What is the 6-NDFL declaration and what is it used for?

Form 6-NDFL is a type of reporting submitted to the tax authorities by persons engaged in business activities and using the labor of hired workers. The abbreviation NDFL stands for “personal income tax.”

Form 6-NDFL, mandatory for all employers, valid since 2016

Form 6-NDFL contains data on all deductions and accruals for taxes on employee salaries made by the manager.

Reporting has been developed to strengthen control by the Federal Tax Service over the correctness, completeness and timeliness of personal income tax payment to the budget. This form has been in effect since the beginning of 2021, but in no case has it canceled the earlier form 2-NDFL. Sample form 6-NDFL here. If questions arise related to the preparation of this report form, it would be useful to refer to the legislation.

One of the main regulations in our country that deals with the taxation system is the Tax Code.

Table: regulations governing activities related to personal income tax

| Name | Characteristic |

| Tax Code of the Russian Federation. | Establishes a system of taxes and fees in our country. |

| Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7–11/ [email protected] | Introduces a new tax return 6-NDFL. The registration procedure can be found here. |

| Information from the Federal Tax Service dated November 20, 2015. | Explains the rules for calculating personal income tax by businessmen. |

| Letters from the Federal Tax Service of Russia. | They touch upon the issues of preparing the 6-NDFL declaration and control ratios. |

The main differences between forms 6-NDFL and 2-NDFL:

- The new declaration details information for each individual who received any income from a business entity during the reporting period.

- Form 6-NDFL reflects not only accrued and paid income, but also all deductions made, as well as calculated taxes.

- A new report is completed and submitted to the regulatory authority based on the results of the reporting quarter (2-NDFL is submitted once a year).

Form 6-NDFL differs from the calculation of 2-NDFL not only in terms of submission, but also in content

Form 6-NDFL has not changed since last year. Calculation of 6-NDFL can be submitted in electronic form and in paper form.

The second option is used if no more than 25 people received income during the tax period. The 6-NDFL report is also prepared for payments under a civil law agreement (GPC).

According to the GPC agreement, the date of actual receipt of income is the day the money is paid to the individual. It doesn’t matter whether it’s an advance payment or a final payment. Each such payment is recorded in 6-NDFL as a separate block and date.

Tax Code of the Russian Federation (clause 1, clause 1, article 223)

An example of filling out 6-NDFL under a GPC agreement can be found here.

We smoothly move on to the “malicious” Section 2

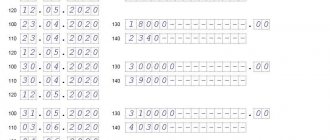

This section of the form is considered the most labor-intensive to fill out. The fact is that Sections 1 and 2 are very different from each other. The first contains mainly generalized financial data, and the second - directly those that affect the reporting quarter. We record data about the most important lines:

- line 100 reflects the date of actual receipt of the employee's earned income

- line 110 indicates the date of deductions of tax liabilities

- line 120 – deadline by which it is planned to transfer tax liabilities

- line 130 – the amount of earned income of the employee

- line 140 – amount of tax liability withheld from income received

Where and when is the 6-NDFL declaration submitted?

The declaration is submitted by those organizations and individual entrepreneurs that have employees. This also applies to notaries, lawyers and other persons with private practice. The report is provided every quarter. In this case, you must have time to submit it before the end of the month following the reporting quarter.

It often happens that the day the report is submitted falls on a holiday or weekend. In such a situation, the submission of documents is postponed to the next working day following the rest days.

An individual entrepreneur is one of the tax agents who must submit 6-NDFL

Table: deadlines for submitting reports in 2017–2018.

| Period | Deadline for submission |

| Quarter 1 | May 2, 2021 |

| Quarter 2 | July 31, 2021 |

| Quarter 3 | October 31, 2021 |

| Year | April 2, 2021 |

Unlike quarterly reporting, the deadline for submitting an annual declaration always falls on the last day of the month, the first quarter after the reporting year.

If tax agents fail to submit Form 6-NDFL on time, then penalties will be assessed in accordance with the Tax Code of the Russian Federation. Employers who violate the deadlines established by law will have to pay 1 thousand rubles to the budget. for each month of delay.

