Organizations and entrepreneurs that are tax agents must annually provide information on income for each of their employees. In addition, employees may need this certificate to submit it to various authorities, for example, to obtain a car loan or a home mortgage. This form underwent changes in 2015, adjustments were made on the basis of the Order of the Federal Tax Service dated October 30, 2015, registered under number ММВ-7-11/ [email protected]

Who must submit 2-NDFL for 2016

Organizations and individual entrepreneurs that are recognized as tax agents for personal income tax must withhold and transfer to the personal income tax budget from income paid to individuals. In addition, tax agents are required to report this to the Federal Tax Service at the end of each year. For these purposes, 2-NDFL certificates are annually submitted to the tax inspectorates.

It is worth noting that from 2021, another type of income tax reporting has been introduced - quarterly calculations of 6-NDFL. However, they do not replace reporting in the form of 2-NDFL certificates. The fact is that in 6-NDFL calculations, data is grouped as a whole by tax agent. The 2-NDFL certificate, in turn, is of a purely individual nature, since the certificate must be filled out personally for each individual who received income. Also see “Annual calculation of 6-NDFL for 2021: filling samples.”

When you can not submit 2-NDFL

There is no need to submit 2-NDFL certificates in 2021 if during 2016 the organization or individual entrepreneur did not pay income to individuals for which they are tax agents. So, for example, you don’t have to report on employees for whom the organization did not pay wages or make any other payments from January to December 2021. There is no need to submit 2-NDFL with zero indicators. There is simply no point in zero 2-NDFL certificates.

What income does not require 2-NDFL?

All income not taxed at a rate of 13% does not require filling out 2-NDFL. These include:

- all state benefits, the only exception is disability benefits;

- various compensation payments, pensions provided for by the legislation of the Russian Federation;

- alimony;

- donor rewards;

- grants allocated to support culture, science, education;

- awards in certain areas of activity;

- one-time financial assistance from an employer, a charitable foundation,

- states;

- scholarships;

- income received from the sale of products from your own subsidiary plot.

A complete list of income that does not require filling out 2-NDFL is contained in the legislation of the Russian Federation.

Having a problem? Call a lawyer: +7

— Moscow, Moscow region

+7

— St. Petersburg, Leningrad region

The call is free!

How to fill out 2-NDFL 2021?

The procedure for filling out 2-NDFL is specified in the legislation. The title page should contain the following information:

- the year for which the document contains data;

- serial number;

- date of document preparation.

In the column “Attribute of the certificate,” the number 1 is entered if the information indicates the volume of accrued income and tax withheld from it. The number 2 means that personal income tax withholding was impossible. The header part must contain the four-digit code of the inspection for which the certificate is intended.

Deadline

Organizations and individual entrepreneurs are required to submit 2-NDFL certificates about income and withheld personal income tax to the Federal Tax Service no later than April 1 of the year following the reporting year (clause 2 of Article 230 of the Tax Code of the Russian Federation). However, April 1, 2021 is a Saturday. In this regard, the deadline for submission is moved to the next working day. Accordingly, most tax agents need to submit 2-NDFL certificates for 2016 with “sign 1” no later than April 3, 2021 (inclusive).

Also, information must be submitted to the Federal Tax Service on Form 2-NDFL in relation to individuals to whom the tax agent paid income in 2021, but personal income tax was not withheld from this income. For example, if in 2016 an organization gave a gift worth more than 4,000 rubles to a citizen who is not its employee. The deadline for submitting such certificates is no later than March 1 of the year following the reporting year (clause 5 of Article 226 of the Tax Code of the Russian Federation). Accordingly, if you paid income to individuals in 2021 from which personal income tax was not withheld, then no later than March 1, 2021 (this is Monday) you need to submit 2-NDFL certificates to the Federal Tax Service Inspectorate for these individuals with the “2” order. Moreover, within the same period, the “physicist” himself must be notified about the unwithheld tax. See “2-NDFL due date: important dates.”

Presentation method

It is possible to submit 2-NDFL certificates “on paper” only if in 2016 the number of individuals who received income from a tax agent is less than 25 people (Clause 2 of Article 230 of the Tax Code of the Russian Federation). If 25 or more people received income, then they must report electronically via telecommunications channels through an electronic document management operator.

Sample of filling out 2-NDFL using a practical example

Rassvet LLC is preparing a 2-NDFL certificate for 2021 for Deputy Director Nikolai Petrovich Tsvetkov. The employee is a tax resident of the Russian Federation. Tsvetkov’s salary, according to the staffing table, is 50,000 rubles per month.

