In this article we will rely on the tax code of the Russian Federation, the chapter of personal income tax. Personal income tax payers are individuals. faces, i.e. our employees: residents (stay in the Russian Federation more than 183 days a year) and non-residents. The object of taxation is only those incomes that were received from sources in the Russian Federation.

Definition of 12 month period.

To calculate personal income tax, it is necessary to determine the status of the employee - whether he is a resident or not. To do this, we find out from the foreigner how many days he has lived in Russia over the past year. It is not necessary to count from January and from the beginning of the month. A billing period of 12 months can begin, for example, December 25, 2021. and ends on December 24, 2021. The main thing is that during this interval the worker has lived in the country for 183 calendar days or more.

The period of 183 days is determined by summing up all calendar days in which individuals. the person was in Russia, and days of traveling abroad for short-term treatment and training for 12 consecutive months. Moreover, the days required to determine residence do not have to be consecutive; they can be interrupted, for example, during a vacation or business trip. Let's look at an example:

Thus, for 12 consecutive months from October 21, 2013. to October 20, 2014 our employee was in the Russian Federation for more than 183 days. This means that as of October 21, 2014. (on the day of payment of income) he is recognized as a tax resident of the Russian Federation , i.e. his income is taxed at a rate of 13%.

How to confirm your resident status?

- Access control marks in the passport,

- employment contract,

- certificate from the place of work,

- certificate from the educational institution,

- time sheet.

A foreigner can provide these documents at his own request if he wants 13% personal income tax to be withheld from him. Initially, the employer does not require them.

What the law says

According to paragraph 2 of Art. 207 of the Tax Code of the Russian Federation, tax residents are persons who stay in Russia for more than 183 days within one year or receive income from sources in the Russian Federation. In this case, the days of entry and exit are not taken into account. In addition, this period is not interrupted:

- when traveling abroad for up to 6 months;

- undergoing treatment or training;

- carrying out work in offshore hydrocarbon fields.

As before, non-resident personal income tax in 2021 pays at a rate of 30%; this is stated in clause 3 of Art. 224 Tax Code of the Russian Federation. In some cases, the rate may differ. For example, participants in Russian companies contribute 15% on dividends. And foreigners who work under a patent or are highly qualified specialists pay personal income tax at a general rate of 13%. Similar amounts of payments are made by residents of countries that are members of the Eurasian Economic Union, as well as refugees.

As you can see, income tax in Russia is quite high for foreigners if there is no right to a preferential rate.

For more information, see “Personal Income Tax Rates”.

Labor of foreign citizens in Russia (residents and non-residents)

Within the framework of the country's tax code, a tax resident is a person who has stayed within the territorial borders of the state for at least 183 days during the last year. Acquiring this status obliges a person to transfer to budget funds amounts equivalent to the amount of taxes levied on Russians. Consequently, from a legal point of view, non-residents and persons residing in the Russian Federation on a temporary basis are equal in tax obligations.

Calculation order

Income tax is determined on all funds received during the month (not on an accrual basis). The calculation is made separately for each amount.

The sequence of calculating personal income tax for foreign citizens in 2018 is as follows:

| Stage | What does it include |

| 1 | Residence is established in accordance with Art. 207 Tax Code of the Russian Federation |

| 2 | Determine payer status |

| 3 | Set the rate taking into account the above characteristics |

| 4 | The tax base (NB) is determined in accordance with Art. 211 of the Tax Code of the Russian Federation and calculate the tax |

| 5 | Fill out forms 2-NDFL and 6-NDFL |

Also see “Confirmation of the status of a tax resident of the Russian Federation” - a new service of the website of the Federal Tax Service of Russia.”

Personal income tax 2021: foreigners sell real estate

For the taxation of income of non-residents received from the sale of property, the period of ownership did not matter until the end of 2021, and personal income tax was levied in any case. But from January 2021, in paragraph 17.1 of Art. 217 of the Tax Code of the Russian Federation has been amended, according to which income received from the sale of real estate after 01/01/2019 is exempt from personal income tax, subject to the minimum holding period.

Let us recall the minimum period of ownership of property:

- for purchased before 2021 - more than 3 years;

- for acquired starting from 2021 (Law of the Russian Federation “On Amendments...” dated November 29, 2014 No. 382-FZ) - more than 5 years, while for some situations of receiving property a 3-year period remains.