There is a fine for late submission of the 6-NDFL report.

Supervisory authorities are empowered to block the current accounts of those individual entrepreneurs and commercial organizations that are more than 10 days late in submitting reports. If business entities submit Form 6-NDFL with inaccurate data, they face a fine of 500 rubles. for each incorrectly completed report.

The report is submitted to the tax office at the location of the organization or place of residence of the individual entrepreneur.

If a company has separate divisions, reporting is submitted depending on where employees receive income.

The completed 6-NDFL declaration can be sent to the Federal Tax Service by mail

The report is sent in the following ways:

- via the Internet (in this case, the delivery date is the date the letter was sent by email);

- by mail with a list of the contents (the delivery date is considered to be the day marked by the postal worker on the shipping receipt);

- in person or through an official representative of the company (the date of submission is the date stamped by the tax inspector on the second copy of the report).

Zero report 6-NDFL

If there are no employees in the company or the company or individual entrepreneur did not accrue or pay income to individuals, then Form 6-NDFL is not submitted. But this does not exclude the submission of a zero 6-NDFL report. The sample can be found here. Tax authorities will expect reports from firms and individual entrepreneurs, even if they do not need to report to them regarding Form 6-NDFL, since inspectors may not yet have such information. To prevent a fine from being assessed in this case, many taxpayers prefer to submit zero reports.

In this regard, taxpayers can do the following:

- submit a letter to the Federal Tax Service stating that the company or individual entrepreneur is not required to submit the 6-NDFL calculation;

- submit a zero calculation of 6-NDFL.

Tax agents have the opportunity to submit a zero calculation of 6-NDFL

If taxpayers decide to send a zero report, then they should be prepared for the fact that it will have to be sent at the end of each reporting period. The title page of the zero report is drawn up in the same way as the usual form 6-NDFL, but dashes are placed in the columns of sections 1 and 2.

Video: procedure for submitting the 6-NDFL declaration

Sanctions of the Federal Tax Service

As we wrote above, the Tax Service will not turn a blind eye to shortcomings in the preparation of Form 6-NDFL, even regardless of the quality of explanations it itself provides for taxpayers. We will say more - the matter may not be limited to a fine. The deadline for submitting 6-personal income tax for the first quarter of 2021 is reduced to May 2, 2017.

If an organization submits a report with errors and, after its “reversal,” does not take any action to correct it within 10 days (and such cases are not uncommon), then Federal Tax Service employees have the right to block the company’s account until the corrected document is offset. And when you correct it yourself and submit it again, this is purely your decision. The Tax Service is not to be trifled with - don’t go to a fortune teller.

Procedure for filling out form 6-NDFL

When filing a 6-NDFL declaration, you should pay attention to the following features:

- When submitting a document in writing, the report is filled out in black, blue or purple ink.

- Rows are filled from left to right. If any data is missing, a dash is placed in the corresponding sections.

- In those lines where there should be values in numbers, a “0” is placed instead of a dash.

- Amounts are recorded in rubles and kopecks. The tax amount is rounded to the nearest ruble.

- Corrections of any kind are prohibited.

- If an error is detected, the report is redone.

Form 6-NDFL must be completed in accordance with legal requirements

Form 6-NDFL consists of a title page and two sections.

The title page is filled out like this:

- indicate the TIN and KPP of the legal entity (for individual entrepreneurs - only the TIN);

- the correction number is entered (for the primary report it is set to “000”, if an adjustment report is already submitted, then “001”, etc.);

- the code of the period for which the report was compiled is entered (the codes can be viewed in the Appendices to the order approving the form) and the year: if a report is submitted for nine months, then the period code will be “33” and the year “2017”);

- Next, the code of the tax authority to which the report is sent and the code of the place of submission are indicated (can also be viewed in the Appendix): the code of the report is submitted at the place of registration of the legal entity - “212”, if at the place of residence of the individual entrepreneur - “120”;

- the name of the legal entity or full name of the individual entrepreneur is indicated;

- the OKTMO code is set (all-Russian classifier of municipal territories). If there are several codes, then you need to fill out several reports for each code;

- a contact telephone number is indicated, the number of pages of the report and the number of sheets of appendices to it are indicated, if any.

