By Decree of the Government of the Russian Federation dated August 19, 2017 No. 981, a new invoice form was approved: for 2021 it is possible on this page. It's free. We will also list here the mandatory details added in 2021.

Get the form for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- invoices

- Fill out and print the document online (this is very convenient)

Let us remind you that the document is issued by the seller to the buyer upon release of inventory items. Based on a correctly executed invoice, VAT is accepted for deduction or refund.

From January 1, 2021, you need to fill out the invoice in a new way. This is due to an increase in the VAT rate.

VAT and invoice

When paying for the transaction, the seller is charged value added tax. It is the document that we consider (invoice), as confirmation of VAT payment, that is registered by the buyer in a special book. Based on this document, he fills in the corresponding indicators in the VAT return. According to the law, the buyer has the right to a tax deduction under this taxation article (Article 169 of the Tax Code of the Russian Federation), if everything is completed correctly and accurately.

There are situations when VAT is not charged, for example, for entrepreneurs working under the simplified tax system. But often the buyer, despite this circumstance, asks for an invoice, even without VAT. This is not the seller’s responsibility, but sometimes it is still worth meeting the buyer’s request and issuing an invoice, just indicate in the document that it is without value added tax, without filling out the corresponding line of the form.

IMPORTANT! If you are not a VAT payer, you should not indicate a 0% rate on your invoice instead.

Even zero percent shows the real rate to which you are not entitled in this case. Specifying a rate that does not correspond to reality can create many problems for the recipient of the document, starting with a fine and ending with the accrual of the standard 18% rate.

Postings when transferring an advance from the buyer

When transferring the advance payment, the buyer must perform the following actions:

- Accept for deduction the VAT indicated in the advance payment slip received from the seller;

- Allocate VAT on received goods and materials against the previously made payment and send it for deduction;

- Restore advance tax.

To reflect transactions with sellers, account 60 is used, on which advance transferred amounts are taken into account separately, while you can open an independent subaccount 60 av, while other transactions with sellers will be taken into account in the subaccount 60 r.

The accounting entries look like this:

- Deb. 60 av. Credit. 51 – advance payment transferred.

- Deb. 68 Cred. 60 Av – tax on prepayment is accepted for deduction;

- Deb. 19 Cred. 60 rubles – tax allocated on goods and materials received;

- Deb. 68 Cred. 19 – the allocated income tax is accepted for deduction;

- Deb. 60 av Cred. 68 – advance VAT restored;

- Deb. 60 RUR Credit. 60 Av – the advance was offset.

In what cases is an invoice not needed?

There are situations when issuing an invoice is not necessary, and the transaction is confirmed by other documents: an invoice for payment, invoices, etc. You don’t have to worry about an invoice if:

- the transaction is not subject to VAT (Articles 149, 169 of the Tax Code of the Russian Federation);

- the enterprise sells goods to individuals at retail for “cash” (for such transactions, a strict reporting form or a receipt from the cash register is sufficient);

- entrepreneurs are under special tax regimes (simplified taxation, imputation, unified agricultural tax, have a patent);

- a legal entity gives the goods to its employee free of charge (based on letter of the Ministry of Finance of the Russian Federation dated February 8, 2021 No. 03-07-09/6171);

- delivery of goods is planned, and an advance has been received for it (in this case, this product is produced no longer than six months, or the buyer does not pay VAT, or the transaction has a zero rate for this tax, for example, the product is being exported).

How are they interconnected?

Based on the invoice, payment is made for products, goods sold or work performed. And the very fact of transfer of goods and materials to another organization is confirmed by the consignment note. If the organization is a VAT payer, then an invoice is issued so that the seller or buyer has grounds for crediting or writing off VAT and displaying this tax in tax documentation. And also so that a third-party organization can make payment based on the seller’s details.

All documents are primary and are issued for external use, as well as to reflect actions in internal document flow. Based on each of these documents, entries are made in accounting journals.

What are the consequences of mistakes?

Errors and inaccuracies may be accidentally made in any document; their price may vary depending on the significance of the paper. What are the consequences of errors in the invoice?

If this document is filled out with inaccuracies, the buyer may be denied a VAT tax deduction. Naturally, in the future the buyer will no longer want to deal with the seller who caused him such a loss.

Error error discord

Not every mistake leads to dire consequences. Let's consider the most common variants of incorrectness in the invoice, on the basis of which the tax office has the right to refuse to reimburse VAT (clause 2 of Article 169 of the Tax Code of the Russian Federation).

- Unknown authorship. If it is difficult to determine from the document who exactly is the buyer and who is the seller, such an invoice will be considered invalid. This is quite likely. If the details of both parties are incorrectly specified or missing, such as:

- Name of the organization;

- address;

- TIN.

- Wrong product or service. If the invoice does not clearly indicate which product was purchased or service was provided, or this information contradicts other documents, VAT will not be refunded. For example, according to the invoice, “Romashka” candies were shipped (this name of the product is indicated in column 1), but in fact “Red Poppy” candies were sold.

- Inaccuracies in monetary figures. Problems associated with incorrectly indicating the cost of products (services) or the advance received for them also neutralize the value of the invoice. This may be related:

- with an incorrect indication of the payment currency (pay attention not only to the name of the currency, but also to its code);

- with omission or incorrect information regarding the quantity of goods (units of work or services);

- with errors in prices;

- incorrect calculation of cost (quantity multiplied by price does not result in the indicated figure in the “cost” column).

- Incorrect VAT calculation . In the column where VAT is indicated, one rate is indicated, and the amount is calculated using another, or a standard percentage is calculated when the rate should have been zero.

