

Do writs of execution presented with an invoice and providing for the write-off of funds in favor of a commercial creditor have priority over the taxpayer's payments to the budget?

From the clarifications of the Ministry of Finance (in particular, letter No. 03-02-07/1/9544 dated March 5, 2014), we can conclude that “payments preceding the fulfillment of the obligation to pay taxes” means payments under executive documents of the 1st and 2nd stages, specified in paragraph 2 of Article 855 of the Civil Code of the Russian Federation.

That is, these are the payments that precede the execution of orders from the tax authorities to write off and transfer tax debts.

A second approach to the interpretation of this phrase is possible. It is based on the fact that “the taxpayer’s order to write off funds to pay taxes (advance payments), fees, insurance premiums, relevant penalties and fines and to transfer them to the budget system of the Russian Federation” is also the fulfillment of the obligation to pay tax, and she is assigned to the fifth stage.

In the previous edition of paragraph 2 of Article 855 of the Civil Code of the Russian Federation, in the articles of the federal law on the federal budget for the corresponding year, the write-off of funds under settlement documents providing for payments to budgets was classified as one priority (regardless of the basis for payment - voluntary or forced). But subsequently, by Federal Law No. 345-FZ of December 2, 2013, the legal regulation of the order of debiting funds from the account was changed.

Therefore, payments, the order of execution of which, in accordance with civil law, precedes the fulfillment of the obligation to pay taxes and fees, are payments classified as the first to fourth priority.

There is an intermediate position, according to which the suspension of debit transactions on a taxpayer’s account only due to his failure to submit a tax return, in the absence of documented debt to the budget, cannot interfere with the execution of court decisions that have entered into legal force (letters of the Ministry of Finance No. 03-02-07/1 /38928 dated July 6, 2015 and No. 03-02-07/1/15056 dated March 12, 2021).

Can an organization open an account in another bank if its account in the servicing bank is blocked?

Banks, under threat of a fine, are prohibited from opening new accounts for those persons in respect of whom a decision has been made to suspend operations (clause 12 of Article 76, clause 1 of Article 132 of the Tax Code of the Russian Federation).

The procedure for informing banks about the suspension of operations and about canceling the suspension of operations on accounts (transfers of electronic funds) is established by Order of the Federal Tax Service of Russia No. ММВ-7-8/117 dated March 20, 2015.

According to the order, information is provided by contacting the bank:

- to the Internet service “System for informing banks about the status of processing electronic documents”;

- to a unified system of interdepartmental electronic interaction (SMEI).

They contain information from the decision to suspend transactions on accounts (transfers of electronic funds) in the bank, in particular, the number and date of the tax authority’s decision to suspend transactions on accounts (transfers of electronic funds) in the bank, indicating the date and time (in hours, minutes Moscow time) of its placement in the Internet service or receipt in SMEV.

Is it possible to close an account while the decision to suspend operations is in effect?

According to the new paragraph 3 of Article 858 of the Civil Code of the Russian Federation, termination of a bank account agreement is not grounds for lifting the suspension of operations on the account.

In this case, measures to limit the disposal of the account apply to the balance of funds in the account.

Thus, even if the account is closed, the balance of funds will not be released to the client until the suspension of operations on the account is lifted.

Please also note that in accordance with clause 8.5 of Bank of Russia Instruction No. 153-I dated May 30, 2014, in the event of termination of a bank account agreement in the presence of restrictions on the disposal of funds in the bank account provided for by law and if there are funds in the account, making an entry the closure of the corresponding personal account in the Open Accounts Registration Book is carried out after the lifting of these restrictions no later than the business day following the day the funds are written off from the bank account.

Under what conditions does the tax authority have the right to make a decision to suspend transactions on accounts?

Operations are suspended by the head (deputy head) of the tax authority on seven grounds, which, in turn, can be conditionally combined into three groups.

The first may include decisions taken as a measure to ensure the collection of tax debts.

The second group includes decisions taken as a measure to ensure the submission of individual tax reporting documents.

The third group includes decisions taken as a measure to ensure electronic document flow with the tax authority.

What belongs to the first group of suspension decisions?

