Decree of the Government of the Russian Federation dated August 19, 2017 No. 981 approved a new form of invoice: for 2021 you can

During 2021, you need to submit your VAT return four times. The report will be the first

Based on the invoice, the company has the opportunity to receive VAT deductions. In this case, it is necessary to comply

Almost every company (IP) at certain stages of its activities needs additional cash injections.

Dear respondents! Please note that the deadline for submitting the 2-MP expires on January 25, 2021,

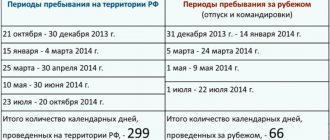

In this article we will rely on the tax code of the Russian Federation, the chapter of personal income tax. Personal income tax payers are

In case of gratuitous (unpaid) transfer (provision) of property (property), the specifics of calculating income tax are documented

Which hairdressing salons need an online cash register? Federal Law No. 54-FZ on cash register equipment requires customers to be counted

In this article you will find a list of reports to be submitted in 2021. IN

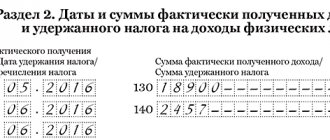

Employer reporting Natalya Vasilyeva Certified tax consultant Current as of June 12, 2019 Calculation of 6-NDFL