- Unknown VAT amount . If the required number is not in the corresponding column, although it is indicated in the “rate” column, and also if the given number is not obtained by multiplying the rate and the amount paid for goods (services).

When mistakes are not fatal

Tax authorities do not have the right and usually do not refuse a tax refund if there are other deficiencies in the invoice, for example:

- lowercase letters are used instead of capital letters or vice versa;

- quotation marks missing;

- missing or extra characters such as periods, dashes, commas, parentheses;

- there is no checkpoint or it is indicated incorrectly;

- there is no description of the work performed or services provided (information in column 1);

- there is no justification of the invoice by the contract number;

- errors in specifying payment details;

- numbering with inaccuracies;

- information about the consignee is not duplicated if he and the buyer are the same (the same goes for the seller and the consignor).

An error was made, what should I do?

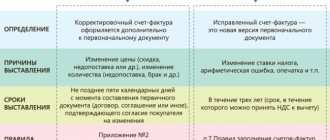

If the seller who issued the invoice finds errors in it, he has the right to make the necessary adjustments. The buyer does not have this right, but he can point out the error to the invoice issuer and ask for corrections. For this purpose, a special operation is provided - invoice adjustment .

Account level

In this input window, you must specify the account level of the letter index of the counterparties. For example, if the account is 62/A, then the entry window should contain the number “2”.

If the score is 62/1/A, then the number “3” should appear in the input window.

Entering digital values is carried out both from the keyboard and using the built-in calculator. In the latter case, left-click on the input window.

A calculator button appears. Click this button.

A calculator appears. Select the desired number and press the “Substitute” button.

The account level value appears in the input window.

Adjustment rules

- Both copies are subject to changes - both those belonging to the seller and those intended for the buyer.

- Corrections must be endorsed by the head of the selling organization and certified with his seal (the signature of the chief accountant is not required). Instead of the director, an authorized person can sign, indicating his full name and position, and also mark that the signature is “for the head of the organization.”

- Be sure to date the corrections.

- Incorrect data must be crossed out, the correct data must be written in the free field, and “corrected” must be indicated next to it, and which indicators should be added to which and in which column.

IMPORTANT INFORMATION! If there are too many errors and correction is difficult, it is easier to reissue the damaged document. This does not contradict the law, since the Tax Code of the Russian Federation does not directly prohibit replacing a defective invoice with a new document. But sometimes such a right will have to be defended in court.

Actions of the invoice recipient

If a corrected invoice was sent to the buyer, he must change the data in the purchase book, because the parameters of the defective invoice or erroneous data were indicated there. To do this, the buyer needs to use an additional sheet from the Book, only to match the tax period of the purchase. On this sheet, you need to make a record of the cancellation of a specific invoice and calculate the amount of purchases made before this invoice, thus determining the amount corresponding to the canceled invoice.

The buyer has the right to exercise the legal possibility of deducting VAT not only in the tax period when he made the purchase: it is only important that the document is registered on time.

Sample of filling out an invoice

Drawing up a standard invoice is not the most complicated procedure, however, it may raise some questions for beginning professionals.

- At the beginning of the document, the invoice number and the date it was filled out are written.

- Next, indicate the details of the company that is a supplier of goods or services: write its full name, legal address (with postal code), Taxpayer Identification Number (TIN), KPP (all this information must correspond to the constituent papers of the enterprise).

- Shipper and consignee information is then included.

- Next, provide a link to the payment document (its number and date) and enter information about the buyer: everything is similar to how the lines about the seller were filled out.

- After this, data is entered on the currency that is used in monetary settlements between the parties to the agreement (in writing and in the form of a code according to the All-Russian Currency Classifier (OKV)).

The account number can be anything, the main condition is that it follows an ascending line to the previous ones. Moreover, in cases where, for some reason, the numbering sequence is violated (for example, invoices 21, 22, 23 are followed by 8), this does not threaten any sanctions from regulatory authorities and tax authorities. As for the date, the invoice must be made either immediately on the day of delivery of inventory items or provision of services or within a five-day period thereafter.

These lines should be filled out only when it comes to the sale of inventory items (i.e., when providing services or performing work, you need to put a dash in them). When we are talking specifically about purchase and sale, then if the consignor is the seller of the goods, then you can either duplicate the address completely, or briefly indicate this with two words “same”. But the address of the consignee must be indicated in full, including the zip code, office or warehouse number and telephone number.

The ruble is coded with the numbers 643.

The next part of the document contains a table that includes the main indicators of the transaction.

- The first column contains the name of the object of the contract (as it appears in the contract itself).

- In the second, if necessary, the product code according to the All-Russian Classifier of Units of Measurement (OKEI), symbol (pieces, liters, kilograms, etc.).

- Column number three indicates the total quantity or volume of goods/services/work, then the price per unit of measurement.

- Columns from five to nine are mandatory: the cost with and without tax, the amount of tax (which, as you know, can be 0%, 10%, 18%), as well as the final price with tax are entered here. Companies operating without VAT can mark this in the required box.

- The tenth and eleventh columns are for foreign goods. 10 and 10a include information about the country of origin of the goods (in the form of an OKSM code) and a short verbal designation); the last column contains the number of the customs declaration, if any.

At the end, the invoice is signed by the head of the company (director or general director), as well as the chief accountant . If this is the same person, the signature should be duplicated.

Display method

An invoice can be issued on paper or electronically. Left-click on the “Issue method” input window.

A button for selecting the setting method appears. Click on it.

The window for selecting the setting method appears. Select the desired line. Click "OK".

The required method appears in the input window.