Regional law on property tax based on cadastral value

The possibility of paying tax at cadastral value in the region is introduced by the law of the constituent entity of the Russian Federation.

Such a law can be adopted only after approval of the results of determining the cadastral value of real estate (clause 2 of Article 372, clause 2 of Article 378.2 of the Tax Code of the Russian Federation). For example, in Moscow, the specifics of determining the tax base in relation to individual real estate objects are determined by the Moscow Law of November 5, 2003 No. 64 “On the property tax of organizations.”

If there is no law, then the calculation procedure is over for you.

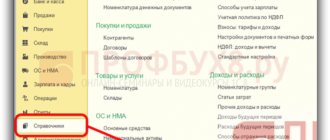

Selecting available taxation systems

Whether a tax regime can be applied depends on the organizational and legal form, revenue, availability of employees and their number, types of activities and other conditions.

Thus, for the application of the simplified tax system, limits are established on revenue and the number of employees, the cost of fixed assets, and the share of participation of organizations in the authorized capital. Comparative analysis of special regimes and restrictions

When analyzing, it is necessary to take into account the conditions of doing business, which are not fixed by law, but in fact are mandatory. For example, if a company has one key client who needs to submit VAT, only OSNO is suitable.

As a result of this step, a closed and, as a rule, small list of options remains. Sometimes there is only one tax regime left.

List of objects subject to cadastral value tax

Real estate subject to tax must be included in the list of objects for which the tax base is determined as the cadastral value. This list is compiled by the authorized executive body of your constituent entity of the Russian Federation (clause 1, clause 7, article 378.2 of the Tax Code of the Russian Federation).

The list for the current year must be compiled no later than January 1. It is sent to the tax authorities at the location of the relevant real estate objects and is posted on the official website of the executive body or on the website of the constituent entity of the Russian Federation.

Please note that the list contains a specific property (for example, a building), indicating its cadastral number, full address and KLADR code. If you do not find your property on the list, the calculation procedure is completed.

For more information about which objects can be included in the list, read the material “For which real estate objects is the tax base calculated based on the cadastral value?” .

By inventory value

The calculation formula differs from the previous one only in the absence of a deduction: the inventory value is multiplied by the size of the share and by the tax rate (N = IS * RD * NS).

So, for the owner of half an apartment with an area of 90 m2, the inventory value of which is 450,000 rubles, and the rate is set at 0.1%, the tax will be calculated as follows: 450,000 * 0.5 * 0.1% = 900 rubles.

Data on inventory value can be requested from the BTI department. It is impossible to do this online - you will have to personally visit the service and request the required information.

The amount of cadastral value required for calculation

The tax base is determined as the cadastral value of the object as of January 1 of the year, which is the tax period (clause 2 of Article 375 of the Tax Code of the Russian Federation). Therefore, payment of tax is possible only if this value is determined. If not, you will not have an obligation to pay tax due to the lack of a tax base (clause 2 of Article 375, subclause 2 of clause 12 of Article 378.2 of the Tax Code of the Russian Federation).

Once you have established the cadastral value, you can proceed to determining the tax base and calculating tax (advance payments).

To find out where you can find out the required cadastral value, read the article “How to find out the cadastral value of property?” .

Attention! If the cadastral value is established by the court taking into account VAT, then the taxable base is the value of the property excluding tax. See details here.

How to find out about debts

The deadline for paying taxes is December 1 of the next calendar year. If taxes have not been paid by this time, then you have a debt to the state (debt).

You can find out about the presence of debt on the Federal Tax Service website in the taxpayer’s personal account (via the website) or in the mobile application - “Taxes FL” (publisher of the “Federal Tax Service of Russia” application).

The easiest way to enter it is through State Services, using the password for the State Services website.

If everything was done correctly, the amount of debt will be displayed here

Here you can see real estate and movable property for which you must pay taxes

If websites and applications are too complicated and incomprehensible, then visit the tax office or MFC in person. Take your citizen's passport and TIN with you.

| Usually the tax office sends a notice and a receipt for payment by mail; if nothing has arrived, then find the information yourself. |

Determination of the tax base

If you are the owner of the entire property, then the tax base is equal to its full cadastral value.

If you own part of the property, and the cadastral value is determined for it as a whole (for example, a room in a building), the tax base will be the share of the cadastral value based on the share of the premises’ area in the total area of the building (clause 6 of Article 378.2 of the Tax Code of the Russian Federation).

See also “How to pay tax on “cadastral” property in common ownership?”.

For example, you own a premises with an area of 300 square meters. m in a building with an area of 3,000 sq. m. m. The cadastral value of the building is 30 million rubles.