A decision made in order to ensure the execution of the actual decision to collect the tax (clause 1 of Article 76 of the Tax Code of the Russian Federation). It should be noted that in addition to the decision on collection by the tax authority, a demand for tax payment must also be sent to the taxpayer.

The tax authority's order to write off funds to pay tax and the decision to suspend operations can be sent to different accounts of the taxpayer.

This group also includes a decision made to ensure the execution of a decision made based on the results of consideration of tax audit materials (clause 10 of Article 101 of the Tax Code of the Russian Federation).

The subsequent cancellation of the decision to prosecute (refusal to prosecute for committing a tax offense) does not in itself mean that the decision to suspend operations was made illegally. It becomes illegal if it is not canceled in a timely manner.

What grounds for suspending operations can be attributed to the second group?

First of all, this is the failure to submit a tax return.

The period for making a decision to suspend transactions on accounts for failure to submit a declaration from 2015 is three years and ten working days from the date of the deadline for submitting a declaration established by the Tax Code of the Russian Federation.

This limitation on the time limit for making a decision also applies to declarations not submitted to the tax authority before 2015.

Can transactions be suspended for failure to submit an income tax return at the end of the reporting period?

Suspension of transactions for failure to submit a declaration should be applied provided that a certain document is a tax return in content and not in title.

Suspension of operations should not be applied for failure to submit a tax return for corporate income tax at the end of the reporting period.

This document does not meet the concept of “tax return” established by Article 80 of the Tax Code of the Russian Federation.

A similar distinction between two independent documents - the tax return submitted at the end of the tax period, and the calculation of the advance payment submitted at the end of the reporting period, is reflected in paragraph 17 of the Resolution of the Plenum of the Supreme Arbitration Court No. 57 of July 30, 2013.

Due to the fact that declarations based on the results of the reporting period are not included in the list of documents given in paragraph 3 of Article 76 of the Tax Code of the Russian Federation, violation by the taxpayer of the deadlines for their submission does not give rise to the right of the tax authority to suspend transactions on bank accounts. This conclusion is confirmed by the ruling of the Supreme Court No. 305-KG16-16245 dated March 27, 2021.

Is it legal to suspend transactions on the accounts of a tax agent if he fails to submit reports?

Article 80 of the Tax Code of the Russian Federation differentiates the reporting of the taxpayer and the tax agent.

At the same time, in the chapters of part two of the Tax Code of the Russian Federation, the tax agent’s reporting form can be called differently: not only calculation, but also declaration, information, etc.

Paragraph 11 of Article 76 of the Tax Code of the Russian Federation stipulates that the rules for suspending transactions on bank accounts also apply to tax agents.

The same principle applies: if the tax agent has not submitted to the tax authority a document that is not a tax return, then the suspension of transactions on his accounts as an interim measure on the basis of subparagraph 1 of paragraph 3 of Article 76 of the Tax Code of the Russian Federation does not apply (paragraph 23 of the resolution of the Plenum of the Supreme Arbitration Court No. 57 dated July 30, 2013).

Suspension of transactions on accounts on such grounds as failure to submit a declaration, in addition to taxpayers, is possible in relation to those persons who, not being taxpayers, must submit tax returns in accordance with the Tax Code of the Russian Federation.

For example, Chapter 21 of the Tax Code of the Russian Federation, in certain cases, obliges tax agents who are not taxpayers or who are taxpayers exempt from fulfilling taxpayer obligations related to the calculation and payment of tax to submit VAT returns.

Failure to submit what other forms of reporting entails the suspension of operations?

Calculation of personal income tax amounts calculated and withheld by the tax agent (clause 1 of Article 80 of the Tax Code of the Russian Federation). The tax agent submits the specified calculation for the first quarter, half a year, nine months - no later than the last day of the month following the corresponding period. For the year (tax period) - no later than April 1 of the next year (clause 2 of Article 230 of the Tax Code of the Russian Federation).

If the tax authority does not receive a calculation in form 6-NDFL from the tax agent within ten days after the expiration of the established period, then there are grounds for making a decision to suspend transactions on the accounts of the tax agent (clause 3.2 of Article 76 of the Tax Code of the Russian Federation).

