A current account is a necessary tool for any modern business. Not only do they pass through r/s

In order to get an answer to the question of what code 503 means in

The role of value added tax in the Russian Federation Value added tax is an indirect tax

Federal laws of November 30, 2016 No. 401-FZ and No. 405-FZ amended Article 266

Any enterprise or organization, one way or another, carries out cash transactions and manages

The responsibility of tax agents is to provide reporting in Form 6-NDFL. Reports must be provided every

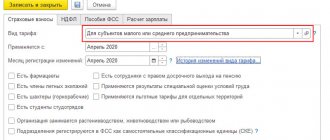

Kontur.Accounting is a web service for small businesses! Quick establishment of primary accounts, automatic calculation of taxes, sending reports

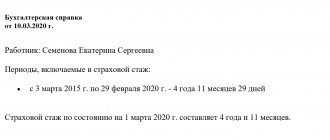

Calculation of length of service from 2021 An important change in sick leave has occurred for all employers since

Article 88 of the Tax Code of the Russian Federation defines a desk tax audit as an audit of the tax law

Adjustment invoice (ACF) refers to tax primary documents. The scope of its application, as well as the primary