In this article we will not touch upon reports that are not related to UTII and are submitted depending on other factors (6-NDFL, SZV-M, etc.). We will talk about the declaration - an integral part of the activities of imputations

Despite the fact that this special mode greatly simplifies the work of an accountant, you will still have to report. In this article we will not touch upon reports that are not related to UTII and are submitted depending on other factors (6-NDFL, SZV-M, etc.). We will talk about the declaration - an integral part of the activities of imputators (clause 3 of Article 346.32 of the Tax Code of the Russian Federation).

Let us remind you that, subject to certain conditions, any taxpayer can voluntarily switch to imputation (clause 3 of Article 346.29 of the Tax Code of the Russian Federation).

Order of the Federal Tax Service of Russia dated June 26, 2018 No. ММВ-7-3/ [email protected] approved the current declaration form. Each time you prepare a reporting form, check that it is up to date.

The declaration is submitted before the 20th day of the first month of the next quarter (clause 3 of Article 346.32 of the Tax Code of the Russian Federation). It turns out that the months for declaring income will be April, July, October and January. Sometimes the reporting deadline falls on a weekend or holiday, in which case the law allows reporting on the first working day after legal non-working days (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Kontur.Extern will tell you when to pay UTII and help you calculate the amount of tax.

Send a request

Which Federal Tax Service should I report to?

In most cases, you need to submit a report to the Federal Tax Service at the place of business , but there are exceptions. These are types of activities for which it is impossible to determine a specific place, namely:

- motor transport services for the transportation of goods and passengers;

- retail delivery and distribution;

- placement of advertising on transport.

When carrying out such types of activities, organizations report on UTII to the Federal Tax Service at their location , and individual entrepreneurs - at their place of residence .

If a businessman has several points and/or types of activities on UTII, then the declaration is submitted according to the following rules:

- One type of activity, several objects:

- if all points are located within the same municipality (have one OKTMO), then one UTII declaration is submitted, in which the physical indicators of all points should be summarized;

- if the points are in different municipalities, several declarations are submitted (according to the number of OKTMO) to the tax authority of each of them without summing up the indicators.

- Several activities:

- if they are carried out through one object, then one declaration is submitted, in which as many sheets of Radel 2 are filled in as there are types of activities carried out (for each type - a separate sheet);

- if the activity is carried out in different municipalities, then a separate declaration with the required number of sheets of Section 2 (according to the number of types of activity) is submitted to the Federal Tax Service of each entity.

It is important to understand that there is no zero UTII declaration , since the amount of tax depends on physical indicators (size of retail space, number of employees, etc.) and is not related to the amount of income received.

Section 1

The OKTMO code (line 010) can be automatically determined on the Federal Tax Service website.

Usually the code includes 11 digits, but there are companies that will have it a little shorter. In this case, the free cells are crossed out and the code will look like “27881249—”.

As for the values of the indicators in this section (line 020), they need to be filled out using the initial data of sections 2 and 3. The amount of tax due to the budget is reflected in line 020 (clause 2, clause 4.1 of the Filling Out Procedure).

If there are not enough lines with code 010, you need to fill in the missing number of sheets in section 1.

Presentation method

You can submit a UTII declaration in one of three ways:

- personally or through a representative;

- by mail in a valuable letter with an inventory of the contents;

- via TKS through an electronic document management operator.

When applying in person or when submitting through a representative, the declaration is drawn up in two copies: one - for the Federal Tax Service, the second (with a note from the tax office about acceptance) - for yourself. The representative must have a document confirming his authority .

It is advisable to fill out the declaration through special services or programs that generate machine-readable code . It duplicates all the data from the report. This is especially true if it is submitted during a visit to the Federal Tax Service. Otherwise, you may be faced with a requirement to attach a declaration on digital or other media.

How to fill out a UTII declaration

The current declaration form consists of a title page and three sections. Next, we’ll tell you how to fill out each of them line by line.

Title page

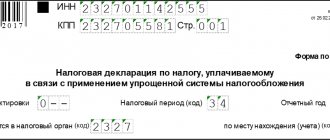

At the top of the title page information about the taxpayer, tax authority and declaration is indicated:

TIN - 10 digits for an organization, 12 for an individual entrepreneur.