The employee has one six-year-old child, so Tsvetkov’s taxable income decreased monthly by 1,400 rubles, i.e. the amount of the standard deduction. However, the deduction was not provided to the employee for the entire year, but only from January to July inclusive, since in August the total income exceeded the possible limit of 350,000 rubles (clause 4, clause 1, article 218 of the Tax Code of the Russian Federation).

Tsvetkov N.P. owns a recently purchased dorm room, so he is entitled to a property deduction. This right is confirmed by a notification from the tax service.

The accountant generated a 2-NDFL certificate for Nikolai Petrovich Tsvetkov based on the results of 2021 - .

Come in and register with an electronic signature certificate (from any CA in the Russian Federation) in Kontur.Externe and use the service for 3 months for free

Try it

New form: approved or not

The form of a certificate of income for an individual 2-NDFL and the procedure for filling it out were approved by order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/485. At the same time, a new form of 2-NDFL certificate for reporting for 2016 was not developed or approved. The new form simply does not exist. In 2021, you need to fill out the form that was used before when reporting for 2015 was submitted. See “Certificate 2-NDFL in 2021: current form.”

The composition of the current form of certificate 2-NDFL is as follows:

| Help 2-NDFL in 2021: composition | |

| Section 1 | Tax agent information. |

| Section 2 | Data about an individual |

| Section 3 | Income taxed at the rate (the rate must be specified). |

| Section 4 | Standard, social, investment and property deductions. |

| Section 5 | Total income and tax amounts (total information). |

You can download the current 2-NDFL certificate form using this link.

What does the sign “1” and “2” mean in the help?

- Item 1 in certificate 2 Personal income tax must be included in all certificates if a report is provided on the tax received and calculated for the employee for the past year.

- Sign 2 in personal income tax certificate 2 is placed only in cases where the tax agent cannot withhold income tax. And the main thing is not to get confused when drawing up the form.

Please note that if you mistakenly indicate attribute “2”, although attribute “1” should be indicated, in this case the inspectorate may consider that you did not submit the certificate within the established time frame, since with “1” the deadline for submission is April 1, and with “2” - until March 1.

Filling out the certificate: useful samples

Next, we will explain the procedure and features of filling out 2-NDFL certificates for 2016 using specific examples. We will also provide a final sample of the filling, which can be downloaded as a visual example.

Formatting the title

In the title of the certificate for 2021, in the “attribute” field, mark 1 if the certificate is provided as an annual report on income and withheld amounts of income tax (clause 2 of Article 230 of the Tax Code of the Russian Federation). If you are simply informing the Federal Tax Service that it was impossible to withhold tax in 2021, then indicate the number “2” (clause 5 of Article 226 of the Tax Code of the Russian Federation).

In the “Adjustment number” field, show one of the following codes:

- 00 – when preparing the initial certificate;

- 01, 02, 03, etc. – if you fill out a corrective certificate (that is, if in 2021 you “correct” previously submitted information”);

- 99 – when filling out a cancellation certificate (when you need to completely “cancel” the information already submitted before).

In the “In the Federal Tax Service (code)” field, mark the tax office code, indicate the year “2016” in the title, and also assign a serial number and date of generation to the certificate. As a result, the title of the 2-NDFL certificate for 2021 may take the following form:

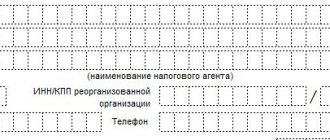

Section 1: enter information about the tax agent

In section 1 of the form, provide basic information about the organization: name, tax identification number, checkpoint, contact telephone number. However, keep in mind that individual entrepreneurs indicate only the TIN, and they put a dash in the checkpoint field.

If the income of an individual was paid by the head office of the company in 2021, then in the 2-NDFL certificate you need to show the TIN, KPP and OKTMO at the location of the head office. If the income was received from a separate division, then mark the checkpoint and OKTMO at the location of the “separate division”.

In the “OKTMO Code” field, indicate the code of the territory in which the tax agent is registered. You can recognize this code by the Classifier approved by order of Rosstandart dated June 14, 2013 No. 159-st. However, if the 2-NDFL certificate is generated on behalf of an individual entrepreneur, then the approach when filling out should be as follows:

- indicate OKTMO at the place of residence of the entrepreneur according to the passport (except for individual entrepreneurs on UTII and on the patent taxation system);

- if the individual entrepreneur is on “imputed” or “patent”, then reflect OKTMO at the place of business in the appropriate tax regime.

