Employer reporting

Natalya Vasilyeva

Certified Tax Advisor

Current as of June 12, 2019

The 6-NDFL calculation contains data on all income received by employees of a company or individual entrepreneur, including sick leave and vacation pay. Let's look at an example of how to correctly fill out a report on sick leave and vacation pay and how to reflect these payments in 6-NDFL if they transfer to another reporting period.

Dates of receipt of income and withholding of personal income tax

Unlike salary, the day of actual receipt of income for which is considered the last day of the month, the day of receipt of income for vacation pay (including compensation for unused vacation upon dismissal) and sick leave is considered the date on which they were transferred to the employee’s bank account, or paid in cash (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

The employer must pay vacation pay to the employee 3 working days before the vacation. As for sick leave benefits, the employer accrues them on the basis of sick leave within a 10-day period, paying them on the next “payday” day.

“Vacation pay” and “sick leave” personal income tax, as well as tax on other income, must be withheld on the day of their payment, and transferred to the budget no later than the last date of the month of payment to the employee, taking into account the transfer to the next working day if it coincides with weekends and holidays (p 6 Article 226 of the Tax Code of the Russian Federation). Let us remind you that for tax withheld from salary and compensation for vacation, the transfer deadline is the next day after payment of income.

These features of reflecting dates, common for sick leave and vacation pay, must be taken into account when filling out section 2 of the 6-NDFL calculation.

Example of reflecting sick leave

SPARTA LLC has 4 employees; for the second quarter they were paid the following amounts:

- Salary for April 120,000 rubles – May 04

- Salary for May – 120,000 rubles – June 05

- Sick leave for an employee 8,000 rubles – May 13

- Salary for June 120,000 rubles – July 4

The tax must be transferred to the treasury on the day of payment of wages. Wages for June must be reflected in the first section of the calculation, but not indicated in the second.

Rice. 2 Sample of filling out sick leave in calculation

When analyzing the difficulties associated with how to reflect vacation and sick pay in 6-NDFL, it is necessary to turn to tax legislation, which defines the basic principles characterizing the calculation and filling out of 6-NDFL with vacation and sick pay.

The regulatory framework that determines how to reflect vacation pay in 6-NDFL (see example above) is the Tax Code of the Russian Federation, the Labor Code of the Russian Federation and Letters of the Ministry of Finance of the Russian Federation.

Similar articles

- Recalculation of vacation pay in 6-NDFL: is clarification needed?

- Date of personal income tax withholding in 6 personal income tax

- How to reflect carryover vacation pay in 6 personal income taxes

- An example of how vacation pay is reflected in Form 6-NDFL

- 6-NDFL for individual entrepreneurs without employees

Features of reflecting vacation pay in 6-NDFL

When filling out Section 1 of form 6-NDFL, the amounts of vacation pay are shown together with other income of individuals. But in Section 2, vacation pay should be reflected separately from income that has other deadlines for paying personal income tax to the budget. In addition, vacation pay paid on different dates is reflected separately from each other.

For example, in April 2021, the organization paid employees:

- On the 5th, the salary for March is 100,000 rubles, including personal income tax of 13,000 rubles,

- vacation pay for two employees: April 12 - 10,000 rubles. (personal income tax 1300 rubles), April 26 – 8000 rubles. (personal income tax 1040 rub.).

Here is how these amounts will be distributed in 6-personal income tax for the six months:

Deadlines for submitting calculations 6-NDFL

The form is compiled after the end of each quarter on an accrual basis. The calculation must be submitted to the Federal Tax Service inspection during a personal visit, using postal services or via telecommunications channels. However, only those companies that have no more than twenty-five employees can submit them in paper format to the tax authorities.

6 personal income tax in 2021, what changes

The date of transmission of the report is the day of actual transmission of the document if the payer submits it independently. If the company transmits the report by mail or electronically, then the date is set to the day the document was actually sent.

6ndfl_1-3.jpg

How to reflect “carryover” vacation pay in 6-NDFL

Situations with so-called “rolling over” vacation pay arise when vacation begins in one month and ends in another, or when vacation pay is paid at the end of one month, and the vacation itself begins in the next.

Such “rolling” vacation in 6-NDFL does not have any reflection features, since the dates of payment of vacation pay, withholding and transfer of tax are taken into account here, based on which, according to the general rules, the calculation is filled out.

For example, an employee received vacation pay on March 28, and went on vacation on April 2. Payment of vacation pay, withholding and transfer of personal income tax will be reflected in 6-personal income tax of the 1st quarter, because The tax is withheld immediately - March 28, and the deadline for its transfer is March 31.