KPP - code assigned by the Federal Tax Service to which the report is submitted. The IP does not indicate it.

The page number is indicated in the format “001”, “002” and so on.

The correction number is “0—” for the initial submission of the report, and the serial number of the correction for the updated report.

Tax period - code from Appendix No. 1 to the Procedure:

- 21 - I quarter;

- 22 - II quarter;

- 23 - III quarter;

- 24 – IV quarter;

- during reorganization (liquidation) of an organization: 51 - I quarter;

- 54 - II quarter;

- 55 - III quarter;

- 56 - IV quarter.

Reporting year — 2021.

Tax authority code : the first 2 digits are the code of the subject of the Russian Federation, the last are the number of the tax authority.

Code at location (registration) from Appendix No. 3 to the Procedure:

- 120 - At the place of residence of the individual entrepreneur;

- 214 - At the location of a Russian organization that is not the largest taxpayer;

- 215 - At the location of the legal successor who is not the largest taxpayer;

- 245 - At the place of activity of the foreign organization through a permanent representative office;

- 310 - At the place of activity of the Russian organization;

- 320 - At the place of activity of the individual entrepreneur;

- 331 - At the place of activity of the foreign organization through a branch of the foreign organization.

Taxpayer : full name of the company, as indicated in the constituent documents, or last name, first name, patronymic of the entrepreneur (each word on a new line).

Code of the type of economic activity according to OKVED - it can be viewed in an extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs.

Information on reorganization and liquidation is filled in by legal successors or liquidated organizations. The codes are given in Appendix No. 2 to the Procedure.

Contact telephone number for contacting the taxpayer - only numbers with the city code are indicated without spaces or other symbols.

At the bottom, the person signing the declaration must certify the completeness and authenticity of the data reflected in it:

The following persons can sign:

- Individual entrepreneur . There is no need to duplicate your full name; just sign and date it.

- Head of the organization . His full name, signature and date are indicated.

- The taxpayer's representative is an individual . Enter his full name, date and signature, and indicate a document confirming his authority.

- The taxpayer's representative is a legal entity . The full name of the authorized employee is entered, a date and signature are given, and a document confirming the authority is indicated.

Title page

Section 1

This section reflects the result:

- Line 010 - OKTMO.

- Line 020 - the amount of tax to be paid.

Section 1

The section consists of several blocks of lines 010 and 020. If the taxpayer operates in several municipalities within one Federal Tax Service, then fills in the corresponding number of blocks. Otherwise, only the first block is filled in, dashes are placed in the rest.

Section 2

Following the title page, it is advisable to begin filling out Section 2.

Section 1 must be completed last, since it contains the calculation results that are made in Sections 2 and 3.

If a subject is engaged in various activities subject to UTII, he must fill out several sheets of Section 2 according to the number of types of activities.

Section 2 is completed as follows:

- Code of the type of business activity. The code for the type of activity for which Section 2 is being filled out is reflected here:

| Code | Name of type of business activity |

| 1 | Provision of household services |

| 2 | Provision of veterinary services |

| 3 | Providing repair, maintenance and washing services for motor vehicles |

| 4 | Provision of services for the provision of temporary possession (for use) of parking spaces for motor vehicles, as well as for the storage of motor vehicles in paid parking lots |

| 5 | Provision of motor transport services for the transportation of goods |

| 6 | Provision of motor transport services for the transportation of passengers |

| 7 | Retail trade carried out through stationary retail chain facilities with trading floors |

| 8 | Retail trade carried out through facilities of a stationary retail chain that do not have sales floors, as well as through facilities of a non-stationary retail chain, the area of the retail space in which does not exceed 5 square meters |

| 9 | Retail trade carried out through stationary retail chain facilities that do not have trading floors, as well as through non-stationary retail chain facilities with a retail space exceeding 5 square meters |

| 10 | Delivery and distribution retail trade |

| 11 | Provision of public catering services through a public catering facility with a customer service hall |

| 12 | Provision of public catering services through a public catering facility that does not have a customer service hall |

| 13 | Distribution of outdoor advertising using advertising structures (except for advertising structures with automatic image changes and electronic displays) |

| 14 | Distribution of outdoor advertising using advertising structures with automatic image changes |

