Which hairdressers need an online cash register?

Federal Law No. 54-FZ on cash register equipment requires customers to count through an online cash register. You also need to indicate on the check the names of services, works and goods, among other mandatory details (Article 4.7 of Law 54-FZ). Responsibilities arise at different times depending on the form of business ownership, the presence of employees and the taxation system.

The online cash register should be used by individual entrepreneurs, employees and all legal entities. Individual entrepreneurs using the PSN and the simplified tax system can issue a check with a single amount, and from February 1, 2021, they must print the names and quantities of paid services and goods on the check.

Until July 1, 2021, there is a deferment for the use of cash registers for the following individual entrepreneurs:

- work without employees under an employment contract;

- provide services;

- They sell only their own products, for example, masks and soap prepared in a beauty salon.

The listed individual entrepreneurs may not issue the client a check, BSO or any other confirmation of payment acceptance until July 1, 2021.

What is it for?

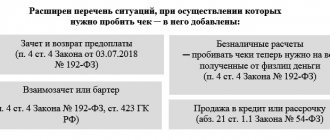

In 2021, the government obliged all entrepreneurs to install a fiscal device that will function in real time. This is necessary to increase collections of payments from sales and services to the population. The businessman is obliged to record the fact of the transaction, and the equipment will automatically send the information to the Federal Tax Service through the OPD. The absence of a receipt upon purchase was previously considered an illegal act. This reporting mechanism eliminated the possibility of receiving uncontrolled funds. If the fiscal data operator does not receive reliable information, then there will be a reason for an inspection by the Federal Tax Service. For an administrative violation, fines are imposed on the organization for the absence of an online cash register at the individual entrepreneur.

Which hairdressing salons have the right not to use online cash registers at all?

Firstly, individual entrepreneurs and legal entities that run a hairdressing salon in a remote or hard-to-reach area can work without a cash register. The territory receives this status based on the decision of the regional authorities; check the status of your locality with the regional tax office. If your business is exempt from using a cash register, you are required to issue, at the client’s request, a document that confirms the fact of payment (Clause 3, Article 2 of Law 54-FZ).

Secondly, self-employed citizens, participants in the experiment for Moscow and the Moscow region, Kaluga region and Tatarstan, can work without a cash register. The income of such citizens should not exceed 2.4 million rubles. per year or relate to the sale of excisable goods (Article 4 of Law No. 425-FZ dated November 27, 2018). Self-employed people must also report settlements with clients to the tax office, but not through the cash register and OFD, but through a mobile application. According to the application data, professional income tax (PIT) is calculated.

Evotor 5

Smart terminal with clear functionality based on Android. Among other models, it stands out for its minimal size - slightly larger than a modern smartphone. An ideal solution for mobile craftsmen. Has 2 cameras of 5 MP each.

- Dimensions: 20.5*8.6*5

- Weight – 400 gr.

- Receipt width – 57 mm.

- Acquiring - no.

- Printing speed – 50 mm.

- Number of checks – 100 km. or 1 million checks.

- Cutter - no.

- Battery – yes, 6-12 hours.

- Internet connection – Wi-Fi, Sim card.

- Compatible with 1C - yes.

- Availability of ports for additional equipment – yes, any with a USB connector.

Price from 13,000 rub.

What does a hairdresser need besides a cash register?

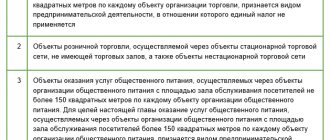

A beauty salon, hairdresser, barbershop - everyone is required to report to the tax authorities on sales through the cash register (we described the deadlines above). Technical requirements for cash registers are regulated by 54-FZ:

- The cash register must have a fiscal drive - a flash drive-type device that stores information about transactions at the cash register;

- The cash register must print a receipt with a certain set of details - to do this, it needs to be connected to a service that electronically stores the names of services and goods, prices, names of cashiers and other information.

The cash register must be connected to the fiscal data operator to transfer information to the tax office (see exceptions below).

Maintain a catalog of services and products in the Kontur.Market service. The Market's cash register program receives from the service the names of services and goods, prices, quantities, and discount amounts. Sign up for a free test drive of the service for a month.

Send a request

Evotor 5i

An improved model of a smart terminal with an expanded list of capabilities compared to Evotor 5 with the same external dimensions.

- Dimensions: 20.5*8.6*5

- Weight – 560 g.

- Receipt width – 57 mm.

- Acquiring - yes.

- Printing speed – 50 mm.

- Number of checks – 100 km. or 1 million checks.

- Auto cut - yes.

- Battery – yes, 6-12 hours.

- Internet connection – Wi-Fi, Sim card.

- Compatible with 1C - yes.

- Availability of ports for additional equipment – yes, with a USB connector.

Price from 23,000 rub.

Of all the models presented, the optimal one for a beauty salon is the Evator 5i. The model is equipped with built-in acquiring, which means you don’t have to spend money on a terminal. The user-friendly interface allows even beginners to operate the device, and the stylish appearance fits into any interior.

If an online cash register is needed only for printing receipts, then pay attention to the Mercury 115F - no unnecessary functions and a low price.

Separately from online cash registers, we will consider 2 models of fiscal registrars - stationary devices connected to a computer.

Which hairdressing salons need a fiscal data operator, and which do not?

Fiscal data operator is an organization that receives information about sales, returns and other operations from the cash register, and then sends it to the tax office via the Internet.

If you do not have the Internet or it is unstable, you may have the right not to use the services of the OFD. This is allowed for businesses that operate in areas remote from communication networks. If your hairdresser is located in such a locality, use the cash register in offline mode - this setting is set at the cash register when registering it with the Federal Tax Service. How to register a cash register with the tax office.