Suspension of transactions on accounts does not apply if, regardless of the number of individuals who received income from the tax agent, the calculation of personal income tax amounts is submitted within the prescribed period on paper and not in electronic form.

Can transactions on accounts be suspended for failure to submit calculations for insurance premiums?

They can, formally, starting from August 31, 2021. The corresponding addition is included in paragraph 3.2 of Article 76 of the Tax Code of the Russian Federation by Federal Law No. 232-FZ of July 29, 2021.

Payers making payments to individuals submit calculations for insurance premiums no later than the 30th day of the month following the billing (reporting) period.

It is necessary to take into account the situations set out in paragraph 7 of Article 431 of the Tax Code of the Russian Federation (errors, inconsistencies, unreliable personal data), in which the calculation is considered not submitted.

About the fact of failure to submit no later than the day following the day of receipt of the calculation in electronic form (ten days following the day of receipt of the calculation on paper), a corresponding notification must be sent to the payer.

For failure to submit what payments will transactions on accounts be suspended?

It is possible that the tax authorities will suspend transactions on accounts and for failure to submit calculations, the deadline for submission of which occurred in the period from 2021 to August 31, 2021.

Please note that operations may be suspended for failure to submit calculations with zero indicators.

According to the Federal Tax Service, the absence of payments from the payer of insurance premiums in favor of individuals during a particular settlement (reporting) period does not relieve him of the obligation to submit to the tax authority a calculation of insurance premiums with zero indicators within the prescribed period (letter of the Federal Tax Service No. BS-4 -11/ [email protected] July 16, 2018).

At the same time, taking into account judicial practice regarding tax returns, we dare to assume that this security measure can be applied to insurance premium payers who make payments and other remuneration to individuals only if they fail to submit a calculation based on the results of the billing period (calendar year).

We also note that the decision to suspend operations is sent by the tax authority to the bank in electronic form.

The form of the decision to suspend operations was approved by Appendix No. 14 to the Federal Tax Service order No. ММВ-7-8 / [email protected] dated February 13, 2021.

Due to the emergence of a new basis for suspension, no changes have yet been made to this form and the corresponding format. Moreover, the new format of the decision requires approval from the Central Bank.

During what period can the tax authority decide to suspend transactions on accounts for failure to submit calculations in Form 6-NDFL and calculations for insurance premiums?

The Tax Code of the Russian Federation does not have a preemptive period for the tax authority to make a decision to suspend transactions on accounts for failure to submit Form 6-NDFL and calculation of insurance premiums.

Before the introduction of preemptive deadlines in the Tax Code of the Russian Federation for making a decision to suspend operations for failure to submit a declaration, in judicial practice there were examples of invalidation of a tax authority’s decision made more than three years after the grounds for its adoption arose.

The court proceeded from the fact that exceeding a reasonable time for making a decision may mean its invalidity (Resolution of the Federal Antimonopoly Service of the Moscow District No. KA-A40/7460-07 of August 8, 2007).

The tax agent and the payer of insurance premiums can be recommended to use this argument in the case where the tax authority decided to suspend transactions on accounts not immediately (after ten days from the date established for submitting the calculation), but after some long time.

What can be classified as the third group of grounds for suspending operations?

Failure to fulfill the obligation to transfer to the tax authority a receipt for the acceptance of documents sent by the tax authority in electronic form via telecommunication channels (hereinafter referred to as TCS) through an electronic document management operator.

The decision to suspend operations is made in relation to persons obliged to submit tax returns in electronic form who, in violation of paragraph 5.1 of Article 23 of the Tax Code of the Russian Federation, did not submit a receipt for the receipt of the following documents:

- requirements for the submission of documents,

- requirements for providing explanations,

- notifications of summons to the tax authority.

The receipt must be sent no later than six days from the date the documents were sent by the tax authority.

The decision to suspend account transactions can be made within ten days after the expiration of the period established for sending the receipt. Therefore, the decision on suspension should be made no earlier than the seventh day and no later than the sixteenth day after the documents are sent by the tax authority.

The specified periods are calculated in working days.

Operations cannot be suspended if the taxpayer complies with the received requirement (notification) on the merits: documents, explanations are presented, the summoned person appears at the tax authority.