| 15 | Distribution of outdoor advertising using electronic signs |

| 16 | Advertising using external and internal surfaces of vehicles |

| 17 | Provision of temporary accommodation and accommodation services |

| 18 | Provision of services for the transfer for temporary possession and (or) use of retail spaces located in facilities of a stationary retail chain that do not have trading floors, facilities of a non-stationary retail chain, as well as public catering facilities that do not have customer service halls, if the area of each they do not exceed 5 square meters |

| 19 | Provision of services for the transfer for temporary possession and (or) use of retail spaces located in facilities of a stationary retail chain that do not have trading floors, facilities of a non-stationary retail chain, as well as public catering facilities that do not have customer service halls, if the area of each exceeds 5 square meters |

| 20 | Provision of services for the transfer of temporary possession and (or) use of land plots for the placement of stationary and non-stationary retail chain facilities, as well as public catering facilities, if the area of the land plot does not exceed 10 square meters |

| 21 | Provision of services for the transfer of temporary possession and (or) use of land plots for the placement of stationary and non-stationary retail chain facilities, as well as public catering facilities, if the area of the land plot exceeds 10 square meters |

| 22 | Sales of goods using vending machines |

- Address of the place of business activity . The full address is indicated, including the region code from Appendix No. 6 to the Procedure. An example of filling is shown in the following image.

- OKTMO code . OKTMO of the place in which the activity is carried out.

- Line 040 . Basic profitability from paragraph 3 of Article 346.29 of the Tax Code of the Russian Federation. Profitability is indicated per month (rubles) per unit of physical indicator:

| Activities | Physical indicators | Basic yield |

| Provision of household services | Number of employees, including individual entrepreneurs | 7 500 |

| Provision of veterinary services | Number of employees, including individual entrepreneurs | 7 500 |

| Providing repair, maintenance and washing services for motor vehicles | Number of employees, including individual entrepreneurs | 12 000 |

| Provision of services for the provision of temporary possession (for use) of parking spaces for motor vehicles, as well as for the storage of motor vehicles in paid parking lots | Total parking area (in square meters) | 50 |

| Provision of motor transport services for the transportation of goods | Number of vehicles used to transport goods | 6 000 |

| Provision of motor transport services for the transportation of passengers | Number of seats | 1 500 |

| Retail trade carried out through stationary retail chain facilities with trading floors | Sales area (in square meters) | 1 800 |

| Retail trade carried out through facilities of a stationary retail chain that do not have sales floors, as well as through facilities of a non-stationary retail chain, the area of the retail space in which does not exceed 5 square meters | Number of retail places | 9 000 |

| Retail trade carried out through stationary retail chain facilities that do not have trading floors, as well as through non-stationary retail chain facilities with a retail space exceeding 5 square meters | Area of retail space (in square meters) | 1 800 |

| Delivery and distribution retail trade | Number of employees, including individual entrepreneurs | 4 500 |

| Sales of goods using vending machines | Number of vending machines | 4 500 |

| Provision of public catering services through a public catering facility with a customer service hall | Area of the visitor service hall (in square meters) | 1 000 |

| Provision of public catering services through a public catering facility that does not have a customer service hall | Number of employees, including individual entrepreneurs | 4 500 |

| Distribution of outdoor advertising using advertising structures (except for advertising structures with automatic image changes and electronic displays) | Area intended for printing (in square meters) | 3 000 |

| Distribution of outdoor advertising using advertising structures with automatic image changes | Exposure surface area (in square meters) | 4 000 |

| Distribution of outdoor advertising using electronic signs | Light emitting surface area (in square meters) | 5 000 |

| Advertising using external and internal surfaces of vehicles | Number of vehicles used for advertising | 10 000 |

| Provision of temporary accommodation and accommodation services | Total area of premises for temporary accommodation and living (in square meters) | 1 000 |

| Provision of services for the transfer for temporary possession and (or) use of retail spaces located in facilities of a stationary retail chain that do not have trading floors, facilities of a non-stationary retail chain, as well as public catering facilities that do not have customer service halls, if the area of each they do not exceed 5 square meters | Number of trading places, non-stationary retail chain facilities, and public catering facilities transferred for temporary possession and (or) use | 6 000 |