The Ministry of Finance of Russia, in letter No. BS-3-11/10138 dated December 26, 2018, explains the intricacies of the process of selling an apartment by a non-resident. If the period of ownership of the property being sold is less than 5 years, then the non-resident pays tax on the amount of income at a rate of 30%. However, he does not have the right to apply property deductions.

In addition to the above letter, a similar statement is contained in letters of the Ministry of Finance of Russia dated May 27, 2019 No. 03-04-05/38392, dated June 14, 2019 No. 03-04-05/43619 and some others.

Example

Mr. Klyuchnik S.I. sold in April 2021 a country house that had belonged to him for less than 5 years.

Like all individuals who have received independent income, in 2021 he must submit a tax return in form 3-NDFL by 04/30/2021, and then pay the due tax, calculated at a rate of 30%, by 07/15/2021.

How to calculate personal income tax

EXAMPLE 1

accepted on March 12, 2021 for the position of A.N. Frolov, who came from Yerevan. An employee has been hired as a finishing foreman. At the time of signing the agreement, Frolov was on the territory of the Russian Federation. There is a migration card with a period of stay from March 1 to December 31, 2021. The tax base is 30,000 rubles/month. How to pay personal income tax from a foreigner in 2021?

Solution

Until March 1, 2021, Frolov was a non-resident, so income tax was withheld at a rate of 30%. The 183rd day of stay in Russia falls on August 28, 2021. This means that until this moment, income is taxed at a rate of 30%:

From August 29, 2021, Frolov’s income will be taxed at a rate of 13%. Then Stroymir LLC will retain:

EXAMPLE 2

The consulting company hired N.A. Golubev tax law consultant (qualified specialist from Munich). Salary 170,000 rub. Determine personal income tax for a foreign employee. Solution

Based on clause 3 of Art. 224 of the Tax Code of the Russian Federation and 207 of the Tax Code of the Russian Federation, foreigners with the status of a qualified specialist are taxed at a rate of 13%. It turns out that income tax is withheld from Golubeva in the amount of:

Also see “Rules for calculating income tax”.

Employment contract with a foreign specialist

Legal confirmation of legal work activity is a contract. Moreover, every foreigner has the right to demand from the employer that the contract does not have a time frame, despite the fact that migration structures believe that as soon as the validity period of the patent can be considered expired, the contract will also lose its legal force.

Reference! The Labor Code of the Russian Federation regulates only the temporary removal of an employee from a position until the documents are extended and put in order.

How to fill out a 2-NDFL certificate

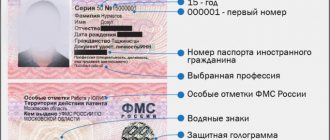

2-NDFL certificates for foreign workers in 2021 are filled out in the same way as for a Russian employee, but there are some nuances.

TIN

If a foreign worker is registered with the Russian tax office, fill out the “TIN in the Russian Federation”. When an enterprise has information about the TIN of the country of citizenship (nationality), then fill out the appropriate field.

FULL NAME.

Personal information is indicated as written in the identity document. It is acceptable to use Latin letters. If there is no middle name, the field is not filled in.

Status

When filling out personal income tax certificate 2 for foreigners, it is important to correctly indicate the status. For example, if a foreign worker is a qualified specialist of the highest category, in the column “Taxpayer Status” they put 3. If he is a non-resident, they put 2. If he is recognized as a tax resident in accordance with clause 2 of Art. 207 of the Tax Code of the Russian Federation, put 1.

Address

The place of permanent residence of the foreigner is determined. The address is written arbitrarily, in Latin letters.

Codes

When filling out the “Identity document code”, they usually put the number 10 in the passport of a foreign citizen.

In the “Country code” field indicate the code of the state in which the foreigner permanently resides. It is taken from the All-Russian Classifier of Countries of the World (Resolution of the State Standard of Russia dated December 14, 2001 No. 529-st).

The payer's income and deduction codes are also filled out in accordance with legal requirements. The Federal Tax Service order No. ММВ-7-11/485 dated October 30, 2015 provides details on filling out the 2-NDFL certificate.

So we have looked at the main points that need to be taken into account when withholding personal income tax from foreigners in 2021, as well as filling out the 2-NDFL certificate.