Section 2: fill in information about the recipient

In section 2, enter the details of the individual to whom the income was paid. So, in particular, indicate your full name and tax identification number, date of birth. We will explain in more detail how to fill out section 2 of the 2-NDFL certificate for 2021 in the table:

| Filling out the fields in section 2 of the 2-NDFL certificate | |

| Field | What to indicate |

| "TIN in the Russian Federation" | Identifier specified in the TIN certificate of an individual. |

| "TIN in the country of residence" | TIN or its equivalent in the country of citizenship of the foreign employee. |

| "Taxpayer status" | One of the following codes: • 1 – for tax residents; • 2 – for non-residents (including for citizens of the EAEU: the Republic of Belarus, Kazakhstan, Armenia and Kyrgyzstan); • 3 – for non-residents – highly qualified specialists; • 4 – for employees who are participants in the state program for the voluntary resettlement of compatriots living abroad; • 5 – for foreign employees who have refugee status or have received temporary asylum in the Russian Federation; • 6 – for foreign employees working on the basis of a patent. |

| "Citizenship (country code)" | Code of the country of permanent residence of the person. The code, for example, of Russia is 643 (according to the Classifier, approved by Resolution of the State Standard of Russia dated December 14, 2001 No. 529-st). |

| “Identity document code” | Code from the reference book “Document Codes” (Appendix 1 to the order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/485). |

| “Residence address in the Russian Federation” | Address of permanent residence of an individual according to a passport or other document confirming such address. |

| Subject code | Directory code “Codes of subjects of the Russian Federation and other territories (Appendix 2 to the order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/485). |

Section 3: grouping income

In the table of section 3 of the 2-NDFL certificate for 2021, show the amount of income received for 2021, the codes of income and deductions and the tax rate. Please fill out this table monthly. At the beginning of the table, show the tax rate at which the income reflected in this section is taxed. If in 2021 an individual was paid income taxed with personal income tax at different rates, then fill out section 3 several times - at each rate.

Let us remind novice accountants that each type of income and each type of tax deductions are assigned individual codes, for example:

- for income in the form of wages - code 2000;

- when paying remuneration under other civil contracts (except copyright) – code 2010;

- when paying benefits for temporary disability - code 2300;

- if there is no separate code for income - code 4800. That is, for example, under code 4800 you can show above-limit daily allowances, compensation for unused vacation, severance pay in excess of three times the average earnings, etc. (letter of the Federal Tax Service of Russia dated September 19, 2021 No. BS- 4-11/17537).

If we talk about the most common case, then if an employee in the period from January to December 2021 received only wages under an employment contract, then section 3 of the 2-NDFL certificate for 2021 with sign “1” may look like this:

Also, in section 3 of the 2-NDFL certificate for 2021, you need to reflect the codes of deductions provided to individuals and the amount of such deductions. However, do not get confused: in section 3, reflect only professional tax deductions (Article 221 of the Tax Code of the Russian Federation), deductions in the amounts provided for in Article 217 of the Tax Code of the Russian Federation and amounts that reduce the tax base on the basis of Articles 214.1, 214.3, 214.4 of the Tax Code of the Russian Federation. The corresponding deduction code must be indicated opposite the income for which this deduction is applied.

New income codes from 2021

In 2-NDFL certificates, separately show the bonuses that employees received in 2016 for production results as part of their remuneration. For such bonuses, code 2002 has been in effect since 2021. If bonuses were issued at the expense of net profit, then show them with code 2003. Note that until 2021, bonuses were not allocated with a separate code: for bonuses for labor, the same code was indicated as for salary in cash – 2000.

Standard, social, investment and property tax deductions should not be reflected in section 3 of 2-NDFL certificates. The following section of the 2-NDFL certificate is provided for them.

Section 4: highlighting deductions

In section 4 of the 2-NDFL certificate, show the standard tax deductions provided in 2021 (Article 218 of the Tax Code of the Russian Federation), social (Article 219 of the Tax Code of the Russian Federation), investment, as well as property deductions for the purchase (construction) of housing (subclause 2 p. 1 Article 220 of the Tax Code of the Russian Federation). The code that must be entered in the “Deduction Code” column can be determined from Appendix 2 to the order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/387. In the “Deduction Amount” column, enter the deduction amount corresponding to the specified code.