| Provision of services for the transfer for temporary possession and (or) use of retail spaces located in facilities of a stationary retail chain that do not have trading floors, facilities of a non-stationary retail chain, as well as public catering facilities that do not have customer service halls, if the area of each exceeds 5 square meters | Area of a retail space, a non-stationary retail chain facility, or a public catering facility transferred for temporary possession and (or) use (in square meters) | 1 200 |

| Provision of services for the transfer of temporary possession and (or) use of land plots for the placement of stationary and non-stationary retail chain facilities, as well as public catering facilities, if the area of the land plot does not exceed 10 square meters | Number of land plots transferred for temporary possession and (or) use | 10 000 |

| Provision of services for the transfer of temporary possession and (or) use of land plots for the placement of stationary and non-stationary retail chain facilities, as well as public catering facilities, if the area of the land plot exceeds 10 square meters | Area of land transferred for temporary possession and (or) use (in square meters) | 1 000 |

- Line 050 . The deflator coefficient K1 2.005 in 2021 .

- Line 060 . Correction coefficient K2 - are established by regulatory legal acts of representative bodies of municipalities. Can be found on the Federal Tax Service website.

Section 2

- Lines 070-090 are used to display line-by-line data for each month of the quarter: in column 2 - the value of the physical indicator;

- in column 3 - the number of days of activity, if during this month the entity was registered or deregistered;

- in column 4 - the amount of calculated imputed income for the month;

Section 2 (end)

Section 3

Section 3 calculates the tax taking into account deductions for insurance premiums and for the purchase of cash register equipment (only for individual entrepreneurs).

Important! Employers can reduce tax by no more than 50% through contributions (line 020). An individual entrepreneur without employees can reduce UTII due to insurance premiums paid for themselves and/or deductions for cash registers down to zero.

There are only 5 lines in Section 3:

- Line 005 . Individual entrepreneurs without employees are given code 2, others - code 1.

- Line 010 . The amount of tax calculated in line 110 of Section 2 is reflected. If there are several Sections 2, the indicators in lines 110 are summed up.

- Line 020. The amount of insurance premiums for employees paid in the period, taken to reduce UTII.

- Line 030 . The amount of insurance premiums that an individual entrepreneur paid for himself in the reporting quarter, taken to reduce UTII.

- Line 040 . The amount of expenses for cash register systems that an individual entrepreneur accepts for deduction in the reporting quarter.

- Line 050 . The amount of UTII payable, taking into account the reduction for insurance premiums. Individual entrepreneurs who claim a deduction using CCP calculate this amount taking into account the deduction.

Section 3

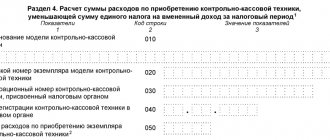

Section 4

Section 4 is included in the UTII declaration in order to comply with clause 2.2 of Art. 346.32 of the Tax Code of the Russian Federation, according to which individual entrepreneurs on UTII have the right to reduce the amount of tax liabilities by the amount of expenses for the acquisition of cash register equipment (including the acquisition of a fiscal drive and OFD).

When submitting reports for the fourth quarter of 2021, Section 4 is not completed because it is irrelevant.

Example

Let's take Lyubimchik LLC from the city of Kashira (Moscow region). The type of activity for which it pays UTII is the provision of veterinary services. The company has 4 employees, for whom insurance premiums in the amount of 18,000 rubles were paid in the 3rd quarter.

The parameters listed above for our example are:

- FP – 4 (number of employees);

- BD – 7,500 rubles per 1 employee per month;

- K1 – 2.005;

- K2 – 1 (decision of the Council of Deputies of the Kashira urban district dated November 27, 2018 No. 91-n);

- base rate – 15%;

- the amount of contributions to be deducted is 18,000 rubles (but not more than half of the tax).

Prepare a UTII declaration for only 149 rubles

Fines

Liability for late submission of a report is imposed in accordance with paragraph 1 of Article 119 of the Tax Code. Anyone who fails to submit a return on time faces a fine of 5% of the tax amount for each full or partial month of delay. The minimum fine is 1 thousand rubles ; it is usually imposed if the subject paid the tax but did not submit the declaration on time. The maximum fine is 30% of the tax amount.

If an organization does not submit a declaration on time, the Federal Tax Service may block its current account . Such a decision can be made by the head of the tax office or his deputy if the declaration is not received within 10 days after the deadline for submission.