The right side of the title page of form 6-NDFL is filled out by a tax inspector

The lower parts of the title page are filled out as follows:

- the left part is for the person submitting the report to the tax authority;

- the right side is for the tax inspector.

Section 1 of form 6-NDFL consists of two blocks, one of which includes lines from 010 to 050, the other from 060 to 090

Section 1 summarizes the income that employees receive in the course of their work activities. This also includes the total tax amounts that will be calculated based on the employee’s income. Section 1 conditionally consists of 2 blocks.

Table: characteristics of section 1 of form 6-NDFL

| Blocks | Lines and their filling |

| The first block includes lines 010 to 050 | This block is filled out separately for each tax rate:

|

| The second block includes lines 060 to 090 | Regardless of the applicable tax rates, it is filled out only once on its first page:

|

Section 2 reflects the indicators produced over the last 3 months of the reporting period.

Section 2 states:

- all actions to accrue income that will be paid in the reporting period (during the quarter) indicating the date of accrual;

- the amount of tax withheld from each income paid, indicating the date of withholding;

- date of transfer of personal income tax to the tax authority in fact.

Section 2 of form 6-NDFL indicates the indicators of the last three months of the reporting period

Section 2 contains lines 100–140:

- in line 100 - the date of actual receipt of income reflected in line 130. Determined in accordance with Article 223 of the Tax Code of the Russian Federation;

- in line 110 - the date of tax withholding on the amount of income actually received, reflected on line 130. The date of withholding in cash coincides with the date of their actual payment. The date of withholding personal income tax on income in kind and received in the form of material benefits coincides with the date of payment of any income in cash from which such personal income tax is withheld;

- in line 120 - the date no later than which the tax amount must be transferred;

- in line 130 - the generalized amount of income actually received (without subtracting the amount of withheld tax) on the date indicated in line 100;

- in line 140 - the generalized amount of personal income tax withheld on the date indicated in line 110.

Sample of filling out 6-NDFL upon dismissal of an employee.

An example of filling out a report when paying overtime.

An example of filling out a report when wages are delayed.

An example of filling out a report in case of excessively withheld personal income tax.

In Form 6-NDFL, maternity benefits are not recorded due to the fact that these payments do not relate to the salary (or other income) of the employee.

Video: rules for filling out the 6-NDFL declaration

Peculiarities of reflecting payments of “rolling” periods in 6-NFDL

The most controversial issues regarding filling out the 6-NDFL calculation are payments for “transition” periods. They are encountered when wages or bonuses are accrued in one reporting period and paid in another.

“Carryover” payments are reflected in the declaration in the reporting period when the operation is completed.

If an employee’s wages are accrued in one month and made in the next, in the 6-NDFL report this operation is reflected as a “carrying forward” payment

Table: example of filling out a report regarding “rolling over” payments

| Situation | How to fill out the form |

| Salaries for March were issued in April. | The March salary paid in April is reflected in section 1 of the calculation for the first quarter. Only accrued income, deductions and tax are entered (lines 020, 030, 040). In lines 070 and 080, “0” is placed, because the tax withholding date has not yet arrived. Personal income tax from March salaries is withheld only in April at the time of payment. Therefore, it is reflected in line 070 of section 1, and the operation itself is reflected in section 2 of the half-year report. |

| Vacation pay for April was issued in March. | In the calculation for the first quarter, vacation pay is reflected in both sections 1 and 2, since the employee’s income arose in March, when he received the money. The company will have to calculate and withhold personal income tax from vacation pay on the day of payment, and transfer the withheld amount to the budget no later than March 31. |

Checking the correctness of filling out the reporting declaration

The 6-NDFL declaration must indicate only correct indicators. It will be helpful to refer to the benchmark ratios when filling out the form.

Control ratios are used to reconcile indicators, i.e. the values of one line must correspond to another or be greater/lesser, etc.

Reference ratios can be found in the following sources:

- in the letter of the Federal Tax Service of Russia dated March 10, 2021 No. 5C-4–11/3852;

- on the Federal Tax Service website (https://www.nalog.ru/rn92/).