In addition, the tax authority does not have the right to decide to suspend transactions on accounts if the taxpayer does not receive a receipt for other documents sent electronically that are not a request for the submission of documents, a request for explanations, or a notice of summons to the tax authority.

What else belongs to this group of grounds for suspending account transactions?

From July 1, 2021, taxpayers required to submit declarations in electronic form must ensure that documents are received from the tax authority at the place of registration in electronic form via the TCS through an electronic document management operator (clause 5.1 of Article 23 of the Tax Code of the Russian Federation).

Failure to connect to electronic document management will result in the suspension of account transactions (subclause 1.1 of clause 3 of Article 76 of the Tax Code of the Russian Federation).

A decision on this may be made within ten days from the date the tax authority establishes the fact of failure to fulfill such an obligation.

This obligation is considered fulfilled if the organization enters into an agreement with an electronic document management operator “for the provision of services to ensure electronic document management with the tax authority at the place of registration of this person” and receives a qualified certificate of an electronic signature verification key.

To what extent can funds in the account be frozen?

For failure to submit a declaration, the Tax Code of the Russian Federation allows a decision to be made to suspend transactions on all accounts of the taxpayer and for the entire amount of funds in these accounts.

Operations may be suspended to the same extent:

- from 2015 - for the taxpayer’s failure to transmit a receipt for acceptance of requests for documents sent by the tax authority in electronic form, requests for explanations or notices of summons to the tax authority,

- from 2021 - for failure to submit Form 6-NDFL by the tax agent,

- from July 1, 2021 - for failure to ensure the obligation to receive documents from the tax authority at the place of registration in electronic form,

- from August 31, 2021 - for failure to submit a calculation of insurance premiums.

In other cases, the suspension of operations is limited to the amount of funds collected.

What to do when the tax authority decides to suspend transactions in relation to all accounts of the taxpayer?

If operations are suspended to ensure the execution of a decision made based on the results of consideration of the audit materials, then the blocked amount is determined as the difference between the debt and the value of the taxpayer’s property, which has already been subject to a ban on alienation (pledge).

Therefore, the excess of the amount in the accounts for which transactions are suspended over the amount of the calculated difference can, at the request of the taxpayer, be eliminated by the tax authority canceling the decision on suspension in the relevant part.

A decision on suspension, made in order to ensure the execution of a decision based on the results of a tax audit, can be canceled if the tax authority replaces the suspension with a bank guarantee, pledge or surety (clause 11 of Article 101 of the Tax Code of the Russian Federation).

The taxpayer may submit an application indicating the accounts in which there is enough money to fulfill the requirement, and asking to cancel the suspension of transactions on other accounts (clause 9 of Article 76 of the Tax Code of the Russian Federation).

The taxpayer has the right to appeal the decision to suspend transactions on accounts if the tax authority violated the collection procedure. For example, a decision was not made to collect the tax or the deadline for its issuance was missed (resolution of the Ninth Arbitration Court of Appeal No. 09AP-31156/2013 of October 7, 2013).

The taxpayer has the right to challenge the calculation of the amount in respect of which a decision was made to limit expenditure transactions.

If the decision of the arbitration court to declare illegal the decision of the inspectorate to bring to tax liability has entered into legal force, the tax authority is obliged to cancel the decision to collect taxes, as well as the decision to suspend transactions on accounts.

The taxpayer should appeal the illegal inaction of the tax authority, which is expressed in the failure to make a decision to lift the suspension of account transactions (Resolution of the Moscow District Arbitration Court No. F05-14131/2014 dated December 8, 2014).

What other protective measures against the suspension of operations can be taken in court?

The taxpayer can obtain a reversal of the decision to suspend transactions on accounts by filing a petition for interim measures in the arbitration court in a dispute with the tax authority.

After the court has taken interim measures, the inspectorate must cancel the decision to suspend operations on the account in relation to the provisions of Article 76 of the Tax Code of the Russian Federation (Resolution of the Presidium of the Supreme Arbitration Court No. 10765/12 of December 25, 2012).

But each of the grounds for suspending account transactions is independent and can be applied independently of each other.

This means that if transactions on the taxpayer’s accounts were suspended for two reasons, one of which ceased to be valid, this does not entail the cancellation or non-execution of interim measures taken on the other basis.