Then the tax base for your premises will be 3 million rubles. (30 million × 300 / 3,000).

Read here how to calculate property tax when changing the cadastral value.

In addition, the tax on movable property has been abolished since 2021. Details in the material “The movable property tax has been abolished.”

Find out whether property taxes are being reduced due to the spread of coronavirus infection in the Ready-made solution from ConsultantPlus. If you do not have access to the system, get a trial demo access for free.

Privileges

The benefits that property owners are entitled to are listed in paragraph 1 of Article 407 of the Tax Code of the Russian Federation. The following categories are recognized as preferential:

- Disabled people of groups I and II, disabled since childhood.

- Participants of the Second World War and other military actions carried out to defend the USSR.

- Pensioners.

- Military personnel and members of their families (in some cases).

- Heroes of the Russian Federation and the USSR, having the Order of Glory 3 degrees.

- Victims of the disaster in Semipalatinsk.

- Participants in operations to test nuclear weapons and eliminate the consequences of the use of nuclear installations.

In addition to the listed categories, creative workers will receive benefits. They will not have to pay tax for premises equipped for work. Citizens who own buildings with an area of up to 50 m2 on plots for individual housing construction or on dacha plots also do not have to pay anything.

The benefit is the entire tax amount. In other words, the presence of a benefit exempts the property owner from paying.

Important: You can receive the benefit by applying for one object on one basis. Having multiple bases doesn't matter.

The benefit applies exclusively to those structures that are presented in the list below:

- Residential buildings and shares in them.

- Apartments and their parts.

- Creative workshops and similar spaces.

- Outbuildings up to 50 m2.

- Garages and parking spaces.

At the request of local authorities, the list can be expanded. Benefits cannot be applied to other objects. The exemption does not apply to buildings valued at more than 300 million and to facilities that are shopping, business or other centers.

Owning several real estate objects allows you to refuse to independently apply for benefits: if several apartments of the owner are subject to taxation, then Federal Tax Service employees will automatically apply the benefit to the one whose tax amount is the highest.

Attention: If a citizen wants to make his own choice, then he needs to notify the service before November 1. The standard type of notification is fixed by the corresponding order of the Federal Tax Service.

Calculation of tax payment

The tax amount for the year is determined by the formula:

TnI = Tax base × Tax rate

If reporting periods and advance payments are established in your region, the payment for the reporting period (for example, for the 1st quarter) must be calculated based on ¼ of the cadastral value (share of cost) of the object (subclause 1, clause 12, article 378.2 of the Tax Code of the Russian Federation):

AP = Tax base × ¼ × Tax rate

In this case, the amount of tax payable at the end of the year will be equal to the difference between the calculated tax amount for the year and the amount of advance payments.

Example

The cadastral value of the property is 10 million rubles. The tax rate is 1.5%. Then:

- The annual tax amount will be 150,000 rubles. (10,000,000 × 1.5%);

- advance payments based on the results of the 1st quarter, half a year and 9 months will be equal to 37,500 rubles. (10,000,000 × ¼ × 1.5%);

- the amount of tax payable at the end of the year is RUB 37,500. (150,000 – 3 × 37,500).

However, if ownership of a real estate item arose or ceased during the reporting period, then the amount of tax for the tax period and advance payment for the reporting period is determined based on the number of full months of ownership. The formulas for calculation are:

- for advance payments:

AP = Tax base × ¼ × Tax rate × Number of full months of ownership of the property in the reporting period/3;

- for the full tax amount for the year:

NnI = Tax base × Tax rate / Number of full months of ownership of the property in a year / 12.

Starting from 2021, a full month of ownership is considered to be the one in which the right to the object arose before the 15th day or was lost after the 15th day (Clause 5 of Article 382 of the Tax Code of the Russian Federation).

EXAMPLE of calculation from ConsultantPlus, if the cadastral value has changed during the year: The organization owns a building that is taxed at the cadastral value. The tax rate in the region where this building is located is 2%. As of January 1, the cadastral value of the building was 100,000,000 rubles. In the spring, the organization dismantled a small part of the building, after which its area decreased. Information about the changed area was entered into the Unified State Register of Real Estate on June 10. After the changes, the cadastral value was determined to be 90,000,000 rubles. The organization will calculate property tax as follows... See . continuation of the example in K+. Trial access to K+ is free.

What happens if you don't pay taxes

You will be charged a penalty for each day of delay after December 1 of the next calendar year. If you do not respond to penalties and notices, then if you reach a large amount of debt (from 30 thousand rubles), the case will be transferred to the court, and then to the bailiffs. They will forcibly write off taxes, penalties, fines from your bank account or block accounts if they do not have enough money to pay off the debt. Other restrictions are possible, for example, a ban on leaving the country.