For non-payment of tax, a fine is imposed under Article 120 of the Tax Code of the Russian Federation . If the subject calculates the tax incorrectly, the fine will be 20% of its amount. If he deliberately underestimates the base, the fine will increase to 40% .

Due dates

A quarter on UTII is a tax period. The declaration is submitted by the 20th day of the 1st month following the tax period.

If this day turns out to be a weekend or holiday, then the due date is shifted towards the next working day.

In 2021, tax return filing deadlines have the following time periods:

| Quarter 2021 | Due date, until |

| I | April 20, 2021 |

| II | July 20, 2021 |

| III | October 20, 2021 |

| IV | January 20, 2021 |

Sample of filling out a UTII declaration

- Title page: Title page of the UTII declaration

- Section 1: Section 1 of the UTII declaration

- Section 2:

Section 2 of the UTII declaration - Section 3: Section 3 of the UTII declaration

Application of deductions

An organization can deduct from UTII the amount of contributions that were paid for insurance of individuals in the reporting quarter. Due to this amount, you can reduce the tax by no more than 50%.

For those working on UTII, the following rules apply in 2021:

- If there are no employees, the amount of contributions paid in the same quarter for your insurance is deducted from the tax. The 50% limit does not apply, meaning the tax can be reduced to zero.

- If you have employees, you need to add up the contributions for them and for yourself and subtract the resulting amount from the tax. It can be reduced by no more than 50%;

- If an individual entrepreneur on UTII, which provides services and does not attract employees, installed a cash register before July 1, 2021, he has the right to deduct the costs of its implementation. The maximum amount for tax reduction is 18,000 rubles for each cash register installed on time. The deduction was provided temporarily, and the last time it can be declared is in the UTII declaration for the 4th quarter of 2021. The following example of filling out a report for individual entrepreneurs shows how to reflect this.

The declaration form can be downloaded in Excel format and filled out on a computer. But we recommend filling out the declaration online using our online service. This will allow you to avoid mistakes and save time.

Create a UTII declaration

The UTII declaration for the 4th quarter of 2021 is filled out on the form approved by Order of the Federal Tax Service No. MMV-7-3 / [email protected] (hereinafter referred to as the Order).

Normative base

- Order of the Federal Tax Service of the Russian Federation dated June 26, 2018 No. ММВ-7-3/414 “On approval of the tax return form for the single tax on imputed income for certain types of activities, the procedure for filling it out, as well as the format for submitting the tax return for the single tax on imputed income for certain types of activities in electronic form.”

- Section 346.29. “Object of taxation and tax base.”

- Letter of the Federal Tax Service dated February 20, 2021 N SD-4-3/3375 “On the application of the provisions of Chapter 26.3 of the Tax Code of the Russian Federation.”

What you need to know to calculate

UTII, as you know, does not depend on the amount of income received - this is why companies and entrepreneurs love it. For the same reason, the government considers this regime outdated, because it was introduced to simplify the calculation of tax in those areas where it is impossible to reliably take into account the volume of revenue. Now, when the use of CCP has become mandatory for almost everyone, there is no such problem.

To calculate the imputed tax, the following parameters are used:

- FP is a physical indicator prescribed in Article 346.29 of the Tax Code of the Russian Federation (number of employees, area of premises for a store and others depending on the activity);

- BD – basic profitability per unit of financial investments (defined in the same article of the code);

- coefficient K1 – deflator. In 2021, it must be taken from the order of the Ministry of Economic Development dated October 21, 2019 No. 684, as amended by order No. 793 dated December 10, 2019. Its value is 2.005;

- coefficient K2 – reducing. It is established by municipal authorities for certain types of “imputed” activities;

- the UTII rate is 15% by default (established in Article 346.31 of the Tax Code of the Russian Federation), but local authorities can reduce it down to 7.5%;

- the amount of insurance premiums that were paid for employees of the organization or individual entrepreneur in the reporting quarter. At the same time, entrepreneurs also take into account their own deductions. The received amount reduces the tax according to the following rules: for organizations and individual entrepreneurs up to 50%, for entrepreneurs without employees to zero.

The tax is calculated as follows: FP x DB x K1 x K2 x Rate. Then, contributions are deducted from the amount received according to the rules stated above.