The fact that the court has taken interim measures prohibiting the tax authority from taking actions to forcibly collect tax debt, in the presence of a decision made in accordance with paragraph 10 of Article 101 of the Tax Code of the Russian Federation that has not been canceled by the tax authority, does not serve as a basis for the resumption of debit transactions on the taxpayer’s accounts.

Failure to submit declarations as a basis for suspension of operations

This is a very common violation. The Code clearly allows fiscal authorities to “block” accounts when a business entity does not file a declaration within the time limits established by law. The courts, as a rule, support the “tax authorities” in this matter (AC of the Kemerovo Region Case No. A27-23305/2016).

At the same time, tax authorities often suspend transactions on accounts as a result of frankly weak interaction between territorial Federal Tax Service Inspectors. Too often in the state tax system, various bases are changed and updated and program failures occur. As a result, this leads to the fact that individual taxpayers receive two (or even three TINs), and individual entrepreneurs are surprised to learn about “tax violations” that they have never committed. As a rule, this is associated with entrepreneurs who have changed their place of residence.

A person submits a declaration at the address of his residence, and the tax authority at the place of his former registration, without waiting for the reporting, suspends operations on the account (AS Moscow Region Case No. A41-34968/15). This is the absolute fault of the inspection and arbitration always recognizes such decisions as illegal.

Why does the tax office block accounts?

Article 76 of the Tax Code of the Russian Federation defines the reasons why the fiscal service may suspend transactions on bank accounts of legal entities and individuals. This:

- declaration not submitted on time. The account may be seized 10 days after the missed deadline for submitting the document;

- there is no response to the tax service's request. As a rule, such requirements indicate a deadline by which a response must be given. If it is absent, the tax office may, after 10 days, block the account;

- tax not paid. Payment must be made within 10 days. Otherwise, accounts may be blocked;

- calculation of the personal income tax of the organization’s employees has not been provided. Accounts are blocked 10 days after the reporting deadline.

Violation of the electronic document flow procedure

This disorder is also quite common lately. The state is actively transferring interaction between taxpayers and government agencies to the sphere of digital technologies. Thus, since 2015, all business entities submitting reports in electronic form are required to confirm receipt of notifications and requirements from the Federal Tax Service by sending them receipts. This receipt is also sent in electronic form through the electronic document management operator. The law also establishes a deadline for sending it: 6 days from the date of receipt of the notification/demand from the fiscal authority. It doesn't seem complicated. However, they are directed by real people, not robots. And people tend to make mistakes and forget. Therefore, having recorded the non-receipt of the receipt, the inspection has the right to block transactions on the account. Most often it doesn't come to this. The Federal Tax Service specialist simply calls the taxpayer and he, having come to his senses, sends a confirmation. If this does not happen, the tax service suspends operations. And when such a case comes to court, the arbitration always takes the side of the fiscal authority (AS of the Sverdlovsk Region. Case No. A60-10890/2017).

The offense in this case is formal in nature and does not require additional evidence.

Interim measures based on the results of an on-site inspection

As a matter of fact, this is not even a reason for “blocking” the account, but rather the result of a kind of analysis by the Federal Tax Service, based on the results of a visit to the office, they come to the location of the company, check the documents and come to the unambiguous conclusion for them that the legal entity is “creating conditions for bankruptcy”, and also makes it impossible to collect penalties, fines and mandatory payments.

Therefore, they first of all prohibit the alienation, as well as the pledge of the owner’s property, and additionally “block” the company’s accounts. In this case, the suspension of operations comes, as they say, “in addition” to the main prohibition, when the value of the property is clearly not enough to pay off the arrears.

However, in practice, it is very difficult for fiscal authorities to formulate and present to the court or taxpayer specific grounds for applying the above measures. If an organization has large turnover, assets, and real property, then the actions of the Federal Tax Service often look unlawful. Therefore, the number of such cases has sharply decreased in the last two or three years, and the courts, as a rule, take the side of taxpayers (AC of the Kemerovo Region Case No. A27-23458/2015).