The tax agent must check, based on the control ratios, whether the report is completed correctly

Using the control ratio, the following is checked:

- are there any errors when transferring indicators from registers;

- are all incomes indicated;

- are there any errors in the calculation;

- whether all deductions are provided to employees and whether there are any excess amounts;

- Is tax withheld from all amounts and transferred to the budget?

Differentiated approach to bonuses

One of the incentives for labor achievements is a bonus paid to employees who have achieved certain successes. At the same time, companies often practice other bonuses that are not directly related to the merits of employees. We are talking, for example, about bonuses paid in connection with an employee’s anniversary or on some holidays. Until recently, according to the regulatory authorities, the “nature” of bonuses did not in any way influence the procedure for assessing personal income tax (see, for example, letters from the Federal Tax Service dated August 1, 2016 No. BS-4-11/ [email protected] , dated 8 June 2021 N BS-4-11/ [email protected] , Ministry of Finance dated March 27, 2015 N 03-04-07/17028, etc.). Now the position of officials has changed radically.

Checking reports by the tax service

Tax inspectors check 6-NDFL calculations received from taxpayers in the following ways:

- on the basis of a desk audit - a mandatory procedure carried out by the tax authorities;

- by means of reconciliation with completed payments to the budget;

- in relation to 2-personal income tax.

Features of the desk audit are as follows:

- the check starts only after individual entrepreneurs or commercial organizations have submitted the 6-NDFL report;

- The duration of the inspection cannot be more than 3 months.

Desk audit is one of the types of tax control of the 6-NDFL declaration

Step-by-step actions of a tax officer:

- Verifies general information about the organization presented in the report form (whether the address, TIN, responsible person and other parameters are correct).

- The 6-NDFL report is filled out with a cumulative total, and therefore, when studying the data in the first and second sections, the inspector makes sure that later data is not less. If a discrepancy is found, the calculation was performed incorrectly.

- Verifies control ratios. With their help, the inspector identifies the compliance of the report with the information available at the Federal Tax Service.

- Recalculates some parameters in order to identify possible arithmetic errors made by the accountant when filling out form 6-NDFL.

- After submitting the annual report, the tax inspector again verifies the control ratios.

Tax authorities carefully check submitted returns for errors made by tax agents

When any errors are discovered during the audit, the taxpayer is notified of them. A request for explanations on existing issues or for data correction is sent to his address.

Control ratios used by tax authorities during audits:

- The date of submission of the calculation, recorded by the tax authority on the title page, is tracked. It must not be later established by law;

- the value in line 020 must be greater than or equal to the value in line 030;

- the value in line 040 must be greater than or equal to the value in line 050;

- the following equality must be observed: line 040 = line 010 * (line 020 - line 030).

When reconciling Form 6-NDFL with completed payments to the budget, the calculation data is compared with the KRSB (settlement card with the budget) for a specific taxpayer:

- first check: personal income tax paid since the beginning of the year according to the CRSB is greater than or equal to the difference between lines 070 and 090;

- second check: the tax payment date according to the KRSB is earlier or coincides with the data in line 120.

The annual report is checked using reconciliation with 2-NDFL. Based on the results of the audit, the amount that taxpayers paid to employees for their work activities must be correlated with the data reflected in the income certificates of individuals.

Non-production bonuses

Bonuses that are not related to labor results and that do not depend on the employee’s position, etc., are reflected differently in Calculation 6-NDFL. Such bonuses are not part of the salary, therefore the “salary” rules for determining the date of receipt of income in this case do not apply to them. This will be considered the day the income is paid, including the day the funds are transferred to the taxpayer’s account. And personal income tax will have to be withheld upon actual payment of the “unearned” bonus to the employee, without waiting for the end of the month.

Example 5. On the occasion of the anniversary of engineer Ivanov I.I. On March 14, 2017, a bonus of RUB 10,000 was paid. In Section 2 of the Calculation Form 6-NDFL, this income should be reflected as follows:

How to submit an updated calculation using Form 6-NDFL

You must fill out the 6-NDFL report carefully to avoid errors. Errors, even if they are blots, are regarded as distortion of information. This leads to the accrual of fines. If the declaration contains errors, then a fine of 500 rubles is imposed on the individual entrepreneur or organization. for each document. It is possible to avoid administrative punishment. To do this, you need to have time to send the corrected document before the inspectors discover the error.