Also see “2-NDFL for a foreign worker”.

Read also

25.04.2018

Personal income tax for non-residents in 2021

residing on the territory of Russia for more than 183 days) and who received income both on the territory of the Russian Federation and abroad, were required to submit to the tax authority a declaration on their actual and expected income no later than April 30, 2001. The declaration must be completed in Russian language in the form of Appendix No. 6 to the Instruction of the State Tax Service of Russia dated June 29, 1995 No. 35 “On the application of the Law of the Russian Federation “On Income Tax from Individuals.”

Deductions from the taxable income of foreign citizens and stateless persons were to be applied only to the income of tax residents of the Russian Federation and carried out in the same manner and amount as established for Russian citizens.

If international treaties of the Russian Federation or the former USSR establish rules other than those contained in the tax legislation of the Russian Federation, then in accordance with Article 7 of the Tax Code of the Russian Federation, the rules of international treaties are applied. It should be borne in mind that international treaties come into force only after the exchange of instruments of ratification between the contracting parties. Currently, Russia has 46 such agreements, including with 8 CIS countries: Azerbaijan, Armenia, Belarus, Kazakhstan, Moldova, Turkmenistan, Ukraine, Uzbekistan.

On January 1, 2001, in connection with the entry into force of part two of the Tax Code of the Russian Federation, changes were made to the taxation procedure for foreign citizens and stateless persons in the Russian Federation. These changes apply to income received starting from 2001. Thus, according to Articles 210 and 223, the recalculation of income received in foreign currency into Russian rubles is carried out at the Bank of Russia exchange rate on the date of actual receipt of income. When receiving income in the form of wages, the date of actual receipt of such income is considered to be the last day of the month for which income was accrued for the performance of labor duties in accordance with the employment agreement (contract).

Article 224 of the Tax Code of the Russian Federation introduces a single rate of 13% instead of the current three-level scale of income tax rates for individuals who are residents of the Russian Federation, and 30% for individuals who are not tax residents of Russia.

When determining the size of the tax base of foreign individuals, one should also take into account those payments of the employer that before January 1, 2001 had a preferential tax regime, i.e. amounts of compensation for expenses for renting residential premises, for maintaining a car for business purposes, for business trips (travel expenses), received from January 1, 2001, are subject to taxation in the Russian Federation in full. In addition, the tax base is not reduced by the amount of contributions made by the employer to compulsory social insurance and pension funds located in the countries of residence of these citizens.

The procedure for exemption from tax payment and offset of tax paid outside the Russian Federation has also been changed.

In accordance with Articles 214, 232 of the Tax Code of the Russian Federation, offset of tax paid by a tax resident of the Russian Federation outside Russia is possible only if the tax was paid in a state with which the Russian Federation has concluded a treaty (agreement) on the avoidance of double taxation.

If the source of income is located in a foreign state with which a treaty (agreement) on the avoidance of double taxation has not been concluded, then the tax withheld by the source of income at its location is not accepted for credit in the Russian Federation.

To obtain tax exemption, offset, tax deductions or other tax privileges, the taxpayer must submit to the Russian Tax Ministry authorities official confirmation that he is a resident of the state with which the Russian Federation has concluded a treaty (agreement) valid during the relevant tax period. avoidance of double taxation, as well as a document confirming the income received and the payment of tax outside the Russian Federation.

According to Article 226 of the Tax Code of the Russian Federation, representative offices of foreign organizations in the Russian Federation from which or as a result of relations with which taxpayers received income are charged with the obligation to calculate, withhold and pay tax on the income of these persons.

The employment of foreign citizens in the representative office of a foreign company in Moscow is carried out in accordance with the Labor Code of the Russian Federation, Decree of the President of the Russian Federation dated December 16, 1993 N 2146 “On the attraction and use of foreign labor in the Russian Federation”, as well as Resolutions Moscow Government dated July 16, 1996 N 587 “On the practice of attracting and using foreign labor in Moscow” and February 24, 1998 N 140 “On measures to ensure the implementation of the Moscow City Law dated October 22, 1997 N 41 and introducing amendments to the Moscow Government Decree dated 07/16/1996 N 587".

| L.N.Medvedeva Tax Advisor |

III rank