In case of gratuitous (unpaid) transfer (provision) of property (property), the specifics of calculating income tax are documented and presented in the Civil and Tax Codes.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

What is gratuitous transfer of property?

The unpaid provision of property means the transfer of things, financial resources, services or intellectual property from one person to another with the absence of payment for temporary or permanent (donation) use, formalized by an appropriate agreement.

Temporary use and donation differ:

- owner of the property. A gift implies that the recipient becomes the owner of the property, whereas in an unpaid transfer the transferor remains the owner;

- temporary or permanent nature of ownership of property. A donation does not imply the return of the object of the agreement. Temporary use is intended for the return of previously received property. At the time of return, the condition of the property is determined by agreement or, by default, the level of natural wear and tear is taken into account.

The parties to the agreement for the transfer of ownership rights may be:

- commercial education;

- non-profit education;

- physical entity;

- a legal entity that is the owner of the donated item.

The following have the right to present property for free use:

- owner of the thing4

- other persons who have this right granted to them by law or by the owner.

Good to know! A commercial association does not have the right to provide property for unpaid use to a person if the latter is its founder, shareholder, manager, and is also a member of the board and inspection bodies.

Donation items may include:

- products belonging to the owner;

- owner's property right;

- property right of the owner in relation to a third party or gratuitous waiver of a certain claim;

- getting rid of the fulfillment of a property obligation (forgiveness of a debt obligation);

- release from a debt obligation to another person.

Let's celebrate! When transferring property, you must include all accessories, components, as well as documents - technical passport, instructions for its use, etc.

Will of real estate

Another popular gratuitous real estate transaction, which provides for the transfer of property after the death of the testator. In fact, property can pass to the legal heirs without a will. However, if you want to distribute it in a certain way or transfer part of the property to third parties who are not the immediate heirs, you need to draw up a will and have it certified by a notary.

The opening of a will occurs after the death of the testator at his place of residence. Heirs must submit an application for acceptance of the inheritance within 6 months from the date of its opening. Then you need to obtain a certificate of inheritance from a notary. Since we are talking about the will of real estate, the next mandatory action of the heir is the state registration of the right to the bequeathed object.

Income tax for an organization transferring property for free use

Since the participant transferring the property for unpaid use has no income, no income tax is charged.

Accordingly, expenses that are not taken into account for taxation in relation to the lender include:

- the total value of the freely transferred property;

- the costs of its maintenance.

Features of tax accounting

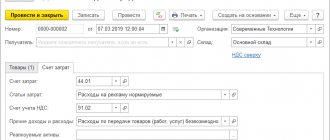

To carry out tax accounting, it is necessary to first conduct an assessment of the unpaid property received, which is made on the date of its receipt and corresponds to its market value.

This assessment can be made by:

- an independent appraiser who has the necessary license;

- the taxpayer himself.

Good to know! If the assessment is carried out by the taxpayer, he must prove the validity of the calculation of the value of the thing through documents showing the submitted prices.

A taxpayer can use the following sources of information about prices on the market:

- exchange prices;

- national statistical offices;

- institutions that regulate pricing;

- mass media.

Property transferred for free use includes:

material and production reserves:

- raw materials and materials used in the production process;

- things intended for sale;

- materials and funds used for management coordination;

- fixed assets;

- intangible funds;

items of intellectual property (prerogative right of the patent holder, copyright, property right, owner's right):

- invention, production model;

- computer utilities, databases;

- topologies of aggregate chips;

- trademark and service mark, name of the place of production of goods;

- breeding achievements;

cash deposits:

- national, municipal and other securities;

- investments in the authorized capital of other institutions;

- loans, depositary investments in credit institutions, receivable liabilities acquired through relaxation of the right to claim, etc.

Subject of the agreement: what can be transferred for free use

To determine the possible objects of a gratuitous use agreement, the legislator refers us to the article of the Civil Code regulating this issue in the context of rental relations.

Guided by Article 607 of the Civil Code, we establish that the owner has the right to transfer the following property for temporary use:

- land plot;

- water bodies and other natural objects;

- company;

- real estate objects: residential and non-residential;

- structures;

- equipment and other property.

Legislation may establish prohibitions and special rules for the disposal of individual objects. For example, additional registration rules are provided for the provision of land plots and other real estate for a time.

From the wording of the above article of the Civil Code, it follows that in order for an item to be borrowed, it must meet the following criteria:

- the transferred object can be distinguished from other similar ones (a specific car, machine or office);

- the use of property does not lead to its reduction or consumption. Only normal wear and tear is allowed;

- the transferred object must relate specifically to material goods.