If a tax agent discovers an error in a report that has already been sent, he can try to avoid penalties by submitting an updated document

Table: features of the refined calculation

| Nature of the error | How to fix |

| Error in the details on the title page (incorrect TIN or organization name). | The details are changed, the remaining data is filled in the same way as the first time. |

| Lines 010–050 for each tax rate are not highlighted. | When filling out section 1, it may not be taken into account that for each tax rate, lines 010–050 are filled out separately. In the adjusted calculation, lines 010–050 are added for each bet, and lines 060–090 will contain total data for all bets. |

| Errors in the reflection of salaries paid in the next period. | The data on lines 040–070 should not be equal. If an organization pays wages next month, then personal income tax will also be withheld in the next month, but will be accrued in the current one. |

| Error in the number of individuals. | Only the incorrect number of individuals on line 060 can be corrected. The same employee cannot be counted twice. |

| There was an error in filling out lines 100–120. | An error when filling out line 100 is indicating the date of payment of salaries instead of the last day of the month. And in line 110 the day of payment of the salary is indicated. Line 120 indicates the date when the tax agent made the transfer to the budget. |

| Incorrect indication of income minus personal income tax on line 130. | Line 130 reflects income before personal income tax, i.e. accrued income. If a different amount is indicated, an “adjustment” must be submitted. |

When submitting an updated calculation, the adjustment number (“001”, “002”, “003”, etc.) is reflected. If tax officials have questions for the taxpayer regarding the submitted declaration, the entrepreneur or company will have to write a letter of explanation for the calculation. The form is submitted in any form, since there is no form approved by regulatory documents. A sample explanation is here.

Requirements for writing an explanation:

- all controversial points must be explained;

- the text must be provided with arguments and evidence;

- The details of the organization and the name of the director must be indicated.

The updated calculation must be submitted within the deadlines established by law.

An updated estimate will be sent within 5 working days. The countdown begins from the moment when the entrepreneur or company personally received requests for explanations.

Video: submitting an updated calculation

Tax return 6-NDFL is a document that must be filled out by participants in business activities (individual entrepreneurs and organizations) that have hired employees. The document is submitted within the deadlines established by law. Violation of these deadlines is fraught with penalties from the tax authorities. Errors made by taxpayers in the report lead to administrative liability in the form of a fine. To reduce the likelihood of errors during self-checking, you should use control ratios. If an error is discovered after filing the declaration, an updated report must be sent. The speed of its sending determines whether a fine will be charged or not.

- Author: ozakone

Rate this article:

- 5

- 4

- 3

- 2

- 1

(0 votes, average: 0 out of 5)

Share with your friends!

Accounting for “non-salary” income in the document “Calculation of salaries and contributions”

Previously, in the 1C ZUP 8.3 program, for so-called “non-salary” income (accounted for by the date of payment, for example, with income code 4800), registered by the document “Accrual of salaries and contributions”, the date of receipt of income was defined as the last day of the month of accrual. payment date is used as the date of receipt for such income : tab Accounting policies and other settings - link Accounting and salary payment:

Now, if in some month it is necessary to pay wages earlier than the usual payment date, for example, if this date falls on a weekend and it is necessary to pay wages on the previous working day, then before filling out (!) the document “Calculation of salaries and contributions” For this month, you should change the payment date in the organization settings.

For example, the usual salary payment date in an organization is the 5th. The organization pays salaries for February not on March 5, but on March 3, since March 5 is a Sunday.

In this case, before filling out the document “Calculation of salaries and contributions” for February, you should indicate in the organization’s settings the date of salary payment – the 03rd day. As a result, the date of receipt of “non-salary” income from which the tax was calculated is determined as 03/03/2017, this can be seen on the “Personal Income Tax” tab of the document “Calculation of salaries and contributions”:

Thus, do not forget to look into the organization’s settings before calculating salaries, or abandon the practice of accruing “non-salary” income in the document “Calculation of salaries and contributions”, and use another document for this purpose, for example, “One-time accrual”.