Suspension of account transactions and violations by credit institutions

Banks are direct participants in the process of “blocking” accounts. After all, all current accounts are located in credit institutions that service them. Fiscal authorities send decisions to suspend operations to banks, and the latter, in turn, are obliged to execute it. Moreover, the law (Article 132 of the Tax Code of the Russian Federation) threatens financiers with sanctions if they open a new account for a taxpayer when all transactions on his existing accounts are suspended. A credit institution can check the fact of “blocking” using the BANKINFORM system, which contains all the necessary information. For violation of these requirements, the tax inspectorate does not hesitate to fine banks, and the courts, as a rule, uphold the decision of the Federal Tax Service (AS of the Ulyanovsk Region Case No. A72-1801/2017).

However, in recent years the number of such violations has increased sharply. Apparently, in the struggle for the client, employees of credit institutions “turn a blind eye” to such “little things”, and the sanction of the article, frankly speaking, is too small for a wealthy financial institution.

How to minimize the risks of blocking

To minimize the risks of account blocking you need to:

- Pay taxes through a current account. In accordance with the recommendations of the Central Bank of the Russian Federation, the share of tax deductions should be at least 1% of debit turnover.

- Pay all taxes on time.

- Register employees on staff. Pay wages, personal income tax and insurance premiums through a current account. At the same time, the amounts of personal income tax and contributions paid must correspond to the average number of employees, and the payroll must be set at a rate not lower than the official subsistence level.

- Check your counterparties.

- Please indicate the purpose of the payment in detail.

- Complete primary documentation correctly.

- When making payments to individuals, do not forget to withhold and transfer personal income tax.

- Provide documents to the bank and the Federal Tax Service upon request.

- For retail trade or other cash-generating activities, deposit cash into the account.

Do you want to know your risk level of being blocked? Use the “Auditor” service, which is part of the Internet bank. The “auditor” will not just conduct an inspection, but will assess the risks and make recommendations.

Haven't become our client yet? Leave a request to open an account right now. Ak Bars Bank also operates a subscription format for servicing a current account. Its essence is that you can pay in advance for 3, 6 or 12 months of cash management services and receive a discount. You will also receive useful business services for free during this period.

How to “unblock” accounts?

There really aren't many options here. The first of them is to pay all taxes, penalties and fines, send declarations or an electronic receipt to the Federal Tax Service. In other words, remove the reason that served as the basis for suspending account transactions.

The second option involves appealing the decision of the fiscal authorities in court. If a business entity is confident that it is right, then it is quite possible that it will be able to prove it to a higher tax authority or in arbitration and overturn the decision of the territorial Federal Tax Service.

Where can I check account blocking?

Freezing is not a closed process. Before an official notification from a bank or the Federal Tax Service, anyone can check the blocking, a competitor of a businessman, or the financial institution itself. You can check the blocking of your current account by the tax office online in advance in several ways:

- Using the official tax website for TIN on the bank information service, where you can find out the necessary information even if the official blocking has not yet occurred;

- In the Financial institution where the account was opened or on its official website in your personal account.

It is worth examining in more detail the procedure for checking restrictions and what actions need to be performed.

Brief conclusions

So, suspending account transactions is a common measure to ensure proper behavior on the part of the taxpayer. Its main function is to encourage a legal entity or entrepreneur to perform certain actions: pay taxes, submit returns, or send an electronic receipt. And it cannot be said that territorial authorities use it all the time. As a rule, the Federal Tax Service suspends movement on accounts when the amount of debt for taxes and other obligatory payments amounts to millions of rubles, or the organization does not send declarations for a long time or does not respond to requests.

However, even a short-term “blocking” of an account can lead to fatal consequences for the company. Therefore, when such situations arise, we advise you to immediately seek help from professional lawyers who will help resolve this problem.

Checking for blocking: step-by-step instructions

In order to obtain information about blocking an account on the tax website, you need to perform only 2 steps.

Step 1. Login to the information system

The check takes place online in a few seconds. To do this, you must select in the information system.

Step 2. Fill out the form and receive results

A form for filling out information appears on the same page. The TIN is required for the taxpayer for whom information is needed. You can take the BIC of any bank - this will not affect the result.

After clicking the “Send request” button, the necessary information will appear.