Based on these principles, it is easy to establish that under a free use agreement the following cannot be transferred:

- objects of intellectual property (inventions, trademarks, works of authorship);

- cash. Providing money with the condition of repayment means a loan transaction. Money cannot be classified as individually defined property. This does not imply the return of the transferred banknotes, but of cash in the same amount.

Income tax for an organization that has received property for free use

Property (thing, labor relations, service) or owner's rights acquired free of charge are considered as non-operating income of the taxpayer.

However, transferred property is not recognized as non-operating income if it was acquired from:

- a providing institution whose investment (part of the share) is equal to 50% or more of the authorized capital of the acquiring participant, and vice versa;

- an individual whose investment (part of the share) is equal to 50% or more of the authorized capital of the acquiring participant;

- founders of the organization to increase net assets, such as the formation of surplus capital and/or funds.

Let's celebrate! If the agreement imposes the costs of maintaining the property on the lender, they are excluded from the costs of the borrower; accordingly, the taxpayer reduces the income received by the totality of available costs.

Transfer of an item under a loan agreement

Items under a free use agreement must be transferred in proper condition, with all necessary documents and accessories. The consequences of transferring things without accessories and documents, if without them the thing cannot be used, entail the right of the recipient to demand the provision of these accessories and documents or termination of the contract and reimbursement of expenses incurred.

If there is a refusal to transfer an item after concluding a contract for gratuitous use, the recipient also has the right to demand termination of the contract and compensation for expenses incurred.

If defects in items are discovered, the recipient has the right to demand:

- free elimination of deficiencies;

- reimbursement of expenses for eliminating deficiencies;

- early termination of the contract and compensation for real damage incurred by it: actual costs and losses.

If the lender refuses to return the item, he submits: A statement of claim to recover property from illegal possession.

Income tax on gratuitous transfer (receipt) of property with transfer of ownership

When carrying out the transfer or acquisition of property with the acquisition of ownership rights, when calculating the amount of income tax, it is necessary to remember that in this case non-operating income arises. The resulting non-operating income is determined by the number of transfers of property.

The tax amount may include:

- property tax;

- transport tax;

- depreciation amount.

Good to know! The above amounts are accrued when the subject of the agreement becomes subject to taxation and is paid by the owner (acquiring participant).

When calculating income tax on the gratuitous transfer of property, you should take into account:

- type of agreement for gratuitous transfer of property;

- liability of the parties;

- features of the calculation of this tax according to the subject of taxation.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (812) 309-53-42 (St. Petersburg) It's fast and free!

Responsibilities for maintaining the item by the borrower

In general, the borrower is obliged to maintain the received item in good condition and bear all costs of its maintenance. In this case, the borrower is responsible for both current and major repairs. These rules apply unless the parties to the contract have determined a different order of contents of the thing.

The risk of accidental loss or accidental damage to property rests with the owner. However, the borrower bears this risk if:

- the thing was lost or damaged due to its use by the borrower not in accordance with the agreement or the purpose of the thing;

- the borrower transferred it to a third party without the consent of the lender (if there was consent, this risk is borne by the lender);

- the borrower, under the circumstances, could have prevented the death or damage of the item by sacrificing his own, but did not do so.

The listed cases are determined on the basis of the borrower’s obligation to take care of the safety of the property received for use and to maintain integrity in the relationship between the parties.

Termination of the agreement

Relations under a gratuitous use agreement are terminated if the agreement expires or is terminated by one of the parties.

The legislation does not contain any instructions regarding special grounds for refusal of an agreement that does not indicate the duration of its validity. The desire of one or both parties is enough. The party must notify the other party of its intention to terminate the contract in advance, no later than one month before the expected expiration date.

If the contract is fixed-term, any party may initiate its early termination in the presence of established circumstances.

Table: grounds for early termination of the contract

| Lender | Borrower |

Has the right to terminate the contract if the borrower:

| The right to terminate the agreement if:

|

Lender's liability

The rules on the limits of the lender's liability follow from his obligations. As already noted, under an agreement on free use, the owner transfers the item to the user in proper condition, complete with auxiliary elements, as well as documentation.

In this case, the lender, through negligence or intentionally, may omit these requirements. Considering himself the owner, the lender often does not bother himself with observing all the necessary nuances. However, like any contract, this transaction assumes responsibility for both participants if they ignore their obligations.

If the user discovers deficiencies that the lender did not inform about, or if the necessary accessories and instructions are not provided, the borrower has the right to choose one of the measures:

- demand correction of deficiencies and transfer of missing elements and documents;

- “break” the contract and request compensation for costs.

The lender will not be responsible for defects or defects in the property if:

- he notified the borrower about these shortcomings;

- the borrower was aware of the nuances of the subject of the transaction;

- the shortcomings were discovered during the examination of the object directly during its transfer.