Tax deduction of 18,000 rubles for online cash registers

The law guarantees individual entrepreneurs on UTII and PSN without employees a tax deduction of up to 18,000 rubles. for each purchased online cash register. The deduction amount can include expenses for the cash register itself, the fiscal drive, services for connecting and setting up the cash register, as well as the cost of the software. The deduction is provided when registering a cash register before July 1, 2019.

If you don’t have time to deal with issues of connecting and registering an online cash register, fill out an application on our website! We will do everything quickly and on a turnkey basis.

Who to entrust settlement with the client

While there was no cash register in the salon, any employee could accept payment from a client. For example, an administrator or a master who provided a service.

With the appearance of a cash register, you need to determine in advance who will work at it and add their names to the list of cashiers when setting up the cash register. This is necessary to comply with the legal requirement to indicate on the check the name of the employee making the payment.

And the names of the cashiers are needed to know who performed what operations at the checkout: how much revenue they brought in, what discounts they provided. The cash register sends this information to the service with which it works in conjunction: it receives from it the items to be printed on the receipt and sends back sales information for generating reports.

Mercury 115F

Classic stand-alone push-button cash register with built-in keyboard. A clear interface and control, and only basic functions - printing receipts and transferring OFD data. Allows you to enter up to 10,000 codes to identify products.

- Dimensions: 23*11.6*6.5

- Weight – 1 kg.

- Receipt width – 58 mm.

- Acquiring - no, but you can punch a check marked “non-cash payment”.

- Printing speed – 35 mm.

- Number of checks – 50 km. or 500 thousand

- Cutter - no.

- Battery bank - yes, up to 500 checks.

- Internet connection options – Wi-Fi, Sim card.

- Integration with 1C - yes.

- Additional ports - yes, barcode scanner, scales.

Price from 5,500 rub.

How to choose an online cash register for your hair salon

If the client pays for services at the reception desk, almost all cash registers are suitable: stationary, monoblocks, fiscal printers and even mobile cash registers.

If your customers are used to paying for the service where they received it, only mobile cash registers are suitable, because they are convenient to move from place to place. Such cash registers are also useful for providing services at home - mobile cash registers have a battery.

We list several models and the options for which they are suitable.

Mobile cash registers MSPOS-K and MSPOS-E-F

Who is it suitable for:

- Masters for field service at home, office, hospital, hotel.

- Small salons with limited space at the reception desk.

- Salons that experience interruptions in the Internet or electricity.

- Large salons with several halls, where the client pays at the place of receiving the service, and not at the reception.

Cheaper than stationary cash registers. The optimal solution for small businesses and startups. See prices for MSPOS-K and MSPOS-E-F with acquiring

- Compact, lightweight, fits into your tool bag.

- Touch color screen.

- Autonomous battery operation for 24 hours.

- You can insert a SIM card to connect to the mobile Internet.

- Built-in camera for reading barcodes (needed if you sell goods).

- The MSPOS-E-F model has a built-in terminal for paying with bank cards.

- The check must be torn off manually.

- The 5.5" screen is comparable to a smartphone screen, but may not be large enough for some employees.

Business Solutions

- shops clothing, shoes, groceries, toys, cosmetics, appliances Read more

- warehouses

material, in-production, sales and transport organizations Read more

- marking

tobacco, shoes, consumer goods, medicines Read more

- production

meat, procurement, machining, assembly and installation Read more

- rfid

radio frequency identification of inventory items More details

- egais

automation of accounting operations with alcoholic beverages Read more

Principle of operation

When receiving money for a product, the equipment requests the assignment of a unique code in the OPD. This process occurs instantly within one second. After accepting the answer, the device generates a receipt, already marked with a unique code. After this, printing occurs on paper and simultaneous transmission of information to the buyer’s email. The consumer has the opportunity to verify the legality of the transaction by checking the registration using the code.

All data on the movement of material assets is immediately sent to the tax office website.

Monoblocks Kontur.Sigma and MSPOS T-F

Who is it suitable for:

- Salons with little free space at the reception desk.

- Large salons with several halls, where the client pays at the reception

- For salons with medium and large flow of clients

- For hairdressing salons with a wide range of services and products

The optimal solution for a mature business in terms of price and capabilities. See prices for Kontur.Sigma and MSPOS T-F.

- The screen and receipt printer form a single compact device.

- On the table it takes up space comparable to a lying sheet of A4 paper.

- The check is cut automatically.

- Large color touch screen: Kontur.Sigma has 10”, MSPOS T-F 11.6”.

- Kontur.Sigma's screen can be tilted.

- There are connectors for connecting a scanner, acquiring terminal, and cash drawer.

- With MSPOS T-F you cannot change the angle of the screen, only with Kontur.Sigma.

- If you need to print long names of services and goods on a receipt, the width of the Kontur.Sigma receipt (57 mm) may seem insufficient, then it is better to use MSPOS T-F (80 mm).

Atol 92F

Stand-alone online cash register with built-in keyboard. Equipped with a built-in battery, a full charge of which is enough for a full work shift. Operates at temperatures from -10 to +45, which allows you to use the device outside the cabin. You can additionally connect a barcode scanner or scales from Atol to the device.

- Dimensions: 20.8*10.3*6.6

- Weight – 500 gr.

- Receipt width – 58 mm.

- Acquiring - no.

- Printing speed – 50 mm.

- Number of checks – 50 km. or 500 thousand pieces

- Cutter - comb. A comb is metal or plastic teeth - a mechanical analogue of an automatic cutter. The teeth help to tear off the check evenly.

- Battery – yes, for 8 hours of operation without recharging.

- Internet connection – Wi-Fi, Sim card, wired Internet.

- Compatibility with 1C - no.

- Availability of ports for additional Equipment – yes, for a scanner or scales.

The price for a device without a fiscal drive is 8,000 rubles.