Recalculation of vacation pay: 6-NDFL

Often in practice, situations arise when vacation pay paid in the previous period has to be recalculated for various reasons, both upward and downward. How to reflect vacation pay in 6-NDFL in this case:

- If the recalculation led to a decrease in the amount of vacation pay, you need to make corrections to the previously submitted 6-NDFL regarding accrued and received income and the tax on it (lines 020, 040, 130). In the report of the period in which the recalculation was made, this will be reflected in the amount of withheld tax on lines 070 and 140, and if the excessively withheld personal income tax was not offset against future payments, but was returned to the individual, it is reflected on line 090.

- If during recalculation the amount of vacation pay has increased, you will not have to submit an “adjustment” for the previous period. It is enough to reflect the amounts of additional accruals of vacation pay and tax on lines 020, 040, 070, 130, 140 of the 6-NDFL calculation of the period in which the recalculation was made. The additional payment made to the employee will be the income of the month in which it is paid.

Rolling sick leave and vacation pay

Very often, rolling vacation or sick leave is understood as a situation where an employee goes on vacation (sick leave) in one month and returns to work in another. Does this fact affect the procedure for filling out the report? No, this fact does not in any way affect the completion of 6-NDFL: payments are reflected in the report on the date of their transfer to the employee.

The situation is completely different with the reflection in the report of payments, the deadline for transferring personal income tax for which is postponed to the next month due to the fact that it falls on a weekend or holiday.

Let's say vacation pay is accrued to an employee on June 5. The date of receipt of income and tax withholding in this case is 06/05/2019, but the deadline for transferring personal income tax is June 30 - falls on a day off (Sunday) and is postponed to July 1. In this case, vacation pay is reflected only in Section 1 of the half-year report. They will be included in section 2 in the 9-month report.

We reflect sick leave in 6-NDFL

All types of hospital benefits are subject to personal income tax. An exception is maternity benefits, which do not need to be reflected in 6-NDFL (Clause 1, Article 217 of the Tax Code of the Russian Federation).

Like vacations, sick leave is included in the total income and tax amounts of section 1, and in section 2 they are reflected in separate lines, depending on the timing of personal income tax payment.

An employee can bring sick leave in one period and receive benefits in another. Such sick leave is included in the calculation of 6-NDFL according to the date of its payment to the employee.

For example, an employer received a sick leave certificate from an employee on March 26. The benefit was paid to the employee along with the next salary - April 5. The tax was withheld on the same day, and the deadline for payment to the budget was the last day of April. Obviously, this sick leave should be reflected in section 2 of 6-NDFL not for 1 quarter, but for half a year.

6-NDFL with an example of sick leave and vacation

In April the company paid 4 employees:

- 04/05/2018 March salary – 100,000 rubles. (personal income tax 13,000 rub.),

- 04/05/2018 sick leave – 5,000 rubles. (personal income tax 650 rub.),

- 04/05/2018 vacation pay – 10,000 rubles. (personal income tax 1300 rub.),

- 04/26/2018 vacation pay – 12,000 rubles. (personal income tax 1560 rub.)

In the 6-NDFL half-year, these amounts will be shown cumulatively on the corresponding lines of section 1, and in section 2 they will be reflected on lines 100-140 as follows:

- salary – separately from other payments,

- sick leave and vacation pay paid on 04/05/2018 - together, since the terms of their payment, withholding, and tax transfer coincide,

- vacation pay from 04/26/2018 – separately from other payments.

Sample of filling out 6-NDFL for sick leave and vacation pay

Let's look at an example of how to fill out the 6-NDFL calculation for sick leave and vacation pay.

Example

Kadrovik LLC paid three of its employees for 9 months:

- Salary for 9 months (cumulative total) - 1,256,000 rubles. (Personal income tax - 187,678 rubles) Total total income with personal income tax - 1,443,678 rubles.

For July, August and September, the salary was 139,500 rubles each. monthly (personal income tax - 20,845 rubles). The monthly salary for July-September (including personal income tax) is 160,345 rubles.

- Sick leave for V.V. Stepanov in the amount of 34,500 rubles. (tax - 5,155 rubles). The amount of sick leave with personal income tax is 39,655 rubles. The transfer date is July 23.

- Vacation pay to V.S. Sergeev in the amount of 49,000 rubles. (tax - 7,322 rubles). The amount of vacation pay with personal income tax is 56,322 rubles. The transfer date is July 29.

- Vacation pay to Smirnov A.B. in the amount of 45,000 rubles. (tax - 6,724 rubles). The amount of vacation pay with personal income tax is 51,724 rubles. The transfer date is August 27.

We will not dwell in detail on the procedure for filling out the title page of the report; you can familiarize yourself with it here.