For systematic tax evasion or non-payment of taxes on a large scale, criminal liability is provided (see Article 198 of the Criminal Code of the Russian Federation). Punishment: fine up to 300,000 rubles. or imprisonment for up to 1 year. You can get off with a suspended sentence.

Retail-Realty real estate trust management specialists recommend that you be very attentive to the timely payment of all your taxes and debts.

Information from European real estate partners: on the website europe-house.com you can choose and buy real estate in Austria. Detailed information is provided for all objects. The service operates without additional or hidden fees.

Real estate sales tax

An option such as calculating tax on the sale of real estate is not relevant for everyone. If the property is in your use for more than 3 years, then you are exempt from paying taxes. What does the state oblige taxpayers who have sold real estate that they have owned for less than 3 years to do?

- To filling out tax returns. The declaration is drawn up in form 3-NDFL and includes a description of the income received from the sale of an apartment or other real estate. In this case, the amount for which the apartment was sold is not significant.

- To pay tax taking into account property deduction. The maximum deduction amount for real estate is 1,000,000 rubles. To calculate, you must use the following formula: (Value of real estate - Fixed deduction amount) * 13% So, for example, if an apartment was sold for 4,000,0000 rubles, the tax deduction amounted to 1,000,000 rubles, then the tax payable will be equal to (4,000,000 — 1,000,000) x 13% = 390,000 rubles.

Please note that shared ownership is taken into account when calculating tax. In this situation, for example, if the deduction is 1,000,000 rubles, then it will be redistributed in appropriate shares among all apartment owners. That is, if one owner has 50% of the apartment, then the deduction for his share will be 500,000 rubles. If the share is a quarter, then the deduction will be equal to 250,000 rubles.

What formula is used?

Real estate tax, also known as property tax, is calculated using the following formula:

Tax = (Cadastral value of real estate - Tax deduction) * Tax rate * Share size

Based on the formula, it is initially necessary to determine the cadastral value of the property. As a rule, this figure is in the cadastral passport or other documents for the object. Let's also consider other elements from our formula that we will need.

Tax deduction

This value represents a certain amount that is usually deducted from the income from which taxes are paid. That is, in the Russian Federation this is income that is taxed at a rate of 13%. Tax deductions can be social, standard, professional, etc. In our case, the tax deduction will be determined in accordance with the type of object for which payment is made:

- if this is an apartment, then the deduction will be 20 sq. m from the price;

- in the case of a room, the deduction will be equal to the cost of 10 square meters. m of room;

- if the tax is paid for a residential building, then the cost of 50 square meters will need to be deducted. m at home.

Please note that the authorities of municipalities and large cities may change the amount of the deduction, so before calculating, you must familiarize yourself with the latest information.

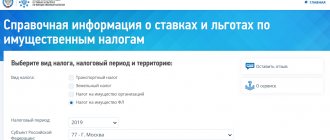

Tax rate

One of the most important elements. Each region sets its own tax rate. You can clarify this with the local federal tax service or on the official resources of the tax service, having first indicated your region of residence. But it must be taken into account that tax rates cannot exceed the data from the following table:

| Tax rate | Object type |

| 0,1% | Residential properties - private houses, rooms, premises, apartments |

| Unfinished objects | |

| Garages and parking spaces | |

| 0,1-0,3% | Objects worth 300-500 million rubles |

| 0,3-2,0% | Property whose price exceeds 500 million rubles |

Share size

In your calculations, take into account how much of the property you own. Each co-owner must make payments in accordance with this share. If the property is entirely yours, then this element can be replaced with the number 1.

Who will be exempt from paying tax?

The following categories of citizens are fully exempt from paying apartment taxes:

- disabled people of groups 1 and 2;

- heroes of the USSR and the Russian Federation;

- persons awarded the Order of Glory of three degrees;

- WWII veterans;

- members of families who have lost a military breadwinner;

- pensioners;

- citizens participating in the liquidation of the consequences of the accident at the Chernobyl nuclear power plant;

- other categories of individuals established by Article 407 of the Tax Code of the Russian Federation.

Tax benefits are provided in the amount of the entire tax amount subject to mandatory payment.

To receive such a benefit, the apartment owner must contact the tax office at the place of registration and fill out the appropriate application for the benefit and the necessary set of documents.

The benefit can be provided only in respect of one object of each category of taxable object at the discretion of the taxpayer.

A specialist on our website will tell you how to check the purity of the transaction when buying an apartment. You will learn how to apply for a life annuity in our detailed and interesting article. Proper execution of a power of attorney for the sale of an apartment will play a significant role in the success of the transaction. Follow the link for all the information.