Some social and property deductions are provided by employers to their employees. In this regard, in the lines “Notification confirming the right to a social tax deduction” and “Notification confirming the right to a property tax deduction,” the accountant needs to note the number and date of the corresponding notification and the code of the Federal Tax Service that issued the notification.

Changes to deduction codes from 2021

From January 1, 2021, the Federal Tax Service has updated the codes for standard tax deductions. Of the codes that were in force in 2021, only two remained the same: 104 and 105. In addition, the previously valid deduction codes for children 114–125 do not apply from January 1, 2021. They were excluded from the directory. Instead, use the new “children’s” codes from 126 to 149. For more information, see “New income and deduction codes for 2-NDFL certificates from December 26, 2021.”

You can also find a complete list of income and deduction codes that may be required to generate a 2-NDFL certificate for 2021 in the material: “Personal income tax codes and amounts of deductions in 2021: table with explanation.”

Let's assume that the employee was provided with the standard tax deduction for the first child in 2021. This deduction in 2017 corresponds to deduction code 126. The deduction amount was 16,800 rubles. In this case, an example of filling out section 4 of the 2-NDFL certificate for 2021 will look like this:

Show all indicators in the certificate for 2021 (except for the personal income tax amount) in rubles and kopecks. However, reflect the amount of tax (personal income tax) in full rubles (do not take into account amounts up to 50 kopecks, amounts of 50 kopecks or more - round up to the nearest whole ruble). For example, if the tax is 15.78 rubles, then show 16 whole rubles on the certificate.

Section 5: summing up

In section 5 of the certificate, summarize the total amount of income of an individual and personal income tax at the end of 2021 for each tax rate. If, during the tax period, the tax agent paid an individual income taxed at different rates (for example, 9%, 13%, 15%, 30%, 35%), then for each of them it is necessary to create sections 3 - 5 of certificate 2 -NDFL. Below in the table we will explain the general procedure for filling out the 2-NDFL certificate for 2021.

| General procedure for filling out the 2-NDFL certificate for 2016 | ||

| Help field | Filling | |

| 2-NDFL with sign 1 | 2-NDFL with sign 2 | |

| "Total Income" | Total income at the end of 2021 (excluding deductions). | The total amount of income in 2021 from which personal income tax was not withheld. |

| "The tax base" | The tax base from which personal income tax is calculated in 2021. | Tax base for calculating personal income tax |

| "Tax amount calculated" | The amount of calculated personal income tax (the tax base is multiplied by the tax rate). | The amount of personal income tax that has been calculated but not withheld. |

| “Amount of fixed advance payments” | The amount of fixed advance payments by which the personal income tax should be reduced (data taken from the notification of the Federal Tax Service). | 0 |

| "Tax amount withheld" | The amount of personal income tax withheld from the income of an individual. | 0 |

| “Tax amount transferred” | The amount of personal income tax transferred for 2021. | 0 |

| “Amount of tax over-withheld by the tax agent” | The excess amount of personal income tax not returned by the tax agent, as well as the amount of overpayment of personal income tax due to a change in tax status. | 0 |

| “The amount of tax not withheld by the tax agent” | The calculated amount of personal income tax not withheld in 2016. | |

Here is an example of filling out section 5 of the 2-NDFL certificate for 2021. Let's assume that the income of an individual for 2021 was 549,200 rubles. After applying tax deductions, the tax base amounted to 457,500 rubles. The tax rate is 13 percent. This means the personal income tax amount is 59,475 rubles (457,500 x 13%). This amount was calculated and withheld by the employer at the end of 2021. And I filled out section 5 of the help like this:

As a result, after filling out all the above sections, a sample 2-NDFL certificate for 2021 with sign “1” may look like this:

List of changes in form 2-NDFL

[ads-pc-3] [ads-mob-3]

The changes concern the form itself, the reporting deadlines remained the same, so what has changed will be discussed below.

The title has a field for adjustments:

- If the report is submitted for the first time, then the code “00” is indicated.

- If a corrective report is submitted, if some error was found in the first one or corrections need to be made, then the next number of the submitted form is entered, for example, for the first correction “01”, for the second - “02”, etc.

- If it is necessary to cancel a previously submitted report form, it is submitted with code “99”.

Section 2 adds information about TIN for foreign employees; the following codes apply to previously added codes:

- “4” – for participants in the voluntary resettlement program for compatriots living outside the Russian Federation.

- “5” – if you have refugee status, as well as for persons with temporary asylum.

- “6” – for foreign citizens working on the basis of a patent.