While remaining the owner of the transferred property, the borrower risks liability if the use of the thing causes damage to an unauthorized person. The owner will be able to avoid unpleasant consequences if he manages to prove the fact of intentional harm or gross negligence by the borrower or an outside entity.

Rules for drawing up a contract

Giving an agreement on the temporary transfer of something an official status occurs by concluding an agreement.

Requirement for the form of agreement

The provision of a thing to a temporary owner can be carried out on the basis of either a written agreement or oral agreement between the participants.

Obviously, if we are talking about relationships between individuals, then such transactions, as a rule, are not formalized in any way. Although the law does not limit citizens’ right to formalize a transaction by drawing up a written contract.

A written agreement is required if:

- at least one of the participants in legal relations is a legal entity;

- if the value of the transferred property is more than 10 thousand rubles.

If the condition of mandatory written form is neglected, it will be very problematic for the parties to defend their position in legal disputes.

The owner of the transferred property is primarily interested in drawing up the contract on paper. Indeed, in the event of damage, it is a written agreement that will allow the owner to protect his rights and demand compensation from the borrower for the damage caused.

Structure and main terms of the contract, sample

The free use agreement is drawn up according to a standard structure, which includes the following conditions:

- parties to the contract;

- subject of the contract;

- term of the contract;

- rights and obligations of the parties;

- liability of the parties;

- termination and modification of the contract.

The agreement between government agencies regulates all the essential terms of the transaction in accordance with the law.

Essential terms of the agreement

The agreement is considered concluded when the parties reach agreement on the following conditions:

- the subject of the contract is a strictly defined object that has the above-mentioned characteristics (non-consumability, irreplaceability);

- gratuitous basis.

As the subject of the contract, it is not enough to simply name the value being transferred. A detailed description of the item is required. If we are talking about a car, real estate or other item subject to state registration, the contract must indicate registration information. Regarding immovable objects, you need to register the address and characteristics of the property. Sometimes a detailed description is included not in the contract, but in the deed of transfer attached to it.

The act of acceptance and transfer confirms the actual transfer of the item and records its condition

The condition of gratuitousness follows from the name of the agreement and the absence of requirements for payment for the use of the thing.

Other conditions include the term of the contract, the scope of powers of the parties, termination of the transaction and resolution of disagreements.

As for the period of validity of the contract, the parties can stipulate a specific period or leave this condition undefined. In the second case, the relationship continues until one of the participants declares a waiver of the agreement.

Rights and obligations of participants

An integral part of any legal relationship is the scope of powers of the parties. The counterparties to the gratuitous use agreement may prescribe and specify their powers, or may limit themselves to reference to the norms of the Civil Code.

The main obligation of the lender is the actual transfer of the thing, which must be:

- in good condition suitable for normal use;

- complete with accessories and documentation necessary for the normal use of the property based on its purpose.

When handing over a car for free use, the lender hands over the keys and documents for the car

Any nuances and malfunctions are stipulated by the owner by the terms of the contract.

The borrower is burdened with the obligation to return the provided item in a condition corresponding to the one in which he received it, taking into account normal wear and tear.

The use of the property must be carried out in accordance with the clauses of the agreement. In the absence of instructions about this, operation should be carried out in the manner usual for this item.

The borrower, in addition to the above, must take measures to ensure the good condition of the property and bear the necessary costs for this. The borrower, unlike the tenant, must carry out not only minor, but also major repairs of the property being used. However, the Civil Code allows the parties to stipulate other conditions for ensuring the safety of the subject of the agreement and incurring associated costs.

Registration requirement

A number of civil transactions are subject to mandatory registration. If this condition is not met, the transaction is considered invalid.

Most often, transactions with real estate, including land plots, as well as with specific objects (intellectual products, cultural objects, weapons) are subject to registration.

An analysis of legal norms allows us to assert that there is no need to register an agreement for the gratuitous use of residential and non-residential facilities.

You will have to register a transaction if the following is transferred for free use:

- land plot for a period of more than 1 year;

- an object included in the cultural heritage.

Payment procedure and terms

The authorities of the constituent entities of the Russian Federation often pass various laws that slightly adjust the procedure and timing of tax collection.

Direct payment of tax by a citizen is carried out at a bank branch or using electronic resources.

Legislation undergoes periodic changes, therefore, when calculating the amount of tax, as well as when paying it, a citizen must be aware of the latest changes. To do this, you need to clarify the information on the website of the tax service or other government portals, as well as by personally contacting the tax office.

In some cases, the law partially or completely exempts a person from the obligation to pay this contribution. These cases are described in detail in the Tax and Civil Code of the Russian Federation.