Kontur.Accounting is a web service for small businesses!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

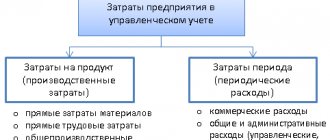

The division of direct and indirect costs is carried out to calculate the tax base and form the cost. This division is important for accounting and tax accounting. In organizations in different industries, expenses of the same type may be classified differently. In order to correctly distribute costs, you need to give them the correct definition.

Direct and indirect expenses in tax accounting

The Tax Code does not clearly define the terms “direct” expenses and “indirect” expenses.

However, from the wording of Articles 318 and 320 of the Tax Code of the Russian Federation, we can conclude that direct costs are those that have a clear connection with the process of production of goods (performance of work, provision of services). Indirect costs do not have such a direct connection. The composition of direct and indirect costs in each organization will be individual. It is necessary to determine a comprehensive list of direct expenses and consolidate it in the accounting policy.

Get a free sample accounting policy and do accounting in a web service for small LLCs and individual entrepreneurs

Expenses that are not specified in the accounting policy as direct will be considered indirect (clause 2 of article 318 of the Tax Code of the Russian Federation). At the same time, there is no need to divide non-operating costs into direct and indirect (clause 1 of Article 318, paragraph 3 of Article 320 of the Tax Code of the Russian Federation).

IMPORTANT. Only those organizations that operate on the accrual basis should distribute expenses into direct and indirect ones. Taxpayers who determine income and expenses using the cash method do not make such divisions.

Table

| Direct costs | Indirect costs |

| What do they have in common? | |

| The same costs can be direct for some production areas and indirect for others. | |

| What is the difference between them? | |

| They are costs that have a clear economic connection with a particular production process | They are costs that do not have a clear economic connection with production processes |

| To a decisive extent influence the cost of goods produced by the company | Limited influence on the cost of goods produced by the company |

| Can be accepted to reduce the tax base only as the goods produced by the company are sold | Can be accepted to reduce the tax base within the reporting period without restrictions |

What are direct costs

Direct costs are those costs that can be attributed to specific goods, work or services. For example, in production these are usually the cost of raw materials and supplies, workers' wages, as well as depreciation of production equipment (machines, machines, workshops). In trade, direct costs can be considered the cost of goods and their delivery, insurance costs, customs duties and other transportation and procurement costs.

Check the financial condition of your organization and its counterparties

What are direct costs?

Direct as costs that are directly related to the production of a product and are decisive in terms of its cost or have a clear economic connection with the object of production.

The main types of direct costs that characterize most types of production:

- purchase of raw materials and components that are used to produce goods by the enterprise;

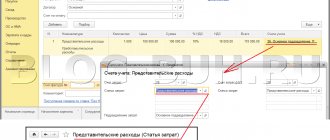

- payment of operating costs - utilities, software licenses;

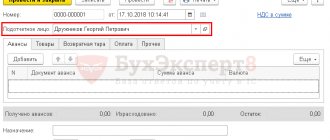

- salaries of personnel employed on factory lines, compensation for contractors.

What are indirect costs?

All costs that are not fixed in the accounting policy as direct and are not non-operating (clause 1 of Article 318 of the Tax Code of the Russian Federation) can be considered indirect.

ATTENTION. The decision about the impossibility of classifying a particular expense as direct (and, accordingly, recognizing it as indirect) must be made in each specific case, taking into account economically sound indicators and features of the technological process. This is explained by the regulatory authorities (letters from the Ministry of Finance dated 09.05.18 No. 03-03-06/1/63428, dated 03.13.17 No. 03-03-06/1/13785, dated 05.19.14 No. 03-03-RZ/23603 and the Federal Tax Service dated 02.24.11 No. KE-4-3/ [email protected] ), and the courts (decision of the Constitutional Court of the Russian Federation dated 04.25.19 No. 876-O).

Rental payments

When classifying rental payments as direct or indirect expenses, you also need to take into account the direct purpose of the leased item. Payments for machines or computers used in production should be classified as direct expenses only.