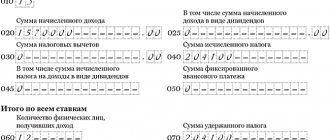

| Section 1 | |

| 010 | We enter the tax rate at which income paid to employees is taxed. For Russian resident employees it is 13%, for foreign employees - 30% |

| 020 | We reflect the entire amount of payments made to employees from the beginning of the year until the end of the reporting period. Please note that the amount is indicated without deduction of personal income tax. In our case, the total amount of income for 9 months was 1,591,379 rubles. (1,443,678 + 39,655 + 56,322 + 51,724) |

| 025 | Since in our example no dividends were paid to employees, we do not fill in this line |

| 030 | Tax deductions, as well as dividends, were not paid to employees in our example, so we indicate “0” in this line |

| 040 | We reflect the entire amount of personal income tax calculated on income for 9 months. In our example, the tax amount for the specified period was 206,879 (1,591,379 x 13%) |

| 045 | Since no dividends were paid in the reporting period, personal income tax on the indicated income was also not calculated |

| 050 | There are no foreign employees working under a patent in the organization from our example. Accordingly, personal income tax was not reduced by the amount of payment paid for a patent by foreign employees |

| 060 | Since payments were made to only three employees in the reporting period, we indicate the value “3” |

| 070 | This line reflects the amount of personal income tax on payments that were made during the reporting period. These, in particular, include salaries for January-August, sick pay and vacation pay for two employees. The tax on September salaries is not taken into account in this line, since the income was paid to employees outside the reporting period - in October. Accordingly, personal income tax on wages for September must be reflected on page 070 of the annual report. In our example, the amount of personal income tax without taking into account the September salary was 1,570,534 rubles. (1,591,379 – 20,845) |

| Section 2 | |

| 100 | We enter the dates for payment of income to employees in the 3rd quarter. For salaries, this is the last day of the month; for vacation pay and sick leave, this is the day of actual payment of income. Note: September salary is not included in Section 2 of the 9-month report, since it will actually be paid only in October. It must be reflected in 6-NDFL for the year. Completing page 100 is not subject to the rule about postponing the deadline to the first working day if it falls on a weekend or holiday. In this regard, we indicate the date for receiving salary income for August - August 31, despite the fact that it falls on a Saturday |

| 110 | The tax withholding date for wages is the day they are actually paid. In the organization from our example, salaries are issued to employees on the 5th of every month, and we indicate it in this line. For vacation pay and sick leave, the tax withholding date will be the day the income is paid. Therefore, for these payments the values on line 100 and line 110 will be the same |

| 120 | For wages, the date of transfer of tax to the budget will be the day following the payment of income to employees. For vacation and sick leave, the tax payment deadline is the last day of the month in which it was issued to employees |

| 130 | We enter the amount of income for specific payments along with personal income tax |

| 140 | We reflect the amount of personal income tax paid on income |

Step-by-step instructions for filling out

Let's look at how sick leave is correctly reflected in the certificate.

Section 1:

- In column 010 the tax rate is entered.

- Point 020 displays the amount of accrued income, the payment date of which relates to the reporting period.

- Column 030 indicates the amount of tax deductions for the specified period (if any).

- Line 040 displays the amount of calculated tax.

Section 2:

- Point 100 displays the actual date of payment of income.

- In column 110 the date of tax withholding is entered.

- Paragraph 120 indicates the day of transfer of personal income tax to the budget. Here you need to set a deadline approved by law.

- In column 130 the amount of income is calculated.

- In paragraph 140 the amount of tax is calculated.

Special cases

- How to fill out 6-NDFL if the benefit was accrued on the last day of the month? When sick leave is accrued on the last day of the month, the readings in columns 100, 110 and 120 will be the same.

- How to reflect sick leave in 6-NDFL if they are accrued together and paid on the same day as salary? If salary and benefits are paid together, for example, on the penultimate day of the month, you can show them as one amount. The entries in section 2 will also match. Otherwise, the dates in the second section will be different and will require their own lines.

- How to show sick leave during vacation with vacation pay? For vacation pay, the day the income is received is also taken as the day the employee receives it.

The deadline for transferring personal income tax is identical to the deadline for sick leave. Thus, when vacation pay and sick leave benefits were transferred on the same day, they can be reflected on one line.

Long non-working days, how to reflect in the report?

Following the words of Vladimir Putin in his video message to the population, non-working days were declared from March 30 to April 30, as well as May 6, 7 and 8. Many enterprises actually ceased their activities during the quarantine, however, they retained the obligation to pay wages for this period. If wages were transferred, then there was a need to withhold income tax and transfer it to the budget.