It is also now possible to indicate the address of registration or place of residence for foreign citizens; the entry is made in the Addressee section.

Changes have been made to deductions in Section No. 4:

- In addition to social deductions received by a citizen of the Russian Federation for treatment and education, an investment deduction may be indicated in the column.

- The newly added field contains information about the notification of obtaining the right to apply deductions.

Section 5 of the form now contains a field that contains information about fixed advance payments with notification details, which confirms the right to use these amounts to reduce personal income tax payments.

Previously, code “18” was used to indicate a certificate of temporary asylum; now code “19” will be used instead. New regions have been added, such as Sevastopol (code 92) and Crimea (91). Sections 3 to 5 are filled out separately for each line.

The full names of foreign workers can be indicated in Latin letters.

Responsibility of tax agents

If you do not submit a certificate in form 2-NDFL for 2021 to the Federal Tax Service on time, the tax authorities will have the right to impose a fine on the organization or individual entrepreneur under Article 126 of the Tax Code of the Russian Federation: 200 rubles.

Also, for failure to submit or for late submission of the annual 2-NDFL certificate, at the request of the Federal Tax Service, the court may impose administrative liability in the form of a fine in the amount against the manager or chief accountant: from 300 to 500 rubles. (Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

In addition, if inspectors from the Federal Tax Service identify errors in 2-NDFL, they may regard them as “unreliable information.” And then the tax agent can be additionally fined 500 rubles for each “unreliable” document. If there are a lot of erroneous certificates, then the fine may increase.

Read also

19.01.2017

When is a 2-NDFL certificate required?

Often a document is required in the following situations:

- the certificate is submitted to the tax office along with other documents for filing a tax deduction;

- 2-NDFL will be needed when registering adoption or guardianship of a child;

- for obtaining a visa;

- to calculate sick leave or vacation pay;

- when applying for a home mortgage;

- to calculate and withhold alimony;

- when preparing a package of documents for the Pension Fund;

- in some cases, 2-NDFL is required for judicial investigation.

Penalties for being late with the new form 6-NDFL

The fine for failure to submit a quarterly report will be 1,000 rubles. for each month of delay. In addition, inspectors will have the right to block the company's account. Tax authorities will be able to suspend transactions on accounts 10 days after the 6-personal income tax is overdue.

In addition, a new article 126.1 will come into force in the code, which will provide for liability for false information - 500 rubles. for every document with errors

And.

Updated information

If, after submitting the certificate to the tax office, the tax was recalculated, draw up a new certificate in form 2-NDFL. When issuing it, in the fields “No. __” and “from __”, indicate the number of the previously submitted certificate and the new date of preparation. And in the “Adjustment number” field, indicate a value that is one more than in the previous certificate. For example, if this is the first adjustment, enter 01. Compile the updated certificate according to the form that was in force in the period for which the adjustments are made. This follows from the provisions of paragraph 5 of the Procedure, approved by order of the Federal Tax Service of Russia dated September 16, 2011 No. ММВ-7-3/576, and letter of the Federal Tax Service of Russia dated February 24, 2011 No. KE-4-3/2975.

There is no requirement to prepare updated 2-NDFL certificates for employees who acquired resident status at the end of the tax period. In such cases, the recalculation of personal income tax and the return of excessively withheld amounts is carried out not by the tax agent, but by the tax inspectorates on the basis of declarations in Form 3-NDFL (clause 1.1 of Article 231 of the Tax Code of the Russian Federation). This was stated in the letter of the Ministry of Finance of Russia dated November 29, 2012 No. 03-04-06/6-335.

Other changes regarding personal income tax

READ ON THE TOPIC:

Standard personal income tax deductions for disabled children will increase fourfold in 2021.

Among other innovations, one concerns the transfer of personal income tax from vacation pay and benefits.

These taxes must be remitted no later than the last day of the month in which the payment was made, i.e. as well as in terms of salary. Deductions for children are provided to employees until their income exceeds RUB 350,000. And the size of the deduction itself has been increased to 12,000 rubles. From 2021, the employer must provide the employee with social deductions for treatment and training.

To obtain property deductions, the period of ownership of real estate has been increased: to be exempt from personal income tax, the minimum period of ownership should be not three, but five years. However, this rule applies only to objects that were acquired after January 1, 2021 and are not used in business activities.

Particular attention is paid to personnel records, which are sometimes more complex than tax and accounting: it is necessary to study and draw up dozens of mandatory documents, employee statements, orders, and instructions.