Information on lines 100 and 110 must be completed in accordance with current rules . And information about the timing of tax transfer on line 120 depends directly on whether the enterprise had permission to carry out activities during quarantine.

Let's look at possible examples.

The organization’s activities did not stop during the quarantine

In this case, accountants fill out Form 6-NDFL in the usual manner. Information on line 120 must be indicated in accordance with existing rules:

- The deadline for transferring personal income tax for sick leave and vacation pay is the last day of the month in which the payment occurred

- for other payments - this is the next day after the payment is made

The organization’s activities ceased only for part of the non-working period

Permission to resume work could be given by the regional authorities, who were later given such powers. In this case, the procedure for filling out 6-NDFL changes slightly. The possibility of transferring personal income tax to the budget appears after the operation of the enterprise has been permitted, which means that this date should be indicated on line 120 .

Let's look at an example. Regional authorities gave permission for the activities of OJSC "Luchik" from April 20 . The accounting department made payments to employees and withheld the corresponding personal income tax. The transfer to the budget must be made within the first working day, that is, April 20. An example of filling is presented below.

First working day date

The organization did not carry out its activities during all non-working days

In this case, there is another option for filling out the 6-NDFL report. From wages transferred to employees in the period from March 30 to May 8, income tax is subject to transfer to the budget on May 12 of the current year. If there were sick leave or vacation pay in May, then the transfer deadline for them is set as usual, that is, until June 1.

OJSC "Tsvetik" suspended its activities from March 30 to May 8 . Wages to employees were paid within the period established by the contracts. Thus, lines 100, 110 and 120 of the section when filling out information about payments made will look like this:

Income tax payment date

Activities ceased for the entire period, but regional authorities extended non-working days after May 12

In this case, when filling out a report, organizations must follow the procedure given in paragraph 3 of this article . Since regional authorities cannot influence the procedure for submitting Form 6-NDFL, in this case only Presidential Decrees are taken into account. Accordingly, on line 120 you need to put the date May 12 . All subsequent payments are reflected in the report according to generally accepted rules.

The Rassvet LLC store did not work until May 8, after which the regional authorities decided to extend non-working days until May 20 . Wages were paid on time. Income tax payments are due on May 12. An example of information reflected in a report:

Tax payment date

Tax authorities pay close attention to compliance with these requirements when submitting a report. It will be checked whether the organization really had the right to carry out activities on the specified days, and how the date is indicated on line 120.

If the company did not carry out its activities throughout the entire period of restrictions, but indicated on line 120 the date from March 30 to May 8, then the maximum penalty that the tax inspectorate can apply is a fine of 500 rubles. Since in this case there was no underestimation or overestimation of the tax amount.

If, on the contrary, an organization was allowed to carry out its activities, but the tax payment deadline was indicated in the report as May 12, then this threatens with more serious sanctions. So the tax office has the right to impose a fine and penalty for each day of delay.

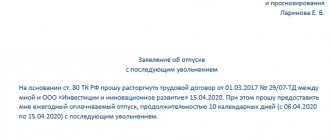

From a letter to the editor

Our employee was on regular vacation from September to October, the money for which was paid three days before the start - in September. While on vacation, the employee fell ill and brought sick leave for the appropriate dates. His vacation pay was reversed and sick leave benefits were awarded. The employee decided to postpone the vacation days to another time, and asked for the overpaid vacation pay to be counted against benefits and subsequent payments (he wrote a statement). On the payday for October (in November), the employee received a salary reduced by the amount owed. The benefit was also not paid, since it was completely covered by the amounts of overpaid vacation pay. How to correctly reflect all this in the calculation of 6-NDFL?

Analysis of Federal Tax Service errors

In letter No. ГД-4–11/ [email protected] dated November 1, 2017, the Federal Tax Service again explains that the 6-NDFL report includes income for the period when funds were specifically paid, and not in the period for which they were accrued.

Above we looked at an example illustrating this situation: the employee was sick in December 2021, and will receive sick leave in January 2021. Accordingly, the amounts of paid sick leave, withheld and transferred tax should be reflected in the report for the 1st quarter of 2018, and not for the 4th quarter of 2021.

Toward the end of the year, the Federal Tax Service of Russia published letter No. GD-4–11 // [email protected] dated November 1, 2017, with an analysis of the most common errors when drawing up and submitting Form 6-NDFL. The list of typical violations also includes the reflection of payments of temporary disability benefits and vacation pay. Their analysis and knowledge of the rules will help you correctly fill out and submit a report on Form 6-NDFL without a fine.

- Author: ozakone

Rate this article:

- 5

- 4

- 3

- 2

- 1

(0 votes, average: 0 out of 5)